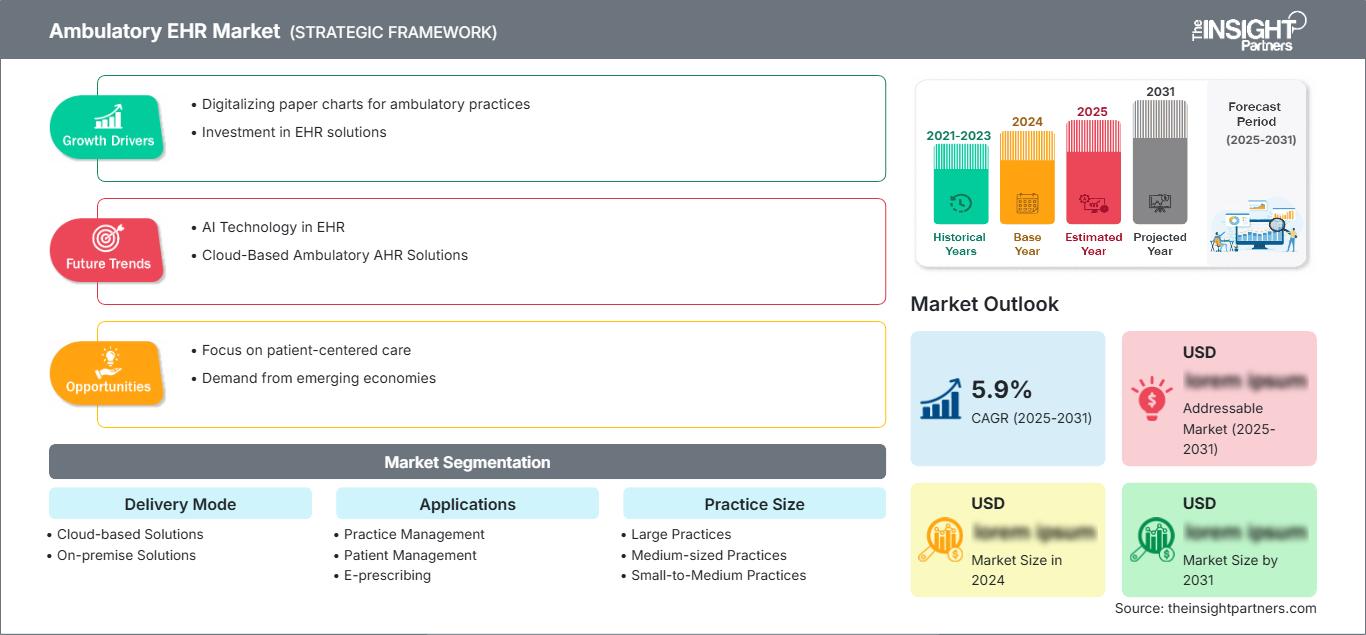

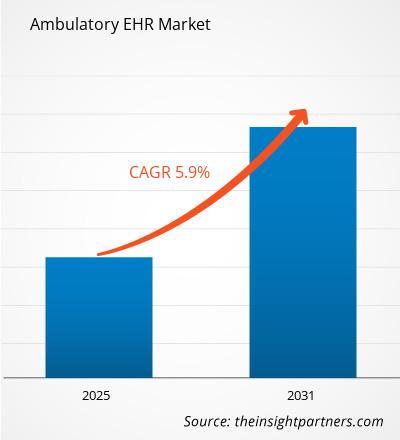

The Ambulatory EHR Market is expected to register a CAGR of 5.9% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Delivery Mode (Cloud-based Solutions, On-premise Solutions), Applications (Practice Management, Patient Management, E-prescribing, Referral Management, Health Analytics, Other Applications), Practice Size (Large Practices, Medium-sized Practices, Small-to-Medium Practices, Solo Practices), End-user (Hospital-owned Ambulatory Centers, Independent Ambulatory Centers). The global analysis is further broken-down at regional level and major countries. The report offers the value in USD for the above analysis and segments

Purpose of the Report

The report Ambulatory EHR Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Ambulatory EHR Market Segmentation

Delivery Mode

- Cloud-based Solutions

- On-premise Solutions

Applications

- Practice Management

- Patient Management

- E-prescribing

- Referral Management

- Health Analytics

- Other Applications

Practice Size

- Large Practices

- Medium-sized Practices

- Small-to-Medium Practices

- Solo Practices

End-user

- Hospital-owned Ambulatory Centers

- Independent Ambulatory Centers

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Ambulatory EHR Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Ambulatory EHR Market Growth Drivers

- Digitalizing paper charts for ambulatory practices: With the rise in digitalization, the demand for ambulatory EHR solutions and services is increasing across the world. Ambulatory EHR supports the workflow of outpatient care, which includes managing office visits, billings and prescriptions. Market players such as eClinicalWorks provide cloud-based solutions for electronic health records and practice management that drive market growth.

- Investment in EHR solutions: Government authorities are widely adopting HER solutions to streamline healthcare services and improve patient outcomes within the facilities. As healthcare workflows for better patient care are crucial, government organizations are investing in EHR solutions that drive market growth. For example, in August 2024, the New Zealand Department of Corrections announced an investment of US$ 5 million to upgrade its electronic health record (EHR) systems.

Ambulatory EHR Market Future Trends

- AI Technology in EHR: The latest advancement in AI technology combined with the most advanced EHR solutions provides enhanced diagnostic support, patient record management, and treatment personalization. The AI-based solutions provide diagnostic assistance with an accuracy of up to 98.7%. With AI-enhanced treatment planning, patient care quality and consistency can be improved. It speeds up patient record management.

- Cloud-Based Ambulatory AHR Solutions: Cloud-based EHR systems are becoming increasingly popular in ambulatory care settings due to their scalability, cost-effectiveness, and ease of access. Cloud solutions enable healthcare providers to access patient data from any location with an internet connection, improving continuity of care, especially for practices with multiple locations or mobile healthcare providers. This trend is expected to continue as cloud technology matures and provides robust data security, seamless updates, and better integration with other healthcare technologies.

Ambulatory EHR Market Opportunities

- Focus on patient-centered care: The rise in focus towards patient-centered care can help healthcare providers to drive their business growth. Patients expect a high-quality experience, which can encourage healthcare providers to adopt advanced digital solutions that can help them provide a better patient experience. This factor leads to the adoption of ambulatory EHR as it focuses on patient care outside of hospitals, including outpatient clinics, specialty practices, and primary care practices.

- Demand from emerging economies: Emerging economies such as India and China are widely adopting digital solutions across various industries to drive their economic growth and gain a competitive advantage in the global market. This factor will lead to the adoption of ambulatory EHR solutions and services in the healthcare sector.

Ambulatory EHR Market Regional Insights

The regional trends and factors influencing the Ambulatory EHR Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Ambulatory EHR Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Ambulatory EHR Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 5.9% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Delivery Mode

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Ambulatory EHR Market Players Density: Understanding Its Impact on Business Dynamics

The Ambulatory EHR Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Ambulatory EHR Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Ambulatory EHR Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Ambulatory EHR Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

Frequently Asked Questions

What are the options available for the customization of this report?

What are the deliverable formats of the emotion AI software market report?

What are the future trends of the Ambulatory EHR Market?

What are the driving factors impacting the global Ambulatory EHR Market?

What is the expected CAGR of the Ambulatory EHR Market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For