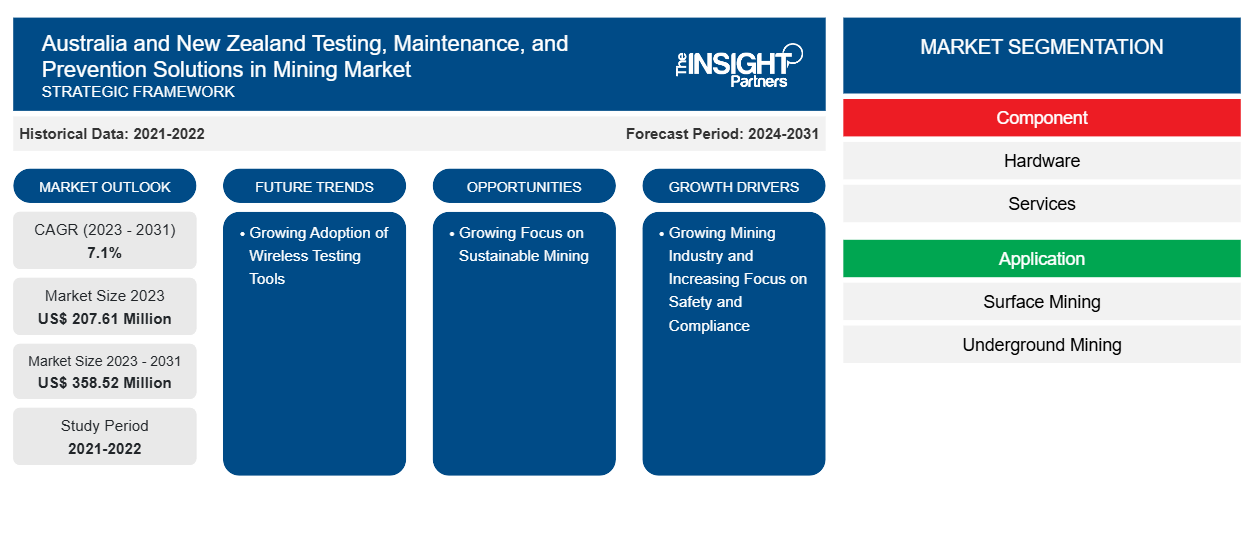

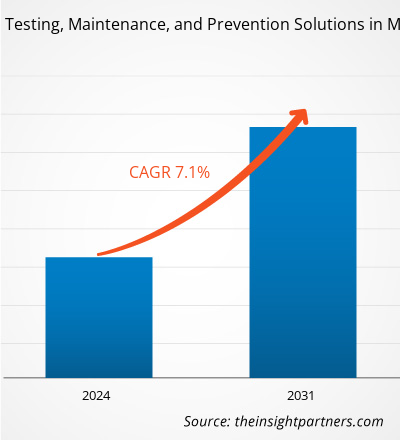

The Australia and New Zealand testing, maintenance, and prevention solutions in mining market size is expected to reach US$ 358.52 million by 2031 from US$ 207.61 million in 2023. The market is estimated to record a CAGR of 7.1% from 2023 to 2031. The growing adoption of wireless testing tools is expected to be a key market trend.

Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market Analysis

The mining industry is an essential component of the global economy, supplying raw materials critical for infrastructure, energy production, and manufacturing. However, mining operations, particularly in surface and underground settings, face significant challenges, including equipment reliability, environmental impact, safety, and operational efficiency. To mitigate these challenges, mining companies rely on advanced testing, maintenance, and prevention (TMP) solutions to optimize their operations, extend the lifespan of assets, and improve overall productivity. The mining industry in Australia and New Zealand is a major contributor to the economy, with both countries possessing rich deposits of minerals such as coal, gold, iron ore, and copper. As mining operations become more complex and the global demand for minerals increases, there is a growing emphasis on optimizing operational efficiency, minimizing risks, and ensuring compliance with safety and environmental standards. This has led to a rising demand for testing, maintenance, and prevention (TMP) solutions in the mining industry.

Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market Overview

Testing, maintenance, and prevention solutions are integral to maintaining the efficiency and safety of mining equipment and operations. These solutions encompass a range of technologies, processes, and strategies that monitor, analyze, and improve the performance of mining equipment, systems, and processes. The aim is to minimize downtime, reduce operational risks, enhance productivity, and ensure compliance with safety and environmental standards. Testing involves the systematic analysis and assessment of mining equipment, materials, and systems to ensure they meet operational requirements and standards. Maintenance refers to the activities designed to preserve, restore, or improve the functionality of mining equipment and systems. Maintenance solutions are critical in extending the operational lifespan of assets and avoiding costly downtime. Additionally, prevention focuses on strategies designed to eliminate and reduce risks that could lead to equipment failure, safety incidents, or environmental hazards. Prevention solutions are proactive measures intended to avoid problems before they occur, thus protecting the workforce, the environment, and operational continuity.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market Drivers and Opportunities

Growing Mining Industry

The mining industries in Australia and New Zealand have long been vital contributors to their economies, driven by abundant natural resources such as coal, gold, iron ore, copper, and other minerals. According to the Australian Bureau of Statistics, Australia's mining sector holds a prominent position in the global export market. It contributed a record US$ 455 billion in export revenue during the financial year 2022–2023. This remarkable performance underscores the industry's capacity to efficiently extract and process minerals, reinforcing Australia's role as a key supplier to meet the growing global demand for resources. With such growth, there is an increased need for enhanced testing and maintenance capabilities to monitor the performance and health of equipment, infrastructure, and systems.

The increase in investments by the governments in the mining industry propels the Australia and New Zealand testing, maintenance, and prevention solutions in mining market. For instance, in October 2024, The New Zealand Government announced its plans to include 149 projects in a fast-track approvals bill, focusing on housing, infrastructure, mining, and agriculture to stimulate a slowing economy. These 11 mining projects include OceanaGold's Waihi North and Macraes Phase 4 projects, Santana Minerals' Bendigo-Ophir gold project, coal miner Bathurst Resources' Buller Plateaux continuation project, BT Mining's Rotowaro mine continuation project, and three projects of mineral sands miner Taharoa Ironsands. The 11 mining projects are expected to play a significant role in the government's strategic goal of doubling the value of its mineral exports to US$ 2 billion by 2035. These projects will focus on the extraction of key resources, including coal, gold, iron sands, and mineral sands, contributing substantially to achieving this ambitious target.

Growing Focus on Sustainable Mining

As the mining industry faces increasing pressure from governments, environmental groups, and stakeholders to minimize its environmental impact, the sector is undergoing a profound shift toward sustainable mining practices. The growing emphasis on sustainability presents significant opportunities for companies specializing in testing, maintenance, and prevention solutions. The demand for advanced technologies and services that can support environmentally responsible operations, ensure compliance with regulatory standards, and optimize resource efficiency is expected to surge in the coming years. In March 2021, Australia's minerals sector announced that it would implement the Towards Sustainable Mining (TSM) system to enhance site-level performance through regular and transparent reporting on key safety, environmental, and social indicators. This includes strengthening partnerships with First Nations landholders and local communities. TSM in Australia will be administered by the Minerals Council of Australia (MCA).

TSM is developed by the Mining Association of Canada (MAC), which is widely adopted by leading mining nations globally. Its implementation in Australia will enable mining companies to demonstrate robust site-level performance across safety, sustainability, and environmental, social, and governance (ESG) metrics, with improved measurement and accountability. TSM will also provide a framework to showcase how mining operations engage with Traditional Owners, supporting their social and economic goals while ensuring the protection of cultural heritage. Hence, initiatives toward sustainable mining are anticipated to provide growth opportunities to the testing, maintenance, and prevention solutions in mining market over the forecast period.

Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Australia and New Zealand testing, maintenance, and prevention solutions in mining market analysis are component and application.

- Based on component, the Australia and New Zealand testing, maintenance, and prevention solutions in mining market is bifurcated into hardware and services. The hardware segment dominated the market in 2023.

- Based on hardware, the Australia and New Zealand testing, maintenance, and prevention solutions in mining market is subsegmented into power quality analyzers, temperature calibrators, dry wells, intrinsically safe multimeters, thermal cameras and mounted thermal cameras, ultrasonic acoustic imagers, process calibration tools, electrical test tools, vibration testing tools, motor alignment tools, network testing tools, and others. The electrical test tools segment dominated the market in 2023.

- Based on application, the market is bifurcated into underground mining and surface mining. The surface mining segment dominated the market in 2023.

Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market Share Analysis by Geography

The testing, maintenance, and prevention solutions in Australia's mining industry is driven by the increasing emphasis on quality in mining operations. Australia's mining industry is widely recognized for its historical significance and its position as a world leader in an industry at the forefront of innovations and sustainability. Per the Australian Bureau of Statistics, the mining industry contributed a record US$ 455 billion in export revenue for Australia in the financial year 2022–2023, highlighting that the industry's emphasis on extracting and processing minerals has made it a significant player in meeting the increasing global demand for resources.

Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market Regional Insights

The regional trends and factors influencing the Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market

Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 207.61 Million |

| Market Size by 2031 | US$ 358.52 Million |

| Global CAGR (2023 - 2031) | 7.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | Australia

|

| Market leaders and key company profiles |

Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market Players Density: Understanding Its Impact on Business Dynamics

The Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market are:

- Megger

- Fluke

- FLIR System

- Testo

- Yokogawa

- Siemens

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market top key players overview

Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market News and Recent Developments

The Australia and New Zealand testing, maintenance, and prevention solutions in mining market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Australia and New Zealand testing, maintenance, and prevention solutions in mining market are listed below:

- SGS developed several solutions to help mining companies address the challenges of extracting minerals in a world with finite resources. SGS uses several ultra-trace methods for vectoring and other exploration applications. One of the company's proven techniques involves the use of Mobile Metal Ions (MMI), an innovative geochemical process used to detect buried mineral deposits in any climate or terrain.

(Source: SGS, Press Release, March 2023)

- Metso announced plans to implement structural adjustments in certain parts of its Minerals equipment business. The planned measures will address the changes in the market environment that are driven by, for example, an increasing emphasis on strategic minerals that support the energy transition. The planned changes will improve agility, extend customer reach and coverage, and enable better alignment with customers. At the same time, Metso seeks to implement efficiency improvements to compensate for slow decision-making that is influencing large customer investments.

(Source: Metso, Press Release, May 2024)

Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market Report Coverage and Deliverables

The "Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Australia and New Zealand testing, maintenance, and prevention solutions in mining market size and forecast at a country level for all the key market segments covered under the scope

- Australia and New Zealand testing, maintenance, and prevention solutions in mining market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Australia and New Zealand testing, maintenance, and prevention solutions in mining market analysis covering key market trends, country framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Australia and New Zealand testing, maintenance, and prevention solutions in mining market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Data Annotation Tools Market

- Diaper Packaging Machine Market

- Molecular Diagnostics Market

- Analog-to-Digital Converter Market

- Terahertz Technology Market

- Medical Enzyme Technology Market

- Medical Devices Market

- Batter and Breader Premixes Market

- Excimer & Femtosecond Ophthalmic Lasers Market

- Medical Second Opinion Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Industry market is expected to reach US$ 358.52 billion by 2031.

Australia is anticipated to grow with the highest CAGR over the forecast period.

The hardware segment led the Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Industry market with a significant share in 2023 and it is also expected to grow with the highest CAGR.

The key players, holding majority shares, in Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Industry market includes SGS SA, Fluke, FLIR System, Testo, and Metso.

The growing adoption of wireless testing tools are the major future trends for the Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Industry market.

The driving factors impacting the Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Industry market include Growing Mining Industry and Increasing Focus on Safety and Compliance.

The Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Industry market was estimated to be USD 207.61 million in 2023 and is expected to grow at a CAGR of 7.1 %, during the forecast period 2023 - 2031.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market

- Megger

- Fluke

- FLIR System

- Testo

- Yokogawa

- Siemens

- Honeywell

- Ventia

- SGS SA

- Metso

Get Free Sample For

Get Free Sample For