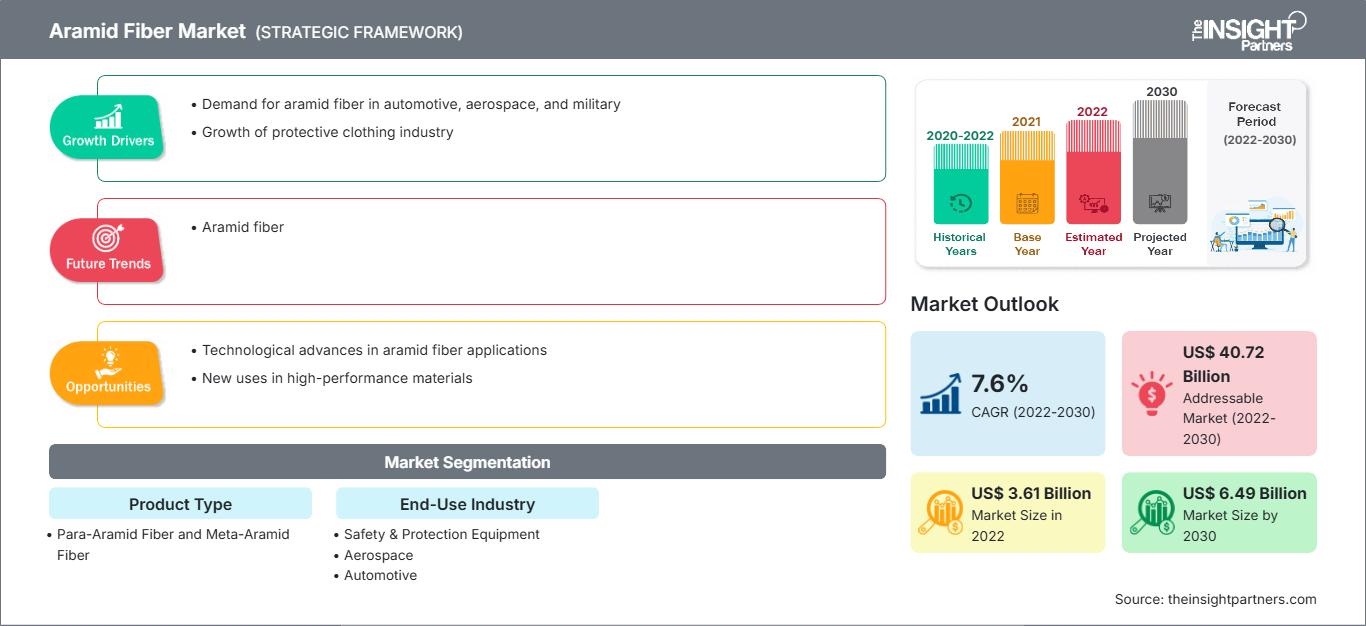

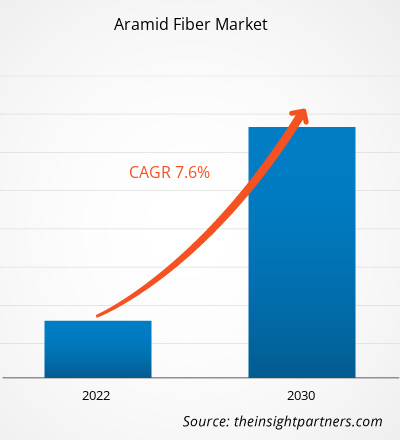

[Research Report] The aramid fiber market size was valued at US$ 3.61 billion in 2022 and is expected to reach US$ 6.49 billion by 2030; it is estimated to register a CAGR of 7.6% from 2022 to 2030.

Market Insights and Analyst View:

Aramid fibers, also known as aromatic polyamides, are synthetic fibers with exceptional strength, heat resistance, and durability. They are renowned for their high tensile strength, which is five to six times greater than that of steel, and their lightweight nature, being only one-fifth the weight of steel. These remarkable properties make these fibers valuable for a wide range of applications, particularly in industries that demand high performance and safety. The unique structure of aramid fibers contributes significantly to their exceptional properties. These fibers consist of long chains of polyamide molecules, where the amide linkages are directly linked to aromatic rings. This arrangement results in a rigid, rod-like structure that imparts remarkable strength and stiffness to the fibers. Additionally, the aromatic rings provide inherent heat resistance and stability, allowing these fibers to withstand high temperatures without significant degradation.

Growth Drivers and Challenges:

The growing demand from the automotive industry has been a major driving force behind the expansion of the aramid fiber market. The demand for these fibers has increased exponentially as automotive manufacturers increasingly focus on producing lighter and more fuel-efficient vehicles. The high strength-to-weight ratio of these fibers, particularly para-aramid variants, including Kevlar, allows for the development of lightweight components without compromising structural integrity. In the automotive sector, these fibers are used extensively in various applications, including manufacturing tires, brakes, pads, and composite materials. The reinforcement of these components with these fibers enhances their durability and resistance to wear, contributing to a longer lifespan and improved overall performance. Moreover, these fibers are utilized in producing automotive composites, providing a balance between strength and weight crucial for achieving fuel efficiency goals. Thus, all these factors are driving the demand for aramid fibers in the automotive sector.

The aramid fiber market, however, faces limitations in growth due to the availability of substitutes that offer similar or alternative properties. Carbon fiber is one of the major substitutes for these fibers, which shares some characteristics with aramid fibers, including high strength and lightweight properties. In certain applications, manufacturers may opt for carbon fiber as an alternative, especially when seeking materials with superior stiffness or conductivity. This competition from substitutes poses a challenge to the widespread adoption of these fibers, particularly in industries where both materials could potentially meet the required specifications.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aramid Fiber Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The "Global Aramid Fiber Market Analysis to 2030" is a specialized and in-depth study with a major focus on market trends and growth opportunities across the globe. The report aims to provide an overview of the market with detailed market segmentation by product type and end-use industry. The market has witnessed high growth in the recent past and is expected to continue this trend during the forecast period. The report provides key statistics on the consumption of aramid fiber globally. In addition, the report provides a qualitative assessment of various factors affecting the aramid fiber market performance globally. The report also includes a comprehensive analysis of the leading players in the market and their key strategic developments. Several analyses on the market dynamics are also included to help identify the key driving factors, market trends, and lucrative opportunities that would, in turn, aid in identifying the major revenue pockets.

The ecosystem analysis and Porter's five forces analysis provide a 360-degree view of the market, which helps understand the entire supply chain and various factors affecting the global aramid fiber market growth.

Segmental Analysis:

On the basis of product type, the market is bifurcated into para-aramid fiber and meta-aramid fiber. In terms of end-use industry, the market is segmented into safety & protection equipment, aerospace, automotive, electronics & telecommunication, and others. The safety & protection equipment segment registered a significant aramid fiber market share in 2022. Aramid fibers, particularly para-aramid variants such as Kevlar, are renowned for their exceptional strength, high modulus, and resistance to impact, making them ideal for applications where safety and protection are paramount. This fiber is extensively used in the manufacturing of ballistic vests and helmets. The inherent ballistic resistance of these fibers, coupled with their lightweight nature, makes them a preferred choice for body armor. Military and law enforcement agencies worldwide widely use aramid-based protective gear to provide personnel with effective protection against ballistic threats without compromising mobility. All these factors are driving the aramid fiber market for the safety & protection equipment segment.

Regional Analysis:

Based on geography, the aramid fiber market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. The market was dominated by Asia Pacific, which accounted for ~US$ 1. billion in 2022. The region encompasses an ample number of opportunities for the growth of the market. Rising foreign direct investments also lead to economic growth in the region. The growing use of these fibers in numerous applications, including automotive parts, electronics, and others, is anticipated to increase the aramid fiber demand in Asia Pacific.

Europe is expected to register a CAGR of over 8.0% from 2022 to 2030. Aramid fibers are crucial for manufacturing lightweight yet robust components in aircraft structures and ballistic protection systems. With Europe being home to leading aerospace companies and a significant defense sector, the demand for aramid fibers in these industries continues to rise. Further, North America is expected to reach around US$ 1.7 billion in 2030.

Industry Developments and Future Opportunities:

Various initiatives taken by the key players operating in the aramid fiber market are listed below:

- In April 2023, DuPont de Nemours Inc. announced the launch of Kevlar EXOTM aramid fiber. Kevlar EXO will provide a combination of lightness, flexibility, and protection from aramid fiber, with life protection as the first of many use cases.

The regional trends and factors influencing the Aramid Fiber Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Aramid Fiber Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Aramid Fiber Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 3.61 Billion |

| Market Size by 2030 | US$ 6.49 Billion |

| Global CAGR (2022 - 2030) | 7.6% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Aramid Fiber Market Players Density: Understanding Its Impact on Business Dynamics

The Aramid Fiber Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Aramid Fiber Market top key players overview

COVID-19 Impact:

The COVID-19 pandemic adversely affected almost all industries in various countries. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific (APAC), South & Central America, and the Middle East & Africa (MEA) hampered the growth of several industries, including the chemical & materials industry. The shutdown of manufacturing units of aramid fibers companies disturbed global supply chains, manufacturing activities, and delivery schedules. Various companies reported delays in product deliveries and a slump in their product sales in 2020. Most industrial manufacturing facilities were shut down during the pandemic, decreasing the consumption of these fibers. In addition, the COVID-19 pandemic has caused fluctuations in aramid fiber prices. However, various industries revived their operations after supply constraints were resolved, which led to a revival of the plastic container market. Moreover, the rising demand for these fibers from the automotive industry is substantially promoting the aramid fiber market growth.

Competitive Landscape and Key Companies:

DuPont de Nemours Inc, Teijin Limited, Yantai Tayho Advanced Materials Company, Hyosung Corporation, Toray Industries Inc, Kolon Industries, Huvis Corporation, China National Bluestar (Group) Co Ltd, Taekwang Industrial Co Ltd, and Kermel SAS are among the key players operating in the global aramid fiber market. The global market players focus on providing high-quality products to fulfill customer demand.

Frequently Asked Questions

In 2022, which region held the largest share of the global aramid fiber market?

Can you list some of the major players operating in the global aramid fiber market?

In 2022, which product type segment is leading the global aramid fiber market?

What are the key factors influencing the aramid fiber market growth?

In 2022, which end-use industry segment registered highest the global aramid fiber market?

Which end-use industry segment is expected to account for the fastest growth in the global aramid fiber market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For