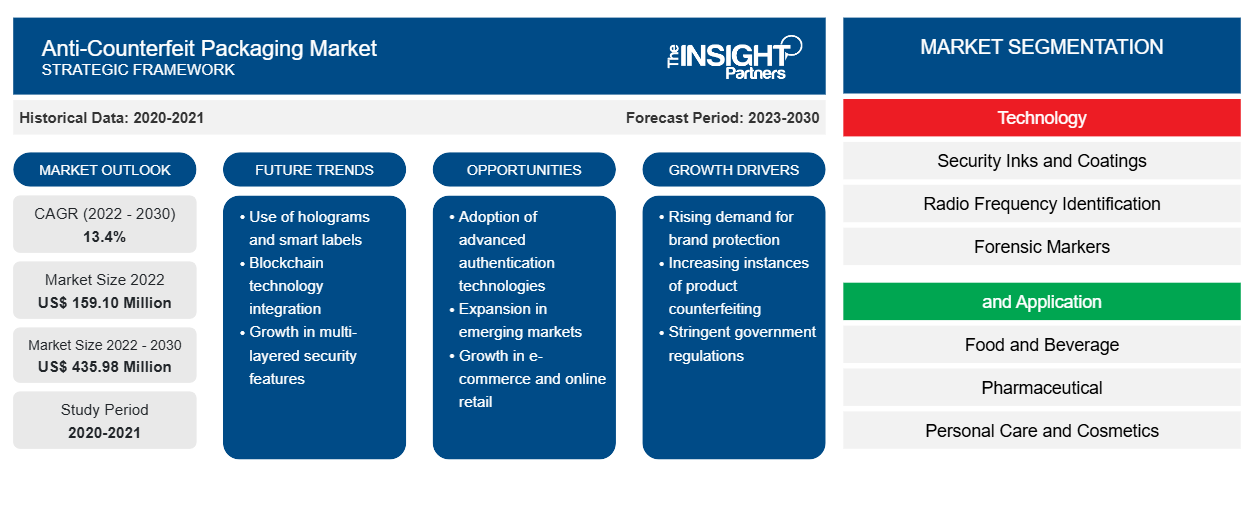

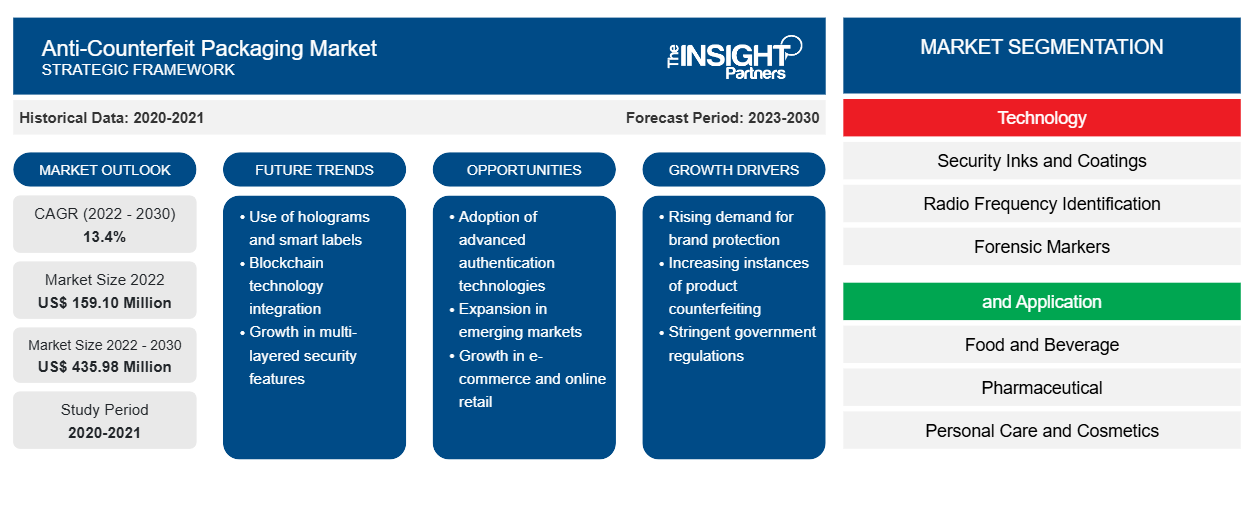

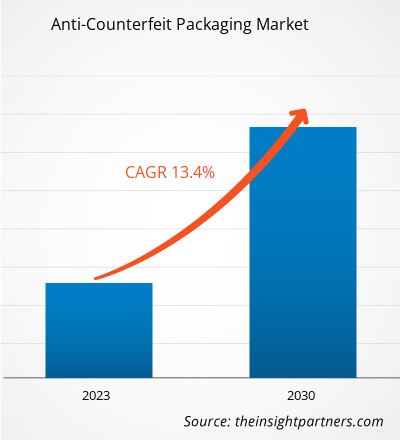

[Research Report] The anti-counterfeit packaging market size is expected to grow from US$ 159.10 million in 2022 to US$ 435.98 million by 2030; it is estimated to register a CAGR of 13.4% from 2022 to 2030.

Market Insights and Analyst View:

Anti-counterfeit packaging refers to the implementation of various measures and technologies to protect products from counterfeiting, replication, or tampering incidents. Counterfeit products pose significant risks to consumer health, safety, and brand reputation. Anti-counterfeit packaging solutions aim to provide authentication, traceability, and security features that help identify genuine products and deter counterfeiting. These solutions often involve the use of advanced technologies such as holograms, unique serialization codes, tamper evident labels, RFID tags, or invisible inks. There is an increasing demand for anti-counterfeit packaging in the pharmaceutical, food & beverages, textile & apparel, and electrical & electronics industries. This factor is significantly driving the anti-counterfeit packaging market across the globe.

Growth Drivers and Challenges:

Counterfeit pharmaceutical products are fake or unauthorized replicas of genuine medications intentionally mislabeled, adulterated, or substandard in quality. Counterfeit pharmaceutical products pose significant risks to public health and safety, leading to a growing concern among regulatory bodies, pharmaceutical companies, and consumers. The pharmaceutical industry is particularly vulnerable to counterfeiting due to the high value and demand for medications, complex global supply chains, and the potential for substantial financial gain for counterfeiters. According to Interpol, the global trade in illicit pharmaceuticals is a substantial crime area as it attracts the involvement of organized crime groups worldwide; it is valued at US$ 4.4 billion. Furthermore, counterfeiting has become a pervasive issue in the global market, affecting various industries and posing significant challenges to governments, businesses, and consumers. Enabled by globalization, e-commerce, and advanced technology, counterfeiters exploit the complexity of supply chains and consumer demand for affordable products. Counterfeiting causes significant economic losses and job displacement, as well as jeopardizes consumer safety and undermines brand reputation and trust in the marketplaces. According to NC State University, counterfeiting has grown from a US$ 30 billion trade in the 1980s and exceeded US$ 600 billion in 2021. The major markets targeted by counterfeiters include consumer goods, aerospace components, tobacco, electronics, automotive parts, pharmaceuticals, industrial components, apparel, and food. However, the implementation and utilization of anti-counterfeit packaging solutions can be complex and require specialized knowledge and equipment. Incorporating anti-counterfeit packaging into an existing supply chain or product authentication systems can be complex. Integration might require packaging line modification, new software or hardware implementation, or coordination with multiple stakeholders in the supply chain. These integration challenges can deter businesses from adopting comprehensive anti-counterfeit solutions. Thus, all these factors are hampering the demand for anti-counterfeit packaging.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Anti-Counterfeit Packaging Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Anti-Counterfeit Packaging Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The global anti-counterfeit packaging market is segmented on the basis of technology, application, and geography. Based on technology, the anti-counterfeit packaging market is segmented into security inks and coatings, radio frequency identification (RFID), forensic markers, tamper evident, holograms, barcode, and others. Based on application, the anti-counterfeit packaging market is segmented into food and beverage, pharmaceutical, personal care and cosmetics, electrical and electronics, textile and apparel, automotive, and others. By geography, the anti-counterfeit packaging market is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America)

Segmental Analysis:

Based on technology, the anti-counterfeit packaging market is segmented into security inks and coatings, radio frequency identification (RFID), forensic markers, tamper evident, holograms, barcode, and others. The radio frequency identification (RFID) segment holds a significant share of the anti-counterfeit packaging market and is expected to register the fastest growth during the forecast period. Radio-frequency identification (RFID), a wireless technology that uses radio waves, is extensively used to combat counterfeiting and improve product authentication. RFID tags can be incorporated into packaging materials, labels, etc., to identify, track, and manage packaged items throughout the supply chains.

Based on application, the anti-counterfeit packaging market is segmented into food and beverage, pharmaceutical, personal care and cosmetics, electrical and electronics, textile and apparel, automotive, and others. The food and beverage segment held a significant share in the anti-counterfeit packaging market and is expected to register substantial growth during the forecast period. Anti-counterfeit packaging plays a crucial role in the food & beverages industry by ensuring consumer safety, maintaining product integrity, and protecting brand reputation. These packaging solutions promote consumer confidence in the authenticity and safety of food products and beverages purchased by them. All these factors are potentially boosting the anti-counterfeit packaging market worldwide.

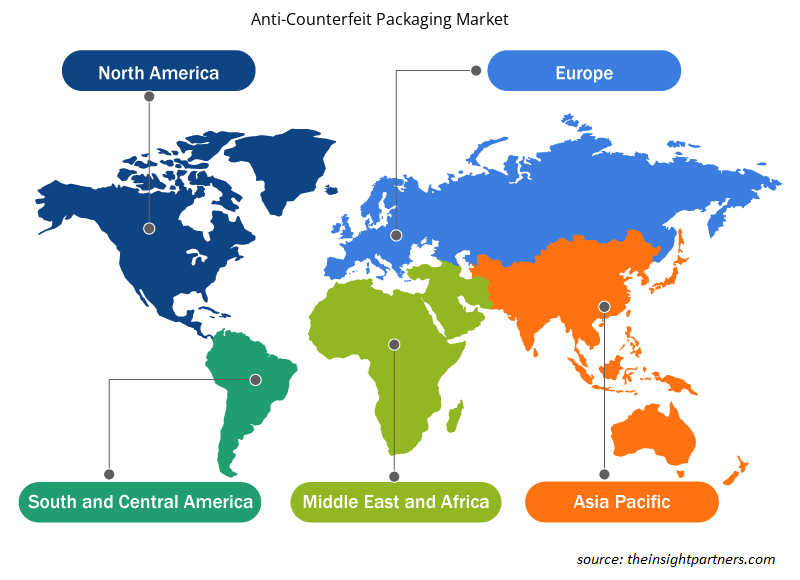

Regional Analysis:

Based on geography, the anti-counterfeit packaging market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. The global anti-counterfeit packaging market was dominated by North America, which accounted for over US$ 50 million in 2022. North America is a major contributor to the global market. Asia Pacific is expected to register a CAGR of over 14% from 2022 to 2030. The anti-counterfeit packaging market in Asia Pacific is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. One of the major factors bolstering the anti-counterfeit packaging market growth in this region is the increasing cases of counterfeiting and stringent regulations associated with anti-counterfeit packaging. Asia Pacific has experienced a significant rise in counterfeit products across various industries, including pharmaceuticals, consumer goods, food & beverages, and electronics. This has raised concerns about product safety, authenticity, and integrity, leading to increased demand for anti-counterfeit measures. Europe is also expected to witness considerable growth, reaching around US$ 90 million by 2030.

Industry Developments and Future Opportunities:

Various initiatives have been taken by the key players operating in the anti-counterfeit packaging market. For instance, in June 2023, Octane5 International LLC was named the “Most Impactful Service Provider” at Licensing International Excellence Awards in Las Vegas, Nevada.

Anti-Counterfeit Packaging Market Regional Insights

Anti-Counterfeit Packaging Market Regional Insights

The regional trends and factors influencing the Anti-Counterfeit Packaging Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Anti-Counterfeit Packaging Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Anti-Counterfeit Packaging Market

Anti-Counterfeit Packaging Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 159.10 Million |

| Market Size by 2030 | US$ 435.98 Million |

| Global CAGR (2022 - 2030) | 13.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

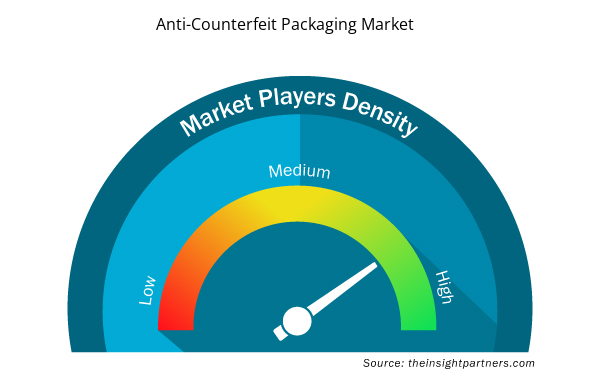

Anti-Counterfeit Packaging Market Players Density: Understanding Its Impact on Business Dynamics

The Anti-Counterfeit Packaging Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Anti-Counterfeit Packaging Market are:

- Arjo AB

- Octane5 International LLC

- Antares Vision SpA

- CCL Industries Inc

- Avery Dennison Corp

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Anti-Counterfeit Packaging Market top key players overview

COVID-19 Impact:

The COVID-19 pandemic affected almost all industries in various countries. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific (APAC), South & Central America (SAM), and the Middle East & Africa (MEA) hampered the growth of several industries, including the chemicals & materials industry. The shutdown of manufacturing units disturbed global supply chains, manufacturing activities, delivery schedules, and essential and nonessential product sales. Various companies witnessed delays in product deliveries and a slump in sales of their products in 2020. Due to the pandemic-induced economic recession, consumers became more cautious and selective in their purchasing decisions. Nonessential purchases were significantly reduced by consumers due to low incomes and uncertain earning prospects, especially in developing regions. Many manufacturers of anti-counterfeit packaging faced a decline in profits due to reduced consumer demand during the initial phase of the pandemic. However, by the end of 2021, many countries were fully vaccinated, and the governments of these countries announced relaxation in certain regulations, including lockdowns and travel bans. People started traveling to different places, which increased the demand for anti-counterfeit packaging, boosting the anti-counterfeit packaging demand. All these factors had a positive impact on the growth of the anti-counterfeit packaging market across the globe.

Competitive Landscape and Key Companies:

A few of the prominent players operating in the global anti-counterfeit packaging market include Arjo AB, Octane5 International LLC, Antares Vision SpA, CCL Industries Inc, Avery Dennison Corp, The Label Printers LP, KURZ Transfer Products LP, Gestion Groupe Optel Inc, Brady Corp, and Constantia Flexibles International GmbH. These players offer high-quality anti-counterfeit packaging and cater to a large number of consumers in the global market.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Technology, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Counterfeit pharmaceutical products are fake or unauthorized replicas of genuine medications intentionally mislabeled, adulterated, or substandard in quality. Counterfeit pharmaceutical products pose significant risks to public health and safety, leading to a growing concern among regulatory bodies, pharmaceutical companies, and consumers. The pharmaceutical industry is particularly vulnerable to counterfeiting due to the high value and demand for medications, complex global supply chains, and the potential for substantial financial gain for counterfeiters.

The major players operating in the global anti-counterfeit packaging market are Arjo AB, Octane5 International LLC, Antares Vision SpA, CCL Industries Inc, Avery Dennison Corp, The Label Printers LP, KURZ Transfer Products LP, Gestion Groupe Optel Inc, Brady Corp, and Constantia Flexibles International GmbH.

Based on the application, pharmaceuticals segment is projected to grow at the fastest CAGR over the forecast period. The pharmaceutical industry is particularly vulnerable to counterfeiting due to potential risks to patient health and fitness. Counterfeit pharmaceuticals can contain incorrect or ineffective ingredients or harmful substances and display incorrect dosages.

North America accounted for the largest share of the global anti-counterfeit packaging market. North America is one of the most significant regions for the anti-counterfeit packaging market owing to drastic increase in the focus on eliminating counterfeit products.

Based on technology, barcode segment mainly has the largest revenue share. The growth of the segment is attributed to the excellent properties of the barcode for anti-counterfeiting. Barcodes are widely used in anti-counterfeit packaging as a simple yet effective method to enhance security and enable product authentication. A barcode is a graphical representation of data that consists of a series of parallel lines and spaces of varying widths.

Developing countries such as India, Brazil, Indonesia, and Mexico are experiencing significant economic growth, industrial development, and increased trade, which is increasing the risk associated with counterfeiting. According to the National Forum to Combat Piracy and Illegality (Fórum Nacional de Combate à Pirataria e a Ilegalidade), in 2021, counterfeiting-related practices cost the Brazilian economy ~US$ 82 billion. Additionally, per the Federation of Indian Chambers of Commerce & Industry (FICCI) report published on September 22, 2022—illicit trade in five key industries, including FMCG, mobile phone, cigarette, and alcohol industries, caused the Indian exchequer a tax loss of US$ 7.93 billion and also resulted in the loss of 1.6 million jobs. As per the World Health Organization, ~120,000 people die each year in Africa due to counterfeit pharmaceuticals.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Anti-Counterfeit Packaging Marke

- Arjo AB

- Octane5 International LLC

- Antares Vision SpA

- CCL Industries Inc

- Avery Dennison Corp

- The Label Printers LP

- KURZ Transfer Products LP

- Gestion Groupe Optel Inc

- Brady Corp

- Constantia Flexibles International GmbH

Get Free Sample For

Get Free Sample For