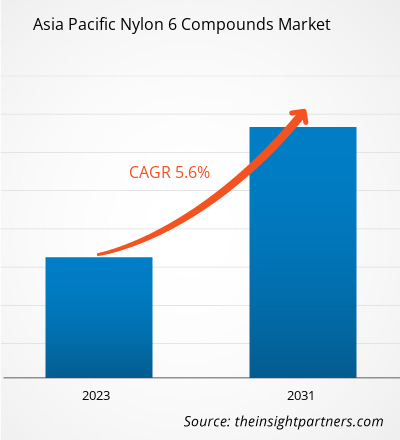

The Asia Pacific nylon 6 compounds market is projected to grow from US$ 2.45 billion in 2023 to US$ 3.78 billion by 2031; the market is expected to register a CAGR of 5.6% from 2023 to 2031. The electrification of vehicles and the emergence of smart automotive electronics are likely to be key trends stimulating the demand for components manufactured from nylon 6 compounds in the market.

Asia Pacific Nylon 6 Compounds Market Analysis

Nylon 6 compounds are the types of engineering plastics made from polyamide 6 (PA 6). These compounds exhibit superior mechanical properties, thermal resistance, and versatility, which render them valuable in the automotive, textile, and electronics industries, among others. Moreover, the continuous expansion of global manufacturing and industrial activities results in an elevated demand for durable and high-performance materials such as nylon 6 compounds. Their lightweight nature helps vehicle manufacturers improve fuel efficiency and reduce emissions. Further, engine covers, air intake manifolds, and various other structural parts manufactured using nylon 6 compounds show durability, high-temperature tolerance, and chemical resistance. Soaring demand for these compounds in the automotive and electronics industries drives the growth of the nylon 6 compounds market. As these compounds are essential for producing various electronic and structural components that require high performance and reliability, a shift toward electric vehicles is further expected to benefit the market in the coming years. The increasing awareness of the extensive advantages of nylon 6 compounds among different industries is likely to create significant growth opportunities for the nylon 6 market players.

Asia Pacific Nylon 6 Compounds Market Overview

According to the Organization Internationale des Constructeurs d'Automobiles, the global sales of passenger cars increased from 84.8 million in 2022 to 93.5 million in 2023. In December 2022, the passenger vehicle market in China expanded due to increased retail sales. As per the China Passenger Car Association, ~2.17 million passenger cars were sold through retail channels in December 2022, recording a year-on-year surge of 3%. From January to December 2022, 20.54 million passenger cars were sold in China, i.e., a rise of 1.9% year-on-year. The China Passenger Car Association states that a car-purchase tax cut policy has massively contributed to vehicle sales since its amendment in June 2022. The domestic demand and export capacity of India signifies the strength of its automotive industry. The burgeoning domestic demand can be ascribed to the rising income of people from the middle class and policy support from the Government of India. The automobile sector in the country received a cumulative equity FDI inflow of ~US$ 34.11 billion between April 2000 and December 2022. Several automakers have started investing heavily in various industry segments in India to keep up with the growing demand. In February 2023, Nissan and Renault announced their plan to invest US$ 600 million in India over the next 3–5 years to expand their share in the passenger cars and electric vehicles market.

Nylon 6 compounds are highly used in motorcycle engine protection covers, air pump components, heater housing, electric fan housing, and wheels due to their high strength, rigidity, and dimensional stability. Therefore, the strong growth of the automotive industry drives the demand for nylon 6 compounds in Asia Pacific countries.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Asia Pacific Nylon 6 Compounds Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Asia Pacific Nylon 6 Compounds Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Asia Pacific Nylon 6 Compounds Market Drivers and Opportunities

Growing Demand from Electronics Manufacturing Industry Favors Market Growth

The electronics industry is one of the largest and fastest-growing industries in Asia Pacific. Printers, printer cartridges, cameras, earphones, electronic components, and other electrical devices are manufactured using nylon 6 compounds. These compounds are known for excellent toughness, electrical insulating properties, and good abrasion resistance, making them ideal for fittings, pins, bushings, and structural components in electronics. Moreover, the low coefficient of thermal expansion combined with high wear resistance properties makes it an excellent choice for many electrical insulating, bearing, and wear components. The transition toward electric vehicles has led to rising sales of electrical and electronic components in the automotive manufacturing industry. In addition, the growing demand for durable consumer electronics underlines the demand for high-efficiency materials in their production processes.

China is the largest manufacturing hub of electronics in the world. Factors such as the availability of skilled labor, low labor costs, and prevalent supply chains drive the growth of the electronics industry in this country. The Government of India has also adopted an aggressive approach to position the country as an alternative market to China. According to Invest India, the global electronics manufacturing services market is anticipated to reach US$ 1,145 billion by 2026, at a CAGR of 5.4% during 2021–2026. The India Brand Equity Foundation states that the Indian electronics manufacturing industry is projected to reach US$ 520 billion by 2025. The electronics industry is subject to strict quality standards and regulations to ensure the safety, performance, and reliability of electronic products. Therefore, the burgeoning demand from the thriving electronic industry fuels the nylon 6 compounds market growth.

Growing Awareness of Advantages of Nylon 6 Compounds to Create Significant Opportunities

Nylon 6 is known as the most critical technical thermoplastic. Modifying nylon 6 using fillers, fibers, internal lubricants, impact modifiers, etc., enhances the mechanical properties, heat and chemical resistance, and processability, making it highly acceptable in end-use industries. The addition of fillers for reinforcement plays a vital role in altering the operational properties of nylon 6 compounds. The fillers used for reinforcement include glass fiber, carbon fiber, carbon black, aramid fiber, minerals, PTFE, and molybdenum sulfide. The stiffness of nylon 6 compounds after the inclusion of glass fillers makes them a suitable substitute for metals. The main characteristics of glass fiber reinforced nylon 6 are high rigidity, mechanical strength, excellent degree of hardness and toughness, and high creep strength. They also possess extreme dimensional stability, good fatigue strength, and high mechanical damping properties. All these properties of nylon 6 compounds make them suitable for use in products that are exposed to severe static loads over extended periods in high-temperature conditions.

Carbon fiber increases the strength, rigidity, and dimensional stability of nylon 6 compounds. Carbon black fillers improve resistance to wear, UV, and electrical conductivity of these compounds. Reinforcing nylon 6 with aramid fibers offers extreme tensile strength and heat resistance in application industries. Mineral fillers such as talc and calcium carbonate increase the stiffness and heat deflection temperatures of nylon 6. PTFE and molybdenum sulfide are used as fillers to provide lubricating properties and a low coefficient of friction for bearings, gears, and other sliding applications. Therefore, the penetration of nylon 6 compounds in industries such as automotive, electronics, packaging, and aerospace due to the growing awareness of their extensive properties is expected to offer lucrative opportunities for the Asia Pacific nylon 6 compounds market during the forecast period.

Asia Pacific Nylon 6 Compounds Market Report Segmentation Analysis

The key segment that contributed to the derivation of the Asia Pacific nylon 6 compounds market analysis is the end-use Industry.

- In terms of end-use industry, the market is segmented into automotive, electrical and electronics, packaging, textile, aerospace & defense, and others. The automotive segment held a significant market share in 2023.

Asia Pacific Nylon 6 Compounds Market Share Analysis by Country

The Asia Pacific nylon 6 compounds market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. In terms of value and volume, China accounted for the largest share of the market in 2023, and it is further expected to record the highest CAGR during the forecast period. The nylon 6 compounds market in India is estimated to register a significant CAGR during 2023–2031. The increasing demand for EVs and HEVs in the country drives the Indian market for nylon 6 compounds. Several favorable government initiatives and programs are promoting the adoption of these vehicles. For instance, the Government of India directly finances EV buyers’ reduction in price. The fiscal incentives include the Goods and Service Tax (GST) rate as low as 5%, which is 28% for vehicles with internal combustion engines. Several chemical manufacturers in the country are engaged in expanding their production facilities to meet the surging demand for nylon 6 compounds from the automotive industry. For instance, in March 2022, BASF SE (Gujarat, India) announced an expansion of its Ultramid nylon 6 compound manufacturing capacity. Ultramid finds wide application in the automotive industry. This production capacity expansion helped the company improve its supply chain by shortening its local delivery time and meeting the just-in-time requirements of the OEMs.

Asia Pacific Nylon 6 Compounds Market Regional Insights

The regional trends and factors influencing the Asia Pacific Nylon 6 Compounds Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Asia Pacific Nylon 6 Compounds Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Asia Pacific Nylon 6 Compounds Market

Asia Pacific Nylon 6 Compounds Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2.45 Billion |

| Market Size by 2031 | US$ 3.78 Billion |

| Global CAGR (2023 - 2031) | 5.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By End-Use Industry

|

| Regions and Countries Covered | Asia Pacific

|

| Market leaders and key company profiles |

Asia Pacific Nylon 6 Compounds Market Players Density: Understanding Its Impact on Business Dynamics

The Asia Pacific Nylon 6 Compounds Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Asia Pacific Nylon 6 Compounds Market are:

- Ginar Technology Co Ltd

- Nytex Composites Co Ltd

- Titan Plastics Compounds Co Ltd

- Zig Sheng Industrial Co Ltd

- Eiwa Bussan Co Ltd

- Lanxess AG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Asia Pacific Nylon 6 Compounds Market top key players overview

Asia Pacific Nylon 6 Compounds Market News and Recent Developments

The Asia Pacific nylon 6 compounds market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the market are listed below:

- BASF launched the polyamide 6 made from 100% textile waste, which was turned into a jacket by the renowned clothing brand Zara. (Source: BASF, Press Release, 2024)

- Toray Industries and Honda Motor partnered to develop a chemical recycling technology for glass fiber-reinforced nylon 6 parts from end-of-life vehicles. (Source: Toray Industries, Press Release, 2023)

- DOMO acquired the European Performance Polyamides business from Solvay for producing and commercializing TECHNYL. (Source: DOMO, Press Release, 2023)

Asia Pacific Nylon 6 Compounds Market Report Coverage and Deliverables

The “Asia Pacific Nylon 6 Compounds Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Asia Pacific nylon 6 compounds market size and forecast for all the key market segments covered under the scope

- Asia Pacific nylon 6 compounds market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter’s Five Forces and SWOT analysis

- Asia Pacific nylon 6 compounds market analysis covering key market trends, country framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Asia Pacific nylon 6 compounds market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The soaring demand from the automotive and electronic manufacturing industries fuels the market growth.

In terms of volume, the market is expected to register a CAGR of 5.3% during 2023–2031. In terms of value, it is estimated to record a CAGR of 5.6% during 2023–2031.

Increasing emphasis on recycled nylon 6 compounds is expected to emerge as a future trend in the market.

Ginar Technology Co Ltd, Nytex Composites Co Ltd, Lanxess AG, Ensinger GmbH, and Domo Chemicals GmbH are among the leading market players.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Asia Pacific Nylon 6 Compounds Market

- Ginar Technology Co Ltd

- Nytex Composites Co Ltd

- Titan Plastics Compounds Co Ltd

- Zig Sheng Industrial Co Ltd

- Eiwa Bussan Co Ltd

- Lanxess AG

- Chiao Fu Material Technology Co Ltd

- Chevy Polymer

- Ensinger GmbH

- Domo Chemicals GmbH

Get Free Sample For

Get Free Sample For