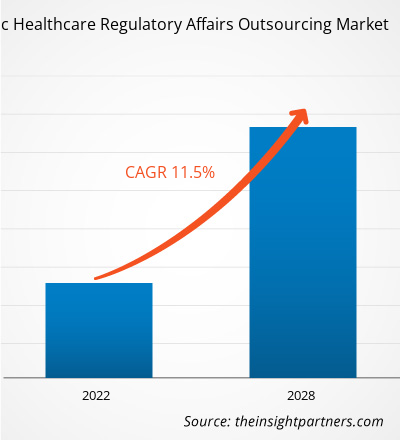

The healthcare regulatory affairs outsourcing market in APAC is expected to grow from US$ 1,203.97 million in 2021 to US$ 2,586.87 million by 2028; it is estimated to grow at a CAGR of 11.5% from 2021 to 2028.

The development of blockbuster therapies such as targeted gene therapies, specialty drugs, and precision medicine that help treat specific diseases and disorders has been a major focus in the healthcare sector for a long period. A few of these therapies are also being combined with medical devices to enhance the quality of drug delivery, dose, and patient monitoring or adherence, which is expected to add to the complexity of the related regulatory strategies and difficulties in their way to market. Thus, developments in emerging segments in healthcare sectors such as specialty therapies, orphan drugs, and personalized medicines are expected to offer significant growth opportunities to healthcare regulatory affairs outsourcing market players during the forecast period.With a favorable supply market—the strong presence of global CROs and regional CROs with local expertise—pharmaceutical companies perceive Asia-Pacific as an attractive market for conducting clinical trials. However, the COVID-19 pandemic has brought unprecedented challenges across the world. The impact of COVID-19 on clinical and regulatory affairs, manufacturing and supply chains, and stakeholder engagements has slowed the pace of the ever-growing pharmaceuticals industry. Australia has been appreciated globally for its measures for managing the COVID-19 spread with strict quarantine systems and advanced contact tracing; however, patient/volunteer participation in clinical trials decreased at some sites as participants were not willing to attend clinics or hospitals dur to the fear of infection. Thus, the pandemic situation has resulted in the halting of clinical trials, delays in product approvals, and disruptions to supply chains. The pandemic has forced pharmaceutical companies and regulatory agencies to adopt innovative strategies to mitigate the challenges observed across various functional domains. The impact of COVID-19 has resulted in delay in onsite inspection due to travel bars and delay in approval for several products. This has caused resulted in the outsourcing of ~65% of pharmaceutical activities to CROs, and the number is expected to reach 75% in the future. Along with this, the demand for innovative pharmaceutical products has put pharma companies under pressure to increase their R&D spending to deliver the new products, while keeping the operating costs unaltered. These conditions have also triggered investments in digital platforms, allowing physicians to monitor patients remotely in an efficient manner. All these factors will impact on healthcare regulatory affairs outsourcing businesses in Asia Pacific.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the healthcare regulatory affairs outsourcing market. The APAC healthcare regulatory affairs outsourcing is expected to grow at a good CAGR during the forecast period.

APAC Healthcare Regulatory Affairs Outsourcing Market Revenue and Forecast to 2028 (US$ Million)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

APAC Healthcare Regulatory Affairs Outsourcing Market Segmentation

APAC Healthcare Regulatory Affairs Outsourcing Market – By Service Type

- Medical & Scientific Writing

- Pharmacovigilance

- Data Management Services

- Life Cycle Management Services

- eCTD and e-Submissions

- Regulatory and Scientific Strategy development

- Chemistry Manufacturing and Controls (CMC) Services

- Regulatory Labelling

- Regulatory Artwork Services

APAC Healthcare Regulatory Affairs Outsourcing Market – By End User

- Pharmaceutical Companies

- Biotechnology Companies

- Medical Devices Companies

- Medical Device Materials & Biomaterials

- Medical Device Biomarkers and In vitro Diagnostics (IVD)

- Medical Device Software (SaMD)

- Medical Device Electromechanics

- Medical Device Substance-based

- Medical Device of Combination Product

APAC Healthcare Regulatory Affairs Outsourcing Market- By Country

- Japan

- China

- India

- South Korea

- Australia

- Rest of APAC

APAC Healthcare Regulatory Affairs Outsourcing Market-Companies Mentioned

- Arriello Ireland Ltd.

- Azierta Contract Science Support Consulting

- IQVIA Inc.

- PAREXEL INTERNATIONAL CORPORATION

- PHARMALEX GMBH

- ProductLife Group

- ProPharma Group

- Voisin Consulting Life Sciences (VCLS)

Asia Pacific Healthcare Regulatory Affairs Outsourcing Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1,203.97 Million |

| Market Size by 2028 | US$ 2,586.87 Million |

| Global CAGR (2021 - 2028) | 11.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Service Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Equipment Rental Software Market

- Artificial Turf Market

- Trade Promotion Management Software Market

- Hydrogen Storage Alloys Market

- EMC Testing Market

- Digital Language Learning Market

- Smart Locks Market

- Digital Pathology Market

- Ketogenic Diet Market

- Health Economics and Outcome Research (HEOR) Services Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Life Sciences : READ MORE..

- Arriello Ireland Ltd.

- Azierta Contract Science Support Consulting

- IQVIA Inc.

- PAREXEL INTERNATIONAL CORPORATION

- PHARMALEX GMBH

- ProductLife Group

- ProPharma Group

- Voisin Consulting Life Sciences (VCLS)

Get Free Sample For

Get Free Sample For