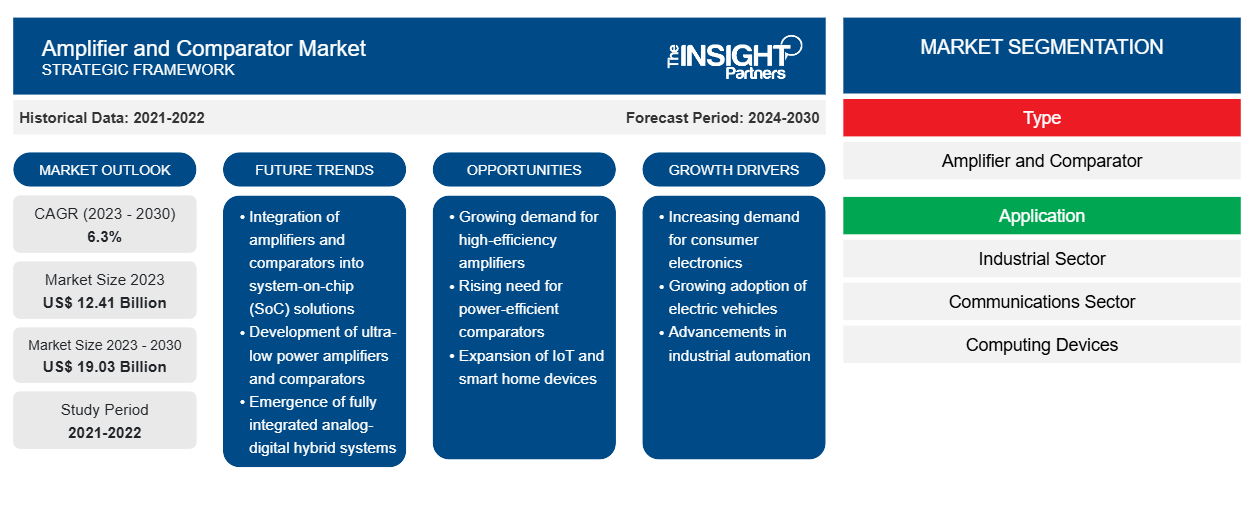

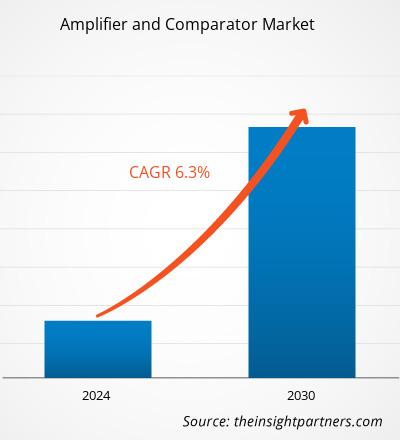

[Research Report] The amplifier and comparator market is expected to grow from US$ 12.41 billion in 2023 to US$ 19.03 billion by 2030; it is estimated to register a CAGR of 6.3% from 2023 to 2030.

Analyst Perspective:

The need for computing devices and the increase in the production of computing devices are a few major factors driving the amplifier and comparator market. With the growing need for computing devices and consumer electronics, various governments are takings steps to increase the production of consumer electronics. The Indian government established India as a worldwide hub for Electronics System Design and Manufacturing (ESDM) by fostering and advancing national skills for designing key components, such as chipsets, and fostering a climate allowing the sector to compete internationally. According to the Press Information Bureau (PIB), the Production Linked Incentive Scheme (PLI) for Large Scale Electronics Manufacturing launched in 2020 under the National Policy on Electronics 2019 offers incentives from 4% to 6% on incremental sales (over a base year) to eligible companies. Manufacturers of mobile phones and specified electronic components, including assembly, testing, marking, and packaging (ATMP) units, are the eligible scheme beneficiaries.

Asia Pacific Market Overview:

The amplifier and comparator market in APAC is segmented into South Korea, India, China, Japan, Australia, and the Rest of APAC. The region comprises various growing economies—India, China, Indonesia, and the Philippines. These countries are witnessing a gradual rise in the adoption of advanced technologies. Further, the availability of low labor costs, low taxes and duties, and a strong business ecosystem are luring global players in the electronic manufacturing industry to expand their manufacturing facilities in this region. In September 2021, Molex, one of the world's leading manufacturers of electronic, electrical, and fiber optic connectivity systems, announced it is expanding its existing manufacturing operations in Hanoi, Vietnam. With this strategic development, the company is expected to support the growing demand for its products across various applications, including smartphones, TVs, and home appliances. Thus, the growing manufacturing industry in APAC is anticipated to offer lucrative opportunities for the amplifier and comparator market in the coming years.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Amplifier and Comparator Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Amplifier and Comparator Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Rising Adoption of Electronic Transportation to Drive Growth of Contraceptives Market

The electronic mode of transportation is perceived to benefit the environment and reduce fuel consumption. Many governments across the world have embraced the Electric Vehicles Initiative (EVI), a multi-government policy forum coordinated by the International Energy Agency (IEA) to accelerate the introduction and adoption of electric vehicles worldwide. According to the IEA, 16 countries are the current participants of this program: Canada, Chile, China, Finland, France, Germany, India, Japan, the Netherlands, New Zealand, Norway, Poland, Portugal, Sweden, the UK, and the US. An electric battery is a core component of the electric mode of transportation. In these batteries, the output of the comparator is used to alert a microcontroller regarding their discharged or low power status. Also, the amplifier is used in EV battery management, and the isolated amplifier offset determines the initial precision of the current sense. Thus, the large-scale application of amplifiers in batteries required for electronic transportation would bolster the consumption of amplifier and comparator in the future.

Segmental Analysis:

Based on type, the amplifier and comparator market is segmented into amplifier ad comparators. The amplifier segment held the largest amplifier and comparator market share in 2022. Also, amplifiers segment is likely to be the fastest growing amplifier and comparator market segment during the forecast period. This is owing to the constant demand for PCB-based (printed circuit board) amplifiers for different electronic products used among various industries worldwide. For instance, the industries such as consumer electronics, military electronics, aerospace electronics, automotive electronics, and other industrial electronic products that includes PCBs inside the products. This is one of the major factors aiding the amplifier and comparator market growth for the amplifier segment.

Amplifiers are essential building components in sensing, communication, and control systems, as they magnify weak signals. The increasing demand for compact and low-power devices, the need for high-speed data communication, and an upsurge in the Internet of Things (IoT) applications are among the factors propelling the use of amplifiers. In December 2021, the Ministry of Communications, India, exempted the use of very-low-power radio frequency devices or equipment for inductive applications from licensing requirements. According to India Cellular and Electronics Associations (ICEA), the exemption of licensing for very-low-power devices would benefit the telecommunications, electronics, and allied sectors in the medium to long term by encouraging the use of these devices. Such initiatives by governments boost the demand for amplifiers and propel the amplifier and comparator market growth.

Regional Analysis:

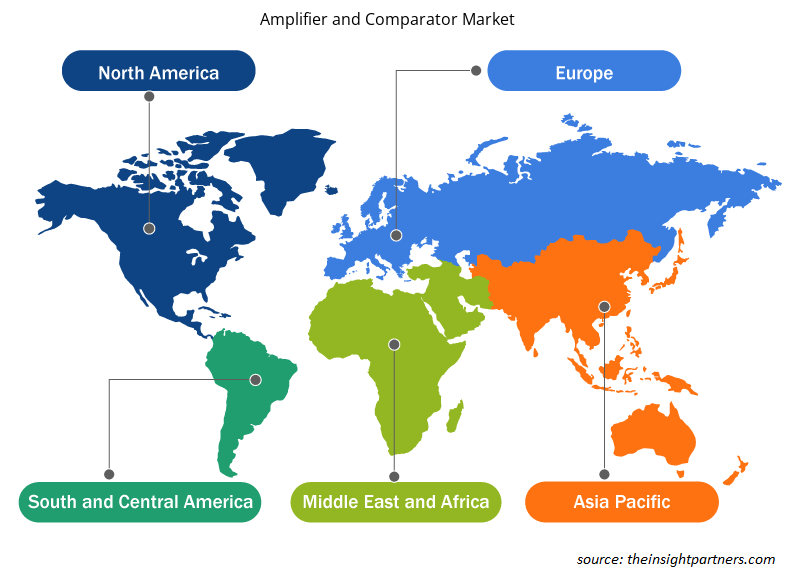

The amplifier and comparator market are segmented into five major regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America. In 2022, North America led the amplifier and comparator market with a substantial revenue share, followed by Europe. Further, Asia Pacific is expected to register the highest CAGR in the amplifier and comparator market from 2023 to 2030.

Asia Pacific accounted for the largest share in the global amplifier and comparator market. One of the major reasons behind the higher amplifier and comparator market share for the region is the presence of largest number of semiconductor fabricating foundries. Further the presence of countries such as Taiwan, China, Japan, and South Korea that are one of the largest bases for electronic products and component manufacturing is another major factor driving the growth of amplifier and comparator market across the region.

Moreover. the European region is likely to be the fastest growing region in the manufacturing and sales of amplifier and comparator market. This is mainly due to the increase in demand for setting up MEMS foundaries across the region wherein several companies along with government of different countries have been collaboratively working to establish a strong electronics and semiconductor manufacturing setup across the region. Moreover, the presence of a strong industrial and automotive sector is another major factor propelling the growth of amplifier and comparator market. This is also due to the growth in deployment of electronic components in the industrial manufacturing and automotive products.

Key Player Analysis:

The amplifier and comparator market analysis consists of the players such as Analog Devices Inc, Broadcom Inc, STMicroelectronics, Microchip Technology Inc, NXP Semiconductors, On Semiconductor, Renesas Electronics Corporation, Skyworks Solutions Inc, Texas Instruments Inc, and ABLIC Inc. Among the amplifier and comparator market players, Analog Devices Inc and Texas Instruments Inc are the top two players owing to the diversified product portfolio offered.

Amplifier and Comparator Market Regional Insights

Amplifier and Comparator Market Regional Insights

The regional trends and factors influencing the Amplifier and Comparator Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Amplifier and Comparator Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Amplifier and Comparator Market

Amplifier and Comparator Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 12.41 Billion |

| Market Size by 2030 | US$ 19.03 Billion |

| Global CAGR (2023 - 2030) | 6.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

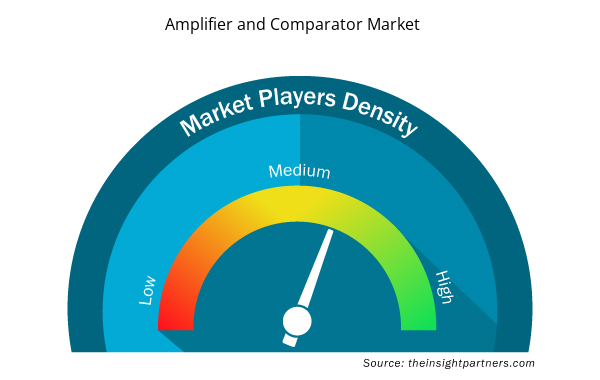

Amplifier and Comparator Market Players Density: Understanding Its Impact on Business Dynamics

The Amplifier and Comparator Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Amplifier and Comparator Market are:

- Analog Devices Inc

- Broadcom Inc

- STMicroelectronics

- Microchip Technology Inc

- NXP Semiconductors

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Amplifier and Comparator Market top key players overview

Recent Developments:

Inorganic and organic strategies such as mergers, acquisitions, new product launches, etc., are highly adopted by companies in the amplifier and comparator market. A few recent key amplifier and comparator market developments are listed below:

- In 2023, Tata Consultancy Services and Renesas partnered plan to work together With the opening of a joint innovation center in Bengaluru and Hyderabad on software development, radio frequency, digital, and mixed-signal design for cutting-edge next-generation semiconductor solutions that will serve the needs of numerous industries.

- In 2023, Renesas unveiled three new MCU groups designed for applications involving motor control. Devices from the RX and RA families are among the more than 35 new products that Renesas launched. With several MCU and MPU families, analog and power solutions, sensors, communications equipment, signal conditioners, and other devices, the new MCUs expanded the leading motor control range in the market.

- In 2022, Hypex Electronics revealed the NCx500 OEM, the first of a new NCOREx family of modules, and announced an updated version of its well-known NCORE Class-D amplifier technology.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, Taiwan, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Optical amplifiers act as optical repeaters in long-distance, fiber-optic communications. Thus, the increasing demand for optical amplifiers with the rise in the implementation of various modern network types bolsters the amplifier and comparator market growth.

The incremental growth, expected to be recorded for the amplifier and comparator market during the forecast period, is US$ 6.61 billion.

The global amplifier and comparator market was estimated to be US$ 12.41 billion in 2023 and is expected to grow at a CAGR of 6.3%, during the forecast period 2023 - 2030.

The amplifier is used in EV battery management, and the isolated amplifier offset determines the initial precision of the current sense. Thus, the large-scale application of amplifiers in batteries required for electronic transportation would bolster the consumption of amplifiers and comparators in the future.

The amplifier and comparator market is expected to reach US$ 19.03 billion by 2030.

The key players, holding majority shares, in amplifier and comparator market includes Analog Devices Inc, Texas Instruments Inc, Renesas, STMicroelectronics NV, and NXP Semiconductors.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Amplifier and Comparator Market

- Analog Devices Inc

- Broadcom Inc

- STMicroelectronics

- Microchip Technology Inc

- NXP Semiconductors

- On Semiconductor

- Renesas Electronics Corporation

- Skyworks Solutions Inc

- Texas Instruments Inc

- ABLIC Inc

Get Free Sample For

Get Free Sample For