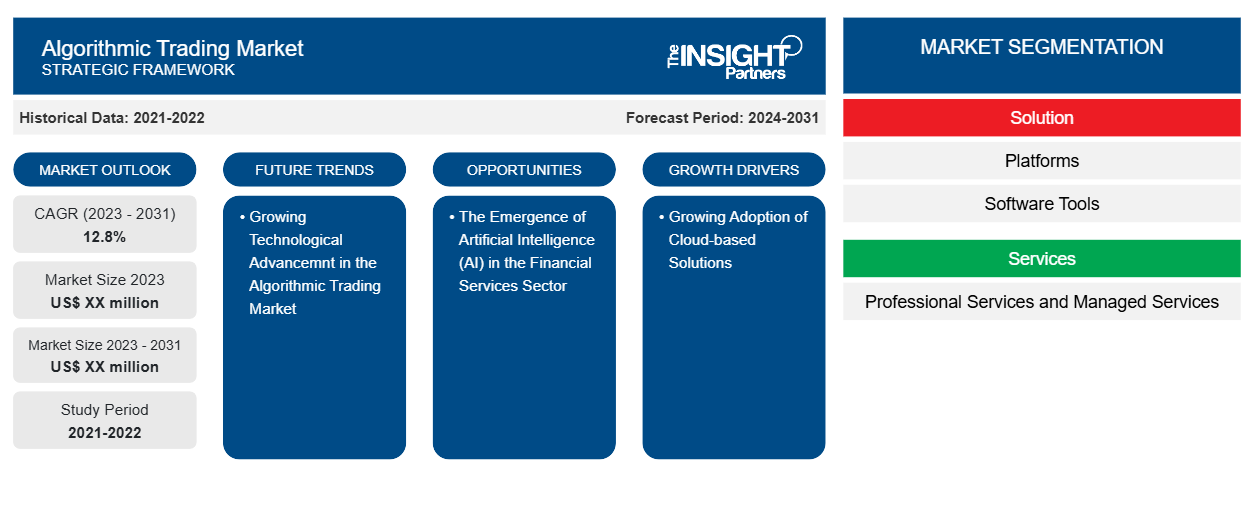

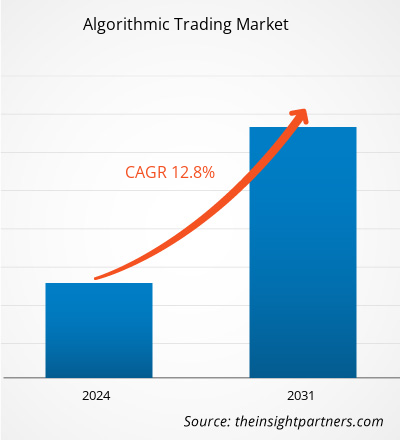

The algorithmic trading market size is expected to at a CAGR of 12.8% from 2023 to 2031. Since the introduction of matching engines in modern exchanges, algorithmic trading has been used worldwide. By eliminating human restrictions, such technological advancements have enhanced the capability of markets to process trades and orders. Thus driving the growth of algorithmic trading market growth.

Algorithmic Trading Market Analysis

The necessity for algorithmic trading is projected to be driven by favorable governmental guidelines, increasing demand for reliable, quick, and effective order execution, swelling demand for market surveillance, and decreasing transaction costs. Large institutional investors and brokerage firms use algorithmic trading to cut the expenses of bulk trading. Furthermore, it is projected that the development of financial service and artificial intelligence (AI) algorithms will generate lucrative market expansion opportunities during the forecast period. An increase in the demand for cloud-based solutions is also projected to support the algorithmic trading market growth.

Algorithmic Trading Market Overview

- Algorithmic trading is a type of automation in which a computer program is used to efficiently execute a defined set of instructions or guidelines that comprises the selling or buying of an asset regarding varying market data.

- Furthermore, the defined sets of rules or instructions are based on quantity, price, timing, or any mathematical model. Investors and traders are adopting algorithmic trading solutions as it helps them execute trades at the best possible prices.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Algorithmic Trading Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Algorithmic Trading Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Algorithmic Trading Market Driver

The Emergence of Artificial Intelligence (AI) in the Financial Services Sector to Drive the Algorithmic Trading Market

- Several financial services companies are increasing their AI and machine learning adoption to take advantage of the information from digitally driven channels. This has further led to the developing trend of data-driven investments in the past few years.

- The usage of algorithmic trading is on the surge due to its complete automation, ease of diversification capabilities, and fast trade execution.

Algorithmic Trading Market Report Segmentation Analysis

- Based on deployment, the algorithmic trading market is segmented into on-premise and cloud-based. The cloud-based segment is expected to hold a substantial algorithmic trading market share in 2023.

- Cloud-based algorithmic trading platforms are anticipated to play a crucial role in the growth of the market, owing to various benefits, such as obtaining maximum profits, automating trading procedures, easy trade data maintenance, scalability, cost-effectiveness, and efficient management.

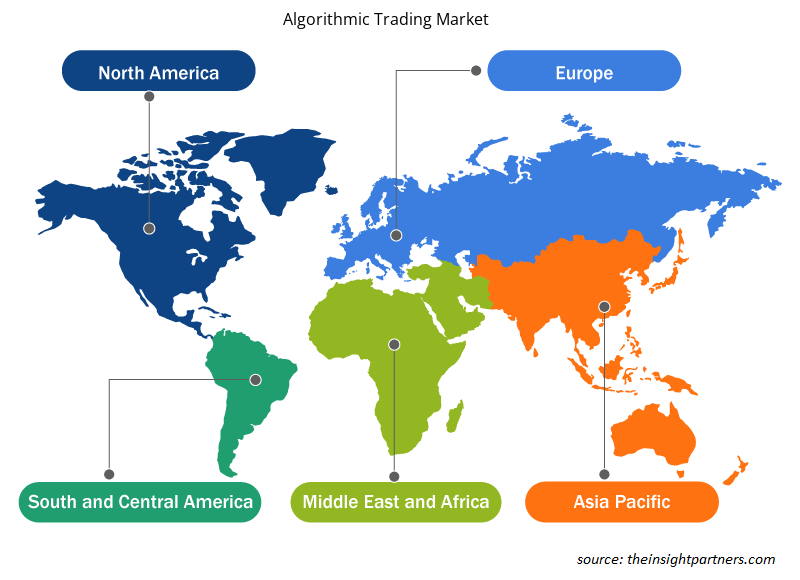

Algorithmic Trading Market Share Analysis By Geography

The scope of the algorithmic trading market is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America dominated the algorithmic trading market share in 2023. The regional growth can be accredited to the presence of several market players in the region. These vendors are also implementing various growth strategies to strengthen their position in the market. Numerous factors, such as the increasing investments in trading technologies and growing government support for global trading activities, are anticipated to contribute to the regional growth of the North American market during the forecast period.

Algorithmic Trading Market Regional Insights

Algorithmic Trading Market Regional Insights

The regional trends and factors influencing the Algorithmic Trading Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Algorithmic Trading Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Algorithmic Trading Market

Algorithmic Trading Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ XX million |

| Market Size by 2031 | US$ XX million |

| Global CAGR (2023 - 2031) | 12.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Solution

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

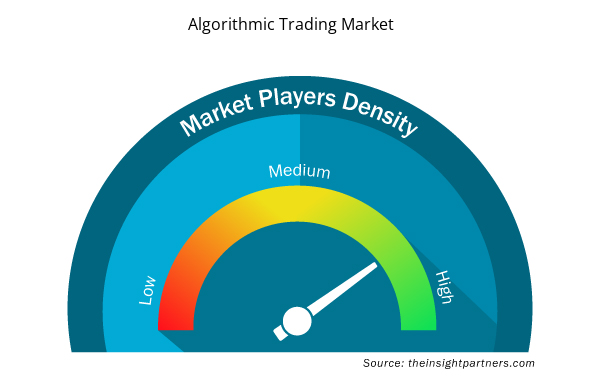

Algorithmic Trading Market Players Density: Understanding Its Impact on Business Dynamics

The Algorithmic Trading Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Algorithmic Trading Market are:

- 63 moons technologies limited

- AlgoTrader

- Argo Software Engineering

- InfoReach, Inc.

- Kuberre Systems, Inc.

- MetaQuotes Ltd.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Algorithmic Trading Market top key players overview

The "Algorithmic Trading Market Analysis" was carried out based on type, mode, distribution channel, and geography. Based on the solution, the market is divided into platforms and software tools. Based on the service outlook, the market is divided into professional services and managed services. Based on deployment, the market is divided into cloud and on-premise. Based on trading types, the market is divided into foreign exchange (FOREX), stock markets, exchange-traded funds (ETF), bonds, cryptocurrencies, and others. Based on the type of traders, the market is divided into institutional investors, long-term traders, short-term traders, and retail investors. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Algorithmic Trading Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the market. Some of the recent key market developments are listed below:

- In October 2022, Refinitiv, an LSEG business, announced the introduction of a personalized, secure, and frictionless global digital onboarding solution to support businesses in streamlining their approach to onboarding customers. Refinitiv's digital customer onboarding solution provides a completely configurable user interface, allowing organizations to offer the product application process that can be delivered via mobile, web, and API. [Source: Refinitiv, Company Website]

Algorithmic Trading Market Report Coverage & Deliverables

The algorithmic trading market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Algorithmic Trading Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Fishing Equipment Market

- Vaginal Specula Market

- Nurse Call Systems Market

- Lyophilization Services for Biopharmaceuticals Market

- Underwater Connector Market

- Employment Screening Services Market

- Maritime Analytics Market

- Pharmacovigilance and Drug Safety Software Market

- Small Internal Combustion Engine Market

- Drain Cleaning Equipment Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Functions ; and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Frequently Asked Questions

The global algorithmic trading market was estimated to grow at a CAGR of 12.8% during 2023 - 2031.

Growing technological adoption and adoption of automated algorithmic trading are the major factors that propel the global algorithmic trading market.

The emergence of Artificial Intelligence (AI) and Machine Learning (ML) in algorithmic trading is anticipated to play a significant role in the global algorithmic trading market in the coming years.

The key players holding principal shares in the global algorithmic trading market are 63 moons Technologies Limited, AlgoTrader, Argo Software Engineering, InfoReach, Inc., and Kuberre Systems, Inc.

Get Free Sample For

Get Free Sample For