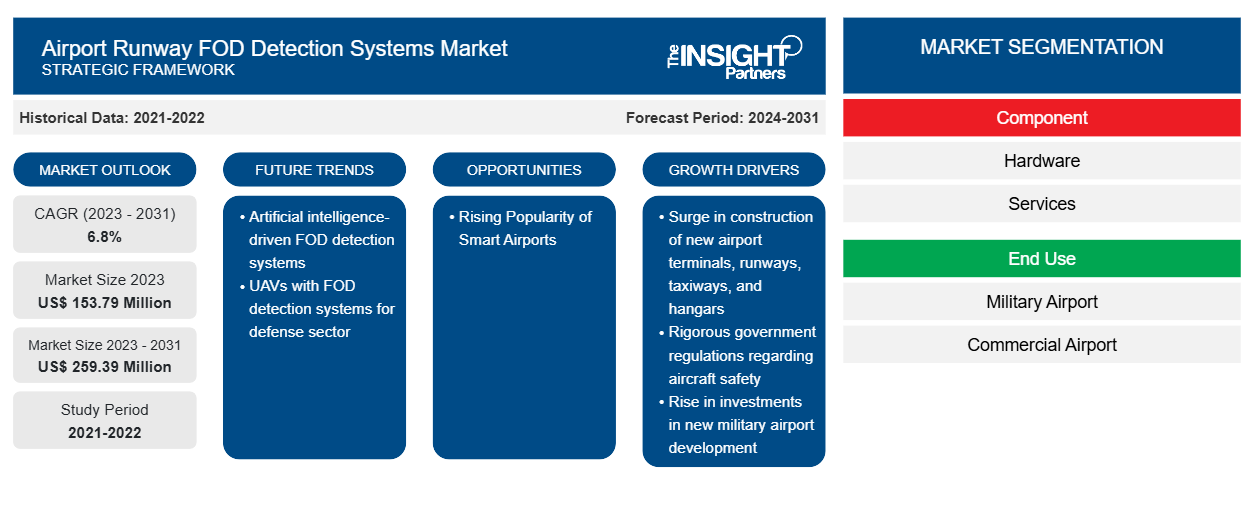

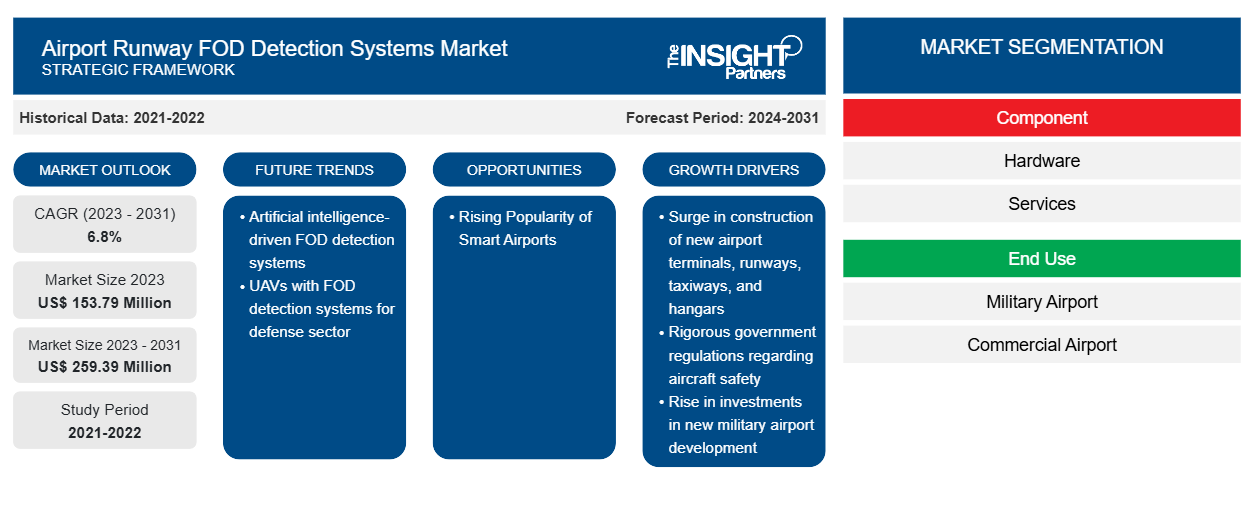

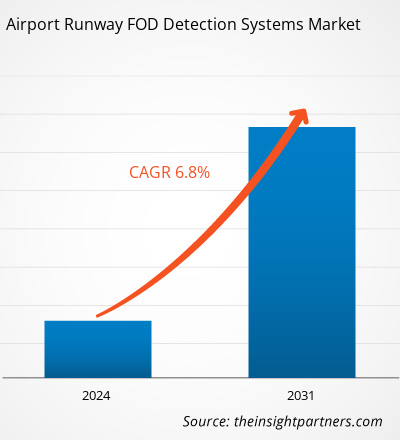

The airport runway FOD detection systems market size is projected to reach US$ 259.39 million by 2031 from US$ 153.79 million in 2023. The market is expected to register a CAGR of 6.8% during 2023–2031. The emergence of innovative UAVs with FOD detection systems for defense sector is likely to bring in new trends in the market.

Airport Runway FOD Detection Systems Market Analysis

Governments of developed countries such as the US, the UK, and China are capitalizing on smart airport technologies, including smart sensors, cameras, communication and network systems, RFID tags, and wearables. This is owing to rising requirements for real-time information and mounting demand for cutting-edge connectivity technologies in airport operations. Similarly, the growing consumer preference for air travel and the increasing volume of air traffic worldwide are boosting the application of airport runway FOD detection systems across various civil airports. In addition, the rising defense expenditure in developed countries has led to an increase in the adoption of FOD detection systems in the military sector. Moreover, the growing implementation of advanced technologies such as cloud, the Internet of Things (IoT), blockchain, and artificial intelligence (AI) by the aerospace & defense industry is anticipated to propel the growth of the airport runway FOD detection systems market in the coming years.

Moreover, FOD poses great threat to the safety and financial threats to the aviation sector worldwide. According to the Federal Aviation Administration, more than US$ 22.7 billion worth of losses occurs each year that are beared by airlines and airports worldwide due to FODs. Such costs are poses great financial threats to different airlines and airports as well. Further, such concerns are pushing the adoption of FOD detection systems across different airports worldwide.

Airport Runway FOD Detection Systems Market Overview

Airport runway FOD (foreign object debris) detection systems primarily facilitate automated scanning of airport surfaces, taxiways, and runways; confer high detection and resolution capability; and provide enhanced situational awareness—thereby confirming enhanced safety to users. The increasing focus of government authorities on constructing smart airports boosts the demand for the integration of smart technologies and systems in airport premises for efficient operation and management.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Airport Runway FOD Detection Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Airport Runway FOD Detection Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Airport Runway FOD Detection Systems Market Drivers and Opportunities

Surge in Construction of New Airport Terminals, Runways, Taxiways, and Hangars

The mounting number of global commercial aircraft fleets is one of the major factors generating the demand for new flights, terminals, runways, and hangars across different airports to cater to the growing passenger traffic worldwide. This fuels the investments from airport authorities to upgrade their respective airport premises to cater to a huge fleet of aircraft, which also improves the overall airport’s operational efficiency. The improved efficiency is also attributed to the introduction of low-cost airlines that have supported air passenger traffic worldwide. In March 2023, the Canadian Kelowna City Council announced approval for funding of US$ 90 million for the expansion project of the Kelowna Airport terminal. Several government authorities of different countries have also been planning to construct new airports across their respective countries to enhance the flow of international cargo trade and development of the air travel industry. For instance, in the US, six new airports are currently under construction. Also, in 2022, the Government of India announced its plans to build ~220 airports by the end of 2025. Numerous projects are under progress across the country; for example, the Sardar Vallabhbhai Patel International Airport Expansion Project, the New International Airport at Navi Mumbai, the Noida International Airport, the Kempegowda International Airport Expansion Project, and the Indira Gandhi International Airport Expansion Project.

In 2018, the Civil Aviation Administration of China (CAAC) announced its plans to construct ~216 new airports by the end of 2035. This plan is likely to boost the total airport count to ~450 airports by 2035 (234 airports currently in 2023). In 2023, Yangzhou Taizhou International Airport (YTY) commenced its expansion project to attain and manage 10 million passengers; 88,670 aircraft movements; and 50,000 tons of cargo annually. In addition, in May 2021, Kansai International Airport (KIX) started an expansion project focused on managing ~40 million international passengers annually. The project is expected to be completed by 2025 for the Expo 2025 Osaka in Kansai. Thus, the construction of new airport terminals, runways, taxiways, and hangars contributes to the growth of the airport runway FOD detection systems market.

Rising Popularity of Smart Airports

The increasing inclination of government authorities toward smart airports boosts the demand for the implementation of smart systems on airport premises. Governments of developed countries such as the US, the UK, and China are capitalizing on smart airport technologies, including communication and network systems, smart sensors, cameras, RFID tags, and wearables, owing to increasing preference for real-time information and mounting demand for advanced connectivity technologies in airport operations. For instance, in 2017, the Civil Aviation Authority of Singapore (CAAS) and NATS Limited implemented the smart digital tower in Changi Airport, which continues to enhance surveillance and communication capabilities. Also, the Government of Canada provided funding of ~US$ 16 million during 2021–2022 to Ottawa International Airport for the restoration of the pavement on Taxiways A, M, AA, BB, and CC, as well as the construction of a light rail transit station at the airport.

Airport Runway FOD Detection Systems Market Report Segmentation Analysis

Key segments that contributed to the derivation of the airport runway FOD detection systems market analysis are component and end use.

- Based on component, the global airport runway FOD detection systems market is segmented into hardware and services. The hardware segment held the largest market share in 2023.

- Based on end use, the market is divided into military airport and commercial airport. The commercial airport segment held the largest share of the market in 2023.

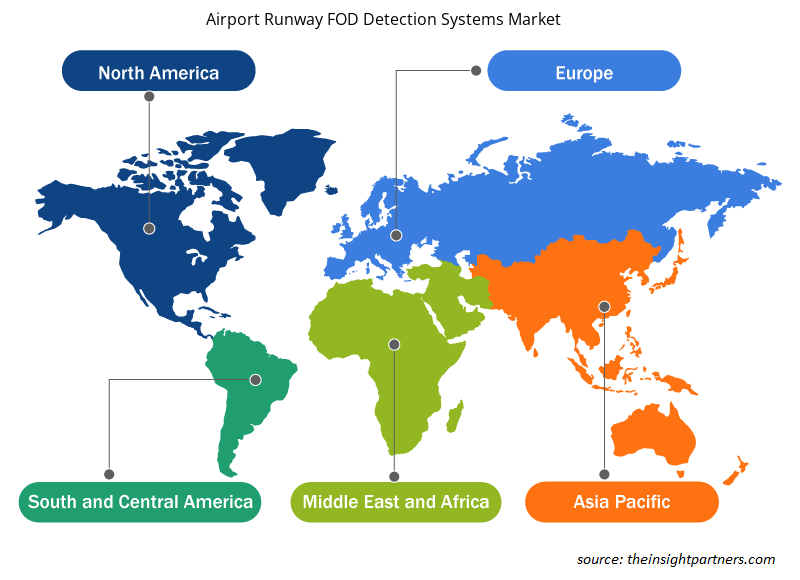

Airport Runway FOD Detection Systems Market Share Analysis by Geography

The geographic scope of the airport runway FOD detection systems market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The aviation sector in North America is witnessing significant expansion and developments, responding to the region's growing air travel demands and economic vitality. Key airports, including Hartsfield-Jackson Atlanta International Airport, Los Angeles International Airport, and Dallas/Fort Worth International Airport, are undergoing modernization projects to accommodate increased passenger traffic. The US has the highest number of airports in the world as well as a significant number of airport technology developers. This makes it easier for airport authorities to procure larger quantities of airport technologies or systems, including FOD detection systems, thereby driving the airport runway FOD detection systems market. The report by Airport Council International (ACI-NA) highlighted that North America's airport infrastructure requires $151.1 billion to maintain or expand from 2023 to 2027.

The Federal Aviation Administration's (FAA) ongoing efforts to develop robust and safe airport and runway infrastructure are encouraging airport authorities to invest in advanced technologies such as FOD detection systems. Therefore, the significant need for modernization of airport and runway technologies by the FAA is another key factor driving the market for airport runway FOD detection systems in North America. Moreover, the Canadian Airports Authority and subsequent airport management always emphasize runway maintenance to prevent runway downtime due to runway accidents. To ensure the constant movement of aircraft fleets to and from the airport, airport administrations are installing FOD detection systems on runways, which is boosting the runway FOD detection systems market in the region. A few of the key players operating in the North America airport runway FOD detection systems market include Pavemetrics Systems; QinetiQ; Thales Group; Varec, Inc.; and XSight Systems Ltd.; among others.

Airport Runway FOD Detection Systems Market Regional Insights

The regional trends and factors influencing the Airport Runway FOD Detection Systems Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Airport Runway FOD Detection Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Airport Runway FOD Detection Systems Market

Airport Runway FOD Detection Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 153.79 Million |

| Market Size by 2031 | US$ 259.39 Million |

| Global CAGR (2023 - 2031) | 6.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

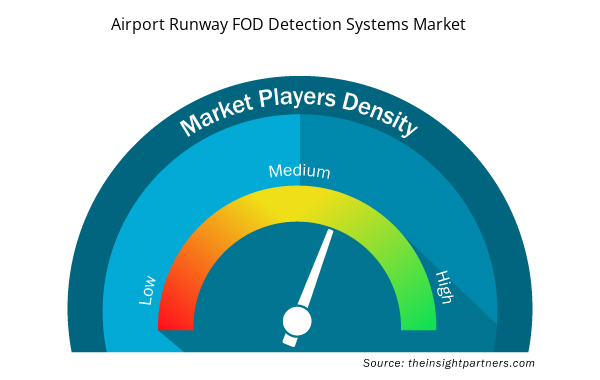

Airport Runway FOD Detection Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Airport Runway FOD Detection Systems Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Airport Runway FOD Detection Systems Market are:

- ArgosAI Teknoloji A.?.

- Moog Inc.

- Navtech Radar

- Pavemetrics

- Plextek Services Limited

- Rheinmetall AG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Airport Runway FOD Detection Systems Market top key players overview

Airport Runway FOD Detection Systems Market News and Recent Developments

The airport runway FOD detection systems market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the airport runway FOD detection systems market are listed below:

Smiths Detection accelerated partnership with SeeTrue. Smiths Detection has successfully integrated and tested SeeTrue's technology into our CT security checkpoint systems. Smiths Detection, a global leader in threat detection and security screening, and a business of Smiths Group, has announced a major step forward in aviation security technology. Working in partnership with SeeTrue, a provider of AI-based threat detection software, Smiths Detection has successfully integrated and tested SeeTrue's technology into its advanced CT security checkpoint systems with the combined solution now ready for immediate implementation pending certification. (Source: Smiths Detection, Press Release, October 2023)

Airport Runway FOD Detection Systems Market Report Coverage and Deliverables

The "Airport Runway FOD Detection Systems Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Airport runway FOD detection systems market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Airport runway FOD detection systems market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Airport runway FOD detection systems market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the airport runway FOD detection systems market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Components and End-Use and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The airport runway FOD detection systems market is likely to register of 6.8% during 2023-2031.

The estimated value of the airport runway FOD detection systems market by 2031 would be around US$ 259.39 million.

ArgosAI Teknoloji A.Ş.; Moog Inc.; Navtech Radar; Pavemetrics; Plextek Services Limited; Rheinmetall AG; QinetiQ Group Plc; Thales SA; Xsight Systems Ltd.; Trex Aviation Systems; Varec, Inc.; Smiths Detection Group Ltd. (Smiths Group plc); Infologic Pte Ltd.; Skylarklabs, Inc.; and Hitachi Ltd are some of the key players profiled under the report.

Artificial intelligence-driven FOD detection systems; and UAVs with FOD detection systems for defense sector are some of the major trends of the market.

Surge in construction of new airport terminals, runways, taxiways, and hangars; rigorous government regulations regarding aircraft safety; and rise in investments in new military airport development are some of the factors driving the growth for airport runway FOD detection systems market.

Asia Pacific region dominated the airport runway FOD detection systems market in 2023.

Trends and growth analysis reports related to Aerospace and Defense : READ MORE..

The List of Companies - Aircraft Runway FOD Detection Systems Market

- ArgosAI Teknoloji A.?.

- Moog Inc

- Navtech Radar

- Pavemetrics

- Plextek Services Limited

- Rheinmetall AG

- QinetiQ Group Plc

- Thales SA

- Xsight Systems Ltd

- Trex Aviation Systems

- Varec, Inc

- Smiths Detection Group Ltd

- Infologic Pte Ltd

- Skylarklabs, Inc

- Hitachi Ltd

Get Free Sample For

Get Free Sample For