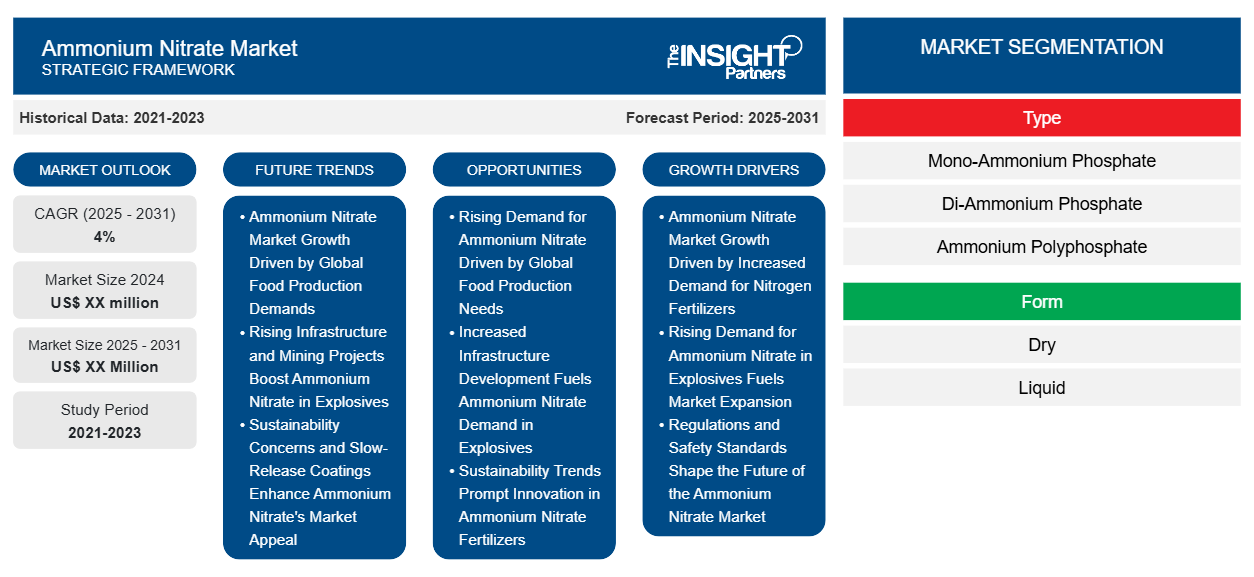

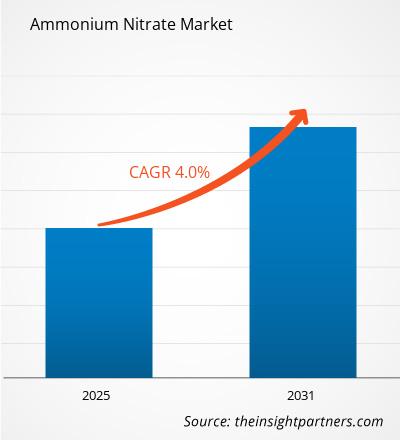

The Ammonium Nitrate Market is expected to register a CAGR of 4% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Type (Mono-Ammonium Phosphate (MAP), Di-Ammonium Phosphate (DAP), Ammonium Polyphosphate). The report further presents analysis based on Form (Dry and Liquid). The global analysis is further broken-down at regional level and major countries. The market size and forecast at global, regional, and country levels for all the key market segments are covered under the scope. The report offers the value in USD for the above analysis and segments. The report provides key statistics on the market status of the key market players and offers market trends and opportunities.

Purpose of the Report

The report Ammonium Nitrate Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Ammonium Nitrate Market Segmentation

Type

- Mono-Ammonium Phosphate

- Di-Ammonium Phosphate

- Ammonium Polyphosphate

Form

- Dry

- Liquid

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Ammonium Nitrate Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Ammonium Nitrate Market Growth Drivers

- Ammonium Nitrate Market Growth Driven by Increased Demand for Nitrogen Fertilizers: The ammonium nitrate market is primarily driven by its widespread use as a nitrogen fertilizer. With the global population growing and the need for increased food production, farmers are increasingly relying on ammonium nitrate to boost crop yields. Its effectiveness as a quick-release nitrogen source makes it a preferred choice, leading to robust market growth.

- Rising Demand for Ammonium Nitrate in Explosives Fuels Market Expansion: Ammonium nitrate is a critical component in the production of explosives for mining, construction, and demolition. As infrastructure projects and mining activities expand globally, the demand for ammonium nitrate in explosives is increasing. This dual role as a fertilizer and explosive precursor is driving substantial growth in the ammonium nitrate market.

- Regulations and Safety Standards Shape the Future of the Ammonium Nitrate Market: Increasing regulations concerning the handling and storage of ammonium nitrate, particularly in the explosives industry, are influencing market dynamics. Manufacturers are investing in safer production and distribution methods to comply with these regulations. As companies adopt safer practices, the market may experience changes in demand patterns and product innovations.

Ammonium Nitrate Market Future Trends

- Ammonium Nitrate Market Growth Driven by Global Food Production Demands: The ammonium nitrate market will witness significant growth, particularly driven by the incessant urge to increase food production across the globe. The challenges that come with population growth culminated by urbanization imprints a great need for effective fertilizers that are capable of increasing crop yields among the farmers. This is because ammonium nitrate contains nitrogen in a form that is readily available for utilized by crops and thus it will remain the product of choice for many agricultural producers hence fuelling the growth of this market.

- Rising Infrastructure and Mining Projects Boost Ammonium Nitrate in Explosives: As the number of infrastructure and raw material development projects across the globe rises, the use of ammonium nitrate in the manufacture of contruction and mining explosives is foreseen to increase. In this way, as both a fertilizer and a user-filling agent, annex A14 enchancing product avolatile extreme troduction will make it exceptionally attractive to investors in the production and sale of ammonium nitrate.

- Sustainability Concerns and Slow-Release Coatings Enhance Ammonium Nitrate's Market Appeal: With increasing environmental provisions, attention is now turning to the use of effective and safe fertilizers. For instance, the introduction the ammonium nitrate slow release coating the environment will protect the environment and optimize fertilizer nitrogen use. It is this concern in sustainability that will attract more users to ammonium nitrate thus facilitating the uptake of this market.

Ammonium Nitrate Market Opportunities

- Rising Demand for Ammonium Nitrate Driven by Global Food Production Needs: The ammonium nitrate market since there is an increased demand for food production as the population increases. Farmers are looking for better and efficient fertilizers to increase their crop yields, and consequently, ammonium nitrate as a nitrogen source will be the most sought after, hence making it a consistent demand for manufacturers.

- Increased Infrastructure Development Fuels Ammonium Nitrate Demand in Explosives: The rise in infrastructural activities across the globe particularly in third world countries is expected to create a high demand of ammonium nitrate in the explosives market. The growth in the construction and the mining industry will increase the demand for effective explosives hence presenting a huge market for suppliers of ammonium nitrate.

- Sustainability Trends Prompt Innovation in Ammonium Nitrate Fertilizers: The trend of adhering to environmental sustainability in agriculture has created a chance to formulate better ammonium nitrate alternatives. Slow release or coated fertilizers for instance are innovations that can improve nutrient use efficiency and will reduce pollution which will entice consumers in the farmers and agri-businesses.

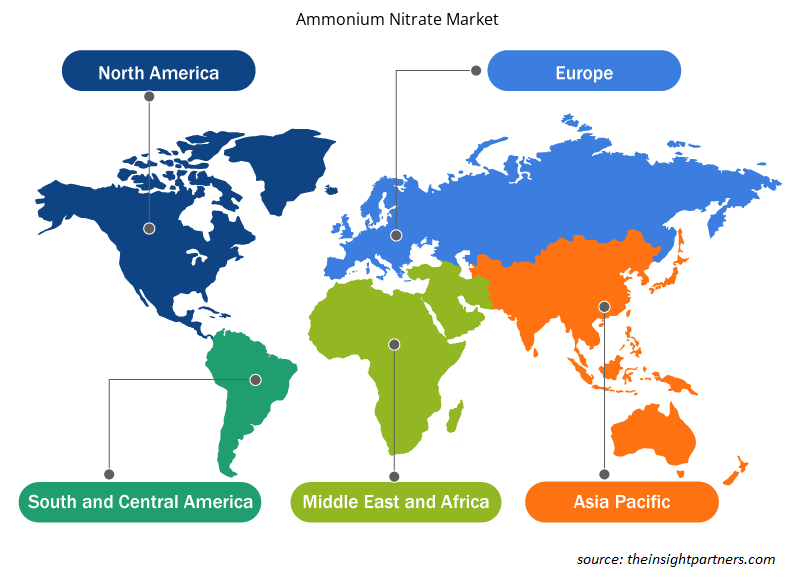

Ammonium Nitrate Market Regional Insights

The regional trends and factors influencing the Ammonium Nitrate Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Ammonium Nitrate Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Ammonium Nitrate Market

Ammonium Nitrate Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 4% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

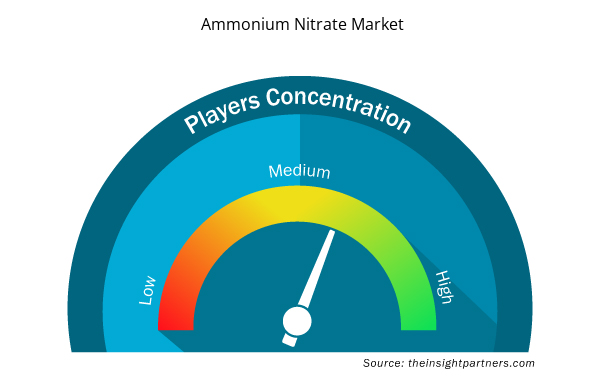

Ammonium Nitrate Market Players Density: Understanding Its Impact on Business Dynamics

The Ammonium Nitrate Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Ammonium Nitrate Market are:

- CSBP Limited

- TradeMark Nitrogen

- CF Industries Holdings Inc

- Orica Limited

- Yara International ASA

- Uralchem

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Ammonium Nitrate Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Ammonium Nitrate Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Ammonium Nitrate Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Increasing agricultural productivity needs is expected to be the key market trends

Based on type, the mono-ammonium phosphate (MAP) segment is expected to witness the fastest growth during the forecast period

Based on geography, Asia Pacific held the largest share of the ammonium nitrate market due to the well-established agriculture industry across the region, coupled with continuous growth and development

Surge in fertilizer demand is driving the market growth

Yara International ASA; CF Industries Holdings, Inc.; Nutrien Ltd.; Orica Limited; Uralchem JSC; Terra Nitrogen Company, L.P.; BASF SE; K+S Aktiengesellschaft; Koch Industries, Inc.; Tessenderlo Group; Fertiberia S.A.; Shanxi Jincheng Anthracite Mining Group; Brevard Chemical Co.; Agrium Inc.; Indian Farmers Fertiliser Cooperative Limited (IFFCO)

The Ammonium Nitrate Market is estimated to witness a CAGR of 4% from 2023 to 2031

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

- CSBP Limited

- TradeMark Nitrogen

- CF Industries Holdings Inc

- Orica Limited

- Yara International ASA

- Uralchem

- Acron Group

- Enaex SA

- Maxam Corp Holding SL

- Sasol Limited

Get Free Sample For

Get Free Sample For