Americas Ventilators Market to Grow at a CAGR of 12.4% to reach US$ 6,076.31 million from 2022 to 2030

The Americas ventilators market size is projected to grow from US$ 2,392.03 million in 2022 to US$ 6,076.31 million by 2030; it is estimated to record a CAGR of 12.4% during 2022–2030.

Market Insights and Analyst View:

Ventilators are the medical device used by patients having breathing difficulty. These devices work by efficiently exchanging oxygen and CO2 in the body. Different ventilator types are available in the market. The ventilators can be used in different healthcare settings such as emergency rooms, intensive care units, and hospitals. The devices are essential to treat patients suffering from respiratory failure, pneumonia, acute respiratory distress syndrome, and other conditions. During the COVID-19 pandemic, ventilators were in high demand as they are essential for treating patients affected by severe infection and lung damage from the virus. Additionally, the increasing prevalence of respiratory disorders and rising technological advancements and innovations in ventilators are expected to create opportunities for market growth in the coming years. Moreover, rising demand for portable and compact ventilators with enhanced functionality is expected to fuel the Americas ventilators market growth in the coming years.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Growth Drivers and Opportunities:

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Chronic obstructive pulmonary disease (COPD), asthma, acute lower respiratory tract infections, tuberculosis, lung cancer, and other respiratory diseases can cause severe illness, acute respiratory failure, or death. Urbanization, pollution, unhealthy lifestyle, and high tobacco consumption are among the factors leading to the surge in the number of respiratory and cardiovascular disease cases.

As per the American Lung Association data of 2023, lung cancer is one of the major causes of cancer deaths in the US. More than 357 deaths are recorded due to lung cancer every day. In addition, lung cancer is one of the most common cancer types and a major cause of death due to cancer in Brazil. As per a study, “Demographic and Clinical Outcomes of Brazilian Patients with Stage III or IV Non–Small-Cell Lung Cancer,” more than 18,700 new cases of lung cancer were diagnosed among men and more than 12,500 cases among women in Brazil during 2018–2019.

COPD is anticipated to become the leading cause of death across the world in the next 15 years. According to the National Center for Biotechnology Information, it is a disease spectrum that includes bronchitis and emphysema and is becoming a significant health and economic crisis. COPD is the third leading cause of death by disease in the US. As per the 2023 American Lung Association data, ~34 million Americans suffer from chronic lung diseases such as asthma and COPD. Per the Office of Disease Prevention and Health Promotion, in the US, ~14.8 million adults were diagnosed with COPD in 2020. Similarly, in 2022, 4.6% of the adult population in the US was diagnosed with COPD, emphysema, or chronic bronchitis. Similarly, as per Statistics Canada, 2 million people have COPD, which can impair a person's capacity to breathe.

According to the Centers for Disease Control and Prevention (CDC), ~24.8 million people in the US had asthma in 2018. Moreover, as per Asthma and Allergy Foundation of America, asthma resulted in about 1.5 million emergency department (ED) visits in 2019 and 4.9 million doctors’ office visits. The Asthma and Allergy Foundation of America 2023 states that ~26 million people in the US had asthma in 2022, i.e., about 1 in 13 people in the country. Per the same source, ~3,517 death cases were recorded due to asthma in 2021.

A ventilator assists the patient affected by respiratory diseases or other such conditions in breathing, as these disorders make breathing difficult or impossible. Therefore, the treatment of respiratory diseases requires mechanical ventilation. Thus, the growing prevalence of respiratory diseases propels the demand for ventilators in American countries.

A major complication associated with the use of mechanical ventilators is their tendency to disrupt normal cardiopulmonary physiology. Medical staff members carefully measure the amount, type, speed, and force of the air the ventilator pushes into and pulls out of the lungs. Moreover, continuous exposure to a significantly high volume of oxygen can prove harmful to the lungs. Exceeding force of air might also weaken the lungs by damaging lung tissue; this is called ventilator-associated lung injury (VALI). The VALI can lead to pneumothorax injuries, pulmonary edema, hypoxemia, and other problems. In addition, it can cause bronchopleural fistula, pneumothorax, nosocomial pneumonia, and other complications that decrease cardiac output, cause gastric problems, and renal impairment. According to a study by the American Society of Microbiology, 80% of nosocomial pneumonia cases are associated with mechanical ventilation, known as ventilator-associated pneumonia (VAP). As per Airway Safety Movement Campaign data, ~250,000 and 300,000 VAP cases are reported in the US each year.

Other ventilator complications are delirium, immobility, and vocal cord problems. Moreover, the breathing tube in the airway could allow the entry of bacteria into the lungs, which would infect the lungs' alveoli. The tube also makes it harder to cough away debris that could irritate the lungs of patients and cause infection. Thus, complications associated with the use of ventilators hinder the growth of the Americas ventilators market size.

Report Segmentation and Scope:

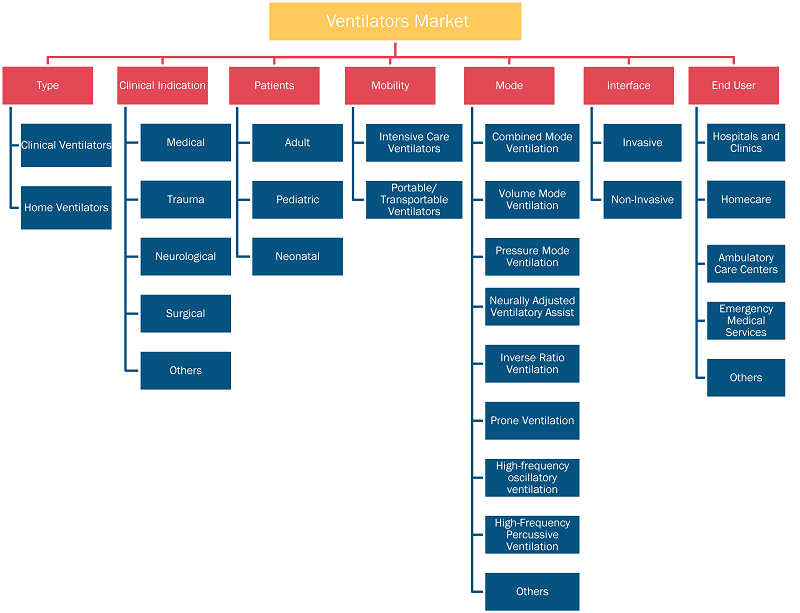

Based on product type, the ventilators market is bifurcated into clinical ventilators and home ventilators. Based on clinical indication, the ventilators market is segmented into medical, trauma, neurological, surgical, and others. By patients, the market is segmented into adult, pediatric, and neonatal. Based on mobility, the ventilators market is bifurcated into intensive care ventilators and portable/transportable ventilators. Based on mode, the ventilators market is segmented into combined mode ventilation, volume mode ventilation, pressure mode ventilation, neurally adjusted ventilatory assists, inverse ration ventilation, prone ventilation, high-frequency oscillatory ventilation, high-frequency percussive ventilation, and others. Based on interface, the ventilators market is bifurcated into invasive and non invasive. Based on end user, the ventilators market is segmented into hospitals and clinics, homecare, ambulatory care centers, emergency medical services, and Others. Based on country, the market is segmented into the US, Canada, Mexico, Brazil, Argentina, Chile, Peru, Colombia, and the Rest of Americas.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Segmental Analysis:

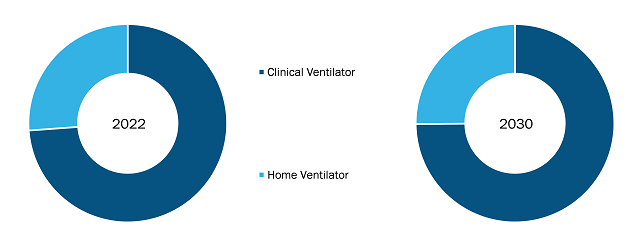

By type, the Americas ventilators market is bifurcated into clinical ventilators and home ventilators. The clinical ventilator segment held a larger market share in 2022. However, the home ventilators segment is anticipated to register a higher CAGR during the forecast period. The number of patients who need homecare ventilation is growing rapidly. Studies have indicated that patients on ventilators are no profit centers for hospital administrations, which induced hospitals to move such patients to other alternative care settings. Thus, the usage of portable and transport ventilators became a preferable choice for hospitals and patients. The use of portable ventilators in homecare settings reduces a patient’s cost of a stay in the hospital and enhances the life quality of patient.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Based on clinical indication, the Americas ventilators market is segmented into medical, trauma, neurological, surgical, and others. The medical segment held the largest market share in 2022 and is anticipated to register the highest CAGR during the forecast period.

The ventilators market, by end user, is segmented into hospitals and clinics, homecare, ambulatory care centers, emergency medical services, and others. The hospitals and clinics segment held the largest share of the market in 2022 and is anticipated to register the highest CAGR in the market during the forecast period. The hospitals and clinics segment is expected to hold a major share of the Americas ventilators market in the coming years owing to the availability of various types of medical ventilators and the growing adoption rate of these devices in hospital settings. The increasing prevalence of respiratory diseases and COVID-19 is also anticipated to propel the market growth for the segment in the future.

Country Analysis:

The US dominates the Americas ventilators market. The US ventilators market size was US$ 1,791.79 million in 2022, and the market is projected to reach US$ 4,464.17 million by 2030; it is expected to register a CAGR of 12.1% during the forecast period. The market growth in the US is attributed to the increasing prevalence of respiratory disorders. According to the Bronchitis Facts and Statistics published in November 2022, bronchitis is a common reason for the hospitalization of adults in the US. About 1 in 20 US adults suffer from acute bronchitis yearly, and ∼10 million people (i.e., 3% of the population) are affected by chronic bronchitis. Thus, the rising number of patients suffering from respiratory disorders will generate the need for supplemental oxygen, thereby inducing the demand for respiratory care devices.

Due to the COVID-19 pandemic, respiratory devices company under the Advanced Medical Technology Association (AdvaMed), an American medical device trade association in the US, boosted their ventilator production from 700 ventilators per week to 2,000–3,000 ventilators per week and is expected to reach 5,000–7,000 per week. In addition, immediate product approvals during this pandemic are also likely to favor the growth of the market. For instance, in April 2020, Medtronic received US Food and Drug Administration (FDA) approval to launch and market its PB560 ventilator immediately. The US government ordered ventilators to cater to rising demand during the COVID-19 pandemic beginning. The government signed ventilator contracts with ventilator manufacturers in April 2020. Therefore, the growing prevalence of respiratory diseases, the presence of major market players in the US, and government efforts to cater to the need for ventilators enhance the Americas ventilators market growth in the US.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the Americas ventilators market are mentioned below.

- In July 2021, Mindray, a global leader in developing and providing advanced medical devices, hosted a virtual launch event to introduce a new turbine-based ventilator, the SV300 Pro. The new SV300 Pro brings the company’s latest state-of-the-art functions and technologies into a compact device to address difficult clinical challenges. To ensure SV300 Pro is ready for emergencies, such as cardiac arrest, the innovative CPRV, a specially developed ventilation mode, is integrated for CPR procedures.

- In May 2020, Vyaire Medical Inc. and Spirit AeroSystems entered into a new manufacturing and supply collaboration to build critical care ventilators at a converted facility in Wichita, Kan. The temporary special partnership allows Vyaire to ramp up production of critical care ventilators quickly. The partnership advances earlier action taken by Vyaire to accelerate the production of ventilators and other related respiratory equipment at its primary production facilities based in North America.

COVID-19 Impact:

The COVID-19 pandemic adversely affected economies and industries in various countries across the world. Lockdowns, travel restrictions, and business shutdowns in Americas affected the growth of several sectors, including the healthcare sector. The COVID-19 pandemic had a significant impact on the ventilators market as well. As healthcare systems across the region focused on managing the growing COVID-19 cases, elective procedures such as certain surgeries were deferred or canceled, resulting in a temporary decline in demand for various medical devices. However, the increasing number of cases and complications of COVID-19 propelled the demand for ventilators in the region. This sudden upsurge in demand and limited supply created a huge burden on manufacturing units for the production of ventilators. Several global manufacturers from different industries came together to produce ventilators to deal with the pandemic. In March 2020, GE Healthcare and Ford Motor Company came together to scale up the production of ventilators — a move aimed to arm clinicians with vital medical equipment to treat COVID-19 patients. Equipped with the essential functions required to treat COVID-19, the new system will be built specifically to address the urgent needs of the pandemic. Such collaborations in the region during the pandemic are expected to impact the market growth positively. During post- COVID-19 pandemic, the production of ventilators has been reduced drastically as there are sufficient ventilators manufactured and procured by the hospitals.

Competitive Landscape and Key Companies:

Medtronic Plc, Koninklijke Philips NV, Hamilton Medical AG, Dragerwerk AG & Co KGaA, Vyaire Medical Inc, Getinge AB, ResMed Inc, ICU Medical Inc, Nihon Kohden Corp, and Shenzhen Mindray Bio-Medical Electronics Co Ltd are a few companies operating in the Americas ventilators market. These companies focus on new product launches and geographic expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. They have a widespread global presence, which helps them serve a large and varied clientele and subsequently expand their market share. The report offers a trend analysis of the ventilators market, emphasizing parameters such as technological advancements, market dynamics, and competitive landscape analysis of leading market players worldwide.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Clinical Indication, Patients, Mobility, Mode, Interface, End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Brazil, Canada, Chile, Colombia, Mexico, Peru, United States

Frequently Asked Questions

The factors driving the growth of the Americas ventilators market include the growing prevalence of respiratory diseases and the rapidly increasing geriatric population.

The Americas ventilators market is expected to be valued at US$ 6,076.31 million by 2030.

A ventilator is an automatic breathing system that transfers breathable air into and out of the lungs to provide breaths to a patient having breathing difficultly. The unit performs by adding oxygen to the bloodstream and removing carbon dioxide from the bloodstream. This helps a patient with respiratory problems get the right oxygen quantity. It also helps the patient's body to heal since it eliminates the extra energy of labored breathing.

The Americas ventilators market was valued at US$ 2,392.03 million in 2022.

The Americas ventilators market majorly consists of the players, including Medtronic Plc, Koninklijke Philips NV, Hamilton Medical AG, Dragerwerk AG & Co KGaA, Vyaire Medical Inc, Getinge AB, ResMed Inc, ICU Medical Inc, Nihon Kohden Corp, and Shenzhen Mindray Bio-Medical Electronics Co Ltd.

The List of Companies - Americas Ventilators Market

- Medtronic Plc

- Koninklijke Philips NV

- Hamilton Medical AG

- Dragerwerk AG & Co KGaA

- Vyaire Medical Inc

- Getinge AB

- ResMed Inc

- ICU Medical Inc

- Nihon Kohden Corp

- Shenzhen Mindray Bio-Medical Electronics Co Ltd.

Get Free Sample For

Get Free Sample For