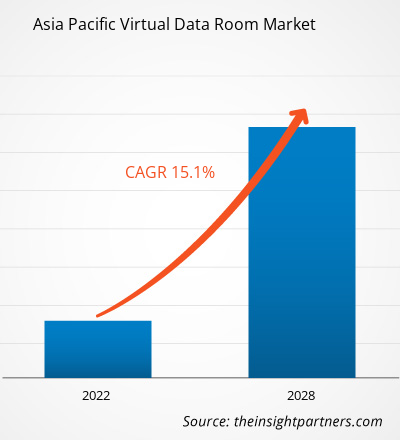

The Asia Pacific virtual data room market is expected to grow from US$ 303.18 million in 2021 to US$ 934.67 million by 2028; it is estimated to grow at a CAGR of 15.1% from 2021 to 2028.

Merger & acquisition activities are gaining widespread popularity in the corporate environment. In the past few years, corporate players from leading industries have witnessed a pragmatic rise in deals. Merger & acquisition are critical tools for corporate executives in achieving their short- and long-term strategic objectives. M&A project transactions were primarily driven by megadeals deals, which are higher than US$10 billion in size. Merger & acquisition activities are stimulating across international and strategic private equity, domestic deals, and multiple industries. In Q2 2021, the technology services industry recorded the highest number of merger & acquisition deals, followed by financial and commercial services and health services. The most notable growth drivers for merger & acquisition activities have been continued from prior years, including recovering cash flows, low cost of debt, strengthening balance sheets, positive growth, investor support, and CEO confidence. The rising importance and demand for effective implementation of mergers and acquisitions are, thus, bolstering the growth of key market players in the virtual data room market.The COVID-19 pandemic has drastically impacted ICT budgets of major companies in Asia Pacific. According to various reports, countries in the region are experiencing 5–7% decline in ICT expenditure. However, senior decision makers continue to consider technology investments as a feasible way to help steer their organizations through COVID-19. According to a report by Asian Development Bank, digital platforms, including technology-based tools provide vast growth opportunities for business of different sizes in Asia Pacific, which can significantly result in a sustainable recovery from the adverse effects of the pandemic. Industry experts claim that countries in this region have gained from rapid technological progress and digitalization.

With the new advancements and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the Asia Pacific virtual data room market. M&A activities are gaining widespread popularity in the corporate environment. In the past few years, corporate players from leading industries have witnessed a pragmatic rise in deals. M&A are critical tools for corporate executives in achieving their short- and long-term strategic objectives. M&A activities are stimulating across international and strategic private equity, domestic deals, and multiple industries. In Q2 2021, the technology services industry recorded the highest number of M&A deals, followed by financial and commercial services and health services. The most notable growth drivers for M&A activities have been continued from prior years, including recovering cash flows, low cost of debt, strengthening balance sheets, positive growth, investor support, and CEO confidence. The rising importance and demand for effective implementation of mergers and acquisitions are, thus, bolstering the growth of key market players in the virtual data room market.

Asia Pacific Virtual Data Room Market Revenue and Forecast to 2028 (US$ Million)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Asia Pacific Virtual Data Room Market Segmentation

Asia Pacific Virtual Data Room Market – By Component

- Software

- Service

Asia Pacific Virtual Data Room Market – By Deployment

- On - Premises

- Cloud

Asia Pacific Virtual Data Room Market – By Organization Size

- SMEs

- Large Enterprises

Asia Pacific Virtual Data Room Market – By Business Function

- Merger & Acquisition

- Finance

- Marketing and Sales

- Compliance and Legal

- Workforce Management

- Others

Asia Pacific Virtual Data Room Market – By End User

- BFSI

- IT & telecommunication

- Healthcare

- Energy & Power

- Retail

- Others

Asia Pacific Virtual Data Room Market – By Country

- Australia

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

Asia Pacific Virtual Data Room Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 303.18 Million |

| Market Size by 2028 | US$ 934.67 Million |

| Global CAGR (2021 - 2028) | 15.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

- Ansarada Group Limited

- BMC Group, Inc.

- Brainloop AG

- CapLinked

- EthosData

- iDeals Solutions Group

- Intralinks, Inc.

- Datasite

- Thomson Reuters Corporation

- Donnelley Financial Solutions, Inc.

Get Free Sample For

Get Free Sample For