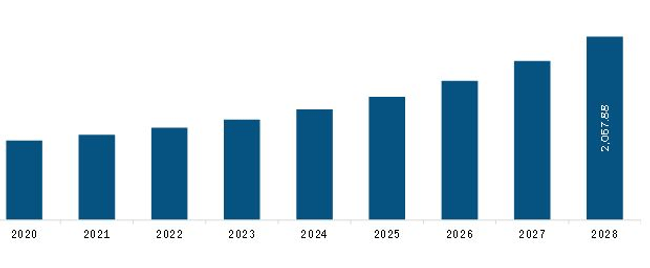

The Asia Pacific semiconductor IP market is expected to grow from US$ 961.6 million in 2021 to US$ 2,067.9 million by 2028; it is expected to register a CAGR of 11.6% from 2021 to 2028.

A majority of the modern SoCs consist of separate blocks of electronic circuit designs that can be highly complex when put together for designing. A semiconductor IP enables the faster, easier, low-cost designing of large and complex chips. The pre-existing blocks of semiconductor IP can be integrated into a large chip that performs different functions. Numerous preexisting blocks are available as semiconductor IPs, including logic gates, memories, register files, datapaths, CPUs, digital signal processors, and single-purpose cores. Significant advancements in technology and a growing focus on designing more single-chip features are driving the market growth. For instance, in November 2021, Arteris IP, a leading provider of system-on-chip (SoC) systems, announced the launch of the Arteris Harmony Trace Design Data Intelligence Solution to ease compliance with functional safety and quality standards of the semiconductor industry. Moreover, in January 2022, US-based semiconductor company AMD has planned to announce 'Ryzen 6000' series of mobile processors based on next-gen 'Zen3+' architecture at the Consumer Electronics Show (CES) 2022. Thus, the growing demand for more advanced chips in various devices and appliances to perform operations in reduced time is driving the semiconductor IP market in Asia Pacific.

Product differentiation and price differentiations have narrowed down in recent times. In such a scenario, the companies look for other factors to help them attract more customers, such as shortening the time-to-market. Automatic test equipment enables quick and efficient testing of products and allows the diagnosis of any anomalies. Identifying anomalies at the initial stages allows manufacturers to take immediate actions to save costs and avoid material wastage. In addition to the growing population across Asia Pacific, the rising incomes and spending capacities of middle-class individuals have bolstered the demands for different products. Thus, the growing pressures for economies of scale while manufacturing and rising spending capacities of individuals boost the integration of semiconductor IP in the semiconductor industry.

With the new features and technologies, vendors attract new customers to grow their footprints in emerging markets. This factor is likely to drive the methanol market. The Asia Pacific semiconductor IP market is expected to grow at a substantial CAGR during the forecast period.

Asia Pacific Semiconductor IP Market Revenue and Forecast to 2028 (US$ Million)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Asia Pacific Semiconductor IP Market Segmentation

The market for Asia Pacific semiconductor IP market is segmented into type, source, and industry vertical. Based on type, the market is segmented into processor sip, interface sip, physical sip, analog sip, and others. Based on source, the Asia Pacific semiconductor IP market is bifurcated into licensing and royalty. Based on industry vertical, the market is segmented into telecom, automotive, industrial, electronics, medical, and others. Based on country, the Asia Pacific semiconductor IP market is segmented into China, Taiwan, Japan, South Korea, and the Rest of Asia Pacific.

Asia Pacific Semiconductor IP Market Companies

ARM Holdings Plc.; Faraday Technology Corporation; CEVA, Inc.; eMemory Technology Inc.; Imagination Technologies Group PLC; Lattice Semiconductor Corporation; Rambus Inc.; Intel Corporation; Xilinx, Inc.; VeriSilicon Holdings Co. Ltd.; Cadence Design Systems, Inc.; Synopsys, Inc.; and Ambit Semiconductors Pvt. Ltd. are among the leading companies operating in the Asia Pacific semiconductor IP market.

Asia Pacific Semiconductor IP Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 961.6 Million |

| Market Size by 2028 | US$ 2,067.9 Million |

| Global CAGR (2021 - 2028) | 11.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Cosmetic Bioactive Ingredients Market

- Non-Emergency Medical Transportation Market

- Hand Sanitizer Market

- Arterial Blood Gas Kits Market

- Smart Grid Sensors Market

- Skin Graft Market

- Single-Use Negative Pressure Wound Therapy Devices Market

- Thermal Energy Storage Market

- Retinal Imaging Devices Market

- EMC Testing Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

- ARM Holdings Plc

- Faraday Technology Corporation

- CEVA, Inc.

- eMemory Technology Inc.

- Imagination Technologies Group PLC

- Lattice Semiconductor Corporation

- Rambus Inc.

- Intel Corporation

- Xilinx, Inc.

- VeriSilicon Holdings Co. Ltd.

- Cadence Design Systems, Inc.

- Synopsys, Inc.

- Ambit Semiconductors Pvt. Ltd.

Get Free Sample For

Get Free Sample For