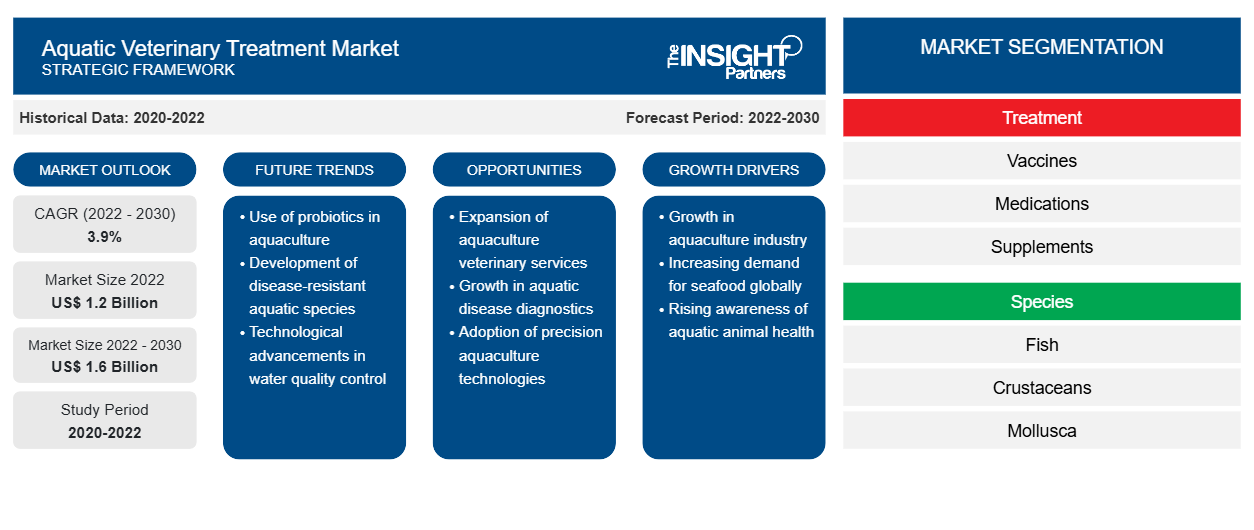

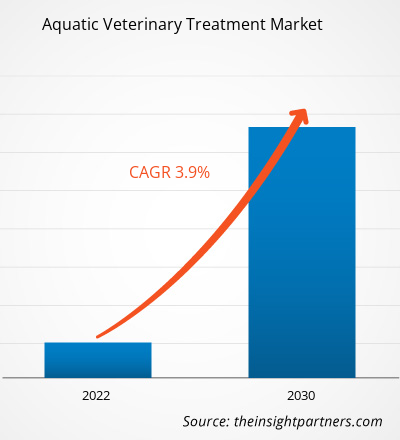

[Research Report] The aquatic veterinary treatment market size is projected to grow from US$ 1.2 billion in 2022 to US$ 1.6 billion by 2030; it is estimated to record a CAGR of 3.9% during 2022–2030.

Market Insights and Analyst View:

The aquatic veterinary treatment discipline involves complete healthcare for aquatic animals, including fish, mollusks, and other aquatic animals. The aquatic veterinary treatment market is growing due to the development of aquaculture industries worldwide, growing infectious diseases among aquatic animals, and the surging demand for food products derived from them. Additionally, ongoing efforts for the development of novel fish vaccines are projected to create ample opportunities for the growth of the market.

Growth Drivers:

The aquatic veterinary treatment market trends include technological innovations in fish and aquatic animal vaccines.

As per the National Oceanic and Atmospheric Administration, and National Ocean Service, aquaculture is used to generate food, rehabilitate habitats, replenish wild stocks, and rebuild endangered species populations in both fresh and salt water. The main aquaculture regions are Asia Pacific, Europe, and South Asia, which account for more than 70% of global aquaculture production. Fish dominate aquaculture, accounting for 66% of the market, followed by crustaceans and mollusca. According to the data from a report titled "The State of World Fisheries and Aquaculture,” published by the Food and Agriculture Organization of the United Nations in 2022, worldwide consumption of aquatic foods, excluding algae, has increased by over five times the quantity consumed almost 60 years ago.

Global aquatic food consumption increased from 28 million metric tons in 1961 to 158 million metric tons in 2019. The consumption increased at an average annual rate of 3.0% from 1961, compared with a population growth rate of 1.6%. A dramatic increase in the demand for live aquatic animal trade, unpredictable expansion in aquaculture and ornamental fish trade, and increased urbanization and industrialization are factors fueling the growth of the aquaculture industry.

As per the World Bank’s income level classification, the 1990–2020 period witnessed quick development in aquaculture, with 51 of low-middle-income countries and 53 of upper-middle-income countries reporting aquaculture production. In 2020, aquaculture contributed 61.7% to total production in upper-middle-income countries, up from 19.8% in 1990. The share of aquaculture in lower-middle-income countries also increased from 14.7% to 46.2% in the same period. Per capita consumption is expanding due to increasing supplies, changing consumer preferences, and rising income. The rising consumption demand of aquatic animals has fueled the production of these aquatic animals, which, in turn, accelerates the growth of the aquaculture industry. Aquaculture medications such as vaccines and supplements lower the chance of infection in aquatic animals and increase the yield of products. Therefore, the growing aquaculture industry is expected to continue to drive the aquatic veterinary treatment market growth during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aquatic Veterinary Treatment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aquatic Veterinary Treatment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The aquatic veterinary treatment market analysis has been carried out by considering the following segments: treatment, species, disease source, route of administration, and geography. Based on treatment, the market is classified into vaccines, medications, and supplements. In terms of species, the market is classified into fish, crustaceans, mollusca, and others. By disease source, the market is segmented into bacterial, viral, parasites, and others. In terms of route of administration, the market is categorized into water medication, medicated feed, and others.

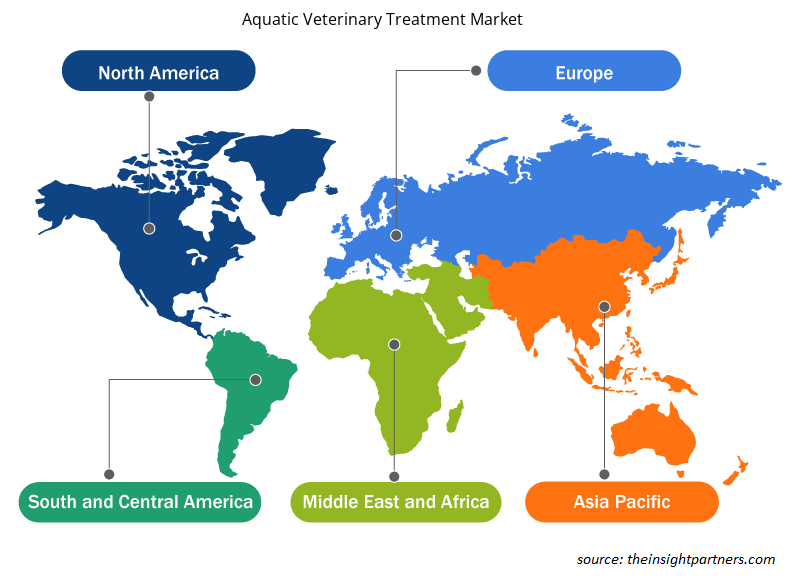

The scope of the aquatic veterinary treatment market report covers North America (the US, Canada, and Mexico), Europe (France, Germany, the UK, Spain, Italy, and the Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), the Middle East & Africa (Saudi Arabia, the UAE, South Africa, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

The aquatic veterinary treatment market, by treatment, is categorized into vaccines, medications, and supplements. The medications segment held a significant market share in 2022. It is anticipated to register the highest CAGR in the market during 2022–2030.

Based on species, the market is segmented into fish, crustaceans, mollusca, and others. In 2022, the fish segment held the largest share of the market and is anticipated to register the fastest CAGR during 2022–2030.

Based on disease source, the market is categorized into bacterial, viral, parasites, and others. The bacterial segment held a significant aquatic veterinary treatment market share in 2022 and is estimated to register the highest CAGR during 2022–2030.

Based on route of administration, the market is segmented into water medication, medicated feed, and others. The water medication segment held a significant aquatic veterinary treatment market share in 2022. It is expected to register the highest CAGR during 2022–2030.

Regional Analysis:

Geographically, the aquatic veterinary treatment market is primarily divided into North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In 2022, North America captured a significant share of the market. In 2022, the US held the largest share of the market in the region. The market growth in North America is attributed to the expanding aquaculture industry, rising demand for aquatic animal-derived food products, increasing prevalence of infectious diseases in the aquaculture sector, and growing development and launch of new aquaculture vaccines. According to the World Bank data, ~5.6 million fish were produced by the North American aquaculture industry in 2021. According to the National Oceanic and Atmospheric Administration, aquaculture generates ~US$ 1.5 billion annually in the US. Thus, the flourishing aquaculture industry fuels the growth of the aquatic veterinary treatment market.

The market players accelerated the production of technologically developed products in the country. For instance, in September 2020, Virbac acquired a range of tilapia vaccines from Ictyogroup, an animal health company specializing in R&D biology. The Virbac Group received rights for the distribution and marketing of registered autogenous vaccines worldwide. In addition, the two companies had partnered for the development of new formulations and new vaccines for the Aqua Virbac division by Ictyogroup. The agreement also allowed the transfer of several employees specialized in technical marketing support and R&D biology from Ictyogroup to Virbac. Thus, the above-mentioned factors propel the aquatic veterinary treatment market growth in the region.

Industry Developments and Future Opportunities:

Apart from emphasizing the factors impacting the market, the aquatic veterinary treatment market report depicts the developments of prominent players. A few initiatives taken by market players operating in the global aquatic veterinary treatment market are listed below:

- In November 2022, Indian Immunologicals Ltd joined hands with the Central Institute of Fisheries Education for the commercial development of India’s first fish vaccine. The vaccine is to be developed to protect freshwater fish against common bacterial diseases.

- In July 2020, Zoetis acquired the Fish Vet Group from Benchmark Holdings as a strategic addition to its Pharmaq business, which advances and commercializes fish vaccines and provides vaccination and diagnostic services for aquaculture. This acquisition improves the geographic reach and enhances the diagnostics expertise and testing services, including environmental testing, that Pharmaq’s reference lab, Pharmaq Analytiq, can offer fish farmers in main aquaculture markets.

Aquatic Veterinary Treatment Market Regional Insights

Aquatic Veterinary Treatment Market Regional Insights

The regional trends and factors influencing the Aquatic Veterinary Treatment Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Aquatic Veterinary Treatment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Aquatic Veterinary Treatment Market

Aquatic Veterinary Treatment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1.2 Billion |

| Market Size by 2030 | US$ 1.6 Billion |

| Global CAGR (2022 - 2030) | 3.9% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Treatment

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

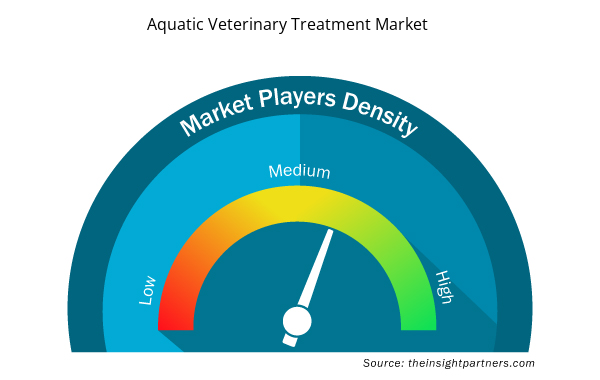

Aquatic Veterinary Treatment Market Players Density: Understanding Its Impact on Business Dynamics

The Aquatic Veterinary Treatment Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Aquatic Veterinary Treatment Market are:

- Merck & Co. Inc.

- Zoetis LLC

- HIPRA

- Phibro Animal Health Corp

- Boehringer Ingelheim Animal Health

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Aquatic Veterinary Treatment Market top key players overview

Competitive Landscape and Key Companies:

The aquatic veterinary treatment market forecast can help stakeholders plan their growth strategies. Merck & Co. Inc., Elanco Animal Health Inc., Zoetis LLC, HIPRA, Phibro Animal Health Corp, Boehringer Ingelheim Animal Health, Nisseiken Co. Ltd., VETERQUIMICA S.A., Microsynbiotix, and AquaTactics Fish Health are among the prominent players in the market. The market players focus on introducing new high-tech products, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Treatment, Species, Disease Source, Route of Administration, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The aquatic veterinary medicine discipline involves complete healthcare for aquatic animals, including whales, sharks, alligators, mollusks, and penguins. The aquatic veterinary market size is growing with initiatives taken by various country governments to develop their respective aquaculture industries and the surging demand for food products derived from aquatic animals.

The global aquatic veterinary market majorly consists of the players such as Esox, Zoetis, Elanco Animal Health, Merck KgaA, Virbac Animal Health, Phbro Animal Health Corporation, Aquatic Diagnostics Ltd, Thermo Fisher Scientific, Ceva, and HIPRA

The global aquatic veterinary market, by type, is segmented into diagnostics and treatments. In 2022, the treatment segment accounted for a larger share of the market. The market for this segment is expected to grow at a higher CAGR from 2022 to 2030.

The aquatic veterinary market size is growing with initiatives taken by various country governments to develop their respective aquaculture industries and the surging demand for food products derived from aquatic animals. Further, ongoing efforts for the development of novel fish vaccines are expected to create ample opportunities for the aquatic veterinary market in the coming years.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Aquatic Veterinary Treatment Market

- Merck & Co. Inc.

- Zoetis LLC

- HIPRA

- Phibro Animal Health Corp

- Boehringer Ingelheim Animal Health

- Nisseiken Co. Ltd.

- VETERQUIMICA S.A.

- Elanco Animal Health Inc.

- Microsynbiotix

- AquaTactics Fish Health

Get Free Sample For

Get Free Sample For