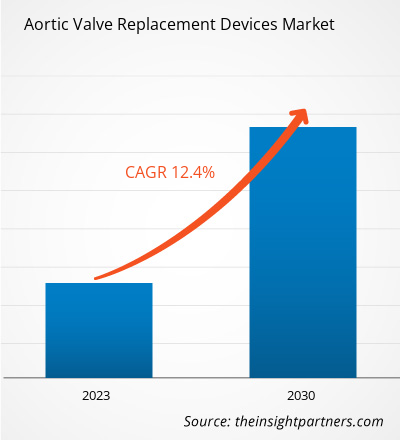

[Research Report] The aortic valve replacement devices market was valued at US$ 7,113.39 million in 2022 and is expected to reach US$ 18,070.32 million by 2030. It is estimated to register a CAGR of 12.4% during 2022–2030.

Analyst’s Viewpoint

The aortic valve replacement devices market analysis explains driving factors such as a rising number of aortic valve replacement surgeries and increasing demand for minimally invasive techniques. Further, the increasing number of clinical studies acts as a future trend for the market growth during 2022–2030. The sutureless valve segment accounted for a larger share of the aortic valve replacement devices market, based on product, in 2022. In terms of surgery, the minimally invasive surgery segment dominated the market in 2022. By end user, the hospitals & clinics segment would dominate the aortic valve replacement devices market with a considerable share during the forecast period.

Aortic valve is one of four valves that regulate blood flow through the heart. The aortic valve separates the heart's main pumping chamber and the main artery that supplies oxygen-rich blood to the body. Aortic valve repair or aortic valve replacement treats aortic valve disease and help restore normal blood flow, reduces symptom, prolong life, and help preserve the function of the heart muscle.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aortic Valve Replacement Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aortic Valve Replacement Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Rising Number of Aortic Valve Replacement Surgeries Boosts Aortic Valve Replacement Devices Market Growth

There has been a significant increase in the number of aortic valve replacement surgeries performed worldwide recently. According to data published by The Texas Herat Institute, ~106,000 heart valve procedures are performed annually in the US. The mitral or aortic valves are repaired or replaced in almost all of these procedures. This surge can be attributed to several factors, including advancements in medical technology, an aging population, and improved awareness of heart-related conditions. Aortic valve replacement is a critical procedure often performed to treat aortic valve stenosis or regurgitation—conditions that can lead to serious complications if left untreated. As medical science continues to evolve, these surgeries are expected to become even safer and more accessible, contributing to better patient outcomes and improved quality of life for those affected by aortic valve diseases. Healthcare systems are adapting to accommodate this growing demand for surgical interventions, emphasizing the importance of preventive measures and early detection in managing cardiovascular health.

Technological Advancements are Creating Lucrative Opportunities in Aortic Valve Replacement Devices Market

The development of minimally invasive surgical techniques (MIS), such as transcatheter aortic valve replacement (TAVR), has modernized the treatment of aortic stenosis (AS). Transcatheter such as transcatheter aortic valve replacement (TAVR), has modernized the treatment of aortic stenosis (AS). Transcatheter aortic valve replacement is less invasive than traditional open-heart surgery, making it possible for high-risk patients who may not have been eligible for surgery to receive treatment. Moreover, developments in materials and design have led to the development of stronger and biocompatible aortic valve replacements, which have improved patient outcomes and reduced the risk of complications.

A few technological advancements by the players in the aortic valve replacement devices are mentioned below:

- In January 2023, Abbott received FDA approval for the Navitor transcatheter aortic valve implantation (TAVI) system to treat people with severe aortic stenosis at high risk of open-heart surgery. Navitor is the latest addition to the company's extensive transcatheter structural heart portfolio, which offers physicians and patients less invasive treatment options for a range of serious heart diseases.

- In September 2022, Medtronic announced the expansion of its newest-generation, self-expanding TAVR system—the Evolut FX TAVR system—in the US. Evolut FX added new features to the existing Evolut platform to enhance the ease of use and predictable valve deployment for physicians.

- In September 2022, Edwards Lifesciences launched SAPIEN 3 Ultra RESILIA valve, which includes Edwards' breakthrough RESILIA tissue technology with the industry-leading SAPIEN 3 Ultra transcatheter aortic heart valve. The launch follows recent US Food and Drug Administration (FDA) approval.

- In September 2021, Abbott received FDA approval for its Epic Plus and Epic Plus Supra Stented Tissue Valves to improve therapy options for people with aortic or mitral valve disease. With this new device, Abbott expanded its Epic surgical valve platform.

- In August 2021, CORCYM enrolled the first patient in the mitral, aortic, and tricuspid post-market study in a real-world setting, i.e., MANTRA. The first implantation was performed at Citta di Lecce Hospital in Italy with a Bicarbon aortic mechanical valve.

- In August 2021, the first Made in India 3D printed heart valve was developed in Chennai. The new heart valves were developed using 3D printers, which could overcome the problems related to artificial heart valves.

- In September 2020, Boston Scientific Corporation introduced the ACURATE neo2 aortic valve system in Europe. This next-generation TAVI technology—a new platform designed with multiple features to improve the clinical performance of the original ACURATE neo platform—had an expanded indication for patients with aortic stenosis compared to the aortic valve system of the previous generation.

Therefore, technological advancements are creating lucrative opportunities in the aortic valve replacement devices market.

Report Segmentation and Scope

Product-Based Insights

Based on product, the aortic valve replacement devices market is bifurcated into mechanical valve and sutureless valve. The sutureless valve segment held a larger market share in 2022 and is likely to register a significant CAGR in the aortic valve replacement devices market during 2022–2030. A sutureless aortic valve replacement device is a bioprosthetic valve designed for implementation without the need for traditional suturing, which is required to secure the valve in a position. These valves are typically made from biological materials. The valve is attached to a stent or frame that can expand and secure it in place once it is positioned correctly within the patient's native aortic valve annulus. The main advantage of sutureless aortic valves is that they can simplify the surgical procedure, reducing surgical time and potentially improving outcomes, especially in patients at higher risk or having limited surgical access due to other medical conditions. As with any medical procedure, the choice of aortic valve replacement device, including sutureless valves, depends on the patient's specific condition, overall health, and individual risk factors.

Surgery-Based Insights

Based on surgery, the aortic valve replacement devices market is bifurcated into open surgery and minimally invasive surgery. The minimally invasive surgery segment accounted for a larger market share in 2022 and is expected to register a higher CAGR during 2022–2030. Minimally invasive surgery for aortic valve replacement is a less invasive approach compared to traditional open surgery. It involves making smaller incisions, often using specialized surgical instruments and video-assisted technology, to access the heart to replace a poorly working aortic valve with an artificial valve, either a mechanical valve or a bioprosthetic valve. The potential benefits of minimally invasive techniques include shorter hospital stays, reduced scarring, and faster recovery times (in normal conditions). TAVR operations are chosen in most cases because they cause less tissue damage and are followed by a quicker recovery time. According to the New England Journal of Medicine, since the inception of this technique in 2007, the number of TAVR surgeries has significantly increased, as surgical replacement has proven unsuitable for older patients. As medical technology advances, these minimally invasive approaches offer more options and improved outcomes for patients requiring aortic valve replacement.

End User-Based Insights

In terms of end user, the aortic valve replacement devices market is segmented into hospitals & clinics, ambulatory surgical centers, and others. The hospitals & clinics segment accounted for the largest market share in 2022. Hospitals & clinics are the largest end users of aortic valve replacement devices, which can be used for treating patients from different age groups suffering from various medical conditions. Many patients visit hospitals to seek treatments for their acute and chronic conditions. Medical staff at hospitals offer convenient services and the best care to patients. Thus, hospitals aim to restore and maintain the public's good health. Staff members employed in hospitals are aware of different aortic valve replacement devices. The rising prevalence of chronic diseases, growing geriatric population, and increasing number of hospitals primarily contribute to the growth of the aortic valve replacement market for the hospitals segment. The geriatric population is twice as likely to get hospitalized than adults of middle age; approximately 17% of Americans aged 65 and above get hospitalized at least once a year, while only 8% of adults aged 45–64 require hospitalization. Cardiovascular disorders, cancer, stroke, and neurological diseases are the leading causes of hospitalization among older patients. Thus, the higher number of patients getting admitted to hospitals is likely to boost the growth of the market for the hospital segment during the forecast period.

Regional Analysis

North America dominated the aortic valve replacement devices market in 2022 accounting for a maximum share, with the US, Canada, and Mexico being the major contributors to the regional market growth. The US is the largest market for aortic valve replacement devices in this region. The aortic valve replacement devices market growth in North America is attributed to the rising prevalence of heart diseases and increasing number of regulatory approvals, R&D activities, and new product launches. Additionally, the technological advancement in the product is likely to offer growth opportunities to the aortic valve replacement devices market in the region.

According to the Cleveland Clinic, heart valve disease affects ~2.5% of people in the US. These include valve regurgitation (leaky) or stenosis (narrowing). Mitral regurgitation and aortic stenosis are the most common valvular diseases in the US. More than 2 million people in the US suffer from a leaking heart valve. The US is at the forefront of the North America aortic valve replacement devices market. Nearly 1.5 million people suffer from aortic stenosis in the US. According to the data published by the National Institutes of Health (NIH), in 2021, ~78,000 transcatheter aortic valve implantation (TAVI) surgeries were performed annually in the country. The presence of key players and the increasing number of clinical studies in the region drive market growth. Initiatives undertaken by private institutions are also expected to bolster the growth of the market. For instance, Edwards Lifesciences Foundation is sponsoring the American Heart Association’s Valvular Disease Education Center and Ambassador Program in the US. Thus, the abovementioned factors are expected to fuel the market growth in the US.

The report profiles leading players operating in the global aortic valve replacement devices market. These include Virgin Pulse Inc, Limeade Inc, Optum Inc, Vitality Group International Inc, Bravo Wellness LLC, Sonic Boom Wellness LLC, WebMD Health Services Group Inc, Fitbit LLC, Asset Health Inc, Healthcheck360, Marquee Health LLC, Wellright Inc, Wellworks for You, Wellable LLC, Wellness 360 Technologies Inc, WellSteps.com LLC, and CHC Wellbeing Inc.

- In February 2023, Medtronic relaunched its Harmony Transcatheter Pulmonary Valve (TPV) System, a minimally invasive alternative to open-heart surgery for congenital heart disease patients with native or surgically repaired right ventricular outflow tract (RVOT).

- In January 2023, Abbott received the US Food and Drug Administration (FDA) approval for the company's latest generation transcatheter aortic valve implantation (TAVI) system, Navitor, to treat people with severe aortic stenosis at high or extreme risk for open-heart surgery. The Navitor TAVI system is the latest addition to the company's comprehensive transcatheter structural heart portfolio that offers less invasive treatment options to physicians and patients for some of the most common and serious heart diseases.

- In July 2021, Limeade acquired TINYPULSE, a pioneer in employee listening software. The acquisition will unite two companies committed to helping their customers create healthy employee experiences.

- In November 2021, Virgin Pulse acquired Welltok to drive better health outcomes and cost reductions. The acquisition would allow the two companies to introduce the industry's first end-to-end engagement and activation platform, supporting clients, members, and consumers across the entire health community.

Aortic Valve Replacement Devices Market Regional Insights

The regional trends and factors influencing the Aortic Valve Replacement Devices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Aortic Valve Replacement Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Aortic Valve Replacement Devices Market

Aortic Valve Replacement Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 7.11 Billion |

| Market Size by 2030 | US$ 18.07 Billion |

| Global CAGR (2022 - 2030) | 12.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

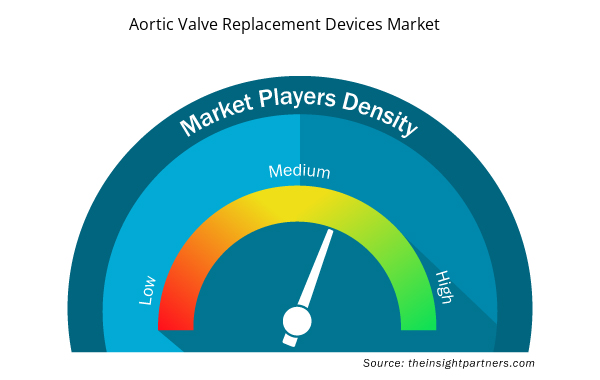

Aortic Valve Replacement Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Aortic Valve Replacement Devices Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Aortic Valve Replacement Devices Market are:

- Abbott Laboratories

- Medtronic Plc

- Boston Scientific Corp

- LivaNova Plc

- Edwards Lifesciences Corp

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Aortic Valve Replacement Devices Market top key players overview

Company Profiles

- Abbott Laboratories

- Medtronic Plc

- Boston Scientific Corp

- LivaNova Plc

- Edwards Lifesciences Corp

- Braile Biomedica Industry, Commerce and Representations Ltd

- Artivion Inc

- JenaValve Technology Inc

- Venus MedTech HangZhou Inc

- Labcor Laboratorios Ltda

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Medical Second Opinion Market

- Industrial Valves Market

- Mobile Phone Insurance Market

- Clear Aligners Market

- Pressure Vessel Composite Materials Market

- Antibiotics Market

- Online Exam Proctoring Market

- Emergency Department Information System (EDIS) Market

- Industrial Inkjet Printers Market

- Intradermal Injection Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Surgery, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The aortic valve replacement devices market majorly consists of the following players, Abbott Laboratories, Medtronic Plc, Boston Scientific Corp, LivaNova Plc, Edwards Lifesciences Corp, Braile Biomedica Industry, Commerce and Representations Ltd, Artivion Inc, JenaValve Technology Inc, Venus MedTech HangZhou Inc, and Labcor Laboratorios Ltda.

Based on product, the aortic valve replacement devices market is bifurcated into mechanical valve and sutureless valve. The sutureless valve segment held the larger market share in 2022 and the same segment registered a significant CAGR in the aortic valve replacement devices market in 2022-2030.

The factors driving the growth of the aortic valve replacement devices market include the rising number of aortic valve replacement surgeries and increasing demand for minimally invasive techniques. However, the product recalls of aortic valve replacement devices hampers the growth of the aortic valve replacement devices market.

Aortic valve repair and aortic valve replacement are methods that treat diseases affecting the aortic valve. The aortic valve is one of four valves that regulate blood flow through the heart. The aortic valve separates the heart's main pumping chamber and the main artery that supplies oxygen-rich blood to body. Aortic valve repair or aortic valve replacement treats aortic valve disease and help restore normal blood flow, reduces symptom, prolong life and help preserves the function of the heart muscle.

The aortic valve replacement devices market is expected to be valued at US$ 18,070.32 billion in 2030.

The aortic valve replacement devices market was valued at US$ 7,113.39 billion in 2022.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Aortic Valve Replacement Devices Market

- Abbott Laboratories

- Medtronic Plc

- Boston Scientific Corp

- LivaNova Plc

- Edwards Lifesciences Corp

- Braile Biomedica Industry, Commerce and Representations Ltd

- Artivion Inc

- JenaValve Technology Inc.

- Venus MedTech HangZhou Inc.

- Labcor Laboratorios Ltda

Get Free Sample For

Get Free Sample For