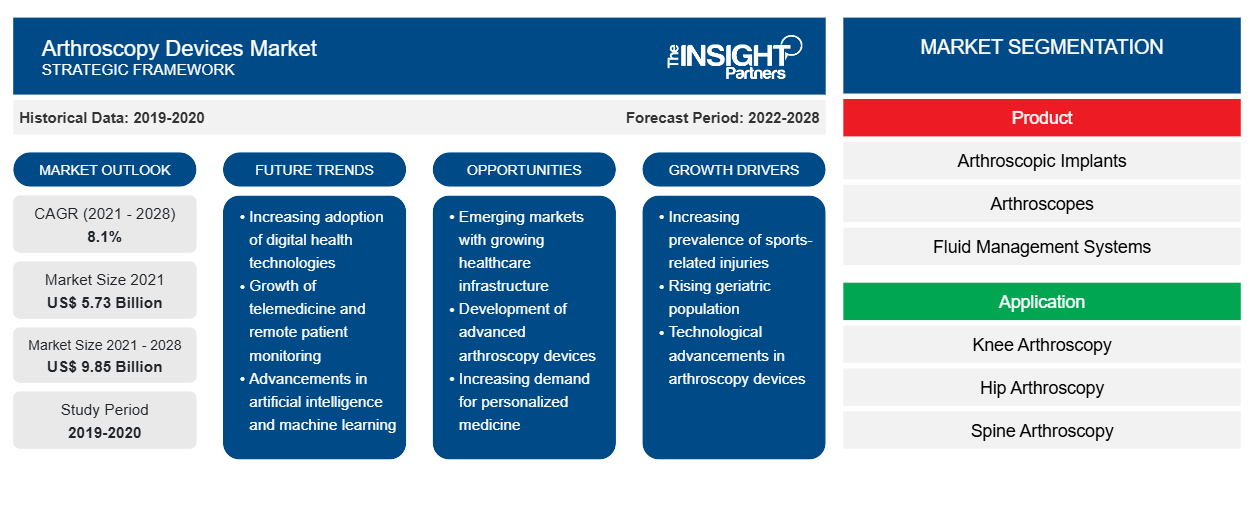

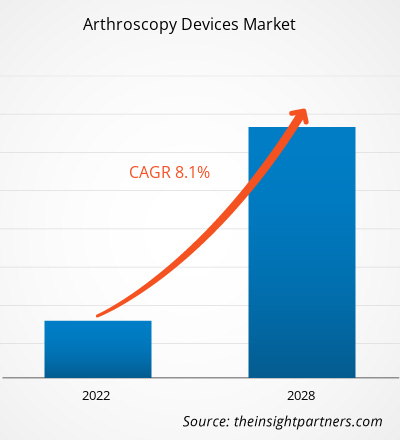

The arthroscopy devices market is projected to reach US$ 9,853.88 million by 2028 from US$ 5,725.24 million in 2021; it is expected to register a CAGR of 8.1% from 2021 to 2028.

Arthroscopy is a procedure for diagnosing and treating joint problems. A surgeon inserts a narrow tube attached to a fiber-optic video camera called an arthroscope through a small incision about the size of a buttonhole. An arthroscope is a medical device that allows doctors to see within bodily joints such as the knee, hip, spine, shoulder, and elbow to inspect, diagnose, and perform therapeutic procedures. Arthroscopy devices can examine illnesses like osteoarthritis, rheumatoid arthritis, tendinitis, and bone tumors in the joints.

The report offers insights and in-depth analysis of the arthroscopy devices market emphasizing various parameters such as market trends, technological advancements, and market dynamics. It also provides the competitive landscape analysis of leading market players worldwide. Furthermore, it includes the impact of the COVID-19 pandemic on the market across all the regions. The COVID-19 pandemic created both a public health crisis and an economic crisis worldwide. Before the pandemic, the global arthroscopy devices market was constantly growing as regular screening, consolations, and treatments were going on. The first wave of COVID-19 disrupted the consultations, follow-ups, and screenings of oncological cases. The uncontrolled situation was created in the healthcare industry worldwide, led the reduced number of consultations and a smaller number of osteoarthritis and rheumatoid arthritis cases diagnosed. Several companies have experienced severe losses in the last quarter of 2019; the pandemic also negatively influenced the first and second quarters of 2020. Hence, the impact of the COVID-19 pandemic on the global market was immediate and drastic. Businesses worldwide were hampered due to disruption in the supply chain and increased demand of healthcare products and services. To reduce COVID-19 infection in hospitals and clinics, healthcare practitioners and patients adopted and preferred remote patient treatment. Under these unforeseeable circumstances, the orthopedic practice could not remain unaffected. Many surgical treatments and non-urgent consultations were canceled or postponed. Elective surgery was suspended in many institutions, and the overall volume of orthopedic cases fell dramatically in order to limit the spread of the virus and reserve and reallocate resources in healthcare personnel (nurses, anesthesiologists), medical equipment (personal protective equipment, ventilators), and beds. The "stay at home" strategy in the world resulted in a significant reduction in arthroplasty and arthroscopy surgeries, as well as a decrease in the incidence of osteoarthritis cases during the COVID-19 period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Arthroscopy Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Arthroscopy Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

As the healthcare infrastructure was disrupted due to the COVID-19 outbreak, and the focus was shifted to the treatment of COVID-19, the diagnosis of various diseases was neglected. In addition, the detection and treatments of musculoskeletal diseases were also hampered by the COVID-19 pandemic. This majorly restrained the growth of the arthroscopy devices market worldwide.

Market Insights

Growing Prevalence of Musculoskeletal Disorders to Drive Market

Musculoskeletal disorders (MSDs) are the most common health conditions worldwide. According to the data published by the World Health Organization (WHO), in February 2021, approximately 1.71 billion individuals worldwide suffered from musculoskeletal problems. Lower back pain is a widespread musculoskeletal condition, affecting 568 million people worldwide. Lower back pain is the major cause of impairment in 160 countries. Musculoskeletal disorders severely impair mobility and dexterity, resulting in early retirement from work, decreased well-being, and diminished ability to socialize. The number of people disabled by musculoskeletal conditions has been growing, and this trend is expected to continue in the next decades.

Furthermore, as per the WHO, high-income countries are the most affected in terms of population (441 million), followed by countries in the WHO Western Pacific Region with 427 million, while Southeast Asia has 369 million. Musculoskeletal diseases are also the leading cause of years lived with disability (YLDs) worldwide, accounting for roughly 149 million YLDs, or 17% of all YLDs. Fractures, which affect 436 million people worldwide, osteoarthritis (343 million), other injuries (305 million), neck pains (222 million), amputations (175 million), and rheumatoid arthritis (14 million) all contribute to the overall burden of musculoskeletal diseases.

Surgical arthroscopy is a well-established therapy option for individuals with chronic joint pain and dysfunction. Compared to open joint procedures, arthroscopy is less invasive and results in better overall patient outcomes in symptom treatment, hospital stay, structural recovery, and long-term outcomes. Thus, the growing prevalence of musculoskeletal disorders, osteoarthritis, and rheumatoid arthritis is expected to drive the market during the forecast period.

Product-Based Insights

Based on product, the arthroscopy devices market is segmented into arthroscopes, arthroscopic implants, fluid management systems, radiofrequency systems, visualization systems, powered shaver systems, and other arthroscopic equipment. In 2021, the arthroscopes segment held the largest share of the market and is expected to register the fastest CAGR of 9.1% during the forecast period.

Application-Based Insights

Based on application, the arthroscopy devices market is segmented into knee arthroscopy, hip arthroscopy, spine arthroscopy, foot and ankle arthroscopy, shoulder and elbow arthroscopy, and others. In 2021, the hip arthroscopy segment held the largest share of the market and is expected to report the highest CAGR of 8.9% during 2021–2028.

The arthroscopy devices market players adopt organic strategies such as product launch and expansion to expand their footprint and product portfolio worldwide and meet the growing demands.

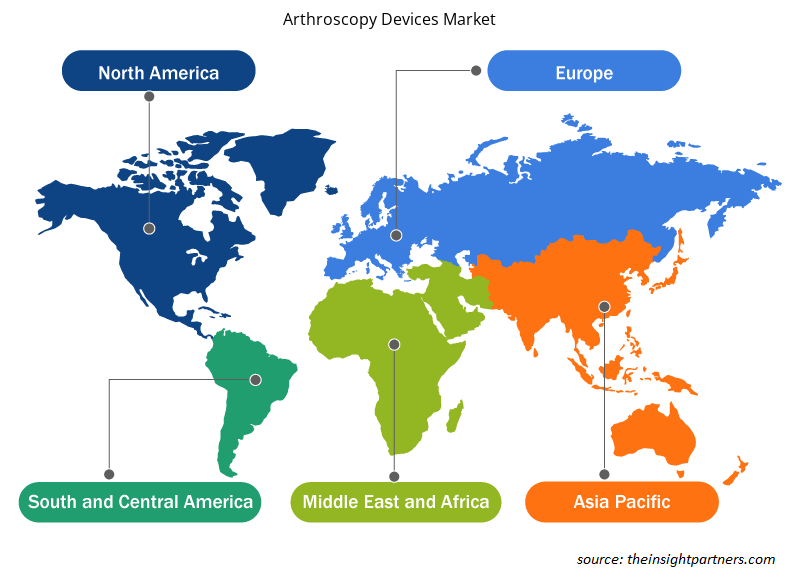

By Geography

Based on geography, the arthroscopy devices market is segmented into North America (the US, Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, and the Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (the UAE, Saudi Arabia, South Africa, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Arthroscopy Devices Market Regional Insights

Arthroscopy Devices Market Regional Insights

The regional trends and factors influencing the Arthroscopy Devices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Arthroscopy Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Arthroscopy Devices Market

Arthroscopy Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 5.73 Billion |

| Market Size by 2028 | US$ 9.85 Billion |

| Global CAGR (2021 - 2028) | 8.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Arthroscopy Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Arthroscopy Devices Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Arthroscopy Devices Market are:

- Arthrex, Inc.

- CONMED Corporation

- Johnson and Johnson Services, Inc.

- KARL STORZ SE & Co. KG

- Medtronic

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Arthroscopy Devices Market top key players overview

Company Profiles

- Arthrex, Inc.

- CONMED Corporation

- Johnson and Johnson Services, Inc.

- KARL STORZ SE & Co. KG

- Medtronic

- Richard Wolf GmbH.

- Smith & Nephew

- Stryker Corporation

- Zimmer Biomet

- NuVasive, Inc.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The North America region secures the major share of the global arthroscopy devices market. Rapid increase in the number of arthroscopies in the region, advancements in arthroscopy products and the highly active research ecosystem for arthroscopic applications is projected to accelerate the growth of the market. Moreover, increasing prevalence of chronic diseases and orthopedic ailments, especially among the aging population in this region of arthroscopy devices is propelling the market's expansion in this region.

Due to an increasing number of infected patients worldwide, several research institutes and leading organizations put an effort to develop efficient methods of COVID 19 treatment and ways to combat pandemic. Many companies manufacturing arthroscopy devices focused on responding emergencies by various strategies such as manufacturing PPEs to healthcare workers, distribution of pharmaceutical drugs and various other activities. For instance, in September 2020, Arthrex, a global leader in minimally invasive orthopedic technology, announced it is using its innovative production capabilities to manufacture and donate more than 6,000 protective face shields to school systems across the region.

According to World Health Organization (WHO). As the epidemic has become a global pandemic, many health authorities focused pandemic-related care and avoided human contact in reaction to growing transmission and strain on health-care resources by postponing elective surgeries, suspending outpatient clinics, and triaging employees involved in urgent care. For instance, as per the British Journal of Surgery published in May 2020 stated that orthopedic procedures would be affected most, with 6.3 million operations cancelled worldwide. Recent COVID-19 guidelines for pediatric orthopedic surgeons suggested focus on urgent care and triaging cases to postpone elective surgeries and clinic appointments, with transition to virtual-based care when appropriate.

Thus, the pandemic had a negative impact on the arthroscopy market in the region.

Johnson and Johnson Services, Inc and CONMED Corporation are the top two companies that hold huge market shares in the arthroscopy devices market.

The arthroscopy devices market majorly consists of players such as Arthrex, Inc.; CONMED Corporation; Johnson and Johnson Services, Inc.; KARL STORZ SE & Co. KG; Medtronic; Richard Wolf GmbH.; Smith & Nephew; Stryker Corporation; Zimmer Biomet; and NuVasive, Inc amongst others.

In 2021, the hip arthroscopy held the largest share of the market, by application. The similar application segment of the arthroscopy devices market is expected to witness growth in its demand at the fastest CAGR from 2021 to 2028.

Arthroscopy is a procedure for diagnosing and treating joint problems. A surgeon inserts a narrow tube attached to a fiber-optic video camera through a small incision about the size of a buttonhole which is called an arthroscope. An arthroscope is a medical device that allows doctors to see within bodily joints such as the knee, hip, spine, shoulder, and elbow to inspect, diagnose, and perform therapeutic procedures. Arthroscopy devices can examine for illnesses like osteoarthritis, rheumatoid arthritis, tendinitis, and bone tumors in the joints.

Key factors that are driving the growth of this market are the growing prevalence of musculoskeletal disorders osteoarthritis and rheumatoid arthritis, rising number of sport injuries requiring arthroscopy procedure to prevent complete joint and rising elderly population. Additionally, the increasing prevalence of obesity and rising number of product launches and approvals are likely to emerge as a significant future trend in the market during the forecast period.

The CAGR value of the arthroscopy devices market during the forecasted period of 2021–2028 is 8.1%.

In 2021, the arthroscopes segment accounted for the largest share of the market; it is further expected to continue its dominance over the forecast period. The arthroscopes are primarily used in the minimally invasive strategy. It aids patients' recovery and reduces scarring. Moreover, the decrease in the life span of arthroscopes due to the sterilization process used to prevent contamination and the launch of single-use arthroscopes. Thus, due to above factors, the arthroscopes segment is expected to dominate the arthroscopy devices market by product segment. Moreover, arthroscopes are expected to register the highest CAGR in arthroscopy devices market during 2021-2028.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Arthroscopy Devices Market

- Arthrex, Inc.

- CONMED Corporation

- Johnson and Johnson Services, Inc.

- KARL STORZ SE & Co. KG

- Medtronic

- Richard Wolf GmbH.

- Smith & Nephew

- Stryker Corporation

- Zimmer Biomet

- NuVasive, Inc.

Get Free Sample For

Get Free Sample For