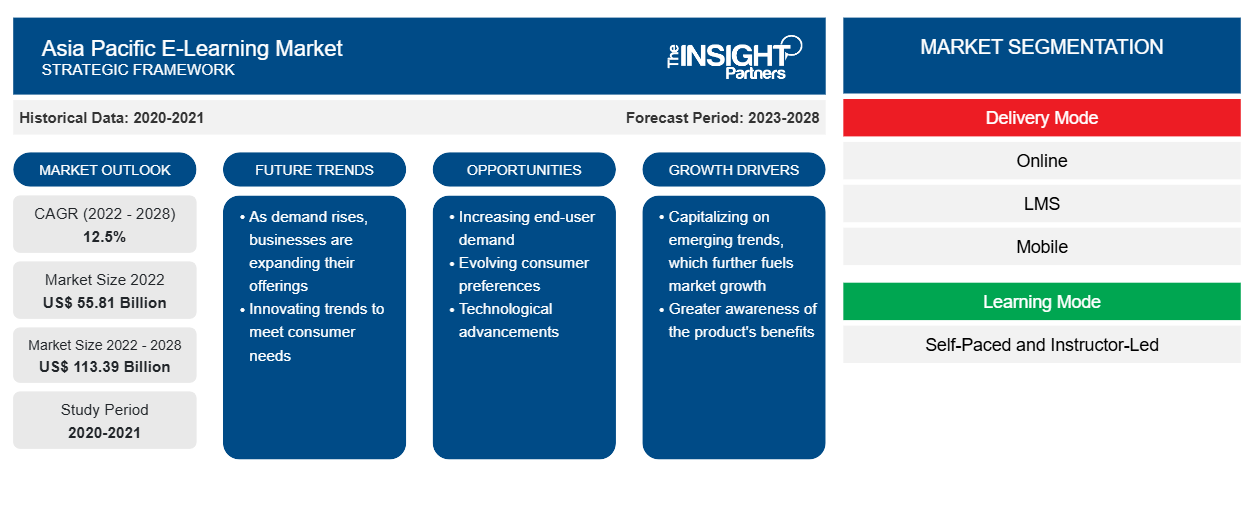

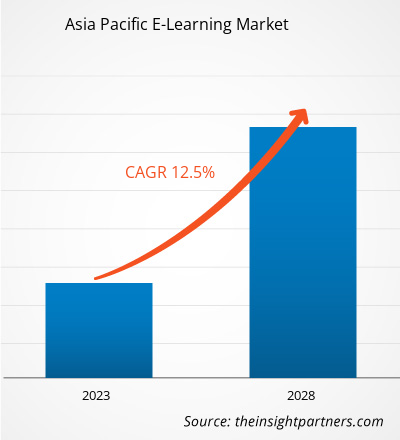

The APAC e-learning market is expected to grow from US$ 55.81 billion in 2022 to US$ 113.39 billion by 2028; it is estimated to register at a CAGR of 12.5% during 2022–2028.

Technological advancements in computers, mobiles, and other IT devices have revolutionized the education sector in APAC. The education system has moved from hardbound books and pencils to e-solutions. Moreover, private and public higher education institutions, educational and testing firms, education ministries, and quality assertion and authorization agencies are among the stakeholders contributing to the flourishment of the e-learning market in APAC. E-learning allows educational institutes to reduce learning costs incurred by equipment required for a classroom setup, rent paid for online training sites, and printing of books and other study materials. Also, the enhanced flexibility associated with e-learning helps service providers explore new opportunities.

Impact of COVID-19 Pandemic on APAC E-Learning Market

With the acceleration of the global health crisis, the demand for learning management systems (LMS), video conferencing tools, and cloud systems has surged across the education sector, as many educational institutions showed a profound interest in conducting online lectures. In South Korea, the Ministry of Science and ICT (MSIT) partnered with the Ministry of Education, and the Ministry of Women and Family to develop new digital learning websites for software coding and 3D education. Further, due to the temporary shutdown of businesses for maintaining social restrictions imposed by government administrations, corporate organizations in several countries began using digital methods to train their employees. Amid such an increased demand for e-learning solutions, platform developers combined the capabilities of artificial intelligence and machine learning with their offerings to provide personalization. The use of AR and VR, VR simulation, 3D boards, and real-life scenarios in e-learning solutions helps enhance learning through immersive and engaging experiences.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Asia Pacific E-Learning Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

APAC E-Learning Market Insights

Ease of Tracking Student Performance and Maintaining Centralized Student Database Fuels APAC E-Learning Market Growth

E-learning allows teachers to track students’ progress and ensure their performance accomplishments are met. Educational institutes are seeking new methods for optimizing their operations and handling student data better. Student database management systems make their tasks easier, reduce manpower requirements, and ensure efficient learning processes. Also, maintaining a centralized student database ensures data-driven collaboration between teachers, students, parents, and admin staff. E-learning platforms provide a one-stop solution for integrating student data from processes such as enrollment, parent-teacher communications, exam results, and attendance records. For example, when students fail online exams, an instructor offers various learning methods aligned with their personalities so they can easily grasp the learning materials and improve their performance. Advanced e-learning systems provide reporting and analytical tools that enable teachers to identify areas that may be missing from their existing courses and areas wherein they excel. For instance, if students have difficulty in understanding certain learning materials, teachers can assess the content and make necessary improvements. In addition, all detailed information related to students—including personal details, completed assignments and exams, payment status, and learning activities—is stored safely in a centralized system; it can all be displayed readily on a single screen. Thus, e-learning platforms aid the ease of tracking student performances and maintaining a centralized database, which boosts their popularity among education stakeholders. This factor is bolstering the APAC e-learning market growth.

Delivery Mode-Based APAC E-learning Market Insights

The APAC e-learning market, by delivery mode, is segmented into online, LMS, mobile, and others. In 2021, the online segment accounted for the largest market share.

Learning Mode-Based APAC E-Learning Market Insights

The APAC e-learning market, based on learning mode, the market is bifurcated into self-paced and instructor-led. In 2021, the instructor-led segment accounted for a larger market share.

End User-Based APAC E-Learning Market Insights

By end user, the APAC e-learning market is divided into academic and corporate. The academic segment is further divided into K-12 and higher institutions. In 2021, the academic segment accounted for a larger market share.

Players operating in the APAC e-learning market adopt strategies such as mergers, acquisitions, and market initiatives to maintain their positions in the market. A few developments by key market players are listed below:

- In June 2022, D-ID, a world leader in AI-driven creative media, entered into a strategic partnership with Skill Plus, a Japanese e-learning platform that plans and sells seminars and e-learning courses. In addition, the partnership aimed to incorporate D-ID's digital human technology into its offerings to be able to address the increased demand for online communications in Japan.

- In March 2022, the Ministry of Education of China announced the “Smart Education of China” initiative, a network of three new online education platforms across K–12 education, higher education, and vocational education. In addition, the initiative aims to leverage technology to narrow educational gaps and represents a notable breakthrough in the nation’s education digitalization strategy.

The APAC e-learning market has been segmented as follows:

The APAC e-learning market, by delivery mode, is segmented into online, LMS, mobile, and others. Based on learning mode, the market is bifurcated into self-paced and instructor-led. Based on end user, the APAC e-learning market is divided into academic (K-12 and higher institutions) and corporate. By country, the APAC e-learning market is segmented into Australia, China, India, Japan, South Korea, New Zealand, and the Rest of APAC.

Company Profiles

- Antoree Pte. Ltd

- GEM Learning

- Cornerstone

- Kydon Holdings Pte Ltd.

- Gnowbe Group Ltd.

- Adobe Inc.

- Cisco Systems, Inc.

- D2L Corporation

- Oracle Corporation

- MARSHALL CAVENDISH EDUCATION PTE. LTD.

Asia Pacific E-Learning Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 55.81 Billion |

| Market Size by 2028 | US$ 113.39 Billion |

| CAGR (2022 - 2028) | 12.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Delivery Mode

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

Asia Pacific E-Learning Market Players Density: Understanding Its Impact on Business Dynamics

The Asia Pacific E-Learning Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Asia Pacific E-Learning Market top key players overview

Frequently Asked Questions

What are reasons behind APAC e-Learning market growth?

What are market opportunities for APAC e-Learning market?

Which country to dominate the APAC e-Learning market in the forecast period?

What are the future trend for APAC e-Learning market?

Who are the major vendors in the APAC e-Learning market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For