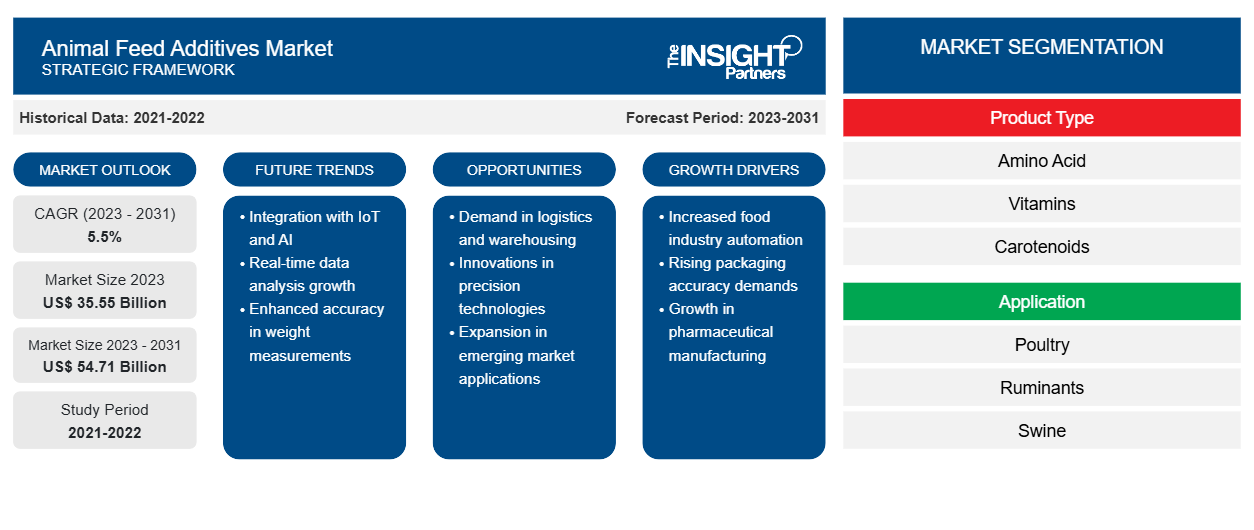

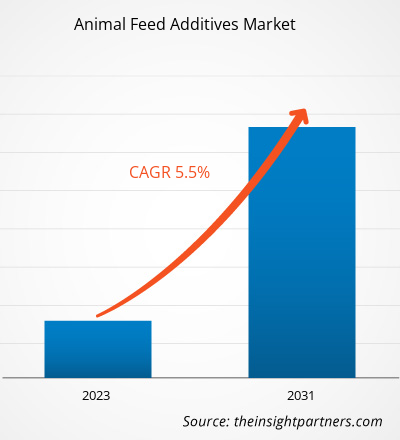

The Animal Feed Additives Market size is projected to reach US$ 54.71 billion by 2031 from US$ 35.55 billion in 2023. The market is expected to register a CAGR of 5.5% in 2023–2031. The rising demand for livestock products is likely to remain key animal feed additives market trends.

Animal Feed Additives Market Analysis

The addition of feed additives is particularly important in specially formulated diets where rapid ingestion is highly desirable. A few additives such as vitamins and amino acids and their metabolites are essential regulators of metabolic activities in animals for resistance to environmental stressors, reproduction, larval metamorphosis, behaviour, immunity, growth, maintenance, nutrient utilization, and feed intake. The various benefits of additives have resulted in the growing utilization of additives to target specific health conditions. Therefore, the increasing use of additives in animal feed is fuelling the demand for the animal feed additives market.

Animal Feed Additives Market Overview

Feed additives are substances or micro-organisms which are intentionally added to feed to enhance their nutritional quality. The additives might impact feed presentation, hygiene, digestibility, or effect on intestinal health. The demand for animal feed additives is increasing at a high pace as the consumption of meat and related products is rising globally. The market is characterized by presence of large number of participants resulting in highly fragmented market. The leading market players are focused on expanding business in international and domestic markets for further market penetration.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Animal Feed Additives Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Animal Feed Additives Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Animal Feed Additives Market Drivers and Opportunities

Increasing Livestock Production to Favor Market

The industrial livestock production has undergone a significant transformation due to the advancements in antibiotics and animal vaccinations. The increasing demand for meat-based products propels the production of industrial livestock. Livestock products account for 16% of energy and 34% of the protein in human diets. Also, livestock production accounts for around 19% of the value of food production and 30% of the global value of agriculture. The demand for livestock products is driven by the changing lifestyles and food preferences, increasing urbanization, growing income, and the rapidly rising world population. Therefore, the high demand for livestock products drives the market. The surge in demand for livestock products subsequently affects the demand for animal feed and feed additives. The additives offer improved gut performance that reduces the need for harmful antibiotics. Phytogenic, acidifiers, and aquaculture are a few examples of additives for gut health. The demand for such additives is growing, especially after the ban on antibiotics as an additive. Therefore, the high demand for livestock products drives the animal feed additives market.

Surging Poultry Industry– An Opportunity in Animal Feed Additives Market

The feed additives are commonly used in poultry diets are antimicrobials, antioxidants, emulsifiers, binders, pH control agents, and enzymes. These additives are primarily used to improve the efficiency of the bird’s growth and laying capacity. It also helps to prevent disease and improve feed utilization. Furthermore, an increase in demand and consumption of livestock-based products such as dairy, dairy-based products, meat, and eggs is expected to drive the feed additives market in the growth and development of poultry livestock.

Animal Feed Additives Market Report Segmentation Analysis

Key segments that contributed to the derivation of the animal feed additives market analysis are product type, and application.

- Based on product type, the market is divided into amino acid, vitamins, carotenoids, enzymes, prebiotics & probiotic, minerals, acidifiers, lipids, and others. Amino acids segment held a larger market share in 2023.

- In terms of application, the market is categorized into poultry, ruminants, swine, aquaculture, and others. The ruminant segment dominated the market in 2023.

Animal Feed Additives Market Share Analysis by Geography

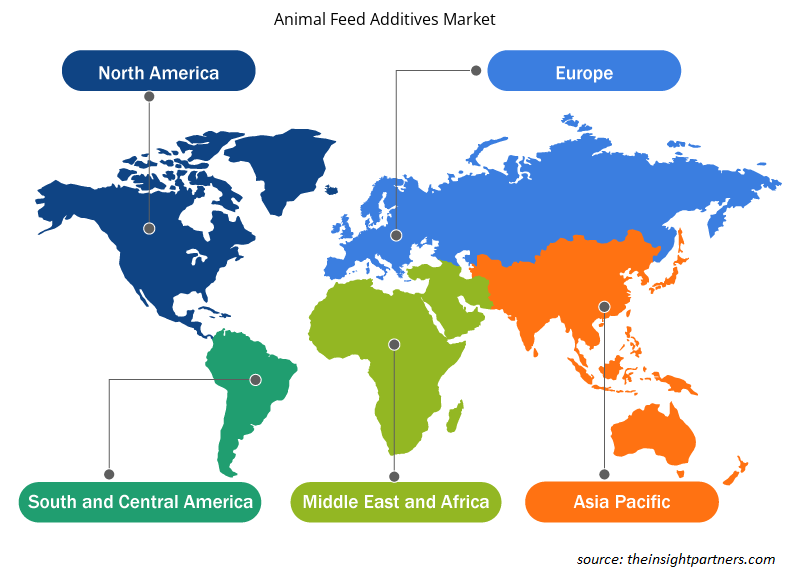

The geographic scope of the animal feed additives market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

The animal feed additives market in Asia Pacific is significantly growing as Asia Pacific is the largest producers of animal feed globally. The region accounts for the largest human population among all five regions and contains around 60% of global population. Hence, the mass of the region is bolstering the demand for meat and dairy products, which is leading the region for livestock and subsequently favouring the animal feed additives market growth in the region. Moreover, rapid urbanization supported by strong economic growth in Asia Pacific is fuelling the demand for meat products across the region. The rising per capita income and improving living standards of consumers in the region is enabling them to afford healthier and nutrients foods.

Animal Feed Additives Market Regional Insights

The regional trends and factors influencing the Animal Feed Additives Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Animal Feed Additives Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Animal Feed Additives Market

Animal Feed Additives Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 35.55 Billion |

| Market Size by 2031 | US$ 54.71 Billion |

| Global CAGR (2023 - 2031) | 5.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

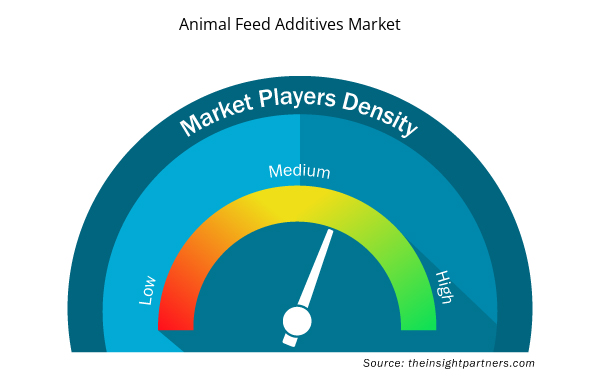

Animal Feed Additives Market Players Density: Understanding Its Impact on Business Dynamics

The Animal Feed Additives Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Animal Feed Additives Market are:

- ADM

- Cargill Incorporated

- Alltech

- Land O'Lakes Inc.

- EVONI

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Animal Feed Additives Market top key players overview

Animal Feed Additives Market News and Recent Developments

The animal feed additives market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion and strategies:

- In December 2022, Adisseo group had agreed to acquire Nor-Feed and its subsidiaries to develop and register botanical additives for use in animal feed (Source: Adisseo group, Press Release)

- In October 2022, the partnership between Evonik and BASF allowed Evonik certain non-exclusive licensing rights to OpteinicsTM, a digital solution to improve comprehension and reduce the environmental impact of the animal protein and feed industries. (Source: Evonik, Newsletter)

- In November 2021, Archer-Daniels-Midland Company announced the opening of its new animal nutrition laboratory located in Rolle, Switzerland. The new lab will support the growth of science-based feed additives in order to meet customer needs for pet food, aquaculture, and livestock species globally. (Source: ADM, Newsletter)

Animal Feed Additives Market Report Coverage and Deliverables

The “Animal Feed Additives Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Non-Emergency Medical Transportation Market

- Electronic Toll Collection System Market

- Nuclear Decommissioning Services Market

- Procedure Trays Market

- Mail Order Pharmacy Market

- Integrated Platform Management System Market

- Space Situational Awareness (SSA) Market

- Arterial Blood Gas Kits Market

- Hair Extensions Market

- Vertical Farming Crops Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and Livestock

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, UAE, UK, US

Get Free Sample For

Get Free Sample For