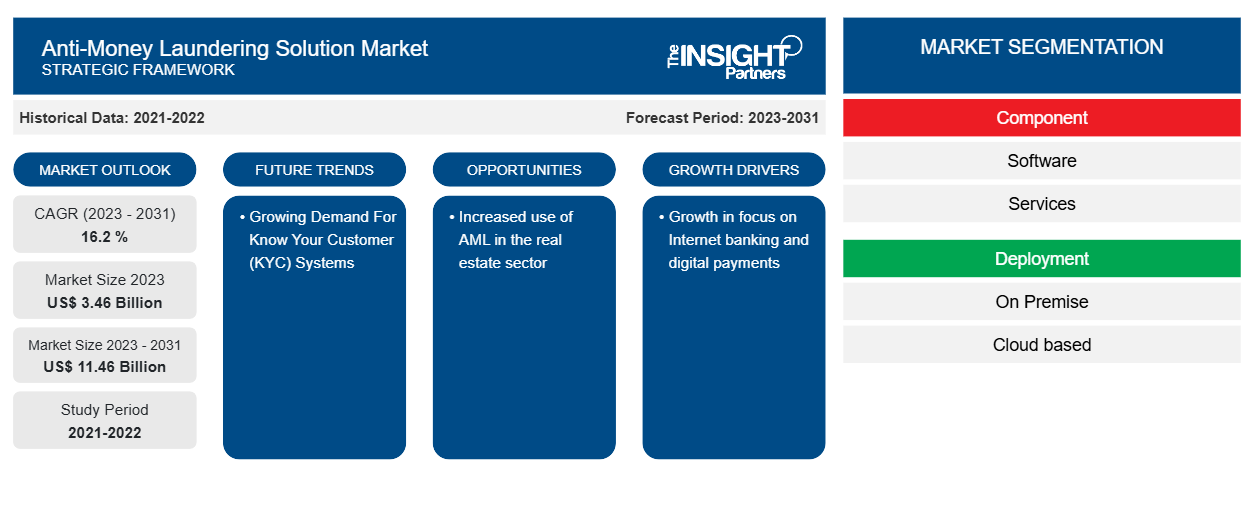

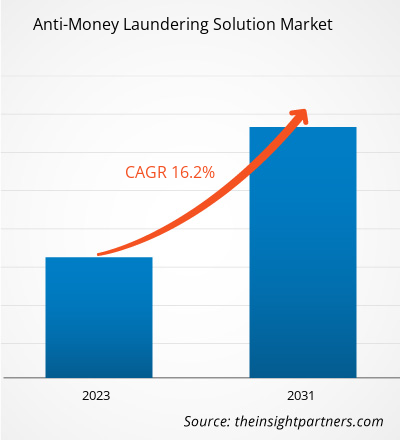

The anti-money laundering solution market size is projected to reach US$ 11.46 billion by 2031 from US$ 3.46 billion in 2023. The market is expected to register a CAGR of 16.2 % in 2023–2031. The Growing Demand For Know Your Customer (KYC) Systems is likely to remain a key anti-money laundering solution market trend.

Anti-Money Laundering Solution Market Analysis

The market for anti-money laundering products is also being driven by the growing internationalization of financial operations. Financial transaction tracking and monitoring are harder as more businesses operate internationally. Furthermore, there are now more obstacles to AML compliance due to the growing usage of digital currencies. Because digital currencies are decentralized and hard to track down, fraudsters find it simpler to launder money with them. Financial institutions can monitor digital currency transactions and identify suspicious activity with the aid of AML solutions.

The market for anti-money laundering products is also driven by growing regulatory pressure. Financial institutions are coming under more and more pressure to abide by the tighter anti-money laundering (AML) legislation that governments across the globe are implementing. Financial institutions can avoid fines for non-compliance by using AML solutions to assist them in fulfilling their compliance requirements.

Anti-Money Laundering Solution Market Overview

Money laundering is a tool used by criminals to cover up their misdeeds. Between 2% and 5% of the global GDP is made up by money laundering. As a result, businesses may find it challenging to adhere to money laundering regulations. Consequently, a number of businesses employ anti-money laundering software or services to identify questionable activities and client information. Compliance specialists utilize services or software to adhere to government regulations and business standards, such as the US Bank Secrecy Act, which aims to stop crimes connected to money laundering.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Anti-Money Laundering Solution Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Anti-Money Laundering Solution Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Anti-Money Laundering Solution Market Drivers and Opportunities

Growth in focus on Internet banking and digital payments

Over the past ten years, online banking and digital payment services have expanded dramatically. Because of these platforms' evolving user demands and technological advancements, financial transactions are being conducted in a completely different way. Because digital payment methods and Internet banking are so accessible and convenient, the economic landscape has shifted. Digital payments have accelerated due to the rise in e-commerce and the increasing number of online buyers opting for cashless transactions. The advent of contactless payments and security measures such as biometric authentication has also resulted in a rise in user confidence. The growing trend of digital payments gives thieves more opportunities to perpetrate financial crimes such as password theft, identity theft, and e-commerce identity fraud. As a result, financial institutions are widely implementing AML solutions to combat this.

Increased use of AML in the real estate sector

Large sums of money are involved in real estate transactions, and the industry's perceived secrecy makes it a desirable target for money launderers. The real estate industry is, therefore, more susceptible to money laundering, with criminals taking advantage of it to fund terrorists, launder illicit funds, and evade paying taxes. Tracking financial transactions and identifying possible money laundering can be difficult when purchasing and selling real estate across borders. Recently, new laws and regulations have been implemented by governments and authorities around the world to combat the growing threat of anti-money laundering (AML) in the real estate sector. Recently, new laws and regulations have been implemented by governments and authorities around the world to combat the growing threat of anti-money laundering (AML) in the real estate sector. A few governments are thinking about creating public registries or registers that make information about benefits and property ownership easily available. This openness will deter people from using real estate as a means of money laundering. A step in the right direction is the government's publication of beneficial ownership data by real estate organizations. It hinders the use of shell corporations to conceal the owners of real property and aids law enforcement in identifying the source of funds. Thus, the increased use of AML in the real estate sector is anticipated to present new opportunities for the anti-money laundering solution market players during the forecast period.

Anti-Money Laundering Solution Market Report Segmentation Analysis

Key segments that contributed to the derivation of the anti-money laundering solution market analysis are offering, technology, and application.

- Based on the component, the anti-money laundering solution market is segmented into software and services. The software segment held a larger market share in 2023.

- By deployment type, the market is segmented into on-premises cloud. The cloud segment held the largest share of the market in 2023.

- By product, the market is segmented into transaction monitoring, compliance management, currency transaction reporting, and customer identity management.

- By industry vertical, the market is segmented into healthcare, BFSI, Retail, IT and telecom, government, and others.

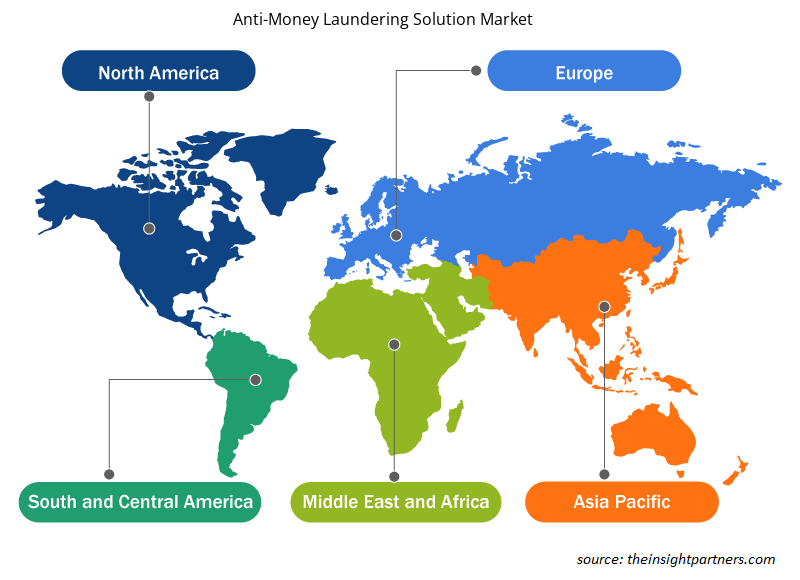

Anti-Money Laundering Solution Market Share Analysis by Geography

The geographic scope of the anti-money laundering solution market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America. In terms of revenue, APAC accounted for the largest anti-money laundering solution market share. Due to numerous innovations made by regional players and government initiatives to increase the security of the financial landscape in the region, China is expected to register significant growth in the Anti-Money Laundering Solutions Market during the projected period.

Anti-Money Laundering Solution Market Regional Insights

The regional trends and factors influencing the Anti-Money Laundering Solution Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Anti-Money Laundering Solution Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Anti-Money Laundering Solution Market

Anti-Money Laundering Solution Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 3.46 Billion |

| Market Size by 2031 | US$ 11.46 Billion |

| Global CAGR (2023 - 2031) | 16.2 % |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Anti-Money Laundering Solution Market Players Density: Understanding Its Impact on Business Dynamics

The Anti-Money Laundering Solution Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Anti-Money Laundering Solution Market are:

- ACCENTURE PLC

- ACI Worldwide, Inc.

- ASCENT TECHNOLOGY CONSULTING

- BAE SYSTEMS PLC

- EastNets

- LexisNexis Risk Solutions Group

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Anti-Money Laundering Solution Market top key players overview

Anti-Money Laundering Solution Market News and Recent Developments

The anti-money laundering solution market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for speech and language disorders and strategies:

- January 2023: US-based FICO Corporation's Siron anti-money laundering and compliance technologies were acquired by IMTF, a pioneer in regulatory technology and process automation for financial institutions. Through this transaction, all of Siron's anti-financial crime solutions were transferred to IMTF for global operations.

(Source: FICO Corporation, Press Release)

- February of 2023 - The RiskAvert solution was successfully implemented at the Cooperative Bank of Epirus by Profile Software, a provider of financial solutions, to enable effective risk management, complete coverage of capital requirements calculations, and the production of the significant supervisory reports mandated by the EU Capital Requirements Regulation/Directive (CRR/CRD) framework, also known as the Basel framework. The anti-money-laundering-solutions-market industry study from Moldor Intelligence, Inc.

(Source: Profile Software, Press Release)

Anti-Money Laundering Solution Market Report Coverage and Deliverables

The “Anti-Money Laundering Solution Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component , Deployment Type , Product , Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The growth in focus toward internet banking and digital payments, and increased use of AML in the real estate sector are the major factors that propel the global anti-money laundering solution market.

The global anti-money laundering solution market was estimated to be US$ 3.46 billion in 2023 and is expected to grow at a CAGR of 16.2 % during the forecast period 2023 - 2031.

The growing demand For Know Your Customer (KYC) Systems is anticipated to play a significant role in the global anti-money laundering solution market in the coming years.

The key players holding majority shares in the global anti-money laundering solution market are Accenture Plc, Aci Worldwide, Inc., Ascent Technology Consulting, Bae Systems PLC, and EastNets.

The global anti-money laundering solution market is expected to reach US$ 11.46 billion by 2031.

Get Free Sample For

Get Free Sample For