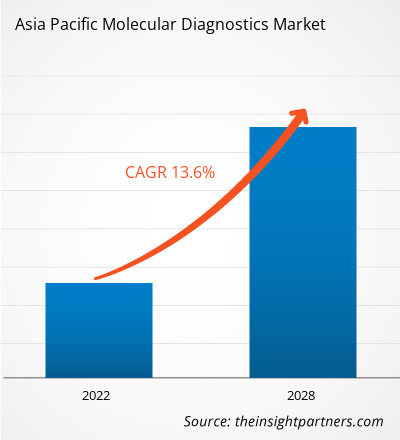

The Molecular Diagnostics market in the Asia Pacific is expected to grow from US$ 3,072.95million in 2021 to US$ 7,488.57million by 2028; it is estimated to grow at a CAGR of 13.6% from 2021 to 2028.

Asia Pacific molecular diagnostics has wide application in various indications such as Oncology, Infectious disease, Genetic testing, Cardiac diseases, Immune system disorders, others. The increasing prevalence of the associated indications is expected to drive the market. For instance, cancer is one of the leading causes of death worldwide. The early detection of cancer can prevent death among the patients. POC diagnostics play an essential role in the early role and monitoring of cancer. The World Health Organization (WHO) stated that about 70% of deaths in low- and middle-income countries were caused by cancer in September 2021. In addition, as per the Global Burden of Disease Study in the Global Health Data Exchange and the World Health Statistics 2020 Cardiovascular Disease (CVD) mortality in China 322 per 100,000 population, India has reported 185 per 100,000 population of an early stage of CVD. Thus, the rising prevalence of target diseases in Asia Pacific Molecular Diagnostics is expected to drive the market.

Countries in the Asia Pacific are facing challenges due to increasing incidences of COVID-19. As per the data of World meter, as of March 16, 2021, China reported a total of 90,066 COVID-19 cases, while in Japan it stood at 448,688, India recorded 11,438,734 cases, South Korea recorded 96,849 cases and Australia reported 29,151 confirmed cases. The shrinking economy of many countries is also going to affect many sectors including pharmaceuticals. As per the Asian Development Bank (ADB), a group of 45 countries in the Asia-Pacific region, is expected to post growth of just 0.1 per cent in 2020. The spread of the pandemic coupled with uncertainty around economic recovery has affected the pharmaceutical industry in the region. This economic impact is expected to have a negative effect on investments in research and development. However, the focus on the treatment of coronavirus is expected to offer new avenues for the point of care diagnostics. Some of the research institutes in the region are actively contributing to the research activities to check the feasibility for the management of coronavirus.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the molecular diagnostics sssmarket. The Asia Pacific Molecular Diagnostics market is expected to grow at a good CAGR during the forecast period.

Asia Pacific Molecular Diagnostics Market Revenue and Forecast to 2028(US$ Million)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Asia Pacific Molecular Diagnostics Market Segmentation

By Disease Area

- Infectious Disease

- Oncology

- Genetic Testing

- Cardiac Diseases

- Immune System Disorders

- Others

By Technology

- Polymerase Chain Reaction (PCR)

- In Situ Hybridization

- Isothermal Nucleic Acid Amplification Technology (INAAT)

- DNA Sequencing and Next-Generation Sequencing (NGS)

- DNA Microarrays

- Others

By Type

- RT-PCR

- qPCR

- Multiplex PCR

- Others

By Product & Services

- Assays and Kits

- Instruments

- Services and Software

By End User

- Diagnostic Laboratories

- Hospitals and Clinics

- Research and Academic Institutes

- Others

By Country

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Malaysia

- Thailand

- Singapore

- Philippines

- Vietnam

- Indonesia

- Rest of Asia Pacific

Companies Mentioned -

- Abbott,

- Agilent Technologies, Inc.,

- Thermo Fisher Scientific Inc.,

- F. Hoffmann-La Roche Ltd.,

- TBG Diagnostics Limited,

- QIAGEN,

- bioMérieux SA,

- Siemens Healthineers AG,

- Illumina, Inc.,

- Danaher,

- Novartis AG.

Asia Pacific Molecular Diagnostics Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 3,072.95 Million |

| Market Size by 2028 | US$ 7,488.57 Million |

| Global CAGR (2021 - 2028) | 13.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Disease Area

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Disease Area, Technology, Product and Services, End User, and Country

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, China, Japan, South Korea

Frequently Asked Questions

Molecular diagnostics (MDx) is a branch of laboratory medicine that studies human, viral, and microbial genomes and the products they encode. In all fields of anatomic and clinical pathology, molecular diagnostic tools and platforms are becoming more important. In the last decade or so, the number of tests based on DNA and RNA analysis has exploded in the clinical laboratory. Molecular diagnostics offers the foundation for successful gene therapy and biologic response modifier applications. It's a powerful tool for determining disease prognosis and therapy response, as well as finding minimum residual disease.

Increase in demand for point-of-care and developments by market players and increasing prevalence of associated diseases are expected to boost the market growth for the molecular diagnostics over the years.

The CAGR value of the molecular diagnostics market during the forecasted period of 2021-2028 is 12.1%.

The infectious disease segment held the largest share of the market in the Asia pacific molecular diagnostics market and held the largest market share of 43.61% in 2021.

The urinary tract infections segment dominated the Asia pacific molecular diagnostics market and accounted for the largest market share of 49.71% in 2021.

The assays and kits segment dominated the Asia pacific molecular diagnostics market and held the largest market share of 61.36% in 2021.

The hospitals segment dominated the Asia pacific molecular diagnostics market and held the largest market share of 44.95% in 2021.

The molecular diagnostics market majorly consists of the players such as Abbott, Agilent Technologies, Inc., Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd., TBG Diagnostics Limited, QIAGEN, bioMérieux SA, Siemens Healthineers AG, Illumina, Inc., Danaher, Novartis AG among others.

F. HOFFMANN-LA ROCHE LTD. and Abbott are the top two companies that hold huge market shares in the molecular diagnostics market.

Asia Pacific molecular diagnostics market is segmented by country into Malaysia, Thailand, India, Singapore, Philippines, Vietnam, Indonesia, and Rest of Asia Pacific. India is the largest market for molecular diagnostics. The growth of this market is primarily driven by the increasing prevalence of associated diseases and increase in demand for point-of-care and developments by market players. Moreover, patients prefer at-home medical care through POC products and services due to increasing awareness about POC products and services.

Trends and growth analysis reports related to Life Sciences : READ MORE..

- Abbott,

- Agilent Technologies, Inc.,

- Thermo Fisher Scientific Inc.,

- F. Hoffmann-La Roche Ltd.,

- TBG Diagnostics Limited,

- QIAGEN,

- bioMérieux SA,

- Siemens Healthineers AG,

- Illumina, Inc.,

- Danaher,

- Novartis AG.

Get Free Sample For

Get Free Sample For