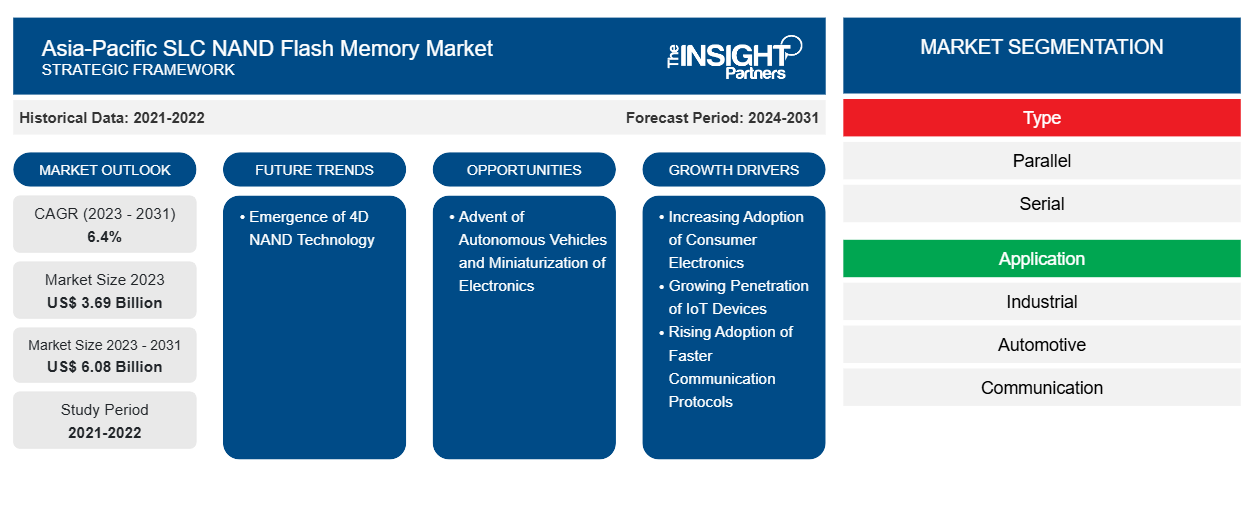

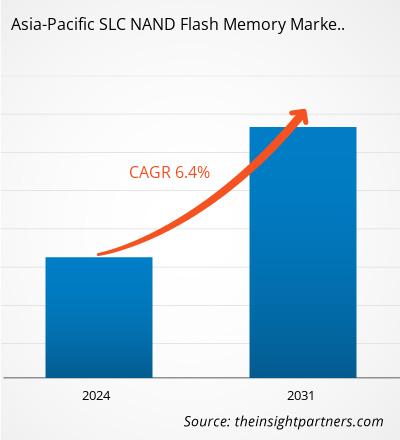

The Asia-Pacific SLC NAND flash memory market size is projected to reach US$ 6.08 billion by 2031 from US$ 3.69 billion in 2023. The market is estimated to record a CAGR of 6.4% during 2023–2031. The emergence of 4D NAND technology is likely to bring trends to the market in the coming years.

Asia-Pacific SLC NAND Flash Memory Market Analysis

The increasing adoption of consumer electronics, rising penetration of IoT devices, and faster communication protocols are a few driving factors in the Asia-Pacific SLC NAND flash memory market. Further, the advent of autonomous vehicles and miniaturization of electronics is expected to create opportunities for the Asia-Pacific SLC NAND flash memory market growth during the forecast period.

Asia-Pacific SLC NAND Flash Memory Market Overview

NAND flash memory is nonvolatile and stores data even when the power is turned off. This makes NAND an excellent choice for internal, external, and portable devices. There are several types of NAND; the single-level cell (SLC) NAND provides the best performance and the highest endurance with a 100,000 program/erase cycle (P/E cycle). SLC NAND stores only 1 bit of information per cell. The cell stores either a 0 or 1; as a result, the data can be written and retrieved faster, which makes it last longer than the other types of NAND. Further, the high endurance of SLC NAND makes it ideal for a broad range of consumer and industrial applications that require dependable and long-lasting supply. Internet of Things (IoT) devices, automobiles, networking equipment, set-top boxes, DSL and cable modems, digital television, mobile phones, printers, and other industrial products are equipped with SLC NAND flash memory. Because of its higher reliability, SLC NAND flash memory has found application in enterprises requiring high performance and data integrity, such as industrial automation, medical devices, and aviation systems. A few major advantages of SLC NAND flash memory are the longest erase and program cycle lifespan, rapid read and write speeds, and lower probability of read/write errors.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Asia-Pacific SLC NAND Flash Memory Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Asia-Pacific SLC NAND Flash Memory Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Asia-Pacific SLC NAND Flash Memory Market Drivers and Opportunities

Increasing Adoption of Consumer Electronics to Favor Market

Asia Pacific has witnessed a remarkable surge in the adoption of consumer electronics. As per the International Trade Administration (ITA) Southeast Asia Region eCommerce Forecast 2020–2027, consumer electronics continues to lead the region’s soaring e-commerce revenue growth. According to the World Economic Forum, as of January 2023, India had more than 700 million smartphone users, 425 million of whom lived in rural areas. More than 50% of the population in the region uses smartphones, and the number of active internet users has increased by 45% since 2019, putting rural India at the forefront of the world's smart revolution. As per the International Trade Administration (ITA), the market for healthcare IT, including wearable healthcare equipment (such as smartwatches), is expected to reach 16 billion by 2025.

A few of the major factors driving the demand for consumer electronics in Asia Pacific are the rising disposable incomes of consumers, technological advancements, and a growing need for digital connectivity. Major countries such as India, China, and Japan experienced a rise in consumer disposable income in 2023 compared to 2022, according to Trading Economics. In addition, rapid urbanization in the region led to the adoption of consumer electronics. According to the India Brand Equity Foundation (IBEF), the premiumization trend has accelerated in the consumer electronics sector, which led to a significant rise in smartphone, appliance, and television sales in the first half of 2024.

Advent of Autonomous Vehicles

The automotive sector is taking huge measures to transform the driving experience for its users. In the last few years, electric vehicles have attracted consumers, coupled with government support, due to the environmentally friendly nature of these cars. Automobiles are becoming smarter and more capable of self-diagnostics, with the launch of advanced driver assistant systems (ADAS), infotainment systems, and car telematics, which further support connectivity within automobiles. At present, the penetration of automated cars is moderately low in Asia Pacific, which is projected to spur in the coming years. The growth in super-intelligent autonomous cars, especially in developing economies such as India and China, is rising owing to increasing incidences of fatal car crashes. Also, connected cars offer innovative safety features integrated with ADAS and other connected car technologies. Next-generation infotainment systems and ADAS will be integrated with memory technologies, offering higher performance and low power consumption capabilities. For effective implementation and functioning of the advanced connected car technologies, the manufacturers require memory technology that supports the advanced technologies as well as the flexibility to support fluctuating data rates. Therefore, the advent of autonomous vehicles is expected to create numerous opportunities for the Asia Pacific SLC NAND flash memory market growth during the forecast period.

Asia-Pacific SLC NAND Flash Memory Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Asia-Pacific SLC NAND flash memory market analysis are type, application, and density.

- Based on type, the Asia-Pacific SLC NAND flash memory market is divided into series and parallel. The parallel segment dominated the market in 2023.

- By application, the Asia-Pacific SLC NAND flash memory market is segmented into automotive, industrial, communication, computers and IT, consumer electronics, and others. The industrial segment held the largest share of the market in 2023.

- In terms of density, the Asia-Pacific SLC NAND flash memory market is categorized into 1GB, 2GB, 4GB, 8GB, and above 8GB. The above 8GB segment dominated the market in 2023.

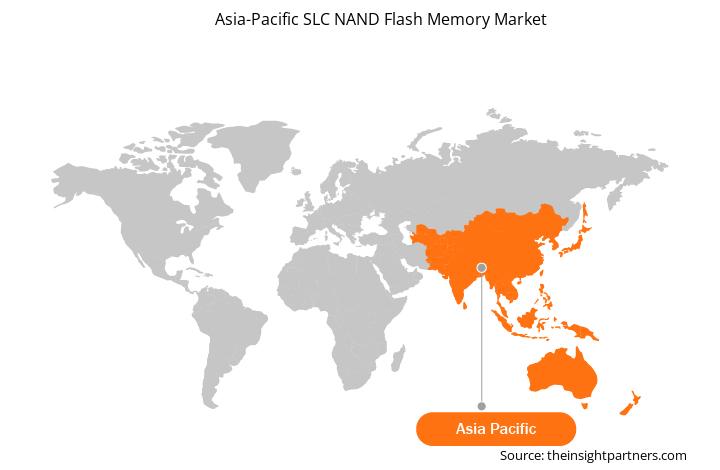

Asia-Pacific SLC NAND Flash Memory Market Share Analysis by Geography

The Asia-Pacific SLC NAND flash memory market is segmented into India, China, Japan, South Korea, Australia, and the Rest of Asia Pacific. In terms of revenue, China held the largest share of the market in 2023. Asia Pacific is the manufacturing hub for semiconductors. According to the Asian Development Bank, East and Southeast Asia account for over 80% of the world's semiconductor output. This growth is critical for technological advancement, which makes the world reliant on the region's semiconductor exports. Asia Pacific is the exporter of SLC NAND technology. Also, the region's economic prospects are dependent on global semiconductor demand. In addition, the presence of market players such as SkyHigh Memory Limited; Micron Technology, Inc.; Toshiba Corporation; etc., supports the Asia Pacific SLC NAND flash memory market growth.

Asia-Pacific SLC NAND Flash Memory Market Regional Insights

The regional trends and factors influencing the Asia-Pacific SLC NAND Flash Memory Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Asia-Pacific SLC NAND Flash Memory Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Asia-Pacific SLC NAND Flash Memory Market

Asia-Pacific SLC NAND Flash Memory Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 3.69 Billion |

| Market Size by 2031 | US$ 6.08 Billion |

| Global CAGR (2023 - 2031) | 6.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

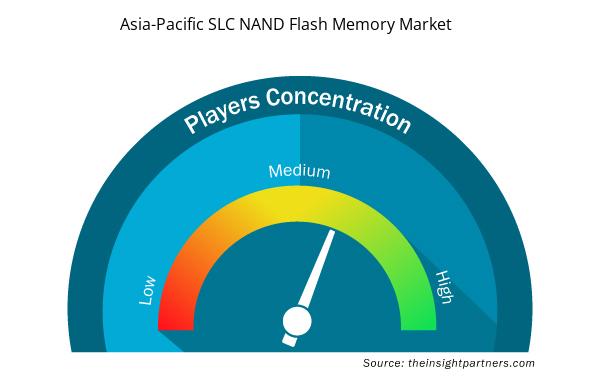

Asia-Pacific SLC NAND Flash Memory Market Players Density: Understanding Its Impact on Business Dynamics

The Asia-Pacific SLC NAND Flash Memory Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Asia-Pacific SLC NAND Flash Memory Market are:

- Micron Technology Inc

- KIOXIA Corporation

- Samsung Electronics Co Ltd

- Winbond Electronics Corp

- SkyHigh Memory Ltd

- Macronix International Co., Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Asia-Pacific SLC NAND Flash Memory Market top key players overview

Asia-Pacific SLC NAND Flash Memory Market News and Recent Developments

The Asia-Pacific SLC NAND flash memory market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the Asia-Pacific SLC NAND flash memory market are listed below:

- Kioxia Corporation, a world leader in memory solutions, announced that the building construction of Fab2 (K2) of its industry-leading Kitakami Plant was completed in July. K2 is the second flash memory manufacturing facility at the Kitakami Plant in the Iwate Prefecture of Japan. As demand is recovering, the company will gradually make capital investments while closely monitoring flash memory market trends. Kioxia plans to start operation at K2 in the fall of the Calendar Year 2025.

(Source: Kioxia Corporation, Press Release, August 2024)

- Samsung Electronics Co., Ltd., the world leader in advanced memory technology, announced it has successfully developed the industry’s first PCIe 4.0 automotive SSD based on eighth-generation vertical NAND (V-NAND). With industry-leading speeds and enhanced reliability, the new auto SSD, AM9C1, is an optimal solution for on-device AI capabilities in automotive applications. Built on Samsung’s 5-nanometer (nm) controller and providing a single-level cell (SLC) Namespace2 feature, the AM9C1 demonstrates high performance for easier access to files with heavy data.

(Source: Samsung Electronics Co., Ltd, Press Release, September 2024)

Asia-Pacific SLC NAND Flash Memory Market Report Coverage and Deliverables

The "Asia-Pacific SLC NAND Flash Memory Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Asia-Pacific SLC NAND flash memory market size and forecast at regional and country levels for all the key market segments covered under the scope

- Asia-Pacific SLC NAND flash memory market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Asia-Pacific SLC NAND flash memory market analysis covering key market trends, regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Asia-Pacific SLC NAND flash memory market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Application, Density

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, China, Japan, South Korea

Frequently Asked Questions

The Asia-Pacific SLC NAND flash memory marketis expected to reach US$ 6.08 billion by 2031.

The key players holding majority shares in the Asia-Pacific SLC NAND flash memory market is Samsung; KIOXIA; Micron Technology, Inc.; SK hynix Inc; and Winbond.

The incremental growth expected to be recorded for the Asia-Pacific SLC NAND flash memory market during the forecast period is US$ 2.38 billion.

The Asia-Pacific SLC NAND flash memory market was estimated to be US$ 3.69 billion in 2023 and is expected to grow at a CAGR of 6.4 % during the forecast period 2023 – 2031.

Emergence of 4D NAND technologyis anticipated to play a significant role in the Asia-Pacific SLC NAND flash memory market in the coming years.

Increasing adoption of consumer electronics, growing penetration of IoT devices, and rising adoption of faster communication protocols are the major factors that propel the Asia-Pacific SLC NAND flash memory market.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Asia Pacific SLC NAND Flash Memory Market

- Micron Technology Inc

- KIOXIA Corporation

- Samsung Electronics Co Ltd

- Winbond Electronics Corp

- SkyHigh Memory Ltd

- Macronix International Co., Ltd

- Flexxon Pte Ltd

- Greenliant Systems

- UNIM Innovation (Wuxi) Co.,Ltd.

- Shanghai Fudan Microelectronics Group Co., Ltd.

- Western Digital Corp

- Kingston Technology Co Inc

Get Free Sample For

Get Free Sample For