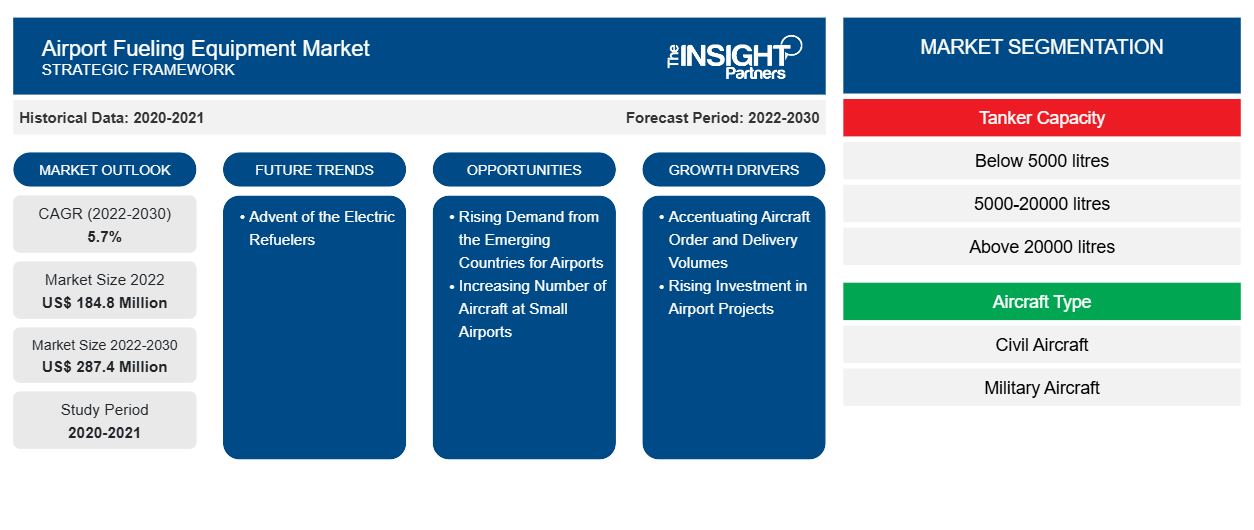

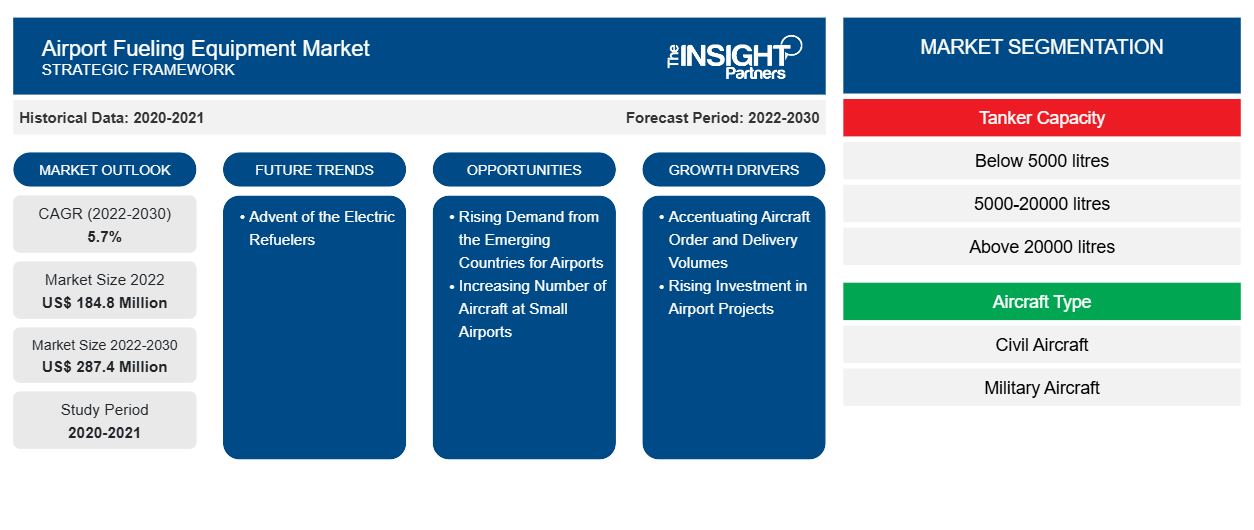

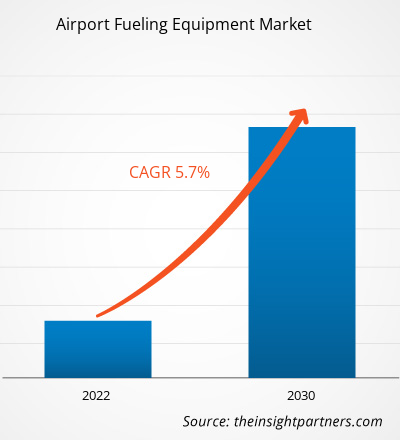

The Airport Fueling Equipment Market size is projected to reach US$ 287.4 million by 2030 from US$ 184.8 million in 2022. The market is expected to register a CAGR of 5.7% in 2022–2030. Airport fueling equipment can vary in tanker capacity, depending on the specific needs and requirements of the airport and the size of the aircraft fleet it serves. The tanker capacity determines the amount of fuel that can be delivered to aircraft during each refueling operation. The selection of the appropriate tanker capacity is based on factors such as the average fuel consumption of the aircraft served, the frequency of refueling operations, and the airport's fueling infrastructure and storage capacity. Properly sized fueling equipment ensures efficient and timely refueling operations while minimizing downtime. All these factors contribute to meeting the demand for airport fueling equipment in the aviation industry.

Airport Fueling Equipment Market Analysis

As air travel continues to grow in emerging markets, there is a greater demand for modern and efficient fueling operations to support the increasing number of flights and passengers. Many emerging economies are investing heavily in airport infrastructure to boost their connectivity and interest in tourism and trade. Establishing new airports and expanding existing ones require the latest fueling equipment to meet international standards and cater to a diverse range of aircraft. For instance, in April 2023, the government of India announced its plans to invest approximately US$ 11.81 billion in the development of airport infrastructure over the next two years. This investment is a response to the growing travel demand and the need to upgrade and expand existing airport facilities to accommodate the increasing number of passengers and aircraft. With this investment, the adoption of advanced technologies and automation in airport operations, including fueling processes, is rapidly increasing. Smart fueling equipment and monitoring systems can optimize fueling efficiency and reduce the risk of errors. Thus, the rising development of airport infrastructure creates a favorable market environment for innovative and advanced airport fueling equipment, leading to the growth of the airport fueling equipment market

Airport Fueling Equipment Market Overview

Military and civil airport fueling equipment serve different purposes and are designed to meet the specific requirements of their respective applications. Military fueling equipment is also designed to support the refueling needs of military aircraft, including fighter jets, transport planes, helicopters, and unmanned aerial vehicles (UAVs). Military fueling operations often require specific security measures and specialized equipment to handle different types of military aircraft and fuel types. Civil airport fueling equipment is used to fuel a wide range of civil aircraft, such as commercial airliners, private jets, and other civil aircraft, in compliance with aviation regulations and safety standards. Military fueling equipment is often designed for mobility and ease of deployment in various operational theaters, including remote locations and combat zones.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Airport Fueling Equipment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Airport Fueling Equipment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Airport Fueling Equipment Market Drivers and Opportunities

Rising Investment in Airport Projects

The worldwide airport count has been rising to cater to a maximum number of airlines and passengers, owing to which investment in expanding the existing airports with new terminals and constructing new airports has also bolstered. As a result, there is a significant demand for new airport fueling equipment. Rising investment in new airports is one of the market's major driving factors. As per the Airport Consultants Council, the US alone will require an investment worth ~ US$ 138 billion over the next five years starting from 2020.

Furthermore, according to several aviation sources, to meet the air passenger demand, huge capital investment is required from the various countries in greenfield airports and expansion of existing airport infrastructure. More than ~ US$ 2 trillion in total capital investment is expected to be required between 2021 and 2040. Such a huge capital investment requirement for the airport construction project will drive the demand for new fueling equipment to supply the fuel at the required time more efficiently. Thus, the rising investment in airport projects is a key driving factor for the market.

Increasing Number of Aircraft at Small Airports

The small airports are witnessing increased traffic at their airports and experiencing fueling services problems to meet the requirements. For instance, according to one of the aircraft operators, most pilots or aircraft operators prefer Mossel Bay airport over George Airport to fuel the aircraft. Thus, due to long queues and waiting times in the refueling facility at George Airport. Such airports with small capacity can be a potential opportunity for the market players.

Airport Fueling Equipment Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Airport Fueling Equipment Market analysis are tanker capacity, aircraft type, power source, and geography.

- Based on tanker capacity, the Airport Fueling Equipment Market has been segmented into below 5000 litres, 5000-20000 litres, and above 20000 litres. The 5000-20000 litres segment held a larger market share in 2022.

- By aircraft type, the Airport Fueling Equipment Market has been segmented into civil aircraft and military aircraft. The civil aircraft segment held the largest share of the market in 2022.

- Based on power source, the Airport Fueling Equipment Market has been segmented into electric and non-electric. The non-electric segment held a larger market share in 2022.

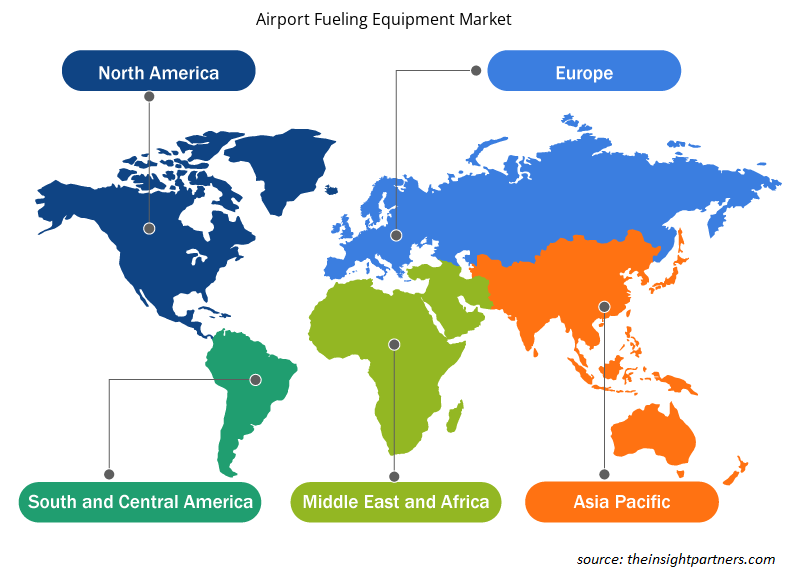

Airport Fueling Equipment Market Share Analysis by Geography

The geographic scope of the Airport Fueling Equipment Market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America has dominated the Airport Fueling Equipment Market in 2022, and it is expected to retain its dominance during the forecast period as well. Further, Asia Pacific region is likely to register highest CAGR in the airport fueling equipment market during 2022-2030. Many modernization and expansion projects have been initiated in various airports across North America to accommodate the rising number of passengers and flights. These projects often involve investments in advanced fueling equipment to improve operational efficiency and capacity fueling station. In February 2023, the US Federal Aviation Administration (FAA) made an announcement to provide ~US$ 1 billion in funding for ninety-nine airports across the country. It is a significant step in supporting the aviation industry's recovery and preparing for increased air traffic. The funding is part of the US President’s Bipartisan Infrastructure Law, which aims to bolster airport infrastructure and capacity to manage the growing number of passengers and flights. Thus, the presence of robust aviation industry, infrastructure development, technological advancements, sustainability efforts, and government support are a few factors that are creating a favorable environment for the airport fueling equipment market in north American region. As airports strive to enhance their operational efficiency and offer a seamless travel experience, the demand for innovative and efficient fueling equipment is expected to continue rising during the forecast period.

Airport Fueling Equipment Market Regional Insights

The regional trends and factors influencing the Airport Fueling Equipment Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Airport Fueling Equipment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Airport Fueling Equipment Market

Airport Fueling Equipment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 184.8 Million |

| Market Size by 2030 | US$ 287.4 Million |

| Global CAGR (2022-2030) | 5.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Tanker Capacity

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

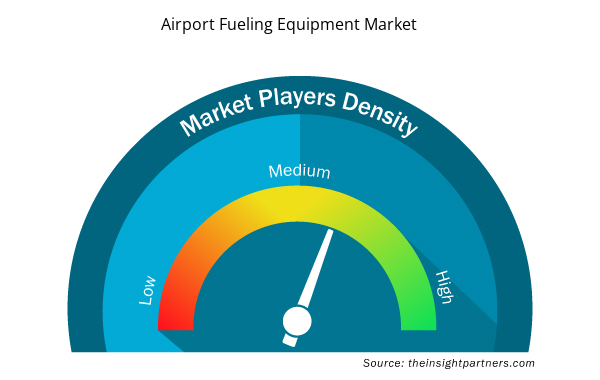

Airport Fueling Equipment Market Players Density: Understanding Its Impact on Business Dynamics

The Airport Fueling Equipment Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Airport Fueling Equipment Market are:

- Garsite Progress LLC

- Titan Aviation SA

- Fuel Proof Ltd

- Dr Ing. Ulrich Esterer GmbH & Co Fahrzeugaufbauten und Anlagen KG

- BETA Fueling Systems LLC

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Airport Fueling Equipment Market top key players overview

Airport Fueling Equipment Market News and Recent Developments

The Airport Fueling Equipment Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for airport fueling equipment market and strategies:

- In 2023, The Stokota company announced their plans to build new production halls in Elblag, Poland, to expand its activities. For that, it has finalized the purchase of approximately 4 ha of land for new investment from the Warmia and Mazury Special Economic Zone. (Source: Stokota, Press Release/Company Website/Newsletter)

- In 2021, TotalEnergies partnered with Titan Aviation to introduce wide range of electric refueling vehicles. the products such as Titan e-RRX and Titan SPR-Xe, model features a digital MMI called EZ Control. (Source: TotalEnergies, Press Release/Company Website/Newsletter)

Airport Fueling Equipment Market Report Coverage and Deliverables

The “Airport Fueling Equipment Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Tanker Capacity, Aircraft Type, and Power Source

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Get Free Sample For

Get Free Sample For