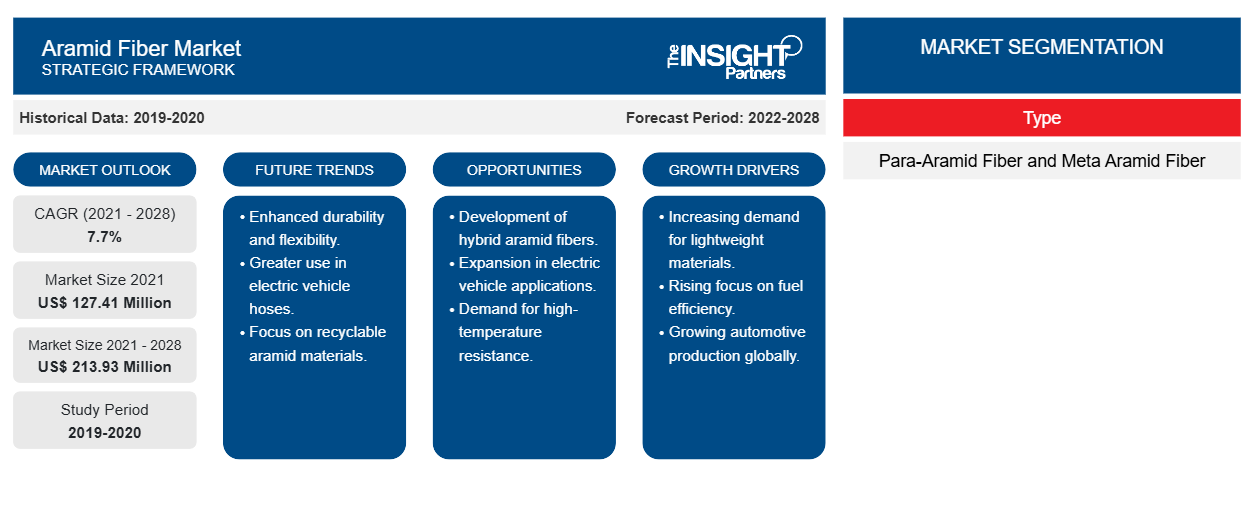

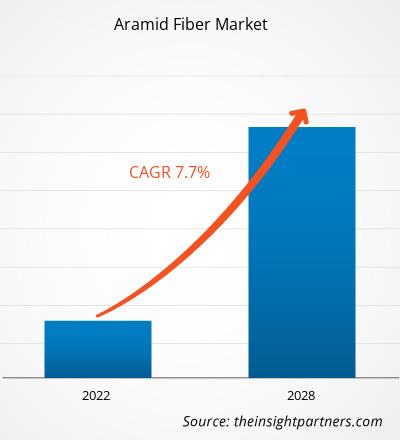

The aramid fiber market for automotive hoses is projected to reach US$ 213.93 million by 2028 from US$ 127.41 million in 2021; it is expected to grow at a CAGR of 7.7% from 2021 to 2028.

Aramid fibers are high-performance synthetic fibers with molecules characterized by relatively stiff polymer chains. These molecules are linked together by strong hydrogen bonds that efficiently transmit mechanical stress. The term "aramid" means "aromatic polyamide." Aramid fibers appear bright golden yellow filaments. These fibers are used to reinforce tires, powertrain components, turbocharger hoses, brake pads, belts, gaskets, clutches, seat textiles, electronics, seat sensors, and hybrid motor materials.

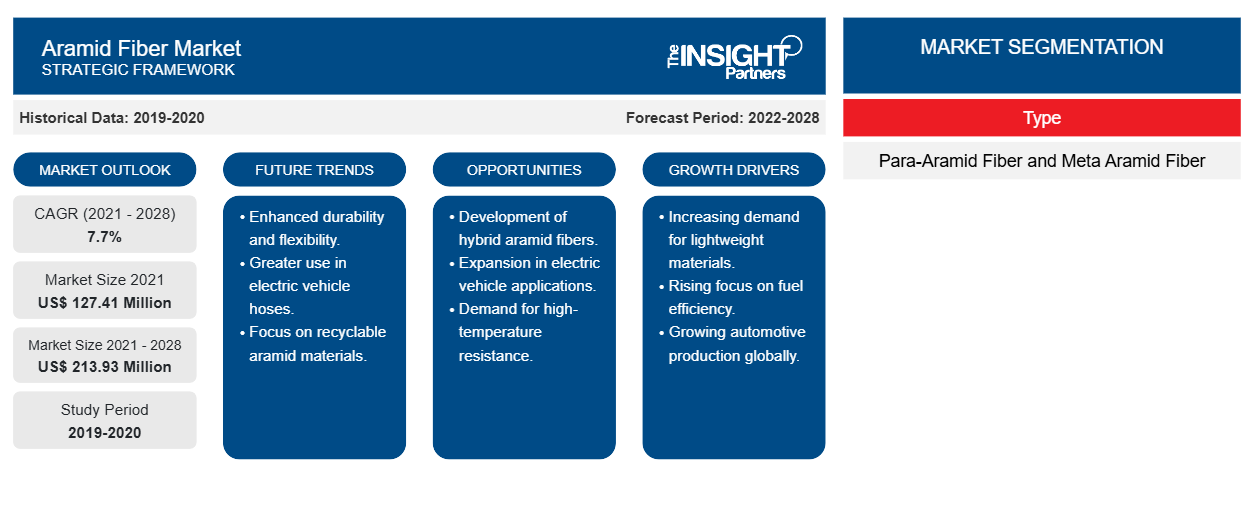

The aramid fiber market for automotive hoses in Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The regional market is projected to witness remarkable growth in the near future due to the rapidly expanding automotive industry, which propels the flourishment of the auto-parts manufacturing industry, especially in countries such as China, South Korea, and India. As the production of electric vehicles increases, so does the number of parts and components in the vehicle, which will further bolster the aramid fiber market for automotive hoses growth in the region.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aramid Fiber Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aramid Fiber Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Aramid Fiber Market for Automotive Hoses

The COVID-19 pandemic significantly impacted the aramid fiber market for automotive hoses in 2020. During the pandemic, the automotive industries temporarily discontinued their production processes, leading to a decrease in demand for products made up of aramid fibers. In addition, the global automotive industry has witnessed a downfall recently. According to the OICA, ~77.62 thousand vehicles were produced globally in 2020, compared to 92.18 thousand vehicles in 2019, indicating a 15.8% drop in production. The drop can be attributed to a lower output in major automobile hubs such as the US, China, Japan, and Germany, which experienced a 19%, 2%, 17%, and 24% decline, respectively, in 2020, compared to 2019. However, the industry has started to gain momentum since the Q4 of 2020 and is expected to witness significant growth in the coming years owing to the rising demand for electric vehicles.

Market Insights

Rise in Demand from Automotive Industry Fuel Market Growth

Aramid fiber is a man-made polymer belonging to the class of strong synthetic and heat-resistant fibers. They provide good resistance to abrasion and organic solvents, and exhibit high melting point, low conductivity, and low flammability. There has been an increase in the use of aramid fibers in the automotive industry in applications such as tires, turbocharger hoses, powertrain components, belts, brake pads, gaskets, clutches, seat fabrics, electronics, seat sensors, and hybrid motor materials. These fibers are used to reinforce transmission, radiator, and turbocharger hoses. The hoses that are reinforced with aramid fibers are stronger and long-lasting and can withstand the toughest conditions.

Car or vehicle production involves a number of materials, such as iron, aluminum, plastic, steel, and glass. Aramid fibers are extensively used as a substitute for aluminum and steel due to their lightweight, high tensile strength, and superior corrosion resistance. Manufacturers in the automotive industry are continuously striving to introduce innovative products to stay competitive in the markets they serve. Safety aspects, excellent performance, and the need for sustainability, pressure the automotive industry to develop high-quality products. They need to ensure a fine performance of automotive hoses irrespective of increasingly difficult conditions. For example, under-hood hose systems must withstand increasingly harsh operating conditions; consequently, the hose reinforcing yarns must have superior strength, as well as chemical, thermal, and dimensional stability. Aramid fibers help improve the safety, performance, and durability of automotive components, including automotive hoses and automotive belts. In addition, they help extend product life, improve product performance, and so on.

Material Type Insights

Based on type, the aramid fiber market for automotive hoses is bifurcated into para-aramid fiber and meta aramid fiber. The para-aramid segment is register a higher CAGR in the market during 2021–2028. Para-aramids have high tensile strength (the highest stress that a material can withstand) and modulus behavior (the tendency of a material to deform when force is applied). Further, para-aramid fibers are stiffer and have greater tenacity as well as strength than meta-aramid fibers. However, they are chemically sensitive, and acids, alkalis, and bleaches weaken the strength of para-aramid polyamide. A few of the examples of para-aramid fibers are Kevlar, Technora, Twaron, and Herron. The demand for para-aramid fibers is driven by their increasing use in security and safety applications. They are used in critical applications such as protective clothing, including bulletproof vests, helmets, and vehicle armor, due to their ultrahigh strength, and rigid and highly-oriented molecular structure.

A few of the companies operating in the aramid fiber market for automotive hoses are Contitech Ag, Dupont, Teijin Limited, Yokohama Rubber Co., Ltd., Schaeffler Ag, Bando Chemical Industries Ltd., Hutchinson Sa, Toyobo Co. Ltd., Aramid Hpm, LLC, Fiberline, and Kolon Industries, Inc. The key companies implement the mergers and acquisitions, and research and development strategies to expand customer base and gain significant share in the global market, further allowing them to maintain their brand name globally.

Report Spotlights

- Progressive industry trends in the aramid fiber market for automotive hoses to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the aramid fiber market for automotive hoses from 2020 to 2028

- Estimation of global demand for aramid fiber for automotive hoses

- Porters analysis to illustrate the efficacy of buyers and suppliers operating in the industry

- Recent developments to understand the competitive market scenario

- Market trends and outlook, as well as factors driving and restraining the growth of the aramid fiber market for automotive hoses

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest, leading to the market growth

- The size of the aramid fiber market for automotive hoses size at various nodes

- Detailed overview and segmentation of the market, as well as the aramid fiber for automotive hoses industry dynamics

- Size of the aramid fiber market for automotive hoses in various regions with promising growth opportunities

Aramid Fiber Market Regional Insights

Aramid Fiber Market Regional Insights

The regional trends and factors influencing the Aramid Fiber Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Aramid Fiber Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Aramid Fiber Market

Aramid Fiber Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 127.41 Million |

| Market Size by 2028 | US$ 213.93 Million |

| Global CAGR (2021 - 2028) | 7.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Aramid Fiber Market Players Density: Understanding Its Impact on Business Dynamics

The Aramid Fiber Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Aramid Fiber Market are:

- ARAMID HPM, LLC

- ARTEL RUBBER COMPANY

- BEAVER MANUFACTURING COMPANY

- CONTINENTAL AG

- DUPONT DE NEMOURS, INC.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Aramid Fiber Market top key players overview

Aramid Fiber Market for Automotive Hoses - by Type

- Para aramid fiber

- Meta Aramid Fiber

Company Profiles

- Contitech Ag

- Dupont

- Teijin Limited

- Yokohama Rubber Co., Ltd.

- Schaeffler Ag

- Bando Chemical Industries Ltd.

- Hutchinson Sa

- Toyobo Co. Ltd.

- Aramid Hpm, Llc

- Fiberline

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Pressure Vessel Composite Materials Market

- Educational Furniture Market

- Online Recruitment Market

- Health Economics and Outcome Research (HEOR) Services Market

- Sports Technology Market

- Fertilizer Additives Market

- Lyophilization Services for Biopharmaceuticals Market

- Microcatheters Market

- Enzymatic DNA Synthesis Market

- Fill Finish Manufacturing Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Para-aramid fiber is being increasingly used for automotive hoses as it is used to transport high temperature gas or fluids as well as support a high-pressure transmission system. Para-aramid fiber also provides superior performance in terms of fatigue, abrasion resistance, chemical stability and temperature resistance. These fibers are stiffer and have more tenacity and strength than meta-aramid fibers.

North America is the second largest for aramid fiber market for automotive hoses over the forecast period. The growth in the automotive sector has led to increasing usage of aramid fiber for automotive hoses. The US is one of the largest automotive markets in the world and in 2018 the light vehicle sales in the US reached 17.2 million units which is the fourth straight year the sales have reached or surpassed 17 million units. In 2019, North America’s commercial vehicle production expanded by 3.6%. Thus, the growing automotive industry in North America has been increasing the demand for aramid fiber for automotive hoses.

Asia Pacific is the fastest growing as well as the dominating region for aramid fiber market for automotive hoses over the forecast period. The presence of various domestic and international players in the region will increased the focus of manufacturers on providing innovative products leading to increased opportunity for the aramid fiber market for automotive hoses to grow. Along with this, an increase in production in the automotive industry will lead to an increase demand for aramid fiber for automotive hoses. There is a rise in the adoption of electric vehicles in the region and moreover, various government policies are supporting the development of the electric vehicle industry in the region. Thus, an increase in adoption of electric vehicle in the region will provide opportunities for the aramid fiber market for automotive hoses to grow.

The major key players operating in the global aramid fiber market for automotive hoses include Aramid Hpm, LLC; Artel Rubber Company; Beaver Manufacturing Company; Continental AG; DuPont De Numerous Inc.; Gates Corporation; Huvis Corp.; Kolon Industries Inc.; Norres; Tejin Limited; and Yokohama Rubber Co., Ltd.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Aramid Fiber Market for Automotive Hoses

- ARAMID HPM, LLC

- ARTEL RUBBER COMPANY

- BEAVER MANUFACTURING COMPANY

- CONTINENTAL AG

- DUPONT DE NEMOURS, INC.

- GATES CORPORATION

- HUVIS CORP.

- KOLON INDUSTRIES INC.

- NORRES

- TEIJIN LIMITED

- YOKOHAMA RUBBER CO., LTD

Get Free Sample For

Get Free Sample For