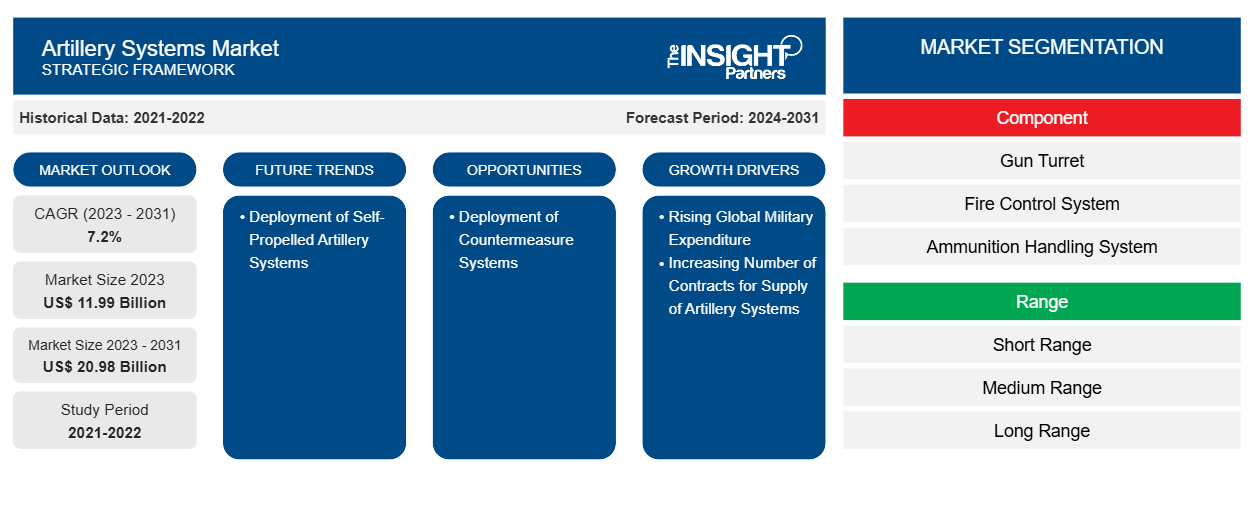

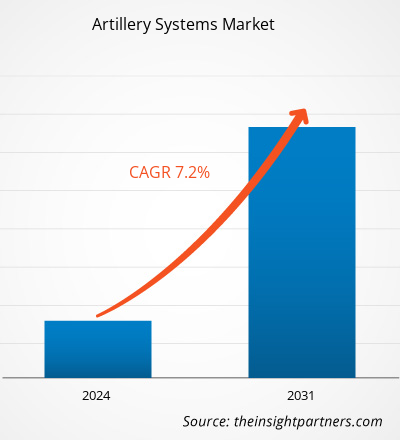

The artillery systems market size is projected to reach US$ 20.98 billion by 2031 from US$ 11.99 billion in 2023. The market is expected to register a CAGR of 7.2% during 2023–2031. Rising deployment of self-propelled artillery systems is likely to bring in new trends in the market.

Artillery Systems Market Analysis

The rise in military expenditures across countries and the increase in tensions among countries are a few major factors propelling the demand for artillery systems across the world. Several countries are taking serious actions to ensure the safety of their nation, owing to which they are collaborating with other countries by joining forces to increase their armed forces capabilities. For instance, following the Russia-Ukraine conflict, the US has been taking initiatives to increase its military presence across European countries for the long haul by establishing its first permanent presence in Poland to bolster regional security. Several forces are being deployed in the country, along with required ammunition and firearms. Such initiatives are driving the growth of the artillery systems market across the world.

Artillery Systems Market Overview

Artillery systems allow armed forces to neutralize or destroy targets during any combat or fire operations. A few major factors driving the growth of artillery systems include rising global military expenditure, increasing number of contracts for the supply of artillery systems, and rising deployment of self-propelled artillery systems by various armed forces worldwide.

The introduction of smart weapons and smart ammunitions, including precision-guided missiles, guided mortars, and guided artillery systems, is likely to fuel the growth of the artillery systems market during the forecast period. In addition, the procurement of military aircraft, combat helicopters, artillery systems, mortars vehicles, infantry fighting vehicles, and tanks in large quantities supports the firearms and ammunitions industry growth worldwide.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Artillery Systems Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Artillery Systems Market Drivers and Opportunities

Rising Global Military Expenditure

The evolving modern warfare scenario has compelled governments of various countries across the globe to assign significant funds and financial aid toward respective defense and military forces. The defense budget allocation supports army and military forces to obtain enhanced technologies and equipment from domestic or international developers. On the other hand, military and army vehicle upgrades are on the rise owing to growing defense budget allocation. Furthermore, the increasing governmental expenditure showcases governments' focus on strengthening national security forces. There is an increased need to reinforce military and border security forces with advanced surveillance, communication, navigation equipment, artilleries, armaments, and vehicles, among others; thus, military forces worldwide are focusing on investing significant amounts in procuring artillery systems and other advanced technologies. Defense forces' constant inclination to acquire new technologies for noncombat and combat operations further boosts military expenditure worldwide.

As per the Stockholm International Peace Research Institute (SIPRI), global military expenditure increased to US$ 2443 billion in 2023, representing a 13.7% increase from 2022. The US, China, India, Russia, and Saudi Arabia were the top five spenders in 2023, accounting for around 61% of global expenditures. The figure given below depicts the yearly spending of these countries.

Military Expenditure of Top Five Countries (2021–2023)

Country |

2021 (US$ Billion) |

2022 (US$ Billion) |

2023 (US$ Billion) |

|

US |

800.67 |

876.94 |

916.00 |

|

China |

293.35 |

291.96 |

296.00 |

|

Russia |

65.91 |

86.37 |

109.01 |

|

India |

76.59 |

81.36 |

83.60 |

|

Saudi Arabia |

55.56 |

75.01 |

75.80 |

Source: SIPRI

The increasing military expenditure encourages incorporating advanced warfare technologies such as high-range antennas, self-propelled artillery, advanced communication devices, unmanned vehicles, radars, missile detection systems, surveillance and navigation systems, and modern warfare technologies. In addition, a high military budget supports the countries in assigning resources for the advancement and upgrade of their existing air, ground-based, and naval defense systems.

Deployment of Countermeasure Systems

The changing geopolitical scenario worldwide boosts the requirement for strong defense countermeasure systems. The constant tension between the nations such as Russia-Ukraine, India-China, Pakistan-India, Israel-Palestine, and US-China is compelling their governments to strengthen their respective armed forces, which is also propelling the procurement of warfare systems such as different types of mortars and howitzers. Therefore, the armed forces across different countries are investing in procuring artillery systems such as surface-to-air rocket artillery, self-propelled howitzers, early warning systems, and border surveillance systems. BAE Systems, General Dynamics Corporation, Honeywell International Inc., Israel Aerospace Industries Inc., Leonardo S.p.A, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, SAAB AB, and Thales Group are among the companies focusing on developing defense countermeasure systems, including radar systems, artillery systems, communication and surveillance systems, and navigation devices. Thus, the increasing procurement and deployment of countermeasure systems is expected to fuel the growth of the artillery systems market in the coming years.

Artillery Systems Market Report Segmentation Analysis

Key segments that contributed to the derivation of the artillery systems market analysis are caliber, range, type, and component.

- Based on component, the global artillery systems market is segmented into gun turret, fire control system, ammunition handling system, auxiliary system, and others. The fire control system segment held the largest market share in 2023.

- Based on range, the market is divided into short range, medium range, and long range. The short range segment held the largest share of the market in 2023.

- By type, the market is divided into howitzer, mortar, and rocket artillery. The howitzer segment held the largest share of the market in 2023.

- In terms of caliber, the market is divided into small caliber, medium caliber, and large caliber. The medium caliber segment held the largest share of the market in 2023.

Artillery Systems Market Share Analysis by Geography

The geographic scope of the artillery systems market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The global artillery systems market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America. North America held the largest artillery systems market share in 2023 and is projected to maintain its dominance during the forecast period. The global artillery systems market plays a pivotal role in shaping the military capabilities of nations, influencing defense strategies, and contributing to geopolitical dynamics. With a multifaceted landscape influenced by technological advancements, security threats, and international collaborations, the artillery systems market is characterized by ongoing modernization efforts, diversification of capabilities, and the integration of cutting-edge technologies. The demand for diversified artillery capabilities is a key factor shaping the global market. Nations seek artillery systems that can address a spectrum of operational scenarios, from conventional warfare to counterinsurgency operations. This diversification includes the development and acquisition of various artillery types, such as towed howitzers, self-propelled artillery, rocket launchers, and mortars. The goal is to possess a versatile artillery portfolio that can respond effectively to different threats and terrains.

Artillery Systems Market Regional Insights

The regional trends and factors influencing the Artillery Systems Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Artillery Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Artillery Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 11.99 Billion |

| Market Size by 2031 | US$ 20.98 Billion |

| Global CAGR (2023 - 2031) | 7.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Artillery Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Artillery Systems Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Artillery Systems Market top key players overview

Artillery Systems Market News and Recent Developments

The artillery systems market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the artillery systems market are listed below:

BAE Systems secured a contract worth US$ 466 million to provide the US Army with its M109A7 Paladin self-propelled howitzers. As per the announcement from the US Department of Defense, the contract encompasses the supply of M992 Field Artillery Ammunition Support Vehicles. The specific quantity of howitzers and support carriers included in the order has not been disclosed. (Source: BAE Systems, Press Release, February 2023)

Artillery Systems Market Report Coverage and Deliverables

The "Artillery Systems Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Artillery systems market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Artillery systems market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Artillery systems market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the artillery systems market

- Detailed company profiles

Frequently Asked Questions

Who are the major vendors in the artillery systems market?

What is the future trend for the artillery systems market?

Which region to dominate the artillery systems market in the forecast period?

What are reasons behind the artillery systems market growth?

What are market opportunities for the artillery systems market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For