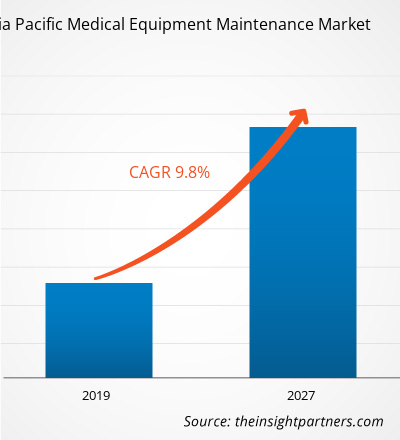

The Asia Pacific medical equipment maintenance market expected to be US$ 3,079.23 Mn in 2018 and is predicted to grow at a CAGR of 9.8% during the forecast period 2019 – 2027, to reach US$ 7,053.03 Mn by 2027.

Korea is the largest geographic market in the region, which is expected to witness significant growth during the forecast period, due to rise in the geriatric population and decrease in the birth rate. In addition, the country is being preferred for medical tourism, which is expected to offer growth opportunities in the market during the forecast period.

Rest of Asia-Pacific Medical Equipment Maintenance Market

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Growth of the Medical Tourism Industry

Medical tourism is one of the driving factors that is leading to the growth of medical equipment maintenance in the Asia Pacific region. With increasing costs of manufacturing against their practices, the medical device manufacturers are struggling to generate enough revenue to please their investors. The developing economies in the region are expected to be the crucial factor in offering better and profitable growth opportunities for the major players to expand their business and geographic reach. The patients travel to the countries due to the use of sophisticated and advanced medical technology products, devices, and equipment. Medical tourism takes place in cases where surgeries and medical care are required.

The developing countries in the Asia Pacific are known to provide a better opportunity for the major players to expand their business. Factors such as cutting-edge equipment, low prices, and infrastructure have encouraged visitors to get a medical check-up or treatment done in an Asian country. Countries such as Thailand, Singapore, South Korea, Malaysia, and India have a well-established medical tourism industry. Foreign patients are primary revenue generators for private hospitals in these countries. Their share held almost 40-55 percent of the private hospitals’ revenue in countries such as Malaysia, Singapore, and Thailand. In India, medical tourism accounted for nearly 25 percent of revenue, whereas in South Korea, the Philippines, and Taiwan, it accounted for almost 10-15 percent of the country's revenue.

In 2016, the medical tourism sector in Asia-Pacific provided treatment for around 10 million patients and generated almost US$16 to19 Bn (i.e., 15-17 billion euros) in revenues. For instance, in India, more than 4 million medical tourists visited for treatment in 2016, generating about US$4 Bn (i.e., 4 billion euros) in health care revenues. Similarly, in Thailand, around 3.5 million foreign patients spent more than US$4 Bn (i.e., 4 billion euros) on health care in 2016. In Singapore, medical tourism generated for almost US$1.7Bn (i.e., 1.6 billion euros) with almost 900,000 patients being treated in 2016. Countries in Asia have also undertaken measures to accelerate the growth of the medical tourism industry. For instance, during September 2018, AirAsia Indonesia and Malaysia Healthcare Travel Council (MHTC) entered into a partnership to promote Penang as Malaysia’s top healthcare tourism destination. Through the partnership, AirAsia will offer flight discounts to MHTC customers, and would also include discounts on medical check-up and non-medical bills by showing their boarding pass. These strategies are expected to lead to the growth of the medical tourism industry, which is further anticipated to drive the market for medical equipment market during the forecast period.

Super Specialty and Multi-Specialty Hospitals are Expanding in the Asia Pacific

Multi-specialty hospitals are hospitals offering more than two unique treatments in their hospitals, whereas super-specialty hospitals offer newer and newer subspecialties for a specific disorder. The physicians in multi-specialty hospitals possess degrees with specializations in particular areas such as, as MD medicine, MD dermatology, MS surgery, and so on. Whereas, in super-specialty, the doctors hold degrees like DM neurology, McH urology, DM gastroenterology, McH neurosurgery.

Multi-specialty hospitals are a single doorway to the patients’ health care needs. They offer a wide range of treatment from newborn to the elderly aged population. These hospitals primarily focus on prevention, disease management, and appropriate clinical interventions.

Both multi-specialty and super-specialty hospitals provide and promote quality care in health & wellness at an affordable cost to society. However, super-specialty hospitals are currently existing only in few countries across the globe. Thus, with growing healthcare needs and a rising preference for specialized treatment, the super-specialty and multi-specialty hospitals hold several opportunities to grow during the forecast period.

Device Type Insights

The Asia Pacific medical equipment maintenance market by device type was led by electromedical equipment segment. In 2018, the segment of held the largest market share in the medical equipment maintenance market, by device type. The segment is also expected to witness growth at a significant rate during the forecast period as it form an essential part of medical equipment maintenance, its demand is expected to grow at a considerable pace during the future years.

Medical Equipment Maintenance Market, by Device Type

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

MEDICAL EQUIPMENT MAINTENANCE – MARKET SEGMENTATION

By Device Type

- Electromedical Equipment

- Endoscopic Devices

- Surgical Instruments

- Other Medical Equipment

By Service Type

- Preventive Maintenance

- Corrective Maintenance

- Operational Maintenance

By Service Provider

- Original Equipment Manufacturers

- Independent Service Organizations

- In-House Maintenance

By Geography

• Asia Pacific (APAC)

- Malaysia

- Singapore

- Thailand

- Philippines

- Indonesia

- Taiwan

- Korea

- Hong Kong

- Rest Of Asia-Pacific

Company Profiles

- Stryker

- Boston Scientific

- Medtronic

- Edward Lifesciences

- Johnson & Johnson

- Abbott

- Terumo Corporation

- B. Braun Melsungen Ag

- Aramark Services, Inc.

- Althea

Asia Pacific Medical Equipment Maintenance Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 3,079.23 Million |

| Market Size by 2027 | US$ 7,053.03 Million |

| Global CAGR (2019 - 2027) | 9.8% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Device Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Device Type, Service Type, Service Provider and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, China, Japan, South Korea

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies

- Stryker

- Boston Scientific

- Medtronic

- Edward Lifesciences

- Johnson & Johnson

- Abbott

- Terumo Corporation

- B. Braun Melsungen Ag

- Aramark Services, Inc.

- Althea

Get Free Sample For

Get Free Sample For