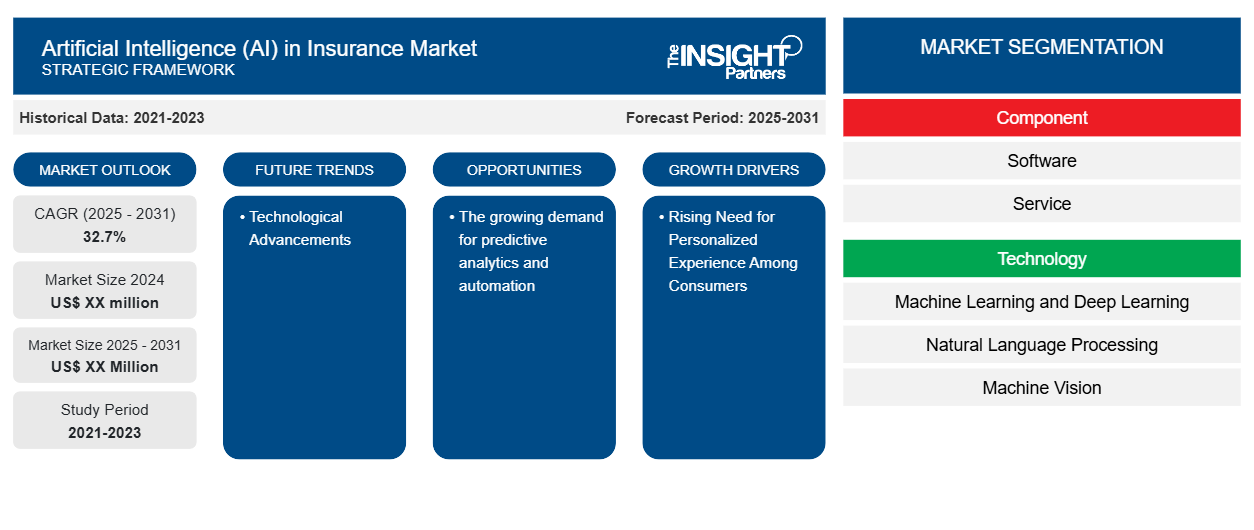

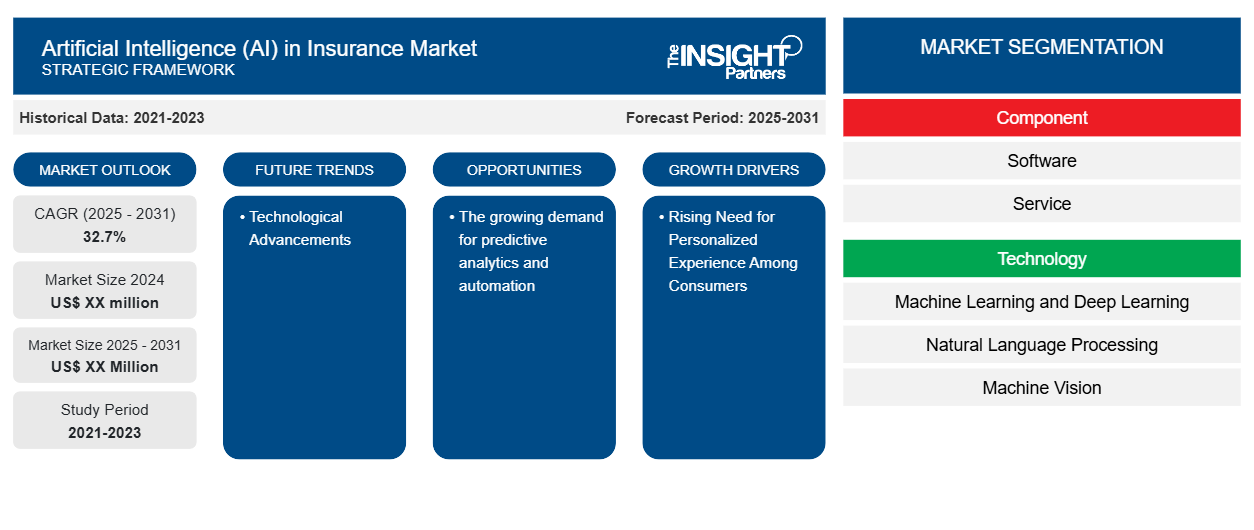

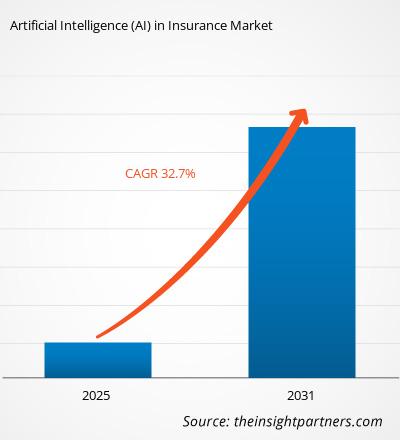

Artificial intelligence (AI) in the insurance market is expected to register a CAGR of 32.7% during 2023–2031. The growing demand for predictive analytics and automation is likely to remain a key trend in the market.

Artificial Intelligence (AI) in Insurance Market Analysis

- The AI Insurance sector supports the insurance industry and puts enormous amounts of data to the optimum level.

- Insurers design customized policies for individuals, systematic underwriting processes, and provide estimates with greater accuracy to customers across the world.

- Integrating AI technology could further enable precise predictions, manage customer interactions, and expand personalized service.

Artificial Intelligence (AI) in Insurance Market Overview

- AI technology could offer a host of potential benefits to embrace change in the insurance industry to manage risk.

- Insurance companies are integrating AI technologies to precisely estimate, manage customer interactions, and expand personalized service and product lines with unprecedented accuracy and speed.

- Within the insurance sector, guarantors use AI to improve customer service, increase efficiency, and fight against fraud effectively.

- AI technologies will allow insurers to draw on developed datasets to recover their processes, from mechanizing customer support to improving risk modeling and predictions.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Artificial Intelligence (AI) in Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Artificial Intelligence (AI) in Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Artificial Intelligence (AI) in Insurance Market Drivers and Opportunities

Rising Need for Personalized Experience Among Consumers to Favor the Market

- Consumers expect personalized experiences, which encourages market players to adopt AI technology to automate insurance processes.

- AI technology supports insurance companies in analyzing customer data and behavior, AI algorithms can section customers, identify their preferences and needs, and tailor marketing messages and product recommendations. This drives customer engagement and loyalty by increasing cross-selling and upselling opportunities for market players.

- AI-powered solutions such as chatbots and virtual assistants are enabling insurers to meet customer demand for prompt and personalized support, which increases the demand, hence driving the market.

Technological Advancements

- Advanced technologies such as machine learning, natural language processing, and computer vision are highly demanded by insurance companies to track customers' behavior and maintain data in real time.

- The volatile growth of AI and machine learning has provided new opportunities to extract value from data.

- Moreover, large language modeling (LLM), is a branch of artificial intelligence handing out data contained in documents.

- Insurers use LLM to accelerate their claims processes and detect fraudulent claims with improved accuracy.

- Additionally, the evolution of Generative AI brings collected data, tools, and functions to provide a data handling and management solution for insurance companies.

Artificial Intelligence (AI) in Insurance Market Report Segmentation Analysis

Key segments that contributed to the derivation of artificial intelligence (AI) in insurance market analysis are offering, deployment, enterprise size, and end-users.

- Based on components, the artificial intelligence (AI) in the insurance market is divided into software and service. The software segment held a larger market share in 2023.

- By technology, the market is bifurcated into machine learning and deep learning, natural language processing (NLP), machine vision, and robotic automation. The machine learning and deep learning segment is anticipated to expand at a significant rate during the forecast period.

- In terms of deployment, artificial intelligence (AI) in the insurance market is segmented into cloud and on-premise. The cloud segment held a larger market share in 2023.

- By application, the market is segmented into claims management, risk management, compliance, chatbots, and others. The chatbot segment is projected to grow during the forecast period.

- based on end-users, the market is divided into life insurance, health insurance, title insurance, auto insurance, and others. The life insurance segment is anticipated to expand at a significant pace during the forecast period.

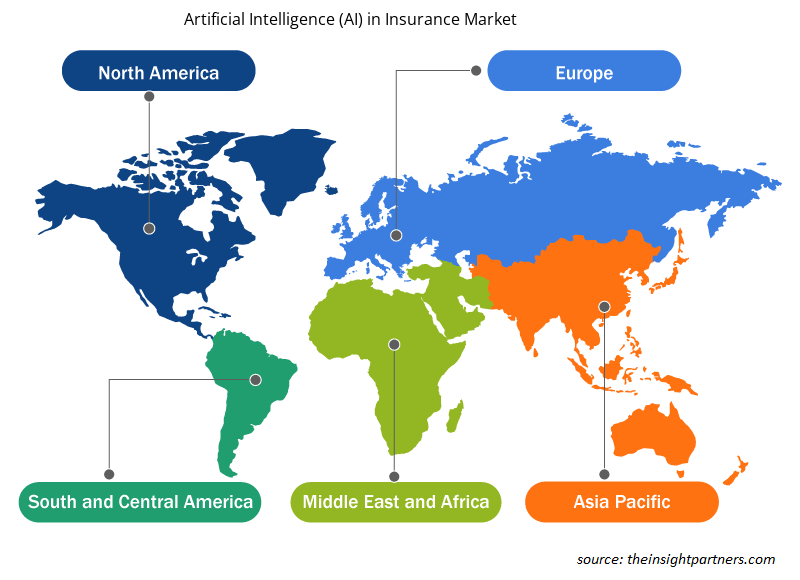

Artificial Intelligence (AI) in Insurance Market Share Analysis by Geography

The geographic scope of artificial intelligence (AI) in the insurance market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

- The market in Asia Pacific is projected to expand during the forecast period, due to technological advancements and the presence of key market players.

- IBM Corp, Microsoft Corp, and OpenText Corporation, among others, are engaged in developing, upgrading, and advancing their portfolio to meet their customers' dynamic needs is driving the market.

Artificial Intelligence (AI) in Insurance Market Regional Insights

The regional trends and factors influencing the Artificial Intelligence (AI) in Insurance Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Artificial Intelligence (AI) in Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Artificial Intelligence (AI) in Insurance Market

Artificial Intelligence (AI) in Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 32.7% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

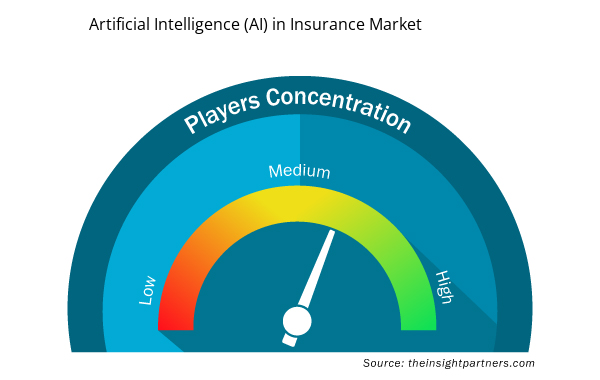

Artificial Intelligence (AI) in Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Artificial Intelligence (AI) in Insurance Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Artificial Intelligence (AI) in Insurance Market are:

- Amazon Web Services, Inc.

- Avaamo

- Cape Analytics, LLC

- IBM Corp

- Microsoft Corp

- Shift Technology

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Artificial Intelligence (AI) in Insurance Market top key players overview

Artificial Intelligence (AI) in Insurance Market News and Recent Developments

Artificial intelligence (AI) in insurance market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in artificial intelligence (AI) in the insurance market are listed below:

- Swiss Re launches an augmented version of its Life & Health underwriting manual Life Guide. The new version comes equipped with Swiss Re Life Guide Scout, a Generative AI-powered underwriting assistant developed by Swiss Re, that integrates Microsoft Azure OpenAI Service. Life & Health insurance underwriting is a complex process that requires accurate and up-to-date information to assess an insurance applicant's risk. Swiss Re Life Guide Scout aims to help increase the efficiency and quality of underwriting by generating swift answers compiled from curated expert knowledge in response to questions asked by the underwriter in natural language. (Source: Swiss Re, Company Website, May 2024)

Artificial Intelligence (AI) in Insurance Market Report Coverage and Deliverables

The “Artificial Intelligence (AI) in Insurance Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Artificial intelligence (AI) in insurance market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Artificial intelligence (AI) in insurance market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Artificial intelligence (AI) in insurance market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for artificial intelligence (AI) in the insurance market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The global artificial intelligence (AI) in the insurance market is estimated to register a CAGR of 32.7% during the forecast period 2023–2031.

The key players holding majority shares in the global artificial intelligence (AI) in the insurance market are Amazon Web Services, Inc., Avaamo, Cape Analytics, LLC, IBM Corp, Microsoft Corp, Shift Technology, Wipro Limited, Avenga International GmbH, SAS Institute Inc., and OpenText Corporation.

The growing demand for predictive analytics and automation to play a significant role in the global artificial intelligence (AI) in the insurance market in the coming years.

North America dominated the artificial intelligence (AI) in the insurance market in 2023.

The rising need for personalized experience among consumers is the major factors that propel global artificial intelligence (AI) in the insurance market.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies

1. Amazon Web Services, Inc.

2. Avaamo

3. Cape Analytics, LLC

4. IBM

5. Lemonade, Inc.

6. Microsoft

7. Osp Labs Pvt Ltd

8. Shift Technology

9. Trov Insurance Solutions, LLC

10. Wipro Limited

Get Free Sample For

Get Free Sample For