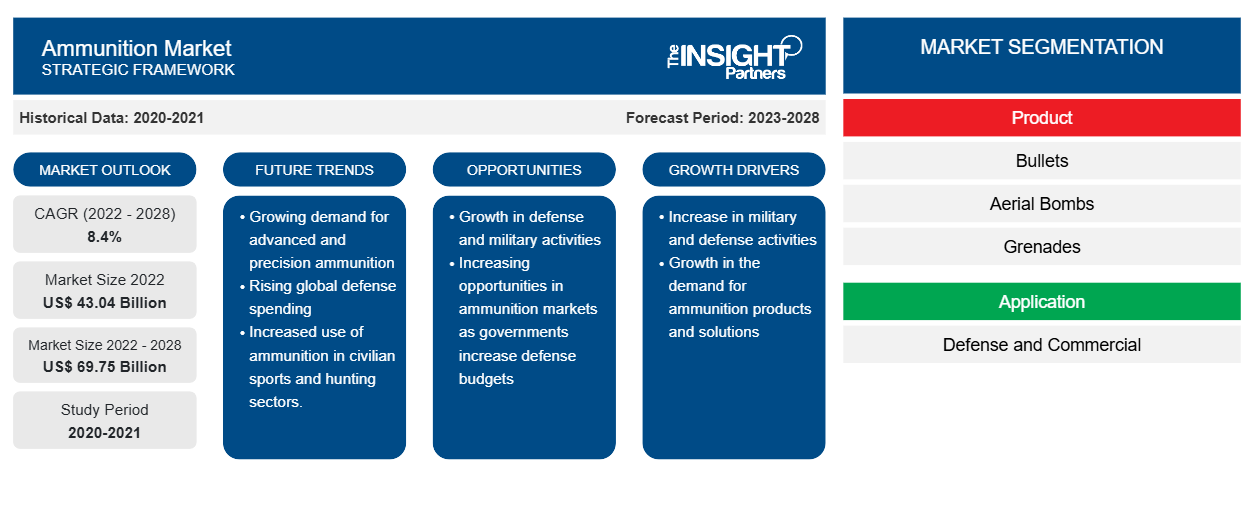

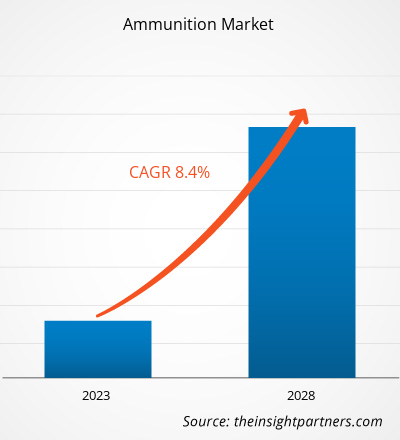

The Ammunition Market is expected to grow from US$ 43.04 billion in 2022 to US$ 69.75 billion by 2028; it is estimated to grow at a CAGR of 8.4% from 2022 to 2028.

The Ammunition Market players are majorly focusing on the development of new and innovative ammunitions to replace different traditional brass cartridges. For instance, Nammo, an international aerospace and defense company, is looking for new lightweight materials that could replace brass cartridges that would benefit individual soldiers by lowering the overall weight and easy transportation of ammunition boxes as well. As a result, the company has invested in MAC LLC, which manufactures ammunition for small arms, to continue the research & development of such products. Further, missile manufacturers have been using composite materials for the last few years for making missiles lightweight, which can allow them to cover extended ranges than those covered by missiles made from conventional materials.

As several country governments have been pushing their capabilities to increase their firepower and strengthen their armed forces, the demand for advanced weaponry systems has been on the rise, thereby driving the Ammunition Market growth. In 2019, a country in Asia Pacific awarded a US$ 30 million contract to Elbit Systems for the procurement of STYLET-guided mortar ammunitions. Similarly, in 2022, Bharat Dynamics Limited (BDL) won a contract worth US$ 394 million to supply Konkurs-M anti-tank guided missiles to the Indian Army. Moreover, in 2022, the US Navy awarded a US$ 217 million contract to Raytheon Technologies for the procurement of Tomahawk guided cruise missiles.

The development of precision-guided grenades by the US armed forces is likely to transform the line infantry attack dynamics worldwide. In 2017, the US Army announced that it would produce 105 XM25 Counter Defilade Target Engagement (CDTE) weapons, which are precision-guided grenade launchers, to assign them to specially trained soldiers. The US Army has already tested the weapon in combat in Afghanistan. The weapon received mixed reviews from soldiers who were using it. Ranger units found the XM25 cumbersome for the battlefield. They were also concerned that the limited basic load of 25mm rounds was insufficient to justify taking an M4A1 carbine out of the mission. However, continuous efforts for improving such ammunitions are likely to generate new opportunities for market players during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Ammunition Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Ammunition Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Ammunition Market Growth

Massive demand for ammunition and firearms in 2020 resulted in the shortage of ammunition as the manufacturers faced challenges in continuing their operations amid the social restrictions imposed in response to the COVID-19 pandemic due to disrupted supply chains, which led to raw material shortages, increased prices, and inventory shortfalls. The defense sector did not experience any significant impact from the pandemic; however, the vendors that produce ammunitions for commercial applications faced many challenges in the procurement of raw materials. The demand for ammunition reduced significantly in 2020 in commercial applications due to the suspension of shooting sports events and hunting activities amid lockdown situations. However, commercial application is a secondary preference for ammunition manufacturers, as their priority is to cater to military demands. Currently, they are focused on grabbing contracts from defense authorities of different countries to remain competitive in the Ammunition Market due to the rise in expenditure by different countries.

Market Insights – Ammunition Market

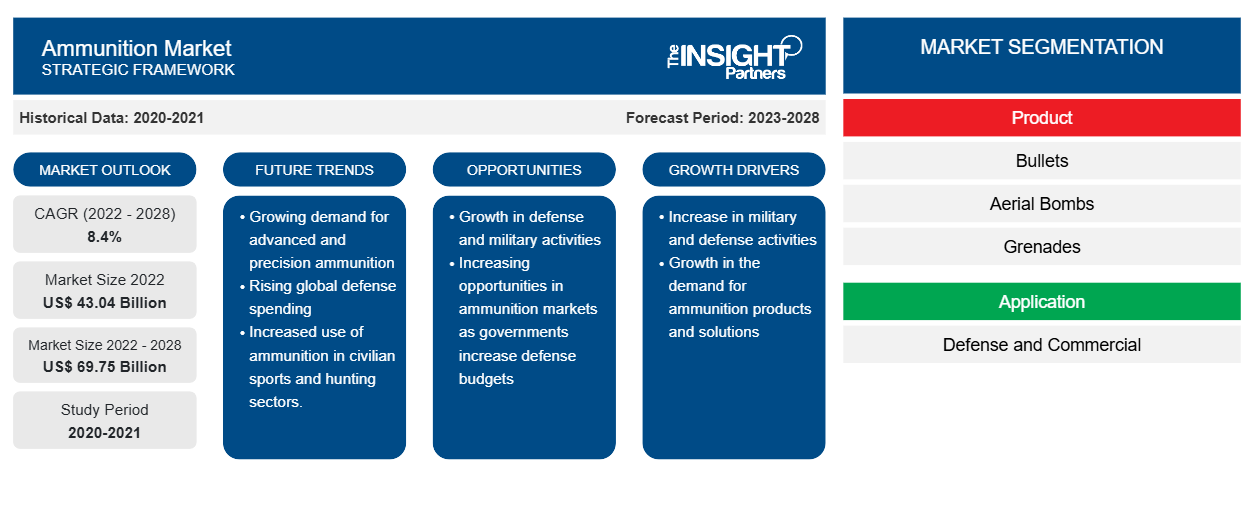

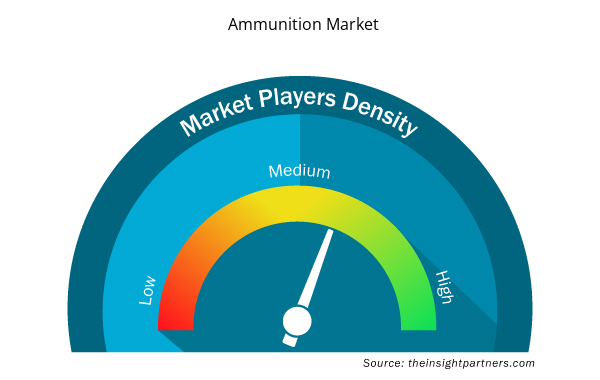

Based on region, the Ammunition Market is primarily segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America. North America is expected to account for the largest Ammunition Market share in 2022 and is expected to continue to be a dominant shareholder during the forecast period. Also, Europe is expected to account for second largest Ammunition Market share in 2022 followed by Asia Pacific. Further, Asia Pacific is expected to register the highest CAGR in the Ammunition Market during the forecast period.

Ammunition Market Regional Insights

Ammunition Market Regional Insights

The regional trends and factors influencing the Ammunition Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Ammunition Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Ammunition Market

Ammunition Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 43.04 Billion |

| Market Size by 2028 | US$ 69.75 Billion |

| Global CAGR (2022 - 2028) | 8.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

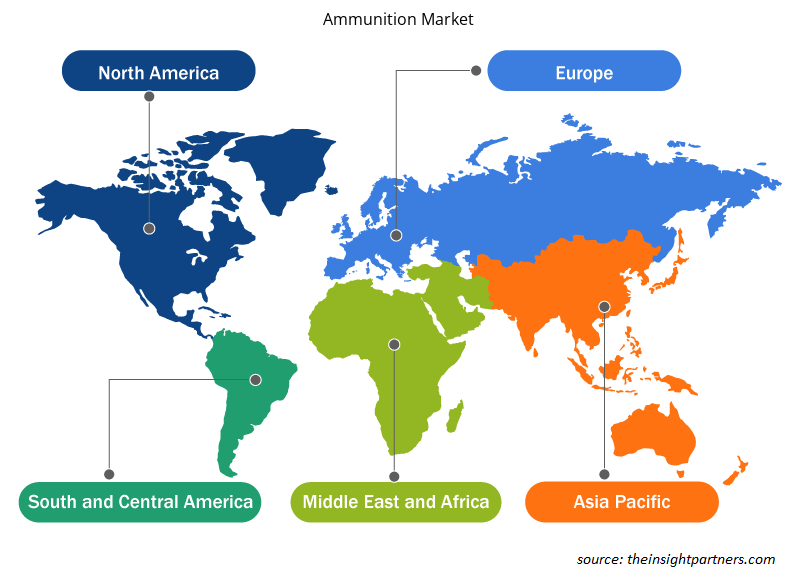

Ammunition Market Players Density: Understanding Its Impact on Business Dynamics

The Ammunition Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Ammunition Market are:

- Northrop Grumman Corporation

- BAE Systems

- Elbit Systems Ltd.

- Raytheon Technologies Corporation

- Vista Outdoor Operations LLC

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Ammunition Market top key players overview

Guidance Insights – Ammunitions Market

Based on guidance, the Ammunition Market is bifurcated into guided and non-guided. The guided segment is expected to dominate the Ammunition Market in 2022, and it is also projected to retain its dominance during the forecast period as well. The growth of the guided ammunitions segment is attributed to huge demand for precision guided missiles and large adoption of guided mortar systems. Advancements in positioning system technologies, such as semi-active lasers, radar homing, inertial navigation systems (INS), and global positioning systems (GPS), are favoring the guided Ammunition Market growth. In addition, the compatibility of the positioning system with the missile's nuclear warhead is likely to boost its inclusion in ammunition. For instance, in May 2022, EMCORE Corporation received its first order to provide multiple SDI170 MEMS inertial measurement units (IMUs) for precision-guided ammunition by a major international weapons system manufacturer. In November 2021, HALCON, a part of the EDGE Group that is a leading manufacturer and supplier of precision-guided weapons, received a contract worth US$ 880 million from the UAE Armed Forces for its Thunder and Desert Sting range of precision-guided munitions.

The Ammunition Market is highly fragmented due to the presence of large number of Ammunition Market players across the world. Thales Group, Raytheon Technologies, Elbit Systems Ltd., Northrop Grumman Corporation, and BAE Systems are among the prominent Ammunition Market players operating worldwide. The top five players account for ~25% of the total market, wherein the other 3 quarters of the market has been acquired by more than 300 vendors.

The Ammunition Market players are witnessing a rise in demand for across several commercial as well as defense applications. Therefore, many companies focus on expanding their product offerings to private and public end users. For this, they are partnering with different companies to develop sustainable solutions for the public and private sectors.

- In May 2022, Nammo signed a contract with the Swedish Defence Materiel Administration (FMV) to be the sole supplier of 12.7mm ammunitions to Swedish armed forces until 2029.

- In March 2022, the defense ministry of Saudi Arabia inked 23 contracts for US$ 3.4 billion with local and international enterprises. During the same period, the Saudi Arabian Military Industries (SAMI) also signed 5 contracts for US$ 1.6 billion to purchase military vehicles, ammunition, and communication devices.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Fish Protein Hydrolysate Market

- Europe Industrial Chillers Market

- Artificial Intelligence in Defense Market

- MEMS Foundry Market

- Real-Time Location Systems Market

- Unit Heater Market

- Public Key Infrastructure Market

- Virtual Pipeline Systems Market

- Passport Reader Market

- Fill Finish Manufacturing Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Application, Guidance, Lethality, and Caliber

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The global market size of the ammunition market by 2028 will be around US$ 69.75 billion

Aerial bomb segment is expected to hold a major market share of the ammunition market in 2022

The US is expected to hold a major market share of the ammunition market in 2022

India, China, and Japan are expected to register high growth rates during the forecast period

Asia Pacific is expected to register the highest CAGR in the ammunition market during the forecast period (2022-2028)

Thales Group, Raytheon Technologies, Elbit Systems Ltd., Northrop Grumman Corporation, and BAE Systems are the key market players expected to hold a major market share of the ammunition market in 2022

Technological advancements across firearms industry

Rise in global military spending promotes procurement of ammunitions

Introduction of lightweight ammunitions

The estimated global market size for the ammunition market in 2022 is expected to be around US$ 43.04 billion

The ammunition market is expected to register an incremental growth value of US$ 26.70 billion during the forecast period

Trends and growth analysis reports related to Aerospace and Defense : READ MORE..

The List of Companies - Ammunitions Market

- Northrop Grumman Corporation

- BAE Systems

- Elbit Systems Ltd.

- Raytheon Technologies Corporation

- Vista Outdoor Operations LLC

- AMTEC Corporation

- NAMMO AS

- Rheinmetall AG

- RUAG Group

- Thales Group

Get Free Sample For

Get Free Sample For