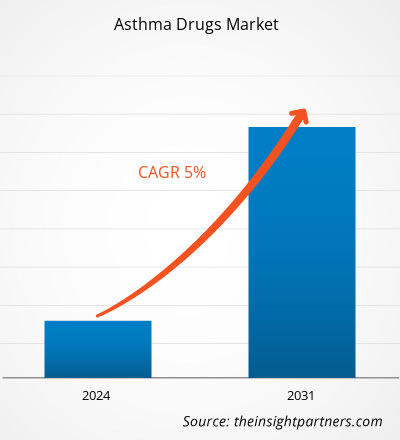

The asthma drugs market size is projected to reach US$ 39.48 billion by 2031 from US$ 26.72 billion in 2023. The market is expected to register a CAGR of 5.00% during 2023–2031. Research activities and product innovations will likely remain a key trend in the market.

Asthma Drugs Market Analysis

The demand for efficient asthma treatments is rising dramatically due to the increasing incidence of asthma worldwide, which is being caused by factors like pollution, changes in lifestyle, and genetic predisposition. Patient outcomes are being improved by ongoing innovation in medication formulations and delivery systems. Patients with severe asthma now have more individualized and efficient treatment options due to the development of biologics that target particular molecular pathways. There are a lot of growth prospects in emerging markets like Asia-Pacific, Latin America, and some regions of Africa due to rapid urbanization, expanding awareness, and bettering healthcare infrastructure. Improved access to healthcare services and rising disposable incomes in these areas also support market expansion.

Asthma Drugs Market Overview

Modern inhaler technology, such as intelligent inhalers with digital health functions, enhances medication compliance and offers valuable information for better asthma management. Demand for asthma medications is driven by improved healthcare provider training, patient education initiatives, and public health campaigns raising awareness of asthma and its management. As a result, the market will probably grow due to the rising demand for medications to treat asthma. The market is growing because of favourable regulatory frameworks and quick approval procedures for novel and creative asthma treatments. Improving asthma management and care standards is another area that governments and regulatory agencies are concentrating on more and more.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Asthma Drugs Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Asthma Drugs Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Asthma Drugs Market Drivers and Opportunities

The Rising Prevalence of Asthma Leads to an Increase in Demand for Asthma Drugs, Favors the Market Growth

Chronic asthma is a respiratory disease characterized by airway inflammation, bronchial hyperresponsiveness, and variable airflow restriction. Air pollution impeded asthma outcomes in adults and children, according to a review paper titled "Impact of Air Pollution on Asthma Outcomes" by Tiotiu et al. Traffic-related air pollution, nitrogen dioxide (NO2), and secondhand smoke (SHS) are significant risk factors for children's asthma development. Exposure to external pollution can cause asthma symptoms, exacerbations, and reduced lung function. Asthma and exposure to air pollution are still linked in the US. Over twenty-three million Americans suffer from this severe, potentially fatal chronic respiratory illness. People who have asthma may experience attacks due to air pollution exacerbating their symptoms. Pollution poses a particular threat to children who have asthma, which affects approximately 6 million children in the US. The impact of air pollution on two genes related to immunological tolerance in children from high-pollution areas was studied by Stanford University's Children's Center researchers. They found that alterations in these two genes led to asthma and that exposure to high concentrations of carbon monoxide (CO), NO2, and PM2.5 (particulate matter) was associated with both short- and long-term changes in these genes. The development of preventative asthma medications may benefit from these findings, which concentrated on the epigenetic effects of exposure to air pollution. Every one of these studies on asthma has advanced our knowledge of the condition in children and provided the EPA with vital data that it can utilize to safeguard both human health and the environment. The asthma medication market is being driven by the accelerated drug discovery and development for asthma brought about by these research projects.

Commercialization of Biologics Creates Significant Opportunities in the Market

Many asthmatics found that using an oral or inhaled controller medication, avoiding triggers, and using a quick-relief inhaler when symptoms flare up are sufficient to manage their asthma. For some people, though, these medications are insufficient to treat their asthma. Recently, several innovative medications, known as "biologics," were granted a license to treat moderate-to-severe asthma. Unlike other drugs, biologics target a particular antibody, molecule, or cell implicated in asthma. Biologics are therefore referred to as precision or customized therapy. A biologic is a medication designed to target particular molecules in humans derived from the cells of a living organism, such as bacteria or mice. Asthma biologics target cell receptors, inflammatory chemicals, and antibodies. By focusing on these molecules, Biologics aims to interfere with the mechanisms that lead to inflammation, which aggravates asthma symptoms. Patients who still experience symptoms after taking their regular daily controller medications are prescribed biologics. Recurrent hospital admissions, ER visits, or the need for oral steroids for exacerbations are signs of poorly controlled asthma. Biologics' primary benefit has been a decrease in the number of asthma exacerbations, which has resulted in fewer ER visits, hospital stays, and the requirement for oral steroids. Other benefits of biologics include decreased asthma symptoms, fewer missed workdays and school, and lower dosages of other controller medications.

The quality of life is enhanced in asthmatic patients by biologics. Reports have shown that certain biologics can help patients with severe asthma function better in their lungs. Currently, omalizumab, mepolizumab, reslizumab, benralizumab, and dupilumab are the five approved biologics for asthma. An antibody that explicitly targets IgE allergy antibodies is omalizumab. A subset of cells known as eosinophils is the target of bevacizumab, mepolizumab, and reslizumab. They are involved in allergic inflammation. A monoclonal antibody called dupilumab binds to a receptor for two molecules that produce allergic inflammation. A physician will order screening tests, such as blood work or skin prick testing for environmental allergens, to ascertain which biologic may be the most effective asthma treatment. It is approved for patients six and older to use omalizumab. Aside from reslizumab, all biologics are authorized for use in patients under twelve. Reslizumab can be used by adults who are at least 18 years old. Trials have demonstrated that biologics are generally safe with a low incidence of adverse effects. Furthermore, the cost of biologics is higher than that of other controller medications; however, this is expected to change due to rising demand, the release of new biologics, and large-scale production.

Asthma Drugs Market Report Segmentation Analysis

Key segments that contributed to the derivation of the asthma drugs market analysis are medications, route of administration, and distribution channel.

- Based on medications, the asthma drug market is divided into quick-relief medicines and long-term control medications. The long-term control medications segment held the most significant market share in 2023.

- By route of administration, the market is categorized into inhaled, prefilled syringes/vials, and others. The inhaled segment held the largest share of the market in 2023.

- By distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The retail pharmacies segment held the largest share of the market in 2023.

Asthma Drugs Market Share Analysis by Geography

The geographic scope of the asthma drugs market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America consists of three countries: the US, Canada, and Mexico. The US is the largest market for asthma drugs, followed by Canada and Mexico. The presence of key market players, the high prevalence of asthma in the US, and the high healthcare spending per capita are expected to drive growth in North America.

Also, efforts, campaigns, and funding from various governmental and private organizations drive asthma drug growth. Research and development efforts towards the development of drugs and the usage of combination drugs, biologics, and monoclonal antibodies are expected to aid market growth.

Asthma is prevalent throughout Asia Pacific; however, it is underdiagnosed and undertreated. Many asthma patients do not utilize inhaled corticosteroids because they are challenging to obtain or, if available, are too expensive. The application of asthma recommendations should be improved to improve asthma care.

Asthma Drugs Market Regional Insights

The regional trends and factors influencing the Asthma Drugs Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Asthma Drugs Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Asthma Drugs Market

Asthma Drugs Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 26.72 Billion |

| Market Size by 2031 | US$ 39.48 Billion |

| Global CAGR (2023 - 2031) | 5.00% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Medications

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

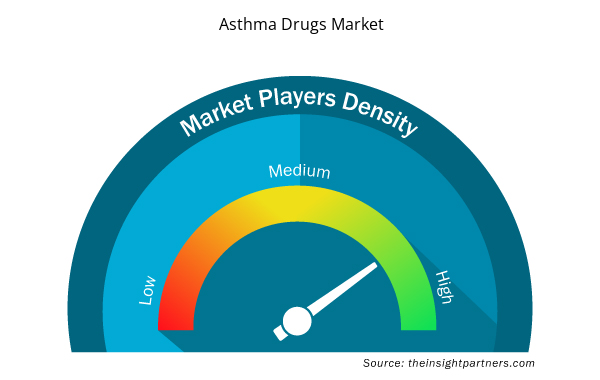

Asthma Drugs Market Players Density: Understanding Its Impact on Business Dynamics

The Asthma Drugs Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Asthma Drugs Market are:

- AstraZeneca

- TEVA PHARMACEUTICAL INDUSTRIES LTD.

- GlaxoSmithKline plc

- Boehringer Ingelheim International GmbH

- Merck & Co., Inc.

- Koninklijke Philips NV

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Asthma Drugs Market top key players overview

Asthma Drugs Market News and Recent Developments

The asthma drugs market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the asthma drugs market are listed below:

- GSK plc announced that it has completed the acquisition of Aiolos Bio (Aiolos), a clinical-stage biopharmaceutical company focused on addressing the unmet treatment needs of patients with respiratory and inflammatory conditions. (Source: GSK plc, Press Release, February 2024)

- Teva Pharmaceutical Industries Ltd. and Launch Therapeutics, Inc. announced a clinical collaboration agreement to accelerate further the clinical research program of Teva’s ICS-SABA (TEV-‘248). Teva and Abingworth, a leading international life sciences investment group, part of global investment firm Carlyle, also announced a strategic development funding agreement in which Abingworth provides Teva up to US$ 150 million to offset Teva’s ICS/SABA (TEV-‘248) program costs. The collaboration combines Teva’s expertise in respiratory technology development and Launch Therapeutics’ innovative late-stage drug development model to progress Teva’s Dual-Action Asthma Rescue Inhaler (TEV-‘248) program. (Source: Teva Pharmaceutical, Press Release, April 2024)

Asthma Drugs Market Report Coverage and Deliverables

The “Asthma Drugs Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Asthma drugs market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Asthma drugs market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Asthma drugs market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the asthma drugs market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Medications, Route of Administration, and Distribution Channels

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The market is expected to register a CAGR of 5.00% during 2023–2031.

AstraZeneca, Koninklijke Philips NV, GlaxoSmithKline plc., Boehringer Ingelheim International GmbH, TEVA PHARMACEUTICAL INDUSTRIES LTD., Merck & Co., Inc., Sanofi, Pfizer Inc., Novartis AG

Research activities and product innovations will likely remain a key trend in the market.

Key factors driving the market are the rising prevalence of asthma, leading to increased demand for asthma drugs, favorable regulatory frameworks, and quick approval procedures for novel and creative asthma treatments.

North America dominated the asthma drugs market in 2023

Get Free Sample For

Get Free Sample For