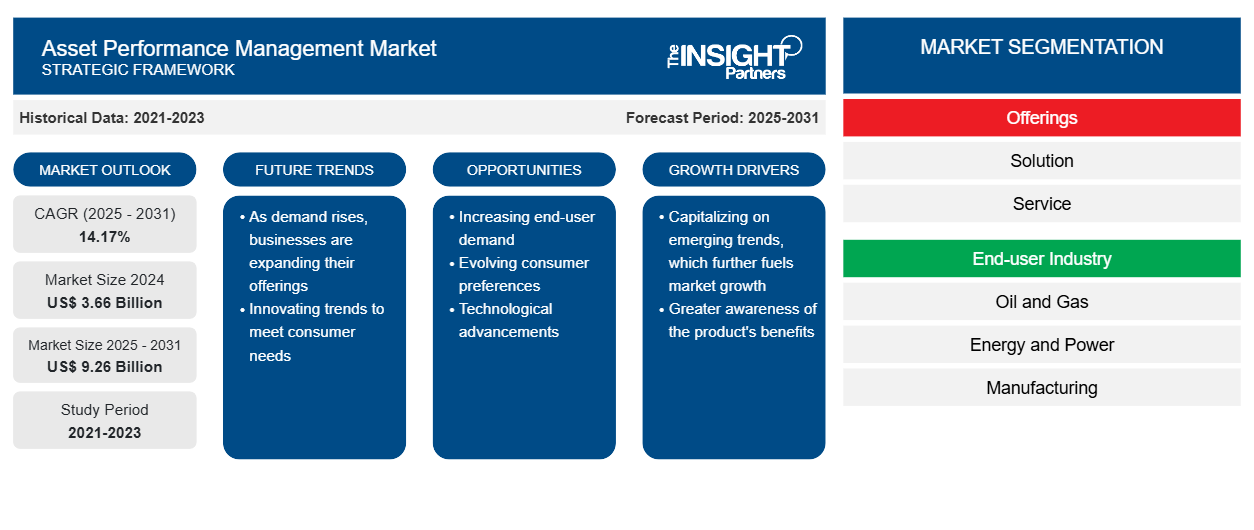

[Research Report] The asset performance management market is expected to grow from US$ 2.81 billion in 2022 to US$ 8.11 billion by 2031; it is estimated to grow at a CAGR of 14.17% from 2022 to 2031.

Analyst Perspective:

Modern asset performance management solutions go beyond traditional machine monitoring and manual data-gathering methods. By merging innovative machine modeling techniques with modern analytics, these solutions provide users with detailed real-time information about machinery/asset availability and maintenance planning based on the most recent data, enabling them to run the facility more efficiently. The development of technologies such as machine learning, IIoT, blockchain, digital twin, and AI is expected to improve the efficiency of asset performance management systems by facilitating the development of innovative solutions and management software, thereby driving the growth prospects of the asset performance management market.

The recent shift in the technological trend of the industrial sector has been among the key driving factors behind the growing acceptance of these technologies. Industry 4.0 is all about using advanced technologies to streamline the industrial sector's traditional operations to prepare them for the next phase of the industrial revolution. Furthermore, these solutions have also been highly effective in helping organizations reduce the total cost of ownership of an asset. They can reduce the idle time of machinery and carry out preventive maintenance based on real-time data, encouraging vendors to adopt asset performance management solutions and propelling the asset performance management market.

Market Overview:

Asset performance management is an integrated set of solutions and services, including various software used to monitor aspects such as asset health and reliability. They are also used to plan strategies for asset management and divestment. For instance, General Electric provides the Predix solution containing several products such as APM Reliability, APM Strategy, APM Integrity and APM Health. APM system provides various perceptions at the point of action to increase and minimize unplanned repair work asset life, decrease interruption, lower maintenance costs, and reduce equipment failure risk.

The growing demand for digital solutions across various industries, such as manufacturing, oil & gas, and chemical, for reducing operational expenses propels the demand for asset performance management market. Using sensors, the asset performance management solution system helps collect different types of data from all the assets, such as heavy equipment, machinery, and others. Integrating disparate data sources, the Asset performance management system builds a data analytics platform that comprehensively views all operational holdings in the industrial facility. Customers can exploit this information to improve asset management processes and prioritize maintenance activities.

Asset performance management (APM) solutions enable organizations to monitor assets continuously to identify, diagnose, and prioritize impending equipment problems in real-time, with the primary goal of helping them maximize profitability by balancing cost, risk, and performance of the assets, plant, or of the people that are operating all those things. Overall, asset performance management solutions provide unique value to modern industrial operations and contribute to asset performance management market growth.

With asset performance management systems, companies from asset-intensive industries can address various issues, including environmental risks, labor safety risks and operational costs, poor decision-making, and increasing maintenance. The overall benefits of the systems, several technological advancements such as digital twin, and IIoT gaining interest in digital asset management solutions are anticipated to contribute significantly to the development of the asset performance management market in the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Asset Performance Management Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Asset Performance Management Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Increased Digital Workforce and Reliability Culture to Drive Growth of the asset performance management market

Asset performance management enables organizations to accelerate to a digital business model. The growth in computing speed and storage makes virtual and global collaboration possible in more fields daily. As networks and technology become more vigorous, the computing power available in consumer hardware endures an upsurge, and employees become more relaxed with working on their devices, rather than meeting face to face or having to come into an office. Having a more digital ability team has been a boon for employers. Technology supporting digitally integrated employees gets stronger and stronger every year, allowing enterprises to keep a very dispersed team on the same page logistically and move towards a similar objective. The growing digital workforce is anticipated to drive the asset performance management market.

Further, organizations achieve control of asset decisions with broad-reaching data that reflect operating impact, resource availability, and real-time situation reports. When industrial organizations require assets to operate at all times, asset performance management helps focus on assets that need renovation to lower the Total Cost of Ownership (TCO) and reduce the risk of unplanned downtime of mission-critical assets. If they want to survive, industrial companies must recognize that they are in the information business, and change extends beyond the assets themselves. Workforces are embracing the digital industry they now work in and are adopting asset performance management tools for safety and reliability in today's highly regulated environments. These factors are driving the asset performance management market share.

Segmental Analysis:

Based on Offering, the asset performance management market is segmented into services and solutions. The solution segment held the largest share of the asset performance management market in 2022, whereas the service segment is estimated to register the highest CAGR in the asset performance management market during the forecast period. Asset Strategy Management (ASM) is a structured process that allows organizations to gain control, effectively manage and eliminate inconsistencies in asset strategies, and ensure assets are up and running at their full potential in the enterprise widely for closing the gap between current asset performance and optimal asset performance. Implementing an asset management program ensures reliability strategies are optimized to deliver the best balance of risk, cost, and performance. It also ensures strategies evolve based on real data, appropriate analysis and justification are provided, and effective review and approval processes are offered. Thus, due to its major significance, the Offering segment is anticipated to propel the asset performance management market.

Regional Analysis:

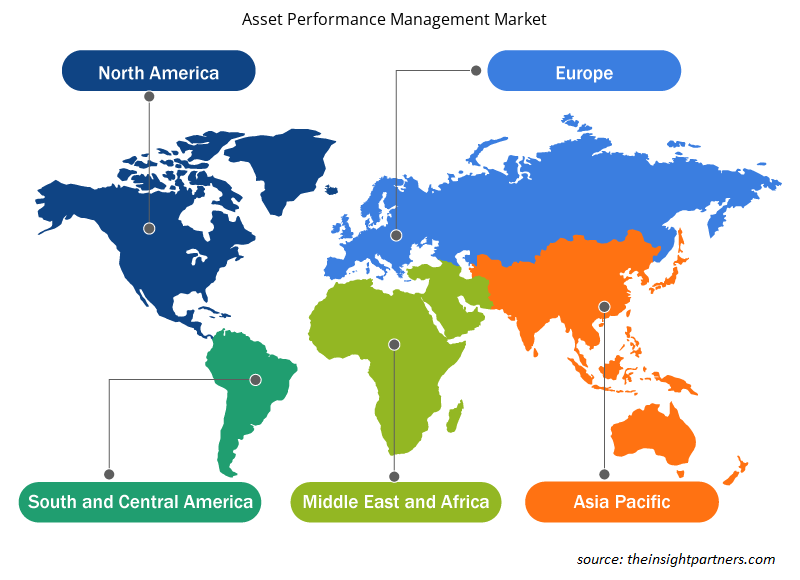

The North America asset performance management market was valued at US$ XXX billion in 2022 and is projected to reach US$ XXX billion by 2031. The asset performance management market is expected to grow at a CAGR of XXX% during the forecast period. Europe has established itself as a dominant asset performance management market, leading market share and driving growth. Several factors have contributed to North America’s strong asset performance management market position. North America is one of the most technologically advanced regions in the world. It accounts for the principal share of the global asset performance management market due to the early adoption of cloud and digital technologies with Industry 4.0 capabilities in the US North American countries have well-established and sustainable economies, which enable them to invest strongly in R&D activities, thereby contributing to the development of new technologies. Due to the timely adoption of trending technologies, such as IOT, big data AI and ML, manufacturers are keen to integrate industrial IOT technologies with their manufacturing processes to simplify asset management and enable predictive and prescriptive maintenance across asset-intensive organizations. The growing need to manage assets sustainably and optimize total cost of ownership (TCO) has led to the adoption of asset performance management solutions across the region. North America is in the lead in deploying asset performance management solutions, which efficiently provide early warning notification with predictive analytics and diagnosis of equipment issues weeks, days, or months before failure.

The growing demand for high-speed data networks and the considerable presence of asset performance management solution vendors in the region contribute to the growth of regional asset performance management. Also, the growing preference for cloud-based asset performance management solutions drives the demand for advanced asset performance management solutions in the region. For instance, in 2021, GE Digital launched the asset service management software named Predix Service Max. The software enabled to reduce the time for industrial equipment operators. Such launched in the region propelling the growth of the asset performance management market. Furthermore, growing investments specifically for research and development of cloud infrastructure organizations in IT infrastructure are further driving regional market growth.

Related to other regions, companies in North America are beholding supportive government policies and favorable business conditions, which empower them to develop and introduce better cloud platforms, afterward foremost to an increase in the acceptance of asset performance management in the market. The number of data analysts, computer scientists, and software engineers who are emphasizing using cloud-based solutions and services is high in Canada. This is further adding to the growth of the North American asset performance management market.

Key Player Analysis:

The asset performance management market analysis consists of players such as ABB Ltd., Aspen Technology Inca., AVEVA Group plc., Bentley Systems Incorporated, General Electric Company, Intel Corporation, International Business Machines Corporation, OSIsoft LLC, Schneider and Siemens AG.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the asset performance management market. A few recent asset performance management market developments are listed below:

- In June 2022, Daniel Arsham and Kohler, a prominent American plumbing and bathroom furniture manufacturer, combined to produce a 3D-printed washbasin. Kohler presented brand-new digital bathroom options and an immersive Daniel Arsham sculpture at Milan Design Week 2022.

- In August 2022, GE Digital announced a software solution combining Performance Intelligence with APM Reliability. Designed for strategic and data-driven decision-making, the software forms a performance advisory solution by integrating real-time thermal performance data and analysis software with analytics for strategic and data-driven decision-making.

- In January 2021, the world's largest Japanese toilet manufacturer, Toto Ltd., introduced an "AI-based Wellness Toilet." The wellness toilet uses cutting-edge sensing technology to monitor and analyze its users' emotional and physical health. Using this information, the user's smartphone app can offer ways to improve their wellness.

Asset Performance Management Market Regional Insights

The regional trends and factors influencing the Asset Performance Management Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Asset Performance Management Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Asset Performance Management Market

Asset Performance Management Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 3.66 Billion |

| Market Size by 2031 | US$ 9.26 Billion |

| Global CAGR (2025 - 2031) | 14.17% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Offerings

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

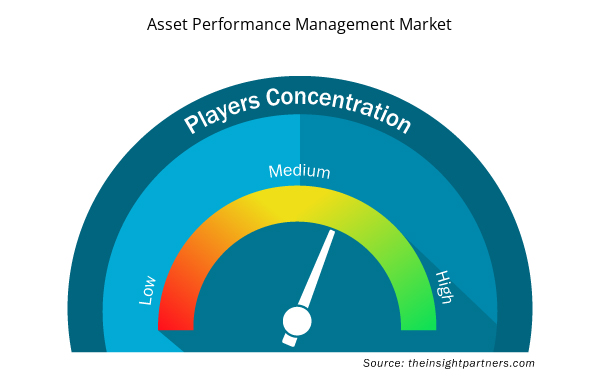

Asset Performance Management Market Players Density: Understanding Its Impact on Business Dynamics

The Asset Performance Management Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Asset Performance Management Market are:

- ABB Ltd.

- Aspen Technology Inc.

- AVEVA Group plc

- Bentley Systems Incorporated

- General Electric Company

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Asset Performance Management Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Investor ESG Software Market

- Smart Parking Market

- Ceramic Injection Molding Market

- Ceiling Fans Market

- Aesthetic Medical Devices Market

- Medical Audiometer Devices Market

- Hydrolyzed Collagen Market

- Fish Protein Hydrolysate Market

- Unit Heater Market

- Health Economics and Outcome Research (HEOR) Services Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Offerings, End-user Industry, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

The List of Companies

Get Free Sample For

Get Free Sample For