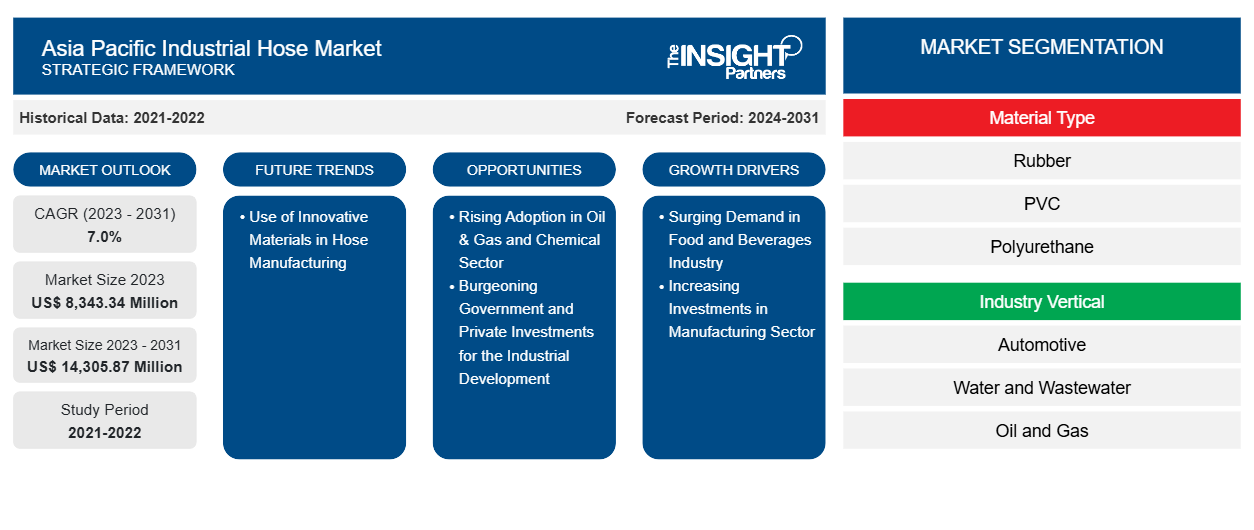

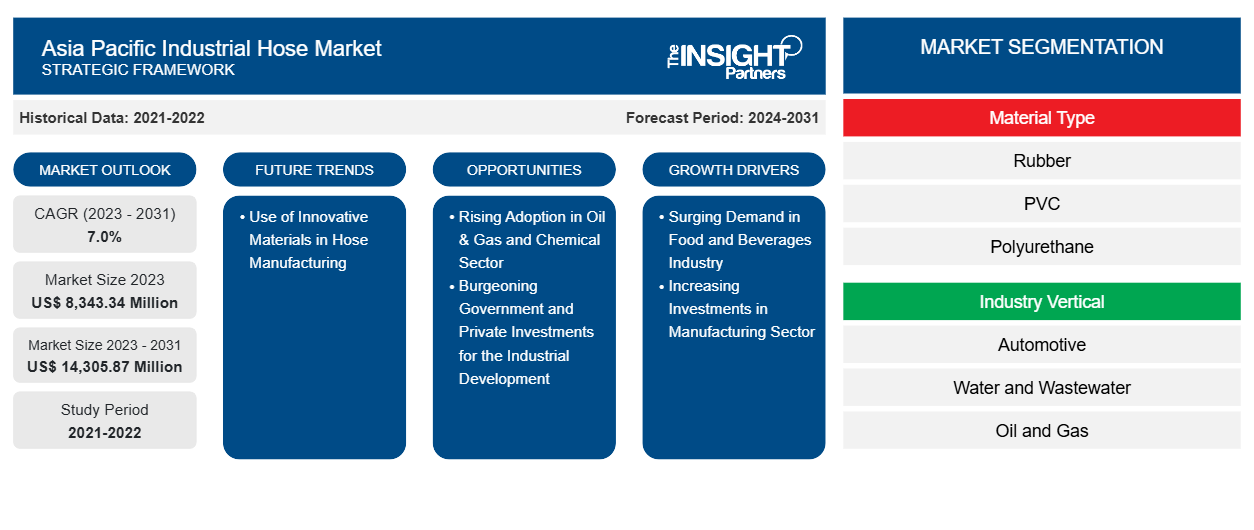

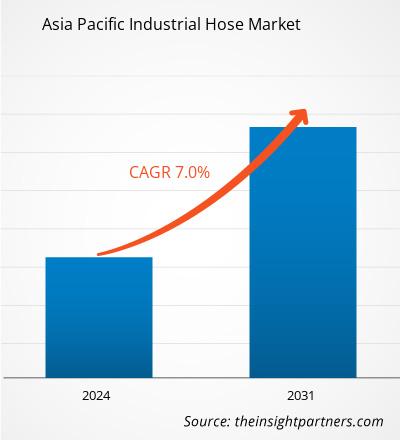

The Asia Pacific industrial hose market size is projected to reach US$ 14,305.87 million by 2031 from US$ 8,343.34 million in 2023. The market is expected to register a CAGR of 7.0% during 2023–2031. The growing usage of innovative materials in hose manufacturing is likely to bring new key trends in the market in the coming years.

Asia Pacific Industrial Hose Market Analysis

Several key players in the Asia Pacific industrial hose market are developing advanced industrial hoses for chemical and oil & gas applications. Hoses developed with new advanced materials are designed to support the requirement of fluid transport applications in various industries.

- In July 2024, Dow announced the launch of NORDEL REN ethylene propylene diene terpolymers (EPDM), a bio-based version of rubber material for a wide range of applications, including automotive, hoses, infrastructure, and consumer applications. This plant-based EPDM material was launched for making various key components such as industrial hoses and automotive weather seals.

- In October 2023, Watson Marlow Bredel B.V. launched Bredel NR Transfer hoses for general fluid transfer applications. This natural rubber-based hose was designed for handling sludges, food and beverage waste streams, and abrasive slurries at pressures up to 12 bar.

Thus, the introduction of innovative material-based hoses by key players operating in the market is likely to bring in new growth trends in the market.

Industrial hoses are commonly used in chemical industries to handle liquid and dry chemical materials. Increasing investments in the chemical and oil & gas sectors bolster the Asia Pacific industrial hose market. In September 2024, Lotte Chemical Titan, South Korea, the largest producer of olefin and polyolefin chemicals, planned to invest US$ 3.95 billion in the new integrated ethylene production project. The LINE project plant has a capacity of 1 million tons per year, along with an added capacity of both ethylene and propylene chemical plants. The company has three standalone polyethylene (PE) plants in the LINE project.

Indonesia imports chemical products valued at US$ 22.9 billion in 2022 and exports US$ 11.2 billion worth of chemicals, as stated by the Observatory of Economic Complexity (OEC). According to BP Statistical World Energy in 2023, the country's refining capacity reached 1.24 million barrels per day (b/d) as of December 2023. Further, in November 2023, Thailand approved an investment of US$ 1.1 billion for projects related to electric vehicle manufacturing factories, waste-to-energy power plants, and data centers. The Thailand government prioritizes investments in renewable energy, automotive, advanced medical devices, digital industries, and aerospace and aviation sectors. In October 2024, Saudi Aramco planned to invest in the expansion of its oil and petrochemical production capacity in Vietnam. Thus, an increase in investments in the oil and gas, and chemical sectors is expected to create significant growth opportunities for the Asia Pacific industrial hose market in the coming years.

Asia Pacific Industrial Hose Market Overview

Major raw materials required for the manufacturing of industrial hoses are natural or synthetic rubber, steel wire, PVC, silicone, nylon, polyethylene, polyurethane, neoprene, coated fabric, and other composites. ExxonMobil; Boedeker Plastics, Inc.; Dow Inc.; Remington Industries; BD Custom Manufacturing, Inc.; Grainger Industrial Supply; Hubbard Supply Co.; Industrial Metal Supply Co.; Murphy and Nolan, Inc.; Metric Metal; American Metals Inc.; Norfolk Iron & Metal; Mill Steel Company; Southern Copper & Supply; Chevron Phillips Chemical; and Westlake Corporation are among the leading raw material suppliers operating in the APAC industrial hose market.

Norres; Sinopulse; Qingdao Qingflex Hose Factory; Qingdao Somax Manufacturing Co., Ltd; Sunhose Online Services; NFK Vietnam Co., LTD.; Minh Lap Co., Ltd.; HUANYU HOSE CO., LTD.; Taiwan PU Corporation; Semperit AG Holding; and Fu Sheng Rubber & Plastic Ind. Co., Ltd. are among the major industrial hose manufacturers operational in Asia Pacific. These companies manufacture industrial hoses to cater to end-use industries such as automotive, oil & gas, water and wastewater, manufacturing, food and beverages, construction, mining, and utilities. Most companies focus on developing advanced and environment-friendly industrial hoses to remain competitive in the market. They either directly distribute their products to end-use industries or outsource their distribution operations to local suppliers and distributors, which thus play a crucial role in the ecosystem of the industrial hose market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Asia Pacific Industrial Hose Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Asia Pacific Industrial Hose Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Asia Pacific Industrial Hose Market Drivers and Opportunities

Increasing Investments in Manufacturing Sector

Industrial hoses are primarily used for transferring fluids such as water, chemicals, and oils in manufacturing industries. Lubrication, cooling, and mixing operations in manufacturing facilities require precise fluid handling. On the other hand, some processes require the movement of air or gases, which need specialized hoses designed for handling high pressures and temperatures. These abilities render high-pressure or high-temperature hoses suitable for several applications in pneumatic systems and hydraulic systems in the manufacturing sector. In automated manufacturing lines, industrial hoses are used to facilitate the movement of conveyor systems and robotic arms. In 2024, South Korea's investment in the industrial manufacturing sectors reached US$ 82 billion. South Korean companies have also raised their capital investment in the semiconductor and automobile sectors. Further, in the first half of 2023, the Thailand Board of Investment (BOI) increased investment of US$ 10.3 billion increased by 70% compared to previous year 2022. Thailand government is expanding its manufacturing capabilities in targeted industries such as food processing, electronics, and automotive, especially in the electric vehicles (EV). In the January-June period 2023, total 464 projects were planned in Thailand which represents a combined value US$ 8.36 billion. Thus, an upsurge in investments in the manufacturing sector creates a massive demand for industrial hoses.

Rising Adoption in Oil & Gas and Chemical Sector

Industrial hoses are commonly used in chemical industries to handle liquid and dry chemical materials. Increasing investments in the chemical and oil & gas sectors bolster the Asia Pacific industrial hose market. In September 2024, Lotte Chemical Titan, South Korea, the largest producer of olefin and polyolefin chemicals, planned to invest US$ 3.95 billion in the new integrated ethylene production project. The LINE project plant has a capacity of 1 million tons per year, along with an added capacity of both ethylene and propylene chemical plants. The company has three standalone polyethylene (PE) plants in the LINE project.

Indonesia imports chemical products valued at US$ 22.9 billion in 2022 and exports US$ 11.2 billion worth of chemicals, as stated by the Observatory of Economic Complexity (OEC). According to BP Statistical World Energy in 2023, the country's refining capacity reached 1.24 million barrels per day (b/d) as of December 2023. Further, in November 2023, Thailand approved an investment of US$ 1.1 billion for projects related to electric vehicle manufacturing factories, waste-to-energy power plants, and data centers. The Thailand government prioritizes investments in renewable energy, automotive, advanced medical devices, digital industries, and aerospace and aviation sectors. In October 2024, Saudi Aramco planned to invest in the expansion of its oil and petrochemical production capacity in Vietnam. Thus, an increase in investments in the oil and gas, and chemical sectors is expected to create significant growth opportunities for the Asia Pacific industrial hose market in the coming years.

Asia Pacific Industrial Hose Market Report Segmentation Analysis

Key segments that contributed to the derivation of Asia Pacific industrial hose market analysis are material type and industry vertical.

- Based on material type, Asia Pacific industrial hose market is segmented into rubber, PVC, polyurethane, silicone, and others. The rubber segment held a larger share of the market in 2023.

- Based on industry vertical, Asia Pacific industrial hose market is segmented into automotive, water and wastewater, oil and gas, chemicals, infrastructure, food and beverages, agriculture, mining, and others. The oil and gas segment dominated the market in 2023.

Asia Pacific Industrial Hose Market Share Analysis

The geographic scope of the industrial hose market report offers a detailed country analysis in the Asia Pacific region. China dominated the Asia Pacific industrial hose market in 2023 and it is expected to retain its dominance over the forecast period as well. This is mainly due to to rapidly growing demand from the automotive and chemical industries. In April 2024, Chinese automotive sector production and sales generated a revenue of US$ 1.52 trillion, which accounted for ~10% of its GDP. Several global automotive leaders are significantly investing in China to expand their production capabilities. For instance, in April 2024, BMW Group Germany announced an investment of US$ 3.12 billion into its production base in Shenyang, Northeast China's Liaoning Province. Industrial hoses play a vital role in automotive manufacturing plants, as they are used to transport coolant, fuel, hydraulic fluid, and other fluids throughout vehicles, thereby aiding in the proper functioning of engines. Automotive companies are investing a considerable amount in the expansion of their plants to meet the current demand for economic development in the country. China is home to several automotive companies, including Harbin Dongan Auto Engine Co Ltd, BYD Co Ltd, Lifan Technology Group Co Ltd, Zhejiang WanliYang Co Ltd, and Landau Technology. These companies are expanding their production capacity to meet growing vehicle sales. For instance, in February 2023, BYD Co. Ltd. largest electric automotive manufacturer planned to invest US$ 1.2 billion to build new battery manufacturing facility in China. This plant requires various types of hydraulic and industrial hoses for manufacturing plants. Further, in December 2021, the KION Group opened a forklift truck manufacturing plant in Jinan, China, to fulfill the domestic demand of the warehouse and logistics sector. Thus, the flourishing industrial, manufacturing, and automotive sectors bolster the industrial hose market in China.

Asia Pacific Industrial Hose Market Report Coverage and Deliverables

The "Asia Pacific Industrial Hose Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Asia Pacific industrial hose market size and forecast at country levels for all the key market segments covered under the scope

- Asia Pacific industrial hose market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Asia Pacific industrial hose market analysis covering key market trends, country framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Asia Pacific industrial hose market

- Detailed company profiles

Asia Pacific Industrial Hose Market Regional Insights

The regional trends and factors influencing the Asia Pacific Industrial Hose Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Asia Pacific Industrial Hose Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Asia Pacific Industrial Hose Market

Asia Pacific Industrial Hose Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 8,343.34 Million |

| Market Size by 2031 | US$ 14,305.87 Million |

| Global CAGR (2023 - 2031) | 7.0% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Material Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

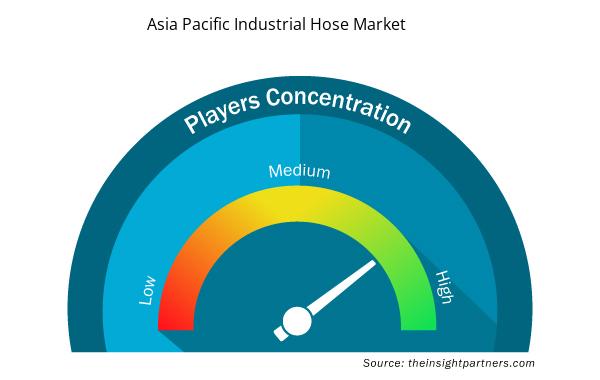

Asia Pacific Industrial Hose Market Players Density: Understanding Its Impact on Business Dynamics

The Asia Pacific Industrial Hose Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Asia Pacific Industrial Hose Market are:

- Norres

- ALFA GOMMA Spa

- Sinopulse

- Qingdao Qingflex Hose Factory

- Qingdao Somax Manufacturing Co.,Ltd

- Sunhose Online Services

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Asia Pacific Industrial Hose Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Digital Pathology Market

- Workwear Market

- Unit Heater Market

- Adaptive Traffic Control System Market

- Health Economics and Outcome Research (HEOR) Services Market

- Virtual Production Market

- Fixed-Base Operator Market

- Adaptive Traffic Control System Market

- 3D Audio Market

- Medical Audiometer Devices Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Several key players in the Asia Pacific industrial hose market are developing advanced industrial hoses for chemical and oil & gas applications. Hoses developed with new advanced materials are designed to support the requirement of fluid transport applications in various industries.

In July 2024, Dow announced the launch of NORDEL REN ethylene propylene diene terpolymers (EPDM), a bio-based version of rubber material for a wide range of applications, including automotive, hoses, infrastructure, and consumer applications. This plant-based EPDM material was launched for making various key components such as industrial hoses and automotive weather seals.

In October 2023, Watson Marlow Bredel B.V. launched Bredel NR Transfer hoses for general fluid transfer applications. This natural rubber-based hose was designed for handling sludges, food and beverage waste streams, and abrasive slurries at pressures up to 12 bar.

Thus, the introduction of innovative material-based hoses by key players operating in the market is likely to bring in new growth trends in the market.

The Asia Pacific industrial hose market is expected to reach US$ 14,305.87 billion by 2031.

The key players operating in the Asia Pacific industrial hose market include Norres; ALFA GOMMA Spa; Sinopulse; Qingdao Qingflex Hose Factory; Qingdao Somax Manufacturing Co.,Ltd; Sunhose Online Services; NFK Vietnam Co., LTD.; Minh Lap Co., Ltd.; HUANYU HOSE CO., LTD.; Taiwan PU Corporation; Semperit AG Holding; and Fu Sheng Rubber & Plastic Ind. Co., Ltd.

The Asia Pacific industrial hose market was valued at US$ 8,343.34 million in 2023; it is expected to register a CAGR of 7.0% during 2023–2031.

The market for food and beverages in China was valued at US$ 1.67 trillion in 2023, recording an increase of 7.38% compared to the previous year. In 2023, the market in Vietnam was valued at US$ 96.47 billion. The Ministry of Industry and Trade, Vietnam attracted investment of ~US$ 30 billion in the food and beverages industry in 2024. Industrial hoses play a vital role in the food and beverage industry by ensuring the safe and efficient transfer of various liquid components and products. As these materials can be corrosive or reactive, chemical or food-grade hoses are used in food and beverage production facilities. Thus, the rapid growth of the food and beverages sector in countries such as Vietnam, China, and Thailand create a massive demand for industrial hoses in Asia Pacific.

Trends and growth analysis reports related to Manufacturing and Construction : READ MORE..

The List of Companies - Asia Pacific Industrial Hose Market

- Norres

- ALFA GOMMA Spa

- Sinopulse

- Qingdao Qingflex Hose Factory

- Qingdao Somax Manufacturing Co.,Ltd.

- Sunhose Online Services

- NFK Vietnam Co., LTD.

- Minh Lap Co., Ltd.

- HUANYU HOSE CO., LTD.

- Taiwan PU Corporation

- Semperit AG Holding

- Fu Sheng Rubber & Plastic Ind. Co., Ltd.

Get Free Sample For

Get Free Sample For