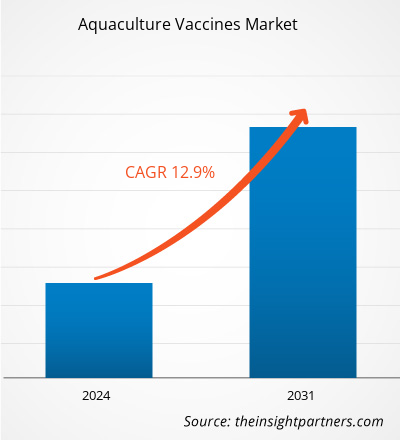

The aquaculture vaccines market size is projected to reach US$ 0.82 billion by 2031 from US$ 0.31 billion in 2023. The market is expected to register a CAGR of 12.90% during 2023–2031. The development of novel vaccines will likely remain a key trend in the market.

Aquaculture Vaccines Market Analysis

The need for vaccinations to treat illnesses in aquaculture species will increase due to the increasing frequency of infectious diseases among aquatic animals. The market will also be supported by increased market players' initiatives, such as new product launches, the opening of new facilities, investments in new projects, and active collaboration with foreign governments. The Asia-Pacific region is anticipated to experience significant growth during the forecast period due to the region's major aquaculture-producing countries, booming aquaculture industry, and rising consumer demand. The region's need for aquaculture vaccines will increase due to these factors.

Aquaculture Vaccines Market Overview

Farmers utilize vaccinations for aquaculture to achieve high profitability due to the growing demand for food products derived from aquatic animals, such as oil, caviar, protein powders, and meat. The market is also seeing a sharp rise in demand for high-quality, sustainable, and healthful meat products that contain little to no drugs. Consuming fish frequently is strongly advised as part of a balanced diet. Fish can produce more protein using their lower feed rate since they have a higher protein content than meat from terrestrial animals and a lower feed conversion rate (FCR) than land animals.

Additionally, fish protein is low in essential amino acids and highly digestible compared to animal-sourced protein. Eating fish and shellfish can reduce the risk of arthritis, inflammation, and heart disease. Fish is considered beneficial to health primarily because it contains long-chain omega 3 (n-3) polyunsaturated fatty acids (PUFA). Furthermore, fish protein contains a large number of bioactive peptides. If these are taken in the right amounts and are bioavailable to humans, they can have many respectable effects on health. The inhibition of the renin-angiotensin-aldosterone system (RAAS) enzyme is responsible for controlling blood pressure. Other health benefits include antioxidant peptides' control of inflammation, maintenance of bone health, mental health benefits from platelet-activating factor acetyl-hydrolase inhibitory (PAF-AH) peptides and opioid peptides, and several other bioactivities. Therefore, there is a growing need for aquaculture vaccines due to the need for healthy aquatic animal breeding.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aquaculture Vaccines Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Aquaculture Vaccines Market Drivers and Opportunities

Growing Aquaculture Industry Favors, the Market Growth

The Food and Agriculture Organization of the United Nations published a report titled "The State of World Fisheries and Aquaculture" in 2022. The report states that the number of aquatic foods consumed globally, excluding algae, has increased by more than five times compared to nearly 60 years ago. The amount of aquatic food consumed worldwide grew from 28 million tonnes in 1961 to approximately 158 million in 2019. From 1961 onward, the average annual consumption growth rate was 3.0%, while the population growth rate was 1.6%. Growing income, shifting consumer preferences, and expanding supply contribute to an increase in per capita consumption. The per capita consumption of aquatic foods in 227 countries was projected by the Food and Agriculture Organization of the United Nations in 2019. In terms of population, in 2019, the nations with lower average global consumption made up 54% of the worldwide population. With over 80 kg of aquatic food consumed annually per person, Iceland, the Faroe Islands, and the Maldives have the highest aquatic food consumption. The global average per capita consumption in 2019 was 20.5 kg. In contrast, the average weight in high-income countries was 26.5 kg, while in low-income countries it was 5.4 kg.

The aquaculture industry is expanding faster than expected due to the growing animal demand. Vaccines for aquaculture reduce the risk of infection and boost product yield. As a result, the aquaculture vaccine market is growing because of the expanding aquaculture sector.

Rising Prevalence of Infectious Diseases in Aquatic Animals Creates Significant Opportunities in the Market

According to the National Library of Medicine (NLM) research study "Prevalence of Anisakid Nematodes in Fish in China: A Systematic Review and Meta-Analysis," which was released in February 2022, anisakid nematodes were common in fish throughout China, with a pooled incidence rate of 45.5%. The highest occurrence percentage was found in fresh fish (58.1%). Anisakid nematodes were most prevalent in Eastern China (55.3%), with the East China Sea having the highest prevalence (76.8%). Data from the Aquaculture Research & Development journal indicates that from 2014 to 2018, approximately 219 cases of infectious diseases were reported in the fresh aquaculture industry. Of these, 1.83% were viral, 74.88% were parasitic, 12.80% were bacterial, and 10.50% of cases combined bacterial and parasitic illnesses. Consequently, it is anticipated that the high incidence of infectious diseases will increase demand for vaccinations, opening up profitable opportunities for the aquaculture vaccines market in the future.

Aquaculture Vaccines Market Report Segmentation Analysis

Key segments that contributed to the derivation of the aquaculture vaccines market analysis are type of vaccine, species, and route of administration.

- Based on type of vaccine, the aquaculture vaccines market is segmented into live vaccine, inactivated vaccine, and others. The inactivated vaccine segment held the most significant market share in 2023.

- By species, the market is categorized into tilapia, trout, salmon, shrimps, and others. The trout segment held the largest share of the market in 2023.

- By route of administration, the market is segmented into injection vaccines, immersion vaccines, and oral vaccines. The injection vaccines segment held the significant share of the market in 2023.

Aquaculture Vaccines Market Share Analysis by Geography

The geographic scope of the aquaculture vaccines market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The US, Canada, and Mexico comprise the three segments of the North American aquaculture vaccines market. The United States holds North America's largest share of the aquaculture vaccines market. The main drivers of market growth are the high incidence of infectious diseases in the aquaculture industry, rising production levels, and the increasing development and introduction of novel aquaculture vaccines. The United States produced 5.2 million tonnes of fish in 2018, valued at US$ 7063.5 million, according to The OECD Review of Fisheries 2020. 17% came from aquaculture and 83% from fisheries. While its value increased by 29%, the production quantity increased by 7% between 2008 and 2018.

Further, the market players accelerated the production of technologically developed products in the country. For instance, in September 2020, Virbac acquired a range of tilapia vaccines from Ictyogroup, an animal health company specializing in R&D biology. The Virbac Group received rights for distribution and market registered and autogenous vaccines worldwide. In addition to the acquisition, as mentioned earlier, the two companies have partnered for the development by Ictyogroup of new formulations and new vaccines, again for the Aqua Virbac division, tilapia, and companies in the aquaculture market. The agreement also provides for the transfer from Ictyogroup to Virbac of several employees specialized in technical marketing support and R&D biology. Thus, the growing developments by various market players in the US aquaculture industry and the factors above will boost the market for aquaculture vaccines in the US.

Aquaculture Vaccines Market Regional Insights

The regional trends and factors influencing the Aquaculture Vaccines Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Aquaculture Vaccines Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Aquaculture Vaccines Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 0.31 Billion |

| Market Size by 2031 | US$ 0.82 Billion |

| Global CAGR (2023 - 2031) | 12.90% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type of Vaccine

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Aquaculture Vaccines Market Players Density: Understanding Its Impact on Business Dynamics

The Aquaculture Vaccines Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Aquaculture Vaccines Market top key players overview

Aquaculture Vaccines Market News and Recent Developments

The aquaculture vaccines market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the aquaculture vaccines market are listed below:

- Merck Animal Health, known as MSD Animal Health outside of the United States and Canada, a division of Merck & Co., Inc., announced that it had signed a definitive agreement to acquire the aqua business of Elanco Animal Health Incorporated for US$ 1.3 billion in cash, consisting of an innovative portfolio of medicines and vaccines, nutrition and supplements for aquatic species; two related aqua manufacturing facilities in Canada and Vietnam; as well as a research facility in Chile. The acquisition is expected to be completed by mid-year 2024, subject to approvals from regulatory authorities and other customary closing conditions. (Source: Merck Animal Health, Press Release, February 2024)

Aquaculture Vaccines Market Report Coverage and Deliverables

The “Aquaculture Vaccines Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Aquaculture vaccines market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Aquaculture vaccines market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Aquaculture vaccines market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the aquaculture vaccines market

- Detailed company profiles

Frequently Asked Questions

What is the expected CAGR of the aquaculture vaccines market?

Which are the leading players operating in the aquaculture vaccines market?

What are the driving factors impacting the aquaculture vaccines market?

What are the future trends of the aquaculture vaccines market?

Which region dominated the aquaculture vaccines market in 2023?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For