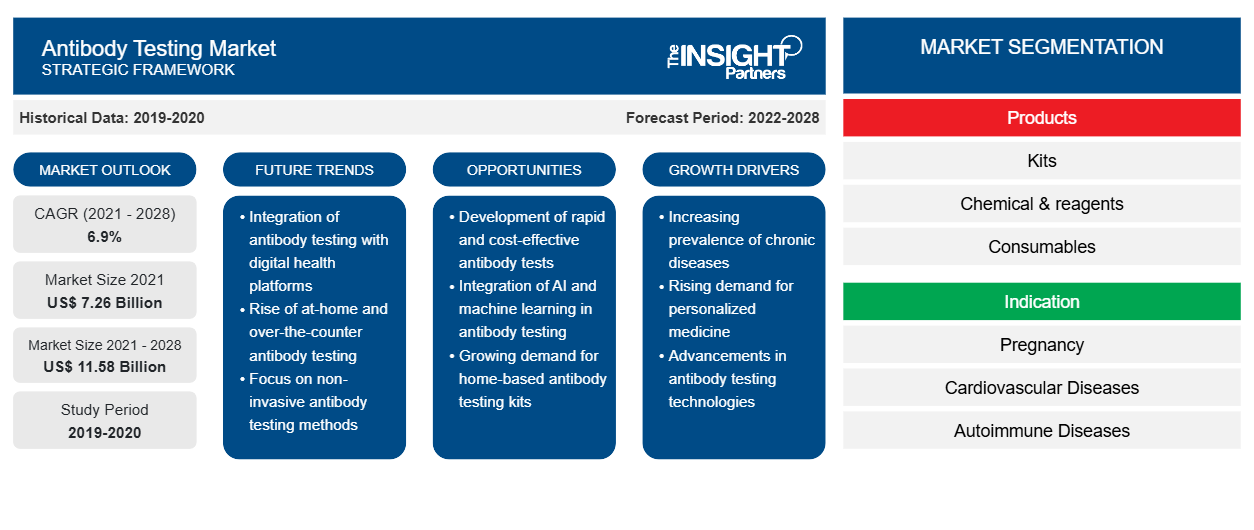

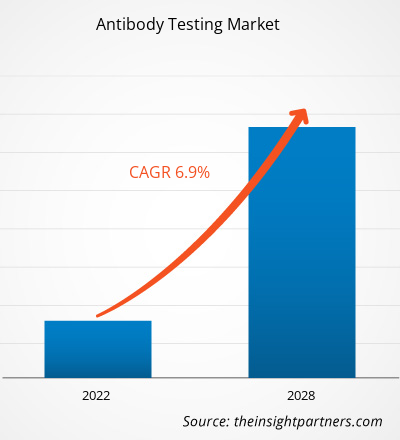

The antibody testing market was valued at US$ 7,260.00 million in 2021 and is projected to reach US$ 11,578.47 million by 2028; it is expected to grow at a CAGR of 6.9% from 2021 to 2028.

Antibodies are immunoglobulins, Y-shaped proteins that are produced by the immune system so as to stop invaders from harming the body. An antibody test is a screening for antibodies in the blood. The body makes antibodies when fighting infections like COVID-19 or when patients are vaccinated. This is how immunity is built against a virus. These tests are also called serological tests. Antibody tests help diagnose an autoimmune disease or rule out other conditions with similar signs and symptoms. In addition, antinuclear antibodies (ANA) are a group of autoantibodies produced by an individual's immune system when it cannot adequately distinguish between "self" and "foreign" components. The ANA test detects the antibodies in the blood. ANA reacts with parts of healthy body cells and causes symptoms such as tissue and organ inflammation, joint and muscle pain, and fatigue. ANA specifically targets substances found in the cell nucleus; hence the antibodies are known as "antinuclear antibodies." Antibody detection kits are predictive of prognosis and detection of COVID-19 infection to support the disease. The antibody testing market is driven by a rising number of COVID-19 cases worldwide, an increasing prevalence of chronic diseases, and a growing senior population. Additionally, growing government support is fueling the growth of Antibody Testing, which influences the development of the market. For example, the U.S. Food and Drug Administration (FDA) publicly shared test performance data for antibody or serology test kits. These results come from a collaborative effort by the FDA, NIH, Centers for Disease Control and Prevention (CDC), and Biomedical Advanced Research and Development Authority (BARDA).

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Antibody Testing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Antibody Testing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

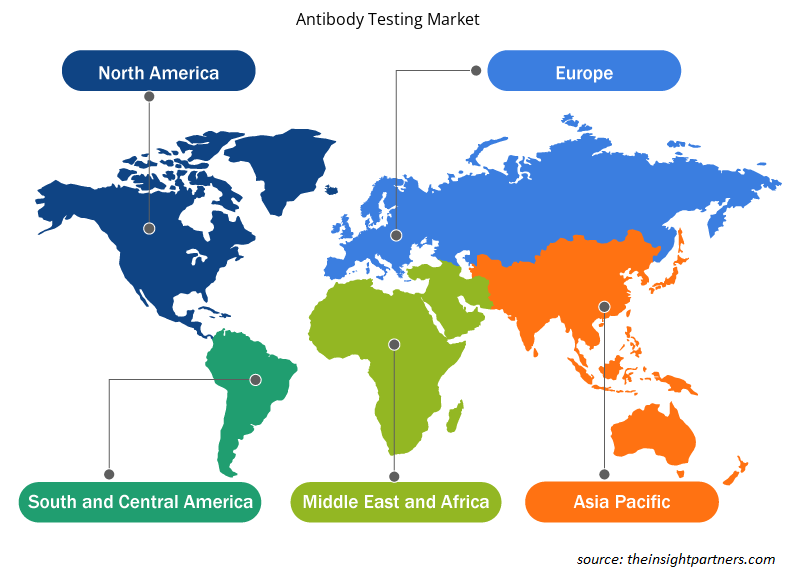

The scope of the antibody testing market includes products, indication, end user and geography. The market for antibody testing is analyzed based on regions such as North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. The report offers insights and in-depth analysis of the antibody testing market emphasizing on various parameters such as market trends, technological advancements, market dynamics, and competitive landscape analysis of leading market players across the globe.

Market Insights

Rising Number of COVID-19 Cases across the World.

Ever since severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) was declared a public health emergency of international concern in late January 2020, medical professionals and researchers have been urging the need for comprehensive and rapid testing of citizens to plan measures that can contain the spread of the virus. Over time, real-time polymerase chain reaction tests and antibody tests have emerged as vital techniques for the global healthcare system to manage the outbreak. Antibody detection is essential for differential diagnosis of SARS-CoV-2. It is a test performed by patient serum or plasma with reagent red cells. Determination of specific antibodies to viral and bacterial pathogens and parasites facilitates the correct therapeutic measures to be taken. Antibody testing is critical for implementing an effective and efficient public health strategy to minimize the adverse impact of the COVID-19 pandemic. It should be adopted for important clinical utility cases and support return-to-work strategy globally.

Antibody detection kits are predictive for prognosis and detection of COVID-19 infections to assist the diseases. Since these kits help examine whether a person has developed antibodies in their bloodstream to fight the SARS-CoV-2, it indicates whether a person has been exposed to or has COVID-19. In order to manage the COVID-19 pandemic and increase patient screening, several companies are offering these rapid antibody detection kits to healthcare workers, hospitals, laboratories, and other professionals. Thus, rising incidence of coronavirus cases and growing government approvals for antibody test kits are the few factors responsible for the growth of the market.

Products-Based Insights

Global antibody testing market, based on products, is segmented into kits, chemical & reagents, consumables. In 2021, the kits segment accounted for the highest share of the market. Growth of this segment is attributed to large number of manufacturers like Abbott, F. Hoffmann-La Roche Ltd, Bio-Rad Laboratories, Inc., and others and higher adoption of kits in various research processes. The same segment is likely to register highest CAGR in the global antibody testing market during the forecast period. Furthermore, the kits segment is sub-segmented into serological test kits, immunoglobulin kits, and lateral flow assay kits. The serological test kits held the highest market share in 2021.

Indication-Based Insights

Global antibody testing market, based on indication, is segmented into pregnancy, cardiovascular diseases, autoimmune diseases, infectious diseases, oncology, endocrine diseases, and others. The infectious diseases segment held the largest share of the market in 2021, and same segment is anticipated to register the highest CAGR in the market during the forecast period.

End User–Based Insights

Global antibody testing market, based on end user, is segmented into hospitals, academic and research institutes, diagnostic laboratories, and biopharmaceutical companies. The diagnostic laboratories segment held the largest share of the market in 2021, and same segment is anticipated to register the highest CAGR in the market during the forecast period.

COVID-19 pandemic had become the most significant challenge across the world. This challenge was frightening especially in developing countries across the globe as it led to reducing imports due to disruptions in global trade. Till date no definitive treatment against COVID 19 has been established. Hence, lack of definitive therapy offers significant opportunities for antibody testing market as US FDA had recently approved use of plasma therapy for critically ill COVID 19 patients. In long run antibody testing market would have significant growth prospects as many market players had received emergency use authorization for their newly developed antibody tests. All such developments would add up to the future demand for the antibody testing market.

Product launches and expansion strategy are commonly adopted by companies to expand their footprint worldwide and meet the growing demand. These strategies are commonly adopted by the market players in order to expand its product portfolio.

The market players operating in the antibody testing market adopted the strategy of product innovation to cater to changing customer demand across the world, which also permits the players to maintain their brand name globally.

- In February 2021, Agilent Technologies Inc. has announced the launch of the Agilent Dako SARS-CoV-2 IgG Enzyme-Linked Immunosorbent Assay (ELISA) kit intended for the qualitative detection of immunoglobulin G (IgG) antibodies to SARS-CoV-2 in human serum or plasma. The kit, which marks Agilent’s entrance into SARS-CoV-2 testing in the US, has completed the notification process to FDA in accordance with Section IV.D of FDA’s “Policy for Coronavirus Disease-2019 Tests During the Public Health Emergency (Revised)”. The assay was planned to be registered in other markets in 2021 including Canada, Europe, and selected Asia Pacific and Latin American countries.

- In April 2020, Abbott has launched a serology test to detect the IgG antibody to SARS CoV 2. This new antibody test utilized Abbott's ARCHITECT i1000SR and i2000SR laboratory instruments, which can run up to 100 to 200 tests per hour.

Antibody testing – Market Segmentation

The antibody testing market is segmented on the basis of products, indication, and end user. Based on products, the antibody testing market is further segmented into kits, chemical & reagents, and consumables. Based on indication, the antibody testing market is further segmented into pregnancy, infectious diseases, oncology, cardiovascular diseases, endocrine diseases, autoimmune diseases, and others. Based on end user, the antibody testing market is further segmented into hospitals, academic & research institutes, diagnostic laboratories, and biopharmaceutical companies. By geography, the global antibody testing market is segmented into North America (US, Canada, and Mexico), Europe (France, Germany, UK, Spain, Italy, Greece, and the Rest of Europe), Asia Pacific (China, India, Japan, Australia, South Korea, and the Rest of APAC), the Middle East & Africa (Saudi Arabia, UAE, South Africa, and the Rest of MEA), and South & Central America (Brazil, Argentina, and the Rest of SAM).

Antibody Testing Market Regional Insights

Antibody Testing Market Regional Insights

The regional trends and factors influencing the Antibody Testing Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Antibody Testing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Antibody Testing Market

Antibody Testing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 7.26 Billion |

| Market Size by 2028 | US$ 11.58 Billion |

| Global CAGR (2021 - 2028) | 6.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Products

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Antibody Testing Market Players Density: Understanding Its Impact on Business Dynamics

The Antibody Testing Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Antibody Testing Market are:

- Thermo Fisher Scientific

- Abbott Laboratories

- Bio-Rad Laboratories, Inc.

- Beckton, Dickinson and Company

- F. Hoffmann La Roche

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Antibody Testing Market top key players overview

Company Profiles

- Thermo Fisher Scientific

- Abbott Laboratories

- Bio-Rad Laboratories, Inc.

- Beckton, Dickinson And Company

- F. Hoffmann La Roche

- Agilent Technologies

- DiaSorin

- Zeus Scientific

- Abcam

- Trinity Biotech

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Lyophilization Services for Biopharmaceuticals Market

- Social Employee Recognition System Market

- Data Center Cooling Market

- Legal Case Management Software Market

- Equipment Rental Software Market

- Aquaculture Market

- Nuclear Decommissioning Services Market

- Single-Use Negative Pressure Wound Therapy Devices Market

- Wheat Protein Market

- Aircraft Wire and Cable Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Indication, and End-User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, Greece, India, Italy, Japan, Mexico, RoSCAM, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The infectious diseases segment dominated the global antibody testing market and held the largest market share of 26.44% in 2021.

The diagnostic laboratories segment dominated the global antibody testing market and held the largest market share of 41.58% in 2021.

The antibody testing market majorly consists of the players such as Thermo Fisher Scientific, Abbott Laboratories, Bio-Rad Laboratories, Inc., Beckton, Dickinson And Company, F. Hoffmann La Roche, Agilent Technologies, DiaSorin, Zeus Scientific, ABCAM, Trinity Biotech and among others.

The kits segment dominated the global antibody testing market and held the largest market share of 54.08% in 2021.

An antibody test is a screening for the presence of antibodies in the blood. The body makes antibodies when it fights infection, like COVID-19 or when patients get a vaccine, like a flu shot. That’s how immunity to a virus is built. These tests are also called serology tests. Antibody tests help diagnose an autoimmune disease or rule out other conditions with similar signs and symptoms. Antibody detection kits are predictive of prognosis and detection of COVID-19 infection to support the disease. The antibody testing market is driven by a rising number of COVID-19 cases worldwide, an increasing prevalence of chronic diseases, and a growing senior population. Additionally, growing government support is fueling the growth of antibody testing, which influences the development of the market.

The factors that are driving growth of the market are rising number of COVID-19 cases worldwide, increasing prevalence of chronic diseases and growing geriatric population are expected to boost the growth of the global antibody testing market.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Antibody Testing Market

- Thermo Fisher Scientific

- Abbott Laboratories

- Bio-Rad Laboratories, Inc.

- Beckton, Dickinson and Company

- F. Hoffmann La Roche

- Agilent Technologies

- DiaSorin

- Zeus Scientific

- Abcam

- Trinity Biotech

Get Free Sample For

Get Free Sample For