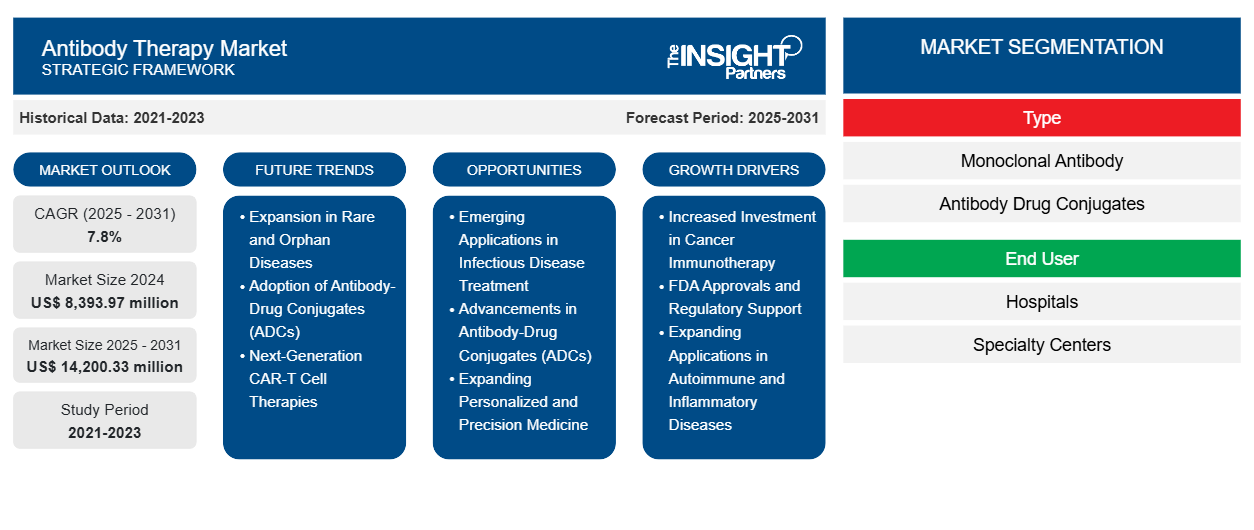

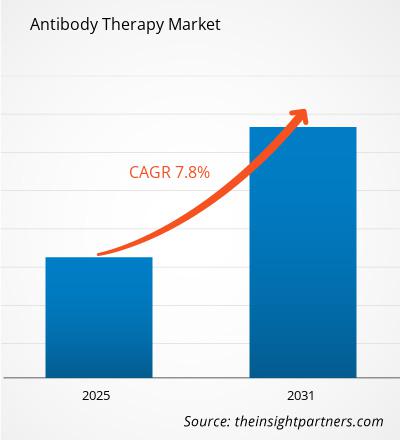

The Antibody Therapy Market is expected to register a CAGR of 7.8% from 2025 to 2031, with a market size expanding from US$ 8,393.97 million in 2024 to US$ 14,200.33 million by 2031.

The Antibody Therapy Market report covers segmental analysis by Type [Monoclonal Antibody, (Oncology, Autoimmune Disease, Infectious Disease, Others), Antibody Drug Conjugates], and End User (Hospitals, Specialty Centers, Others) and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America). The global analysis is further broken down at the regional level and major countries

Purpose of the Report

The report Antibody Therapy Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Antibody Therapy Market Segmentation

Type

- Monoclonal Antibody

- Antibody Drug Conjugates

End User

- Hospitals

- Specialty Centers

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Antibody Therapy Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Antibody Therapy Market Growth Drivers

- Increased Investment in Cancer Immunotherapy: Cancer remains one of the largest therapeutic areas for antibody therapies. Immunotherapies, such as immune checkpoint inhibitors and bispecific antibodies, are transforming the treatment landscape for various cancers, including lung, breast, and colorectal cancer. With increasing investments in cancer immunotherapy research and development, the Antibody Therapy Market is poised for exponential growth as more targeted therapies enter clinical trials and eventually gain market approval.

- FDA Approvals and Regulatory Support: The increasing number of antibody therapies receiving approval from regulatory bodies like the U.S. Food and Drug Administration (FDA) has significantly contributed to the market's growth. The FDA's supportive stance on biologics, including fast-track approvals and orphan drug designations, enhances the development and commercialization of antibody therapies. This regulatory environment fosters innovation and provides pathways for companies to introduce novel antibody drugs more quickly.

- Expanding Applications in Autoimmune and Inflammatory Diseases: Antibody therapies are proving to be effective in treating autoimmune diseases such as rheumatoid arthritis, Crohn's disease, and psoriasis. These therapies specifically target immune system dysfunctions, providing more precise treatment options. As the understanding of autoimmune disorders advances, the market is witnessing an expanding range of antibody therapies targeting specific autoimmune and inflammatory conditions.

Antibody Therapy Market Future Trends

- Expansion in Rare and Orphan Diseases: There is a growing focus on orphan diseases and rare genetic disorders within the Antibody Therapy Market. With advancements in genetic research and the increasing ability to target specific molecular pathways, antibody therapies are being developed to address conditions with limited treatment options. The market will likely see increased approval of antibody-based therapies for rare diseases, supported by orphan drug designations and regulatory incentives, leading to a broader portfolio of available treatments.

- Adoption of Antibody-Drug Conjugates (ADCs): The future of the Antibody Therapy Market will likely see a surge in the use of antibody-drug conjugates (ADCs), which combine the targeting ability of antibodies with the potency of chemotherapy or cytotoxic agents. ADCs enable the delivery of powerful drugs directly to cancer cells while minimizing damage to healthy tissue, making them a highly effective treatment for various types of cancers. As ADC technology advances and more targeted therapies are developed, the market for these therapeutics is expected to grow substantially.

- Next-Generation CAR-T Cell Therapies: The Antibody Therapy Market will also witness the continued rise of chimeric antigen receptor T-cell (CAR-T) therapies, which harness the power of genetically engineered T-cells to target cancer cells. While CAR-T therapies have already shown promise, future advancements in antibody engineering and cellular therapies are expected to improve their efficacy, reduce side effects, and expand their applicability to a broader range of cancers. These therapies are poised to be a cornerstone in the fight against cancer and will contribute significantly to market growth.

Antibody Therapy Market Opportunities

- Emerging Applications in Infectious Disease Treatment: With the success of monoclonal antibodies (mAbs) in treating viral infections like COVID-19, there is a significant opportunity to expand antibody-based therapies to address a broader range of infectious diseases. The rise of new pathogens and the increasing burden of global health threats create a growing need for effective, rapid-response treatments. By developing antibodies for diseases such as HIV, influenza, and emerging viral outbreaks, companies can diversify their portfolios and position themselves as key players in the fight against infectious diseases.

- Advancements in Antibody-Drug Conjugates (ADCs): Antibody-drug conjugates (ADCs) represent a significant opportunity for the Antibody Therapy Market, particularly in oncology. ADCs combine the specificity of monoclonal antibodies with the potent effect of chemotherapy agents, enabling targeted cancer treatment with fewer side effects. As the technology behind ADCs continues to improve, there will be growing opportunities to develop new ADC therapies for a wider range of cancers, enhancing both the efficacy and safety of cancer treatments and creating a lucrative market for innovative therapies.

- Expanding Personalized and Precision Medicine: Personalized medicine is one of the most promising opportunities within the Antibody Therapy Market. As more is understood about genetic and molecular biomarkers, antibodies can be tailored to target specific disease mechanisms in individual patients. This trend is particularly evident in cancer immunotherapy, where therapies are increasingly customized based on tumor characteristics. With the continued focus on precision treatments, companies have the opportunity to create more individualized antibody therapies, improving treatment outcomes and enhancing patient satisfaction. This market segment is expected to see significant growth as the demand for personalized therapies rises.Leveraging Artificial Intelligence for Antibody Discovery

The integration of artificial intelligence (AI) into the discovery and development of Antibody Therapy is a major opportunity. AI-driven platforms can streamline the process of identifying potential antibody candidates by analyzing vast amounts of biological data. These AI tools can enhance the efficiency of drug discovery, reducing the time and cost of bringing new antibody-based therapies to market. By investing in AI-powered research and development platforms, companies can accelerate innovation, optimize lead selection, and ultimately produce more effective antibody drugs, positioning themselves at the forefront of the industry.Growing Biosimilars Market

As patents for blockbuster antibody drugs begin to expire, the biosimilar market is rapidly growing. Biosimilars are nearly identical versions of already approved biologic drugs and offer a cost-effective alternative to expensive antibody therapies. The rise in healthcare costs and the increasing demand for affordable treatment options provide companies with the opportunity to develop and commercialize biosimilars, particularly in oncology and autoimmune disease markets. By capitalizing on the biosimilar market, companies can tap into a large patient population while helping to make antibody therapies more accessible and affordable globally.

Antibody Therapy Market Regional Insights

The regional trends and factors influencing the Antibody Therapy Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Antibody Therapy Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Antibody Therapy Market

Antibody Therapy Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 8,393.97 million |

| Market Size by 2031 | US$ 14,200.33 million |

| Global CAGR (2025 - 2031) | 7.8% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

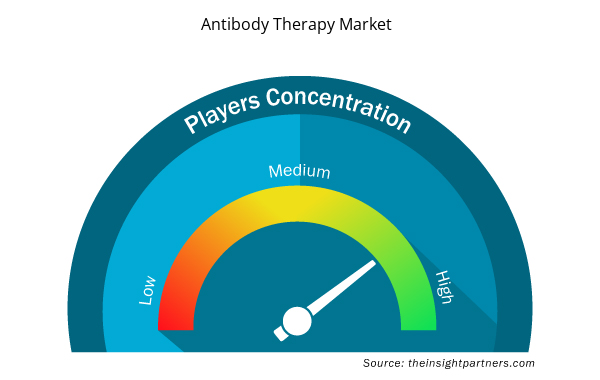

Antibody Therapy Market Players Density: Understanding Its Impact on Business Dynamics

The Antibody Therapy Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Antibody Therapy Market are:

- Merck & Co. Inc

- Eli Lilly and Company

- Seagen

- Novartis AG

- Takeda Pharmaceuticals

- Bristol-Myers Squibb

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Antibody Therapy Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Antibody Therapy Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Antibody Therapy Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Sandwich Panel Market

- Asset Integrity Management Market

- High Speed Cable Market

- Neurovascular Devices Market

- Hair Extensions Market

- Broth Market

- Biopharmaceutical Contract Manufacturing Market

- Artwork Management Software Market

- Electronic Health Record Market

- Space Situational Awareness (SSA) Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The Antibody Therapy Market is expected to register a CAGR of 14.5% from 2025-2031.

The major factors impacting the Antibody Therapy Market are: Increased Investment in Cancer Immunotherapy, FDA Approvals and Regulatory Support and Expanding Applications in Autoimmune and Inflammatory Diseases

Key future trends in this market are - Expansion in Rare and Orphan Diseases, Adoption of Antibody-Drug Conjugates (ADCs) and Next-Generation CAR-T Cell Therapies

Key companies of this market are: Merck & Co. Inc, Eli Lilly and Company, Seagen, Novartis AG, Takeda Pharmaceuticals, Bristol-Myers Squibb, Johnson &Jhonson, AstraZeneca, Regeneron Pharmaceuticals Inc

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request.

Some of the customization options available based on request are additional 3–5 company profiles and country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

Trends and growth analysis reports related to Life Sciences : READ MORE..

- Merck & Co. Inc

- Eli Lilly and Company

- Seagen

- Novartis AG

- Takeda Pharmaceuticals

- Bristol-Myers Squibb

- Johnson & Jhonson

- AstraZeneca

- Regeneron Pharmaceuticals Inc

- Amgen

Get Free Sample For

Get Free Sample For