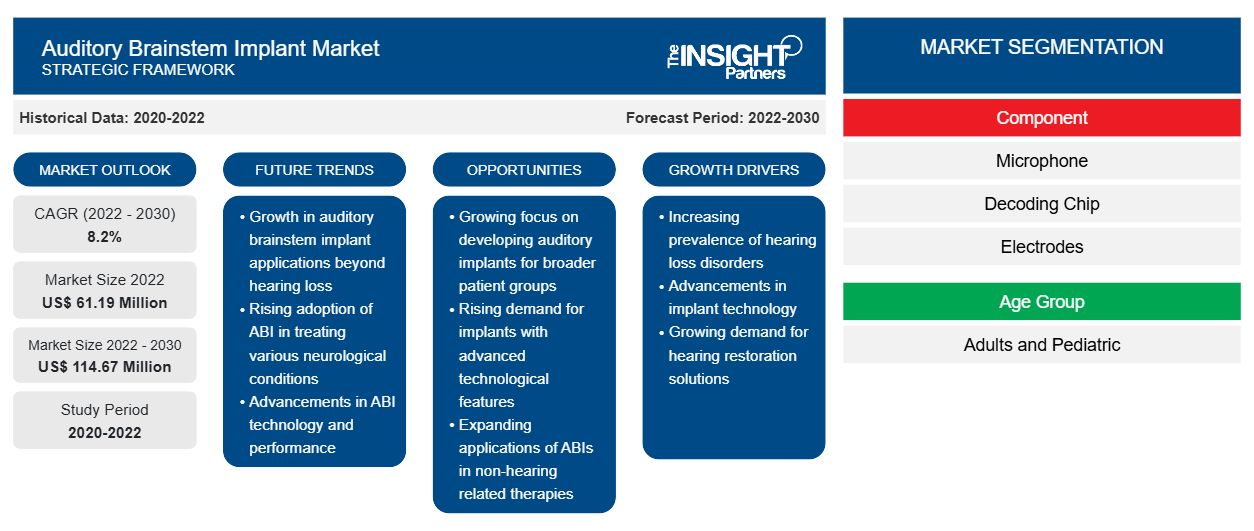

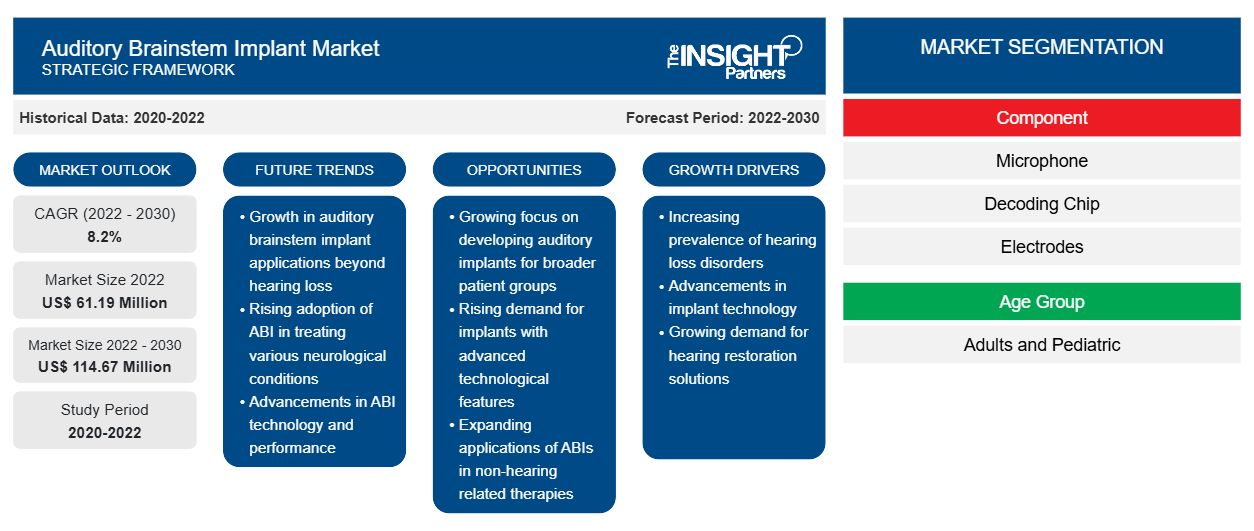

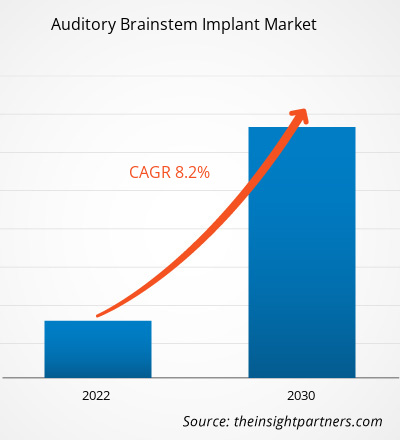

[Research Report] The auditory brainstem implant market is expected to grow from US$ 61.19 million in 2022 to US$ 114.67 million by 2030; it is estimated to register a CAGR of 8.2% from 2022 to 2030.

Analyst’s Viewpoint

The auditory brainstem implant (ABI) is a device that helps patients suffering from hearing disabilities and who cannot receive a cochlear implant (CI) due to anatomic constraints. This neuroprosthetic device bypasses the cochlear nerve and electrically stimulates second order neurons in the cochlear nucleus (CN) using a multichannel surface array. It is usually recommended for patients who have cochlear and retrocochlear pathologies.

The auditory brainstem implant market analysis explains growth drivers such as rising prevalence of sensorineural hearing loss and technological advancements in ABI devices. However, the high costs of surgical treatments and limited reimbursement policies hamper the market growth. Further, development of hybrid devices is expected to emerge as the future trends in the auditory brainstem implants market during 2022–2030.

Market Insights

Growing Prevalence of Sensorineural Hearing Loss to Drive Auditory Brainstem Implant Market Growth

According to an article published by StatPearls in 2023, the US reports 5 to 27 cases of sudden sensorineural hearing loss (SNHL) per 100,000 people every year, resulting in ~66,000 new cases annually. In addition, ~16% of adults worldwide with disabling hearing loss have noise-induced hearing loss (NIHL), another significant cause of hearing loss in adults that is related to occupational noise. It remains a common occupational disease despite legislation in place in most developed countries to prevent NIHL. Many studies have found that ABIs are successful in restoring hearing for Neurofibromatosis type 2 (NF2) patients with bilateral deafness. In an article published by Wolters Kluwer in February 2021, a study was carried out to assess auditory brainstem implantation in a case of a 65-year-old male diagnosed with bilateral cochlear otosclerosis and profound sensorineural hearing loss. The study concluded that extensive otosclerosis of the cochlea may lead to a poor outcome of cochlear implantation. In such cases, an Auditory Brainstem Implant (ABI) could be considered as an alternative treatment for profound sensorineural hearing loss in deaf children and adults who receive little or no benefit from hearing aids and aren’t suitable candidates for cochlear implants.

Furthermore, the availability of advanced hearing implants equipped with innovative technologies has improved their effectiveness in treating hearing impairments. This, combined with minimally invasive surgical approaches, has played a significant role in the growth and prominence of the auditory brainstem implant market.

Future Trend

Development of Hybrid Devices to Emerge as Future Trends in Auditory Brainstem Implant Market During Forecast Period

The development of hybrid devices combining cochlear and brainstem implants is aimed to provide better hearing outcomes for patients suffering from hearing loss and who are ineligible for cochlear implantation due to anomalies of the cochlea and cochlear nerve. According to an article published by International Journal of Audiology in October 2022, a study aimed to assess impedance development following the implantation of Hybrid-L electrodes was carried out. In the study, 137 adult patients were implanted with a Hybrid-L electrode and followed up for at least one year. The study suggested reduced tissue growth with the Hybrid-L electrode array despite smaller contacts.

Therefore, the development of hybrid implants to reduce surgical risks, complications, and recovery time for patients is expected to boost the auditory brainstem implant market growth during 2022-2030.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Auditory Brainstem Implant Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Auditory Brainstem Implant Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope

The auditory brainstem implant market is segmented on the basis of component, age group, application, end-user. Based on component, the auditory brainstem implant market is segmented into microphone, decoding chip and electrodes.

Based on age group, the auditory brainstem implant market is bifurcated into adults and pediatrics. Based on application the market is bifurcated into sensorineural hearing loss and conductive hearing loss. In terms of end user, the auditory brainstem implant market is categorized into hospitals, ENT clinics, and ambulatory surgical centers.

Segmental Analysis:

Component – Based Insights

The auditory brainstem implant market, by component is segmente d into microphone, decoding chip and electrodes. Electrodes segment held the highest market share in 2022.

Age Group-Based Insights

The auditory brainstem implant market, by age group, is segmented into adults and pediatrics. The adults segment held a larger market share in 2022 and is anticipated to hold the larger revenue share in the global market during 2022-2030. This is due to the increasing incidence of congenital profound hearing loss with anomalies in adult population worldwide, which results in rising auditory brainstem implantation surgery. Patients with severe Sensorineural Hearing Loss (SNHL) who are ineligible for auditory nerve surgery or have scarring of the inner ear caused by trauma or infection have found auditory brainstem implant surgery to be extremely effective.

Application-Based Insights

The market, by application is bifurcated into sensorineural hearing loss and conductive hearing loss. The sensorineural hearing loss segment held the larger market share in 2022.

End User-Based Insights

The auditory brainstem implant market, based on end-user is categorized into hospitals, ENT clinics, and ambulatory surgical centers. The hospitals segment will grow with the highest CAGR in the market during 2022–2030. Auditory brainstem implants involve complicated surgeries that needs specialized medical attention, including diagnosis, treatment, and ongoing monitoring. Hospitals play an essential role in delivering complete healthcare services to patients.

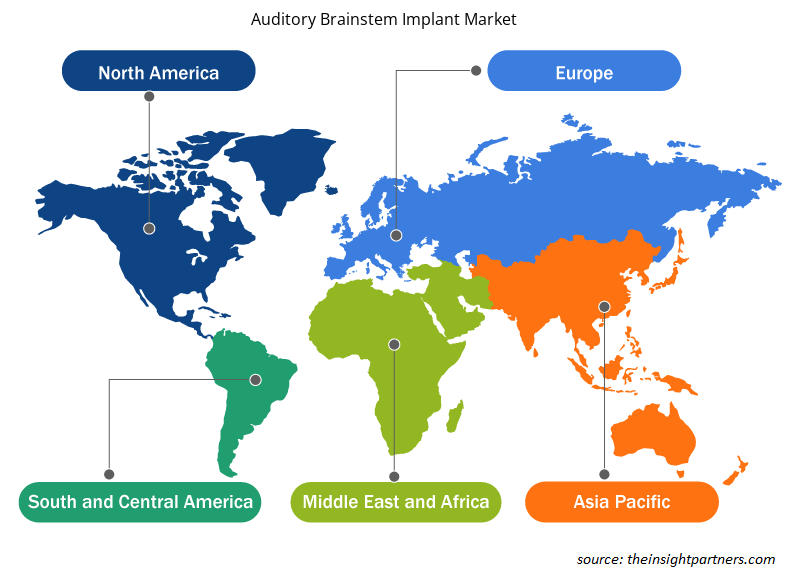

Regional Analysis

The auditory brainstem implant market, based on geography, is segmented into five major regions-North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. The market in North America is expected to grow at a significant rate during the 2022-2030 owing to factors such as the high availability and adoption of advanced treatment options and the concentration of key manufacturers in the region. The US, in particular, records a high adoption rate of auditory brainstem implants owing to various factors such as increasing incidence of hearing loss and growing awareness about these implants.

Cochlear Limited, Med-EL, Oticon Medical, Zhejiang Nurotron Biotechnology Co. Ltd., and Sonova Holding AG are among the key market players analyzed in the report. These leading players focus on expanding and diversifying their market presence and clientele, thereby tapping business opportunities prevailing in the auditory brainstem implant market.

Auditory Brainstem Implant Market Regional Insights

Auditory Brainstem Implant Market Regional Insights

The regional trends and factors influencing the Auditory Brainstem Implant Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Auditory Brainstem Implant Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Auditory Brainstem Implant Market

Auditory Brainstem Implant Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 61.19 Million |

| Market Size by 2030 | US$ 114.67 Million |

| Global CAGR (2022 - 2030) | 8.2% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

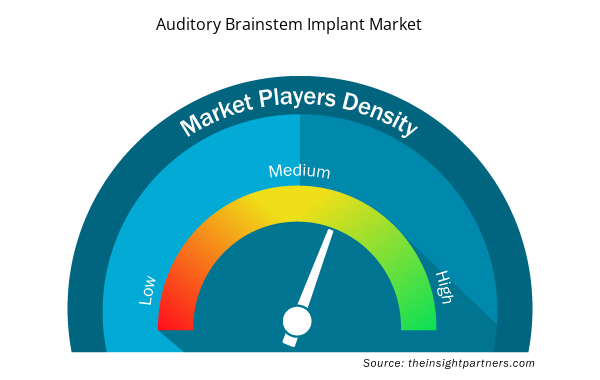

Auditory Brainstem Implant Market Players Density: Understanding Its Impact on Business Dynamics

The Auditory Brainstem Implant Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Auditory Brainstem Implant Market are:

- Cochlear Limited

- Med-EL, Oticon Medical

- Zhejiang Nurotron Biotechnology Co. Ltd.

- Sonova Holding AG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Auditory Brainstem Implant Market top key players overview

Key development by major market player include:

- In January 2022, Cochlear Americas Corporation received FDA approval for its Nucleus 24 Cochlear Implant System. This approval broadens the usage of this device for individuals aged five years and above who have severe to profound hearing loss in one ear [also known as single-sided deafness/unilateral hearing loss (SSD/UHL)] and normal hearing or mild hearing loss in the other ear.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Biopharmaceutical Contract Manufacturing Market

- Nuclear Decommissioning Services Market

- HVAC Sensors Market

- Analog-to-Digital Converter Market

- Smart Mining Market

- E-Bike Market

- Influenza Vaccines Market

- Lyophilization Services for Biopharmaceuticals Market

- Ceiling Fans Market

- Public Key Infrastructure Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Age Group, Application, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The auditory brainstem implant majorly consists of the players including Cochlear Limited, Med-EL, Oticon Medical, Zhejiang Nurotron Biotechnology Co. Ltd., and Sonova Holding AG.

Global Auditory Brainstem Implant is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa and South & Central America. The market in North America held the largest market share of US$ 25.65 million in 2022 and is expected to grow at a significant rate during the forecast period. North America Auditory Brainstem Implant is segmented into the US, Canada, and Mexico.

The microphone segment dominated the global Auditory Brainstem Implant and held the largest market share of 61.76% in 2022.

The auditory brainstem implant (ABI) is a device that helps patients suffering from hearing disabilities and who cannot receive a cochlear implant (CI) due to anatomic constraints. This neuroprosthetic device bypasses the cochlear nerve and electrically stimulates second order neurons in the cochlear nucleus (CN) using a multichannel surface array. It is usually recommended for patients who have cochlear and retrocochlear pathologies.

Rising prevalence of sensorineural hearing loss and technological advancements in ABI devices are driving the global auditory brainstem implant market.

The CAGR value of the auditory brainstem implant during the forecasted period of 2020-2030 is 8.2%.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Auditory Brainstem Implant Market

- Cochlear Limited

- Med-EL, Oticon Medical

- Zhejiang Nurotron Biotechnology Co. Ltd.

- Sonova Holding AG

Get Free Sample For

Get Free Sample For