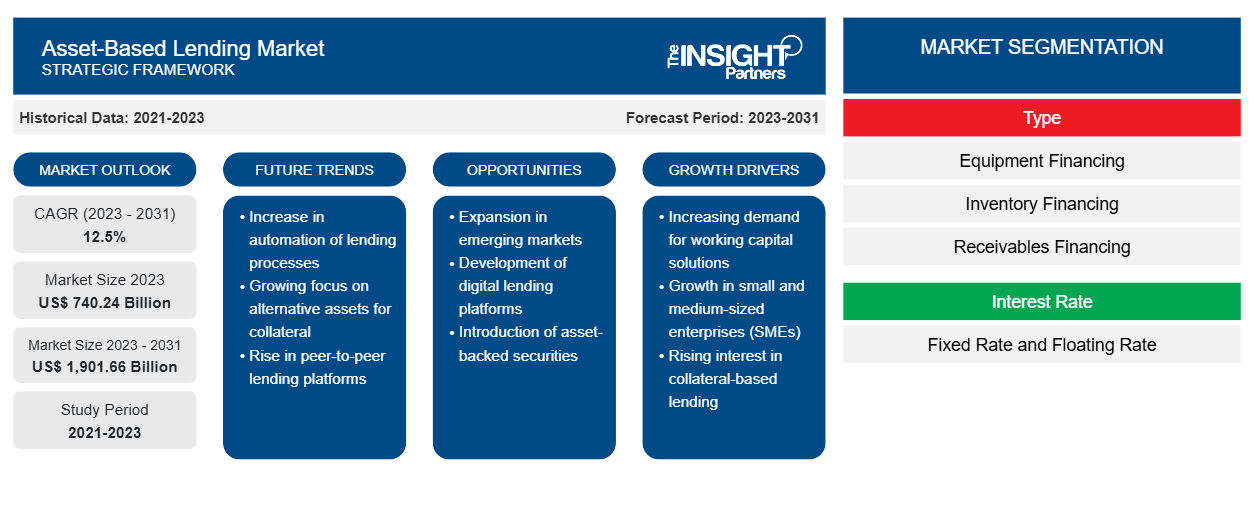

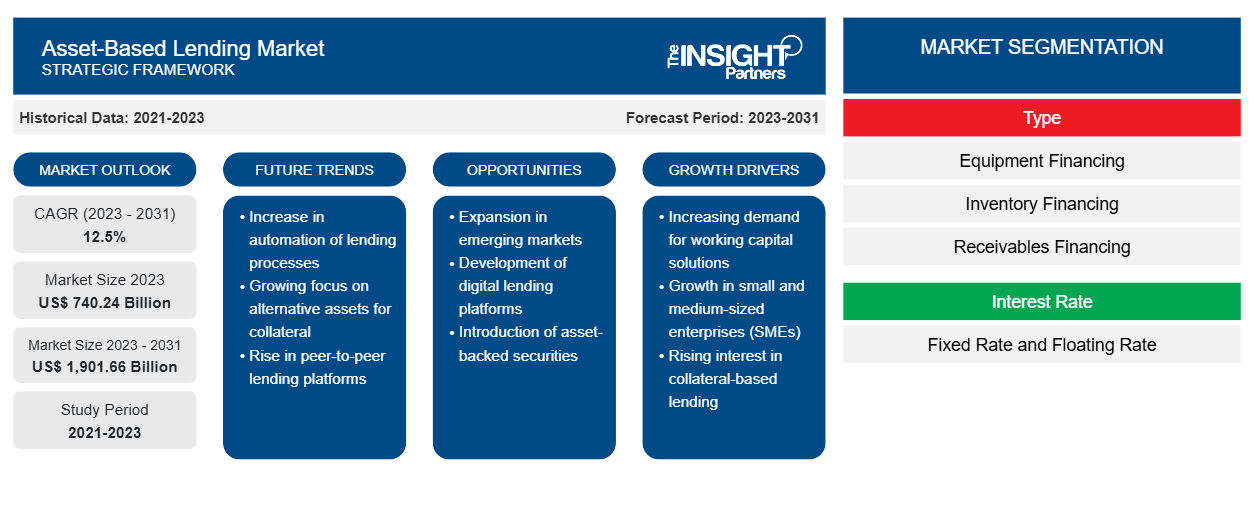

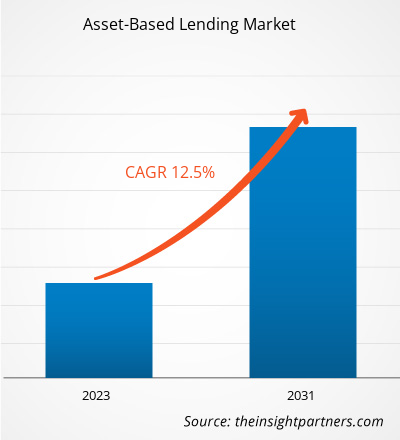

The asset-based lending market size is expected to grow from US$ 740.24 billion in 2023 to US$ 1,901.66 billion by 2031; it is anticipated to expand at a CAGR of 12.5% from 2023 to 2031. Easier qualification criteria for asset-based lending are expected to offer high growth opportunities.

Asset-Based Lending Market Analysis

Asset-based lending is a large asset class that reaches across many different segments of the economy. The ongoing disintermediation of traditional bank financing and technological innovation has spurred rapid growth in recent years, and the trend is expected to continue. Traditional business financing, which evaluates a company's cash flow, is effective for many businesses. However, some companies may be eligible for additional borrowing based on their owned assets. This alternative approach, known as asset-based lending, is more suitable for them. Asset-based lending market solutions allow a wide range of assets, including accounts receivable, brand names, real estate, and intellectual property, to be used as collateral, providing access to vital capital. For businesses with substantial assets, asset-based lending offers significant financing options with a flexible structure that allows for future decision-making. Moreover, special arrangements like FILO (first in, last out) tranches can increase the borrowing capacity.

Asset-Based Lending

Industry Overview

- Lenders favor highly liquid collateral, such as securities, which can converted to cash easily, for times when the borrower defaults on the payments. Loans against physical assets are deemed riskier, and hence, the maximum loan is often less than the book value of the assets.

- There are wide variations in Interest rates, depending on the applicant's credit history, length of time doing business, and cash flow. The collateral-based cash flows that asset-based lending generates are also important in a time of high inflation and macroeconomic uncertainty. The underlying collateral has a tangible value, and the cash flows attached to that collateral are often contractual in nature.

- Moreover, the replacement value of physical collateral tends to rise along with prices in the broader economy.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Asset-Based Lending Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Asset-Based Lending Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Asset-Based Lending Market Drivers and Opportunities

Private Asset-Based Lending to Drive the Asset-Based Lending Market Growth

- The notable speed at which private asset-based lending surged in the outcome of the global financial crisis can be contemplated as a sign of the ongoing structural shift.

- The disintermediation of traditional financial channels has been critical to the growth of private asset-based lending over the last few years. Post the financial crisis, several central banks of different developed nations bought mortgage-backed securities to inject liquidity into the market and restore confidence, while also raising reserve requirements and clamping down on risk-taking. It led to levying higher capital charges on non-mainstream lending.

- The banks responded by lowering their loan books and extending credit to long-established customers on routine terms. It led to the non-availability of funding for several creditworthy consumers and, in turn, increased demand for private asset-based lending.

- With the ongoing economic turmoil, the above-mentioned trend is anticipated to offer good opportunities for asset-based lending market growth.

Asset-Based Lending

Market Report Segmentation Analysis

- Based on the interest rate, the market is bifurcated into a fixed rate and floating rate.

- The fixed-rate segment achieved the highest asset-based lending market share in 2023. It can be attributed to fixed-rate loan's principal benefit of shielding the borrower against unexpected and possibly large increases in monthly payments during sudden spikes in interest rates. Furthermore, loans with fixed rates can be comprehended easily and showcase lesser variation between lenders.

Asset-Based Lending

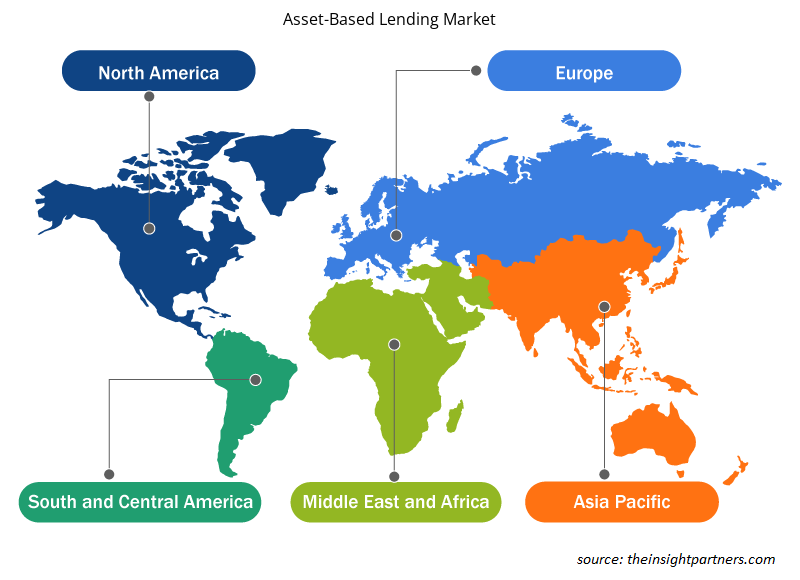

Market Share Analysis By Geography

The scope of the asset-based lending market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. Asia Pacific (APAC) is experiencing rapid growth, but North America is anticipated to hold the largest asset-based lending market share. APAC’s significant economic development and growing interest in trading have presented substantial opportunities for asset-based lending to expand. In the US, non-bank lenders have extended asset-based lending against more than 20% of assets available as collateral. Such trends promote the market growth in North America.

Asset-Based Lending

Asset-Based Lending Market Regional Insights

The regional trends and factors influencing the Asset-Based Lending Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Asset-Based Lending Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Asset-Based Lending Market

Asset-Based Lending Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 740.24 Billion |

| Market Size by 2031 | US$ 1,901.66 Billion |

| Global CAGR (2023 - 2031) | 12.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Asset-Based Lending Market Players Density: Understanding Its Impact on Business Dynamics

The Asset-Based Lending Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Asset-Based Lending Market are:

- Barclays Bank

- Berkshire Bank

- Capital Funding Solutions

- Crystal Financial

- Hilton-Baird

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Asset-Based Lending Market top key players overview

The "Asset-Based Lending Market Analysis" was carried out based on type, interest rate, organization size, and geography. In terms of type, the market is segmented into equipment financing, inventory financing, receivables financing, and others. Based on the interest rate, the market is bifurcated into a fixed rate and floating rate. In terms of organization size, the market is bifurcated into SMEs and large enterprises. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asset-Based Lending

Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the asset-based lending market. A few recent key market developments are listed below:

- In March 2024, Praetura Commercial Finance – together with sister company Zodeq –secured a £200m asset-based lending securitization facility provided by Barclays to boost support for SMEs across the UK. The Barclays facility enhances Praetura’s ability to meet rising demand for alternative lending, with the business expecting to support over 1,000 additional SMEs each year.

[Source: Praetura Commercial Finance, Company Website]

- In October 2023, Solifi, a global fintech software partner for secured finance, announced the latest product enhancements for Solifi asset-based lending. The release includes several new features aimed at improving efficiency through automation, reporting, and customer experience. The company’s SaaS Open Finance Platform enables the rapid release of new features that improve communication between lenders and borrowers. These new features reduce the requirement for manual reporting while bringing innovation to the company’s asset-based lending and receivables financing lenders and customers without disruption to their business.

[Source: Solifi, Company Website]

Asset-Based Lending

Market Report Coverage & Deliverables

The market report on “Asset-Based Lending Market Size and Forecast (2021–2031)”, provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country- level for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- High Speed Cable Market

- Advanced Planning and Scheduling Software Market

- Educational Furniture Market

- Rare Neurological Disease Treatment Market

- Online Exam Proctoring Market

- Frozen Potato Market

- Mesotherapy Market

- Grant Management Software Market

- Nitrogenous Fertilizer Market

- Micro-Surgical Robot Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Interest Rate, Organization Size and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players holding the majority of shares in the global asset-based lending market are Barclays Bank, Berkshire Bank, Capital Funding Solutions, JPMorgan Chase & Co, and Wells Fargo.

The global market is expected to reach US$ 1,901.66 billion by 2030.

The global market was estimated to be US$ 740.24 billion in 2023 and is expected to grow at a CAGR of 12.5 % during the forecast period 2023 - 2031.

The growth of private asset-based lending is expected to play a significant role in the market in the coming years.

Easier qualifications and easy access to loans are the major factors that propel the global asset-based lending market.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Barclays Bank

- Berkshire Bank

- Capital Funding Solutions

- Crystal Financial

- Hilton-Baird

- JPMorgan Chase and Co

- Lloyds Bank

- Porter Capital

- Wells Fargo

- White Oak Financial

Get Free Sample For

Get Free Sample For