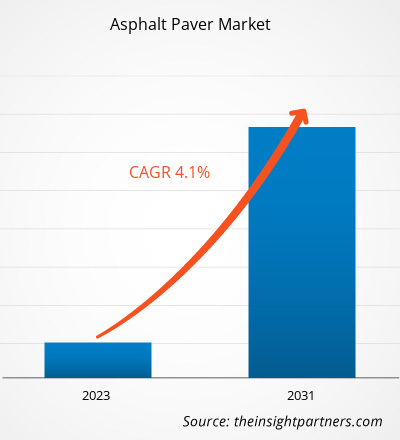

The asphalt paver market size is projected to reach US$ 3,118.04 million by 2031 from US$ 2,261.12 million in 2023. The market is expected to register a CAGR of 4.1% during 2023–2031. Growing development and emergence of electric asphalt pavers is likely to remain key trend in the market.

Asphalt Paver Market Analysis

Continuous growth in road construction projects across the world is one of the factors driving the demand for asphalt pavers. Developing as well as developed nations across the globe are investing heavily in the upgradation and construction of the transportation infrastructure. In 2024, the US government invested ∼US$ 300 billion in repairing and reconstructing roads and bridges in the country. Further, as per official government data in 2024, according to the 2030 Federal Transport Infrastructure Plan, the federal government of Germany is investing ∼US$ 147.6 billion in the improvement and new construction of road infrastructure. According to the data published by the Indian government in 2023, the road infrastructure industry in the country witnessed a 20% growth in investments during 2022–2023 compared to 2021–2022. Such investments in the road construction industry drive the demand for road construction machines, including asphalt pavers machines.

Asphalt Paver Market Overview

Asphalt pavers are one of the road construction equipment that is used to distribute the asphalt and concrete evenly. Asphalt Paver is mainly used for the development of roadways, parking lots, and walking paths. Most of the machines are self-propelled. However, some machines are towed by dump trucks.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Asphalt Paver Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Asphalt Paver Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Asphalt Paver Market Drivers and Opportunities

Increasing Urbanization with Government Investments in Highways Construction Drives Market Growth

According to the updated list of urban areas provided by the US Census Bureau in December 2022, the urban population in the US increased by 6.4% between 2010 and 2020. Urban areas have become denser, with an average population density rising from 2,343 in 2010 to 2,553 in 2020. The West region of the US remained the most urbanized region among the country's four census areas, with 88.9% of its inhabitants living in cities, followed by the Northeast region with 84.0%. According to the figures revealed by the United Nations, the percentage of the population that resided in cities was 80.8% in 2022 (i.e., accounting for 37.5 million people), which increased to 82% in 2023. Such a rapid increase in urban population has created a massive demand for road development in urban cities. Asphalt pavers play a major role in the road infrastructure development in the urban areas. Thus, the growing urbanization with significant investments in infrastructure rebuilding across the world bolsters the asphalt paver market growth.

Technological Advancements in Asphalt Pavers

Several major asphalt paver manufacturers have introduced new machines and systems that can optimize operations. The improved operating functions of the BOMAG paver BF 800 C-2 are intended to help improve performance and efficiency on the construction site. A key development is the new traffic light system that helps improve communication between the paver operator and the asphalt delivery truck driver. This ensures a consistent feed of material into the hopper and shows the truck driver when the hopper is full. In June 2021, BOMAG launched its new range of asphalt pavers, including BF 600 C-3, BF 600 P-3, and BF 800-C3, equipped with the latest technology. BOMAG's new generation of general-purpose and highway pavers is equipped with the company's Advanced Pave system, a digital co-pilot for pavers. It is being offered worldwide. The digital co-pilot allows the driver to control the machine efficiently, increasing productivity and enabling quick completion of asphalt paving. Control elements embedded in the armrests provide the operator with all important functions and thus enable greater concentration on the installation work. Thus, technological advancements integrated into the asphalt pavers are anticipated to create opportunities for the key players operating in the global asphalt pavers market during the forecast period.

Asphalt Paver Market Report Segmentation Analysis

Key segments that contributed to the derivation of the asphalt paver market analysis are type and paving width.

- Based on type, the asphalt paver market is bifurcated into wheeled asphalt pavers and tracked asphalt pavers. The tracked asphalt pavers segment held a larger market share in 2023.

- By paving width, the market is segmented into below 2.5-meter, 2.5 meter to 5 meter, and above 5 meters. The above 5 meter segment held the largest market share in 2023.

Asphalt Paver Market Share Analysis by Geography

The geographic scope of the asphalt paver market report is mainly divided into five regions: North America, Asia Pacific, Europe, the Middle East & Africa, and South & Central America.

Asia Pacific is expected to register the highest CAGR in the global asphalt paver market during the forecast period. In 2023, The Ministry of Transport of China provided investments worth US$ 507 million. The government of China improved and upgraded 7,000 highways in 2023. In addition, the country renovated ∼160,000 km of rural roads. Governments of South Asian countries such as Malaysia, Indonesia, and the Philippines are also making notable investments in road construction. For instance, in 2024, NLEX Corporation announced three new projects in the Philippines. The first project includes the widening of a 5 km road, the second project includes the construction of a 2 km expressway, and the third project is an expansion of NLEX San Fernando to SCTEX Spur. Further, in 2024, the Government of Indonesia announced the largest infrastructure budget of the country, amounting to US$ 26.48 billion, including road infrastructure development and upgradation costs.

The rise in public and private investments in infrastructure development propels the asphalt pavers market growth in India. For instance, in the 2024 interim of India, the Finance Ministry announced three new projects amounting to US$ 11.56 million. Moreover, the continuous undertaking of infrastructure projects in Saudi Arabia, the UAE, and other countries in the Middle East is expected to generate notable opportunities for the asphalt paver market in the coming years. As per the information provided by the US government in 2023, the Government of the UAE is taking initiatives for its economic diversification. In addition, the UAE is involved in various regulatory reforms to increase private investments. Thus, these initiatives have created a favorable environment for global infrastructure service providers, contractors, and construction earth-moving machine manufacturers to expand their business in the country.

The US, Canada, and Mexico are major nations contributing to the continuous development of the construction sector in North America. Government focus in the abovementioned countries on developing roads and bridges to advance connectivity in remote locations propels the demand for asphalt pavers in the region. In 2023, the Bipartisan Infrastructure Law by the Federal Transit Administration funded over US$ 300 billion for projects meant to rebuild and repair roads and bridges in the US. In 2023, it also provided financial aid of US$ 25 billion to renovate and upgrade airports and US$ 17 billion to improve US ports and waterways. Thus, growing government inclination toward infrastructure development is anticipated to drive the growth of the US asphalt paver market.

The high presence of asphalt paver manufacturers such as Caterpillar Inc. and Astec Industries, Inc. (Roadtec) is contributing to the asphalt paver market growth in North America. In 2022, Caterpillar Inc. declared updates to its high-end asphalt paver line. The new Cat AP600, AP1000, AP655, and AP1055 are a few of the asphalt pavers in the overall product line of Caterpillar. In 2023, LeeBoy and Portable Electric (PE) announced working together to electrify the asphalt paving industry.

Asphalt Paver Market Regional Insights

The regional trends and factors influencing the Asphalt Paver Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Asphalt Paver Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Asphalt Paver Market

Asphalt Paver Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2,261.12 Million |

| Market Size by 2031 | US$ 3,118.04 Million |

| Global CAGR (2023 - 2031) | 4.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

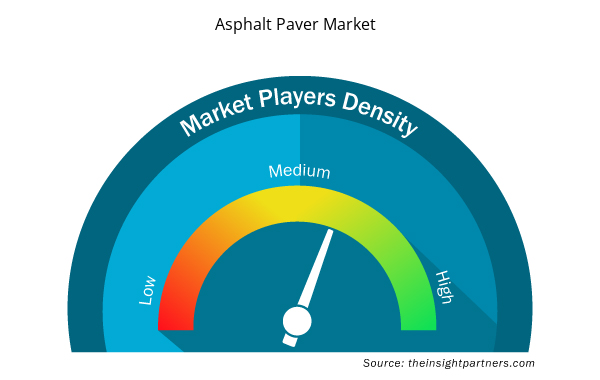

Asphalt Paver Market Players Density: Understanding Its Impact on Business Dynamics

The Asphalt Paver Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Asphalt Paver Market are:

- AB Volvo

- Astec Industries Inc.

- Caterpillar Inc.

- Sany Heavy Industry Co Ltd.

- Sumitomo Corp.

- S.P Enterprise

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Asphalt Paver Market top key players overview

Asphalt Paver Market News and Recent Developments

The asphalt paver market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the asphalt paver market are listed below:

- Astec announced the debut of a new, modern operator control system on all Roadtec RP-series highway-class asphalt pavers. The RP paver line has been updated with operator controls that provide a compact, modern feel and improved functionality. All highway-class asphalt pavers are now outfitted with an innovative digital control system and easy-to-understand touchscreen interface. Source: Astec Industries, Inc., Press Release, March 2022)

Asphalt Paver Market Report Coverage and Deliverables

The “Asphalt Paver Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Asphalt paver market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Asphalt paver market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Asphalt paver market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the asphalt paver market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- EMC Testing Market

- Microcatheters Market

- Artificial Intelligence in Healthcare Diagnosis Market

- Machine Condition Monitoring Market

- Surgical Gowns Market

- Predictive Maintenance Market

- Trade Promotion Management Software Market

- Online Exam Proctoring Market

- Grant Management Software Market

- Authentication and Brand Protection Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Asia Pacific is expected to register the highest CAGR in the global asphalt paver market during the forecast period. In 2023, The Ministry of Transport of China provided investments worth US$ 507 million. The government of China improved and upgraded 7,000 highways in 2023. In addition, the country renovated approximately 160,000 km of rural roads. Governments of South Asian countries such as Malaysia, Indonesia, and the Philippines are also making notable investments in road construction.

AB Volvo, Astec Industries Inc., Caterpillar Inc., Sany Heavy Industry Co Ltd., Sumitomo Corp., S.P Enterprise, XCMG Construction Machinery Co Ltd., Deere & Co, FAYAT GROUP and Leeboy are the key market players operating in the global asphalt paver market.

Several major asphalt paver manufacturers have introduced new machines and systems that can optimize operations. The improved operating functions of the BOMAG paver BF 800 C-2 are intended to help improve performance and efficiency on the construction site. A key development is the new traffic light system that helps improve communication between the paver operator and the asphalt delivery truck driver. This ensures a consistent feed of material into the hopper and shows the truck driver when the hopper is full. In June 2021, BOMAG launched its new range of asphalt pavers, including BF 600 C-3, BF 600 P-3, and BF 800-C3, equipped with the latest technology.

Growing urbanization with significant investments in infrastructure rebuilding across the world is the major driving factor for the asphalt paver market. According to the updated list of urban areas provided by the US Census Bureau in December 2022, the urban population in the US increased by 6.4% between 2010 and 2020. Urban areas have become denser, with an average population density rising from 2,343 in 2010 to 2,553 in 2020. The West region of the US remained the most urbanized region among the country's four census areas, with 88.9% of its inhabitants living in cities, followed by the Northeast region with 84.0%. According to the figures revealed by the United Nations, the percentage of the population that resided in cities was 80.8% (i.e., accounting for 37.5 million people), which increased to 82% in 2023. Such a rapid increase in urban population has created a massive demand for road development in urban cities. Asphalt pavers play a major role in the road infrastructure development in the urban areas.

The construction industry, associated with noise, emissions, and environmental impact, is undergoing a shift toward sustainability and a lower carbon footprint in response to the global call for greener building practices. Electric asphalt pavers can offer various benefits, such as reduced carbon emissions, reduced noise, and low maintenance costs. Several key companies in the market are engaged in the development of electric asphalt pavers. In April 2023, LeeBoy developed and introduced the first electric asphalt paver, named 8520C E-Paver, as a prototype model. This product is developed by the use of General Motors's (GM's) electric drive system. The prototype model runs on a 48-kWh battery and 150 kW electric drive motor.

Trends and growth analysis reports related to Manufacturing and Construction : READ MORE..

The List of Companies - Asphalt Paver Market

- AB Volvo

- Astec Industries Inc.

- Caterpillar Inc.

- Sany Heavy Industry Co Ltd.

- Sumitomo Corp.

- S.P Enterprise

- XCMG Construction Machinery Co Ltd.

- Deere & Co

- FAYAT GROUP

- Leeboy

Get Free Sample For

Get Free Sample For