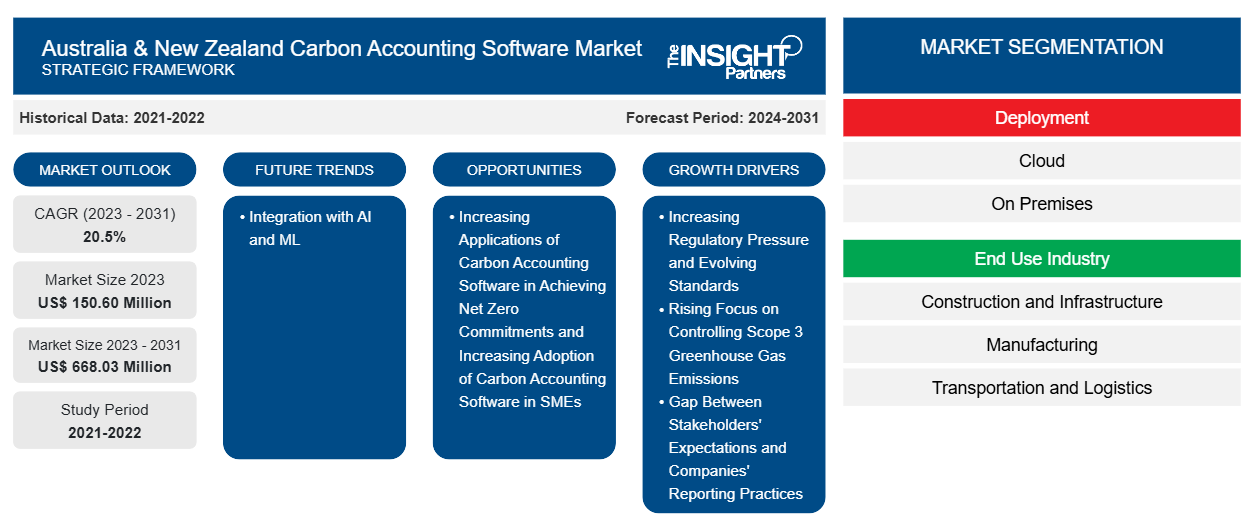

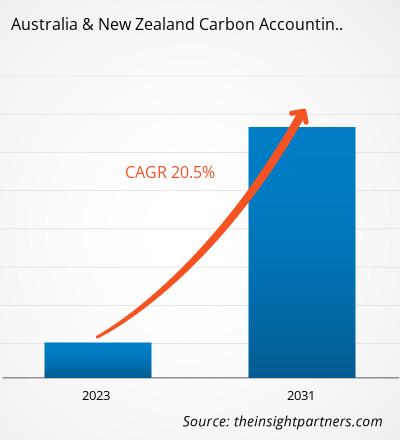

The Australia & New Zealand carbon accounting software market size is expected to reach US$ 668.03 million by 2031 from US$ 150.60 million in 2023. The market is estimated to record a CAGR of 20.5% from 2023 to 2031. Integration of augmented reality and virtual reality for cost visualization is likely to remain a key market trend.

Australia & New Zealand Carbon Accounting Software Market Analysis

The key factors bolstering the Australia & New Zealand carbon accounting software market include increasing regulatory pressure and evolving standards regarding carbon emission reduction, growing focus on Scope 3 greenhouse gas emissions, and the gap between stakeholders' expectations and companies' reporting practices. However, the high implementation cost of carbon accounting software hinders market growth. Further, increasing adoption of carbon accounting software in achieving net zero commitments and increasing adoption in SMEs are expected to create opportunities for the key companies operating in the Australia and New Zealand carbon accounting software market from 2023 to 2031. Notably, integration with AI and ML is expected to be a key trend in the market during the forecast period.

Australia & New Zealand Carbon Accounting Software Market Overview

Carbon accounting is the method of calculating the amount of carbon dioxide emissions directly or indirectly associated with the operations of any company. Organizations often turn to third parties to assist them with carbon accounting to reduce their greenhouse gas, carbon dioxide, and indirect emissions using various methods. Carbon accounting software offerings help businesses track, calculate, and manage their greenhouse gas emissions and carbon footprint, facilitating environmental reporting, sustainability goals, and compliance with emissions regulations. It streamlines data collection, analysis, and reporting to promote transparency and enhance investor confidence.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Australia & New Zealand Carbon Accounting Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Australia & New Zealand Carbon Accounting Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Australia & New Zealand Carbon Accounting Software Market Drivers and Opportunities

Increasing Regulatory Pressure and Evolving Standards Favor Market

The Australian Government is engaged in developing a Net Zero 2050 plan as set out in its 2022 Annual Climate Change Statement, which is in line with recommendations made by the Climate Change Authority. Australia and New Zealand have been experiencing tremendous technological, socioeconomic, and cultural change since the Industrial Revolution. The In the transportation sector, the New Vehicle Efficiency Standard regulates the annual average carbon dioxide (CO2) emission levels of all new vehicles supplied to Australians by car manufacturers. It does not apply to vehicles that are already on the road. The standard is expected to help lower carbon emissions by facilitating a higher supply of more affordable electric, hybrid, and other fuel-efficient vehicle models. Such measures to reduce emissions would help prevent the ill effects of climate change in the coming years. The Ministry of the Environment and the Ministry of Business, Innovation and Employment of New Zealand have published a National Policy Statement (NPS) and a National Environmental Standard (NES) for greenhouse gas emissions from industrial process heat, which were enforced on July 27, 2023. Business entities are now required to take emissions produced by industrial process heat into account when assessing air discharge permit applications. The regulations support New Zealand's commitment to reducing emissions to be able to meet its net zero goals by 2050. They are also aligned with the country's international commitments under the Paris Agreement. Such government regulations meant to achieve carbon emission reduction fuel the demand for carbon accounting software in Australia and New Zealand.

Increasing Adoption in SMEs to Generate Significant Growth Opportunities in Future

Most SMEs agree that accurately tracking and reducing carbon emissions is a critical business imperative. By deploying the right carbon accounting platform, they can gain actionable insights to develop targeted, cost-effective decarbonization strategies. Carbon accounting involves the measurement of a company's greenhouse gas emissions across all operations. Understanding their carbon footprint can help businesses identify high-impact areas to reduce their effect on environment and build their capabilities to ensure compliance with new regulations. Proactively developing a low-carbon strategy allows SMEs to strengthen relationships with stakeholders, achieve cost savings through efficiency, and future-proof their businesses. As consumers and investors increasingly base their decisions on sustainability criteria, organizations that measure, report, and reduce emissions open up new opportunities for growth, funding, partnerships, and public image. Thus, quantifying and reducing carbon emissions is deemed a necessity and a competitive edge amid the current trend of sustainable economies. Carbon accounting software can automatically record emission levels and help businesses take strategic actions to achieve sustainability goals. Hence, the increasing preference for carbon accounting software in SMEs in Australia and New Zealand is anticipated to create opportunities in the market in the coming years.

Australia & New Zealand Carbon Accounting Software Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Australia & New Zealand carbon accounting software market analysis are deployment and end-use industry.

- On the basis of deployment, the market has been segmented into cloud and on-premise. The cloud segment dominated the market in 2023.

- On the basis of end-use industry, the Australia and New Zealand carbon accounting software market has been segmented into manufacturing, construction and infrastructure, transportation and logistics, wholesale trade, and retail trade. The construction and infrastructure industry segment dominated the market in 2023.

Australia & New Zealand Carbon Accounting Software Market Share Analysis by Geography

Carbon dioxide emissions from various sectors in Australia accounted for 355.9 million metric tons in 2022. Moreover, combustible fuel usage in the country totals ~1% of the world's total carbon dioxide emissions. As per the International Energy Agency (IEA), carbon dioxide emissions in the industrial and transportation sectors accounted for more than 35% of the total carbon dioxide emissions in Australia. Emissions from the manufacturing sector reached a high of 53.34 million metric ton in 2022. In contrast, the transportation, postal, and warehousing sectors in the country reported 28.5 million metric tons of carbon emissions.

Australia & New Zealand Carbon Accounting Software Australia & New Zealand Carbon Accounting Software Market Regional Insights

The regional trends and factors influencing the Australia & New Zealand Carbon Accounting Software Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Australia & New Zealand Carbon Accounting Software Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Australia & New Zealand Carbon Accounting Software Market

Australia & New Zealand Carbon Accounting Software Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 150.60 Million |

| Market Size by 2031 | US$ 668.03 Million |

| Global CAGR (2023 - 2031) | 20.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Deployment

|

| Regions and Countries Covered | Australia

|

| Market leaders and key company profiles |

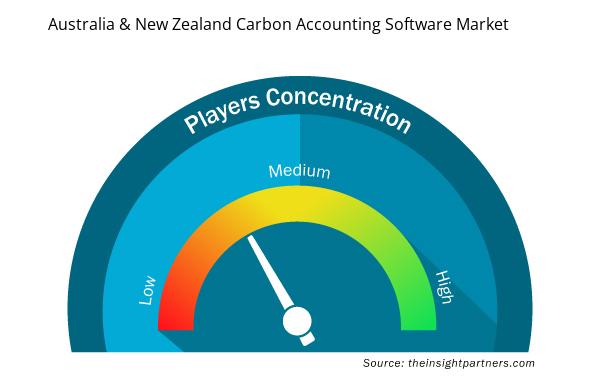

Australia & New Zealand Carbon Accounting Software Market Players Density: Understanding Its Impact on Business Dynamics

The Australia & New Zealand Carbon Accounting Software Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Australia & New Zealand Carbon Accounting Software Market are:

- Workiva

- Avarni

- Terrascope

- Sumday

- ClimateClever

- CarbonetiX

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Australia & New Zealand Carbon Accounting Software Market top key players overview

Australia & New Zealand Carbon Accounting Software Market News and Recent Developments

The Australia & New Zealand carbon accounting software market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Australia & New Zealand carbon accounting software market are listed below:

- Workiva launched a carbon management platform to help its clients comply with the rising demand for climate-risk reporting and global disclosure regulations. On the same day of the launch, it announced the completion of an acquisition of Sustain.Life, a carbon accounting and emissions reporting startup. The consolidation is expected to simplify emission tracking and ensure transparency in emissions data.

(Source: Workiva, Press Release, June 2024)

- Green fintech Cogo announced its partnership with the UK's greener digital bank, Tandem. This partnership has evolved to offer customers a carbon management solution integrated into the bank's app. Working together since November 2022, the extension to this partnership is expected to enable customers to easily measure, understand, and reduce their carbon footprint.

(Source: Cogo, Press Release, October 2024)

Australia & New Zealand Carbon Accounting Software Market Report Coverage and Deliverables

The "Australia & New Zealand Carbon Accounting Software Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Australia & New Zealand carbon accounting software market size and forecast at a country level for all the key market segments covered under the scope

- Australia & New Zealand carbon accounting software market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Australia & New Zealand carbon accounting software market analysis covering key market trends, country framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Australia & New Zealand carbon accounting software market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players holding majority shares in the Australia and New Zealand carbon accounting software market are Microsoft, IBM, Greenly, NetNada, and Diligent.

The Australia and New Zealand carbon accounting software market was estimated to be US$ 150.60 million in 2023 and is expected to grow at a CAGR of 20.5 % during the forecast period 2023 – 2031.

The incremental growth expected to be recorded for the Australia and New Zealand carbon accounting software market during the forecast period is US$ 517.43 million.

The Australia and New Zealand carbon accounting software marketis expected to reach US$ 668.03 million by 2031.

Increasing regulatory pressure and evolving standards; rising focus on controlling scope 3 greenhouse gas emissions; and gap between stakeholders' expectations and companies' reporting practices are the major factors that propel the Australia and New Zealand carbon accounting software market.

Integration with AI and ML is anticipated to play a significant role in the Australia and New Zealand carbon accounting software market in the coming years.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Australia & New Zealand Carbon Accounting Software Market

- Workiva

- Avarni

- Terrascope

- Sumday

- ClimateClever

- CarbonetiX

- GreenHalo

- NedNada

- Trace

- Energy Solution Providers Limite

- Opportune

- IBM Corporation

- SAP SE

- Salesforce, Inc.

- Microsoft

- Diligent Corporation

- Cogo

- Carbon Trail

Get Free Sample For

Get Free Sample For