Asia Pacific Healthcare Electronic Data Interchange (EDI) Market Developments by 2030

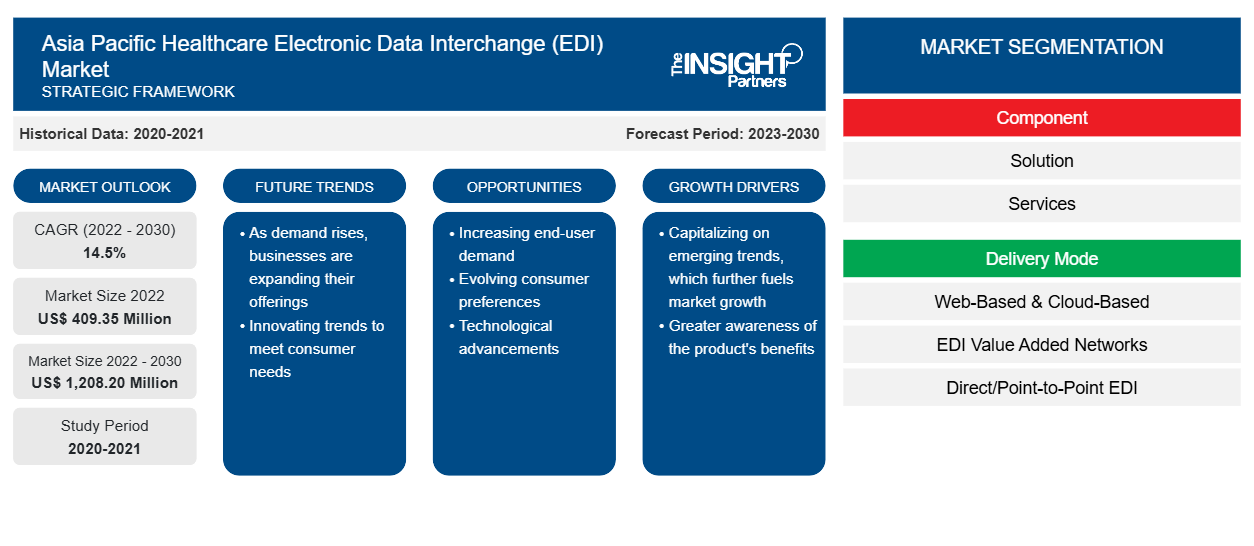

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030Asia Pacific Healthcare Electronic Data Interchange (EDI) Market Size and Forecasts (2020 - 2030), Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Component (Solution and Services), Delivery Mode [Web-Based & Cloud-Based, EDI Value Added Networks (VANs), Direct/Point-to-Point EDI, Mobile EDI, and Others], Application (Claims Management and Healthcare Supply Chain), End User (Healthcare Providers, Healthcare Payers, Medical & Pharmaceutical Industries, and Pharmacies), and Regional Analysis

- Report Date : Nov 2023

- Report Code : TIPRE00030244

- Category : Technology, Media and Telecommunications

- Status : Published

- Available Report Formats :

- No. of Pages : 177

The healthcare EDI market size is expected to grow from US$ 409.35 million in 2022 to US$ 1,208.20 million by 2030; it is estimated to register a CAGR of 14.5% from 2022 to 2030.

Analyst’s ViewPoint

The healthcare EDI market analysis explains market drivers such as the growing need for seamless processing of healthcare claims and administrative transactions, and increasing adoption of healthcare EDI platform in supply chain tracking. Further, technological advancements in healthcare EDI are expected to introduce new trends in the market during 2022–2030. Based on component, the solution segment accounted for a larger share in 2022. Based on delivery mode, the web-based & cloud-based segment dominated the market by accounting maximum share. By application, the claims management segment dominated the market by accounting the maximum share. By end user segment, the healthcare providers segment is likely to account for a considerable share of the healthcare EDI market during 2022–2030.

Electronic data interchange (EDI) in healthcare is a secure way of transmitting data between healthcare institutions, insurers, and patients using established message formats and standards.

Market Insights

Growing Need for Seamless Processing of Healthcare Claims and Administrative Transactions

EDI is a secure way to transfer healthcare data. EDI is regularly utilized by clinics, hospitals, medical practices, and other healthcare companies to transfer medical information. ASC X12, version 5010, is one such example. ASC X12 develops and maintains standards for EDI related to healthcare administrative transactions. Below are a few commonly used ASC X12 transactions frequently adopted in the dental industry.

Commonly Used ASC X12 Transactions in Dental Industry

Transaction Type |

Description |

|

ASC X12 270 |

This transaction allows providers to check whether the patient has an insurance coverage. National Dental Electronic Data Interchange Council (NDEDIC) is working to promote high utilization of ASC X12 270/271 within the dental industry. |

|

ASC X12 271 |

This transaction is an electronic response for eligibility inquiry. The responses by the consumers reveal whether the patient has insurance coverage and accordingly offer benefits available to patients. |

|

ASC X12 275 |

The ASC X12 275 is an electronic transaction used for responding to the insurance company's information by sending "ASC X12 277 RFI to the provider. The ASC X12 275 comprises additional data and/or digital images (x-rays, periodontal charts, treatment notes, etc.) to support the healthcare claims. The transaction is not widely used. |

|

Other ASC X12 |

Other transactions comprise ASC X12 276, ASC X12 277, ASC X12 277CA, ASC X12 277U, ASC X12 RFI, ASC X12 837, ASC X12 835, ASC X12 997, ASC X12 999 |

Source: The Insight Partners Analysis

Additionally, healthcare EDI significantly decreases the time taken to submit and process the claim. For example, not only do EDIs help identify potential mistakes within the claims to be submitted but also assist in processing and providing real-time feedback about the claims submission. For example, the utility of EDI automates manual processes, eliminating paper, printing, physical storage, and cost savings. Also, electronic documents can be processed more quickly as compared to manual processes, ensuring customer needs are met with customer satisfaction. Further, the adoption of EDI in healthcare helps reduce healthcare costs and smooth processes. The adoption of GS1 EDI by Ramsay Healthcare is one such example. Ramsay Healthcare has deployed a full suite of GS1 standards for identifying, capturing, and sharing information that supports interaction with the suppliers. Therefore, the adoption of the GS1 standard suite, Ramsay Healthcare, has increased both the speed and efficiency in purchasing processes that efficiently support operations in hospitals and help ensure continuous delivery of quality healthcare. Procure-to-pay processing costs have been decreased by ~95% per document in Ramsay Healthcare due to the adoption of the GS1 standard suite. Therefore, healthcare efficiency allows healthcare claims to be processed faster through EDI, ultimately driving the market growth.

Future Trend

Technological Advancements in Healthcare EDI

Healthcare organizations deal with vast amount of data every day, starting from patient records and claims to lab results and prescriptions. ~50% of the hospitals in the US have unstructured data, causing a major hindrance in improving the overall healthcare interoperability and connected care initiatives, as per the published report in 2023 by Astera Software. Therefore, technological advancements stand as a reliable solution that can help hospitals overcome challenges associated with hospital-generated data. The Pilotfish’s "ei Console for X12" launched in 2020 is one such example of technological advancement in healthcare EDI. Pilotfish is the only solution that validates healthcare X12 EDI data, translates it, and maps it from any other application by delivering features and modules by reducing minimal complexity. Also, the "eiConsole" for X12 EDI includes an EDI Format Builder that loads a rich data dictionary for EDI transactions, such as field-level documentation and friendly source names. Also, in the eiConsole, the EDI format reader provides automatic prices and reads in X12 transactions.

In September 2022, Prodigo Solutions announced the release of its next-generation EDI platform "Xchange" for healthcare clients that leverage supply chain modernization initiatives and automate transaction processes. This next-generation Xchange has a significantly faster processing time with a small memory footprint to support the ever-increasing volume of EDI documents being transmitted between trading partners. Therefore, with technological advancements in healthcare EDI features, the overall operational efficiency of the healthcare industry is likely to improve, which will promote the market growth during 2022–2030.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Asia Pacific Healthcare Electronic Data Interchange (EDI) Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Component-Based Insights

Based on component, the healthcare EDI market is bifurcated into solution and services. The solution segment held a larger share of the market in 2022 and is anticipated to register a higher CAGR of 14.9% in the market during 2022–2030. Electronic data interchange (EDI) solution comprises data conversion in readable formats, interoperability, IT tools, and data security. For example, the current version of the EDI solution includes standardized messaging to enable seamless information exchange within healthcare organizations. Also, top companies such as IBM provide "IBM WebSphere Data Interchange" solutions that support service-oriented architecture (SOA) and business process management (BPM) implementation. Also, the "IBM WebSphere Data Interchange" solution facilitates the creation, deployment, execution, and management of data transformation and related standards-based processing between standard-based EDI formats and internal application data formats. The IBM WebSphere Data Interchange is utilized in multiple industries, including healthcare. The aforementioned factors are responsible for influential growth of the segment growth.

Delivery Mode-Based Insights

Based on delivery mode, the healthcare EDI market is segmented as web-based & cloud based, EDI value added network (VAN), direct/point-to-point EDI, mobile EDI, and others. The web-based & cloud based segment held the largest market share in 2022 and is anticipated to register the highest CAGR of 15.2% during 2022–2030. Web-based EDI conducts EDI through an internet browser and replicates paper-based documents in the web format. The form comprises fields where the user needs to fill in the information. Once the relevant information is added, it is automatically converted into an EDI message and sent through a secure internet protocol such as File Transfer Protocol Secure (FTPS) and Hyper Text Transport Protocol Secure (HTTPS) or AS2. Web EDI is the simplest form of technology that small and medium-sized enterprises can adopt to create, receive, turn around, and manage electronic documents using a browser.

Likewise, cloud-based EDI solution offers lucrative benefits such as flexibility and scalability, cost-effectiveness, and cloud computing advantage. For example, big healthcare companies such as GE Healthcare is shifting focus from traditional data exchange platform to cloud-based EDI because of improving agility and IT flexibility within the company operations. Also, cloud EDI software provides a combination of technological and business process improvement designed to meet the demands of the organization. From data transformational capabilities to streamlining automation, cloud EDI puts the enterprise in a position to tackle any integration challenges without having to deploy and manage software and hardware.

Application-Based Insights

In terms of application, the healthcare EDI market is categorized into claims management and healthcare supply chain. The claims management segment held a larger market share in 2022 and is anticipated to register the highest CAGR of 14.6% during 2022–2030.

EDI is a standard and routinely used across the healthcare industry, allowing both payers and healthcare professionals to send and receive claims-related information faster, avoiding delays and reducing administrative expenses. The EDI benefits healthcare claims management as follows:

- Electronic claims are automatically checked for HIPAA and payer-specific requirements at the vendor, clearinghouse, and payer levels. Such electronic claims decrease the number of claim rejections, and the same level of automated data generated through EDI cannot be performed on paper claims.

- EDI reduces call timings, obtain information about members, and process claims-related payments through verified authorizations.

For instance, XactAnalysis constantly monitors the data to identify errors, track progress, benchmark performance to reduce claims cost and errors, as well as increases the precision speed of healthcare claims settlements. Additionally, XactAnalysis provides real-time quality assurance and review tools, bulk assignment import, estimates audits, display performance scorecards, assignment network, and many more.

End-User Based Insights

The Asia Pacific healthcare electronic data interchange (EDI) market, by end user, is segmented as healthcare providers, healthcare payers, medical & pharmaceutical industries, and pharmacies. The healthcare providers segment held the largest market share in 2022 and is anticipated to register the highest CAGR of 14.7% during 2022–2030. Healthcare providers require a broad set of tools that drive clinical, financial, and operational success. "Oracle Health" is one such example that strives to streamline clinical and operational workflows to enhance productivity and outcomes across ambulatory clinics and ambulatory surgery centers (ASCs). This is well understood by the following case study, where Children's Minnesota partnered with Oracle Health to maximize efficiency and support quality care. Additionally, Children's Minnesota was able to streamline ready care services or urgent care by utilizing Cerner's new ED LaunchPoint product. The product provided direct visibility to current patient visits and actions as well as a patient summary view with a single click. Further, to support mobility across all patient visit types, "PowerChart Touch" was rolled by Cerner at Children's Minnesota’s primary care. For example, "PowerChart Touch" supports provider mobility on smartphones or tablets, allowing providers to review charts, take photos for easy data/report transfer, and document with in-built dictation software. Such innovative product launches by the providers for efficient and smooth functioning of the healthcare organization promote the overall market growth.

Healthcare EDI Market, by Component – 2022 and 2030

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Regional Analysis

The Asia Pacific healthcare EDI market is segmented into China, India, Japan, South Korea, Australia, and Rest of Asia Pacific. China accounted the largest share of healthcare EDI market. According to the National Institute of Health (NIH) report, China has realized the benefits of adopting electronic data interchange (EDI). For example, data governance systems in the field of healthcare seek to balance and share health data. Also, regulatory need is important as there is a massive amount of health data generated. Therefore, China's Ministry of Health (MOH) has planned to undertake a major project, "the China Golden Health Medical Network Project," in October 2023 to establish a satellite-transmitted nationwide healthcare communication network. The project is set to launch the Golden Health Card, a smart card with an embedded chip to save patient financials and medical information and help patients obtain appropriate healthcare services from hospitals at different geographic locations. Under the same project, the hospitals have started using EDI to communicate with other hospitals, medical resource suppliers, insurance companies, and banks.

The EDI services were first conducted in Beijing hospitals to promote EDI usage in China's healthcare organizations. Beijing was chosen as a research site for the implementation of EDI because it is the capital of China and one of the most industrialized cities. Also, many organizations in Beijing have well-developed IT infrastructure. Therefore, hospitals in Beijing receive more assistance from the government and various industry organizations implement EDI in hospitals. The influx of EDI in Chinese hospitals makes remarkable changes in Level 3 and lower-level hospitals. For example, outpatient registration fees are determined by the healthcare policy in China, and the registration fee difference between Level 3 and lower level hospitals is approx. US$ 0.2. With the difference being so slight, many patients are willing to pay more to go to Level 3 Chinese hospitals with better services. Therefore, Level 1 and Level 2 Chinese hospitals have a fewer outpatient visits, and Level 3 hospitals have long waiting lines. With long waiting lines in Level 3 hospitals, it is more likely to adopt IT infrastructure to maintain competitiveness. However, for low-level hospitals, patient attraction is a critical issue, and they are more likely to invest in marketing rather than IT. Therefore, the implementation of EDI offers both advantages, including IT and marketing, for both Level 3 and low-level hospitals. Thus, such remarkable features provided by the EDI help healthcare system in China dominate the market.

Asia Pacific Healthcare Electronic Data Interchange (EDI) Report Scope| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 409.35 Million |

| Market Size by 2030 | US$ 1,208.20 Million |

| CAGR (2022 - 2030) | 14.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

Frequently Asked Questions

Who are the key players in the healthcare EDI market?

Which end user held the largest share in the healthcare EDI market?

What is healthcare EDI?

What is the market CAGR value of healthcare EDI market during forecast period?

Which component segment leads the healthcare EDI market?

Which are the top companies that hold the market share in healthcare EDI market?

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For