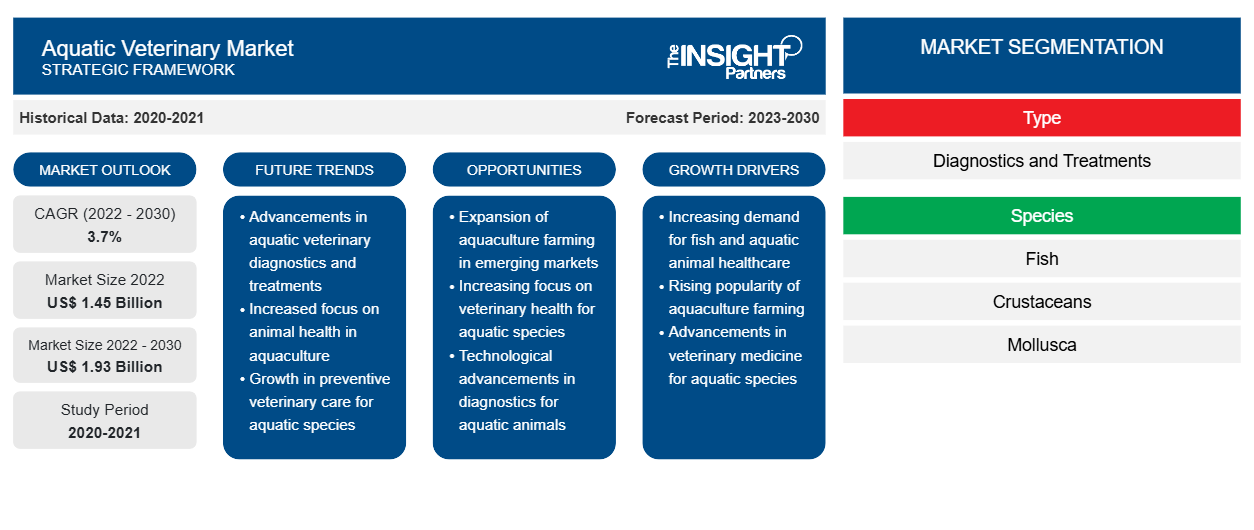

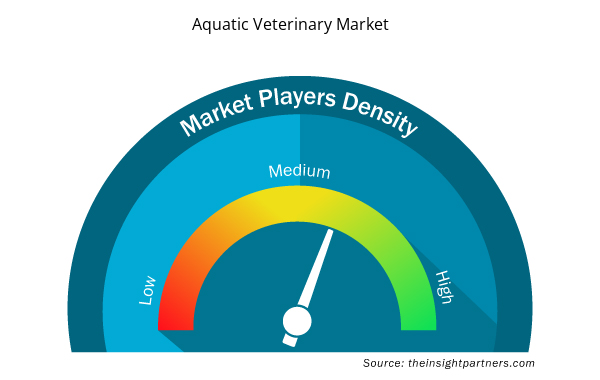

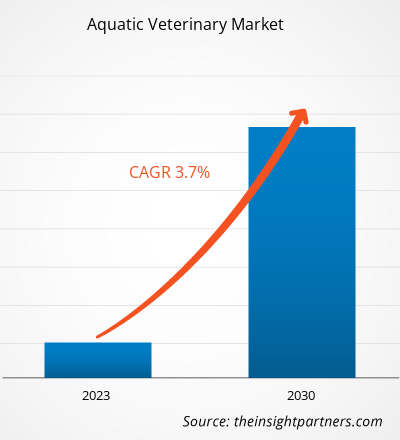

[Research Report] The aquatic veterinary market size is projected to grow from US$ 1,450.44 million in 2022 to US$ 1,934.33 million by 2030; the market is estimated to record a CAGR of 3.7% during 2022–2030.

Market Insights and Analyst View:

The aquatic veterinary medicine discipline involves complete healthcare for aquatic animals, including whales, sharks, alligators, mollusks, and penguins. The aquatic veterinary market growth is attributed to initiatives by the governments of various countries to develop their respective aquaculture industries and the surging demand for food products derived from aquatic animals. Further, ongoing efforts for the development of novel fish vaccines are expected to create ample opportunities for market players in the coming years.

Growth Drivers and Restraints:

The high demand for seafood and the decreasing annual catch of wild fish are crucial factors that can drive the growth of the aquaculture industry at an exponential rate. Thus, governments are taking initiatives to improve and support the growth of the aquacultural industry.

Following are a few recent initiatives:

- In February 2021, the Foundation for Food & Agriculture Research (FFAR) raised funds of US$ 790,326 to create a vaccine delivery system to prevent the spread of tilapia lake virus infections and other diseases in the aquaculture sector.

- In January 2022, Benchmark Animal Health, a top aquaculture biotechnology company, and Cermaq Group AS, a world-leading salmon farming company, received US$ 0.4 million (NOK 4.2 million) in funding from the Norwegian Research Council to support a collaborative research project for the production of a vaccine against Tenacibaculum bacteria-caused salmon diseases.

- In January 2023, the European Commission funded US$ 7.88 million to the PerformFISH project, which was initiated to explore and tackle the major causes of stagnancy in the Mediterranean Marine Fish Farming (MMFF) sector. The PerformFISH has been making efforts to manage challenges associated with sea bass and sea bream in Mediterranean aquaculture.

The European Union (EU), in the framework of Horizon 2020, funded Mediterranean Aquaculture Integrated Development (Media)—a four-year Research and Innovation Action (RIA) project that was jointly approved along with PerformFISH under the program SFS-23-2016—for improving the technical performance of Mediterranean aquaculture. MedAID aims to improve the sustainability and competitiveness of the Mediterranean marine fish-farming sector throughout the value chain. Thus, an increase in government initiatives to support developments in the aquaculture industry drives the growth of the aquatic veterinary market. Further, the aquatic veterinary market trends include the development of novel DNA-based vaccines against different fish pathogens.

Fish vaccines developed for commercial use must be approved by an appropriate national or regional authority. Before the use or trade of vaccines, it is mandatory to follow specific rules and recommendations set by relevant competent authorities. The legislation, requirements, and involved regulatory bodies for authorization may vary by country. In the EU, fish vaccines cannot be authorized by a national competent authority. The European Medicines Agency authorizes them for the entire European Union. The cost of producing vaccines is high as the EU has strict guidelines for vaccine manufacturers regarding good manufacturing practices (GMP). Fish vaccines have a smaller market than other animal vaccines, and their development costs are higher than those of vaccines for other animal species. In the US, the FDA approves fish vaccines. Development of fish vaccines takes more than 10 years or longer and costs nearly US$ 10–20 million. Additionally, the approval process is time-consuming, which prevents new players from entering the market. Thus, a stringent regulatory framework hinders the development and commercialization of fish vaccines, which hampers the aquatic veterinary market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aquatic Veterinary Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aquatic Veterinary Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The aquatic veterinary market analysis has been carried out by considering the following segments: type, disease source, species, and route of administration. Based on type, the market is bifurcated into diagnostics and treatments. By species, the market is divided into fish, crustaceans, mollusks, and others. Based on disease source, the market is differentiated into bacteria, viruses, parasites, and others. In terms of route of administration, the market is segmented into water medication, medicated feed, and others. Based on geography, the aquatic veterinary market is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

The aquatic veterinary market research, based on type, is segmented into diagnostics and treatments. In 2022, the treatment segment accounted for a larger share of the market. The market for this segment is expected to grow at a higher CAGR from 2022 to 2030.

Based on species, the market is segmented into fish, crustaceans, mollusks, and others. The fish segment held the largest aquatic veterinary market share in 2022. It is expected to register the highest CAGR from 2022 to 2030.

Based on disease sources, the market is segmented into bacteria, viruses, parasites, and others. The bacteria segment accounted for the largest aquatic veterinary market share in 2022. It is projected to register the highest CAGR during 2022–2030.

Based on the route of administration, the aquatic veterinary market is segmented into water medication, medicated feed, and others. The water medication segment accounted for the largest share of the market in 2022. The same segment is projected to register the highest CAGR from 2022 to 2030.

Regional Analysis:

The scope of the aquatic veterinary market report entails North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In 2022, North America accounted for the largest market share. The North America aquatic veterinary market is segmented into the US, Canada, and Mexico. The growth of market in the US is attributed to the flourishing aquaculture industry and surging demand for aquatic animal-derived food products.

According to the Fisheries of the US 2020 report, commercial fishermen in the US reported a yield of 8.4 billion pounds valued at US$ 4.7 billion in 2020. Anglers in the country took nearly 200 million trips for recreational fisheries in 2020. These recreational anglers caught approximately 1 billion fish and released 65% of those caught. The overall recreational harvest was estimated at 344 million fish weighing 353 million pounds. Thus, the flourishing aquaculture industry fuels the growth of the aquatic veterinary market in the US.

- In September 2020, the Virbac Group acquired various tilapia vaccines from Ictyogroup, an animal health company specializing in R&D biology. The group received rights for the distribution and marketing of these registered, autogenous vaccines worldwide. The two companies had a partnership for the development of new formulations and new vaccines for the Aqua Virbac division. The agreement also allowed the transfer of several employees specialized in technical marketing support and R&D biology from Ictyogroup to Virbac.

- In July 2020, Zoetis acquired the Fish Vet Group from Benchmark Holdings, PLC to make a strategic addition to its pharma business. The pharmaceutical business of Zoetis commercializes and develops fish vaccines, and offers vaccination and diagnostic services for aquaculture. The acquisition of Fish Vet Group helped Zoetis enhance its diagnostics expertise and testing services, including environmental testing at Pharmaq’s reference lab.

Thus, strategic initiatives by various market players in the US aquaculture industry bolster the aquatic veterinary market in the US.

Industry Developments and Future Opportunities:

The aquatic veterinary market forecast can help stakeholders in this marketplace plan their growth strategies. A few initiatives taken by key players operating in the aquatic veterinary market are listed below:

- In September 2020, the AKVA Group and Vikings signed a design and cooperation agreement to design several land-based salmon farms in the Middle East. AKVA Group provides extensive experience in designing, constructing, and operating modern land-based fish farming.

- In May 2020, the AKVA group acquired Sperre, located in the Notodden town of the Norwegian subsea cluster. The company has extensive experience developing and manufacturing various advanced ROV solutions for aquaculture, oil service, and marine industries.

- In November 2022, Elanco Animal Health Inc and Ginkgo Bioworks launched BiomEdit to discover, develop, and introduce novel probiotics, bioactive molecules, engineered microbial medicines, and microbial monitoring services for animal health.

- In November 2023, Merck Animal Health introduced two training modules in its Fish Welfare series to empower aquaculture businesses and conservation fish communities with training and best practices for improved fish welfare. The training programs were also designed to complement and help fulfill the animal care requirements of aquaculture certification and stewardship programs.

Aquatic Veterinary Market Regional Insights

Aquatic Veterinary Market Regional Insights

The regional trends and factors influencing the Aquatic Veterinary Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Aquatic Veterinary Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Aquatic Veterinary Market

Aquatic Veterinary Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1.45 Billion |

| Market Size by 2030 | US$ 1.93 Billion |

| Global CAGR (2022 - 2030) | 3.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

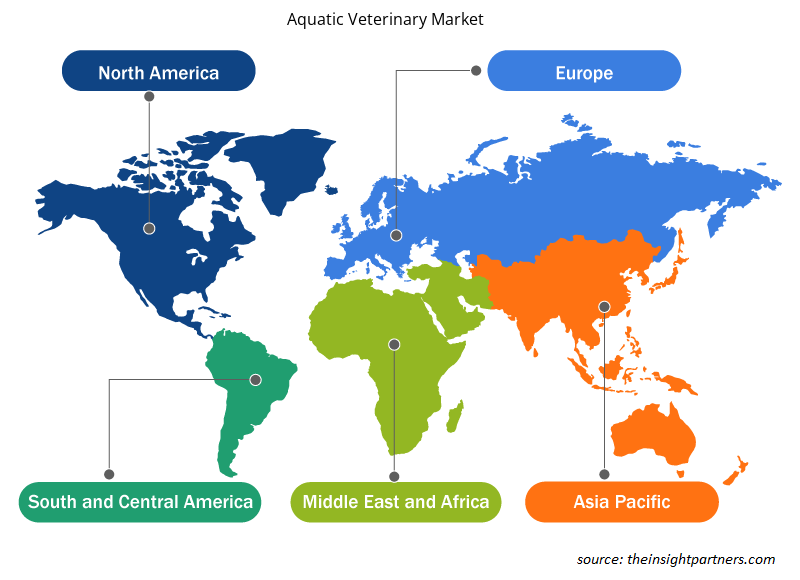

Aquatic Veterinary Market Players Density: Understanding Its Impact on Business Dynamics

The Aquatic Veterinary Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Aquatic Veterinary Market are:

- Esox

- Zoetis

- Elanco Animal Health

- Merck KgaA

- Virbac Animal Health

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Aquatic Veterinary Market top key players overview

Competitive Landscape and Key Companies:

Esox, Zoetis, Elanco Animal Health, Merck KgaA, Virbac Animal Health, Phbro Animal Health Corporation, Aquatic Diagnostics Ltd, Thermo Fisher Scientific, Ceva, and HIPRA are among the prominent players profiled in the aquatic veterinary market report. A few of the growth strategies embraced by these companies to promote their growth are launches, expansion, and relocation. Elanco Animal Health Inc. is among the companies that havehas been implementing organic strategies, which, in turn, have brought about various changes in contributed significantl y to the global health economics and outcomes research services market. . In addition to those mentioned above, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Species, Disease Source, Route of Administration, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The aquatic veterinary medicine discipline involves complete healthcare for aquatic animals, including whales, sharks, alligators, mollusks, and penguins. The aquatic veterinary market size is growing with initiatives taken by various country governments to develop their respective aquaculture industries and the surging demand for food products derived from aquatic animals.

The global aquatic veterinary market, by type, is segmented into diagnostics and treatments. In 2022, the treatment segment accounted for a larger share of the market. The market for this segment is expected to grow at a higher CAGR from 2022 to 2030.

The global aquatic veterinary market majorly consists of the players such as Esox, Zoetis, Elanco Animal Health, Merck KgaA, Virbac Animal Health, Phbro Animal Health Corporation, Aquatic Diagnostics Ltd, Thermo Fisher Scientific, Ceva, and HIPRA

The aquatic veterinary market size is growing with initiatives taken by various country governments to develop their respective aquaculture industries and the surging demand for food products derived from aquatic animals. Further, ongoing efforts for the development of novel fish vaccines are expected to create ample opportunities for the aquatic veterinary market in the coming years.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Aquatic Veterinary Market

- Esox

- Zoetis

- Elanco Animal Health

- Merck KgaA

- Virbac Animal Health

- Phbro Animal Health Corporation

- Aquatic Diagnostics Ltd

- Thermo Fisher Scientific

- Ceva

- HIPRA

- Fish Vet Group

- MELAFIX

- Cenavisa Animal Health & Aquaculture

- Hebei Veyong pharmaceutical Co., Ltd.

- MED-VET BIOLINKS PRIVATE LIMITED

Get Free Sample For

Get Free Sample For