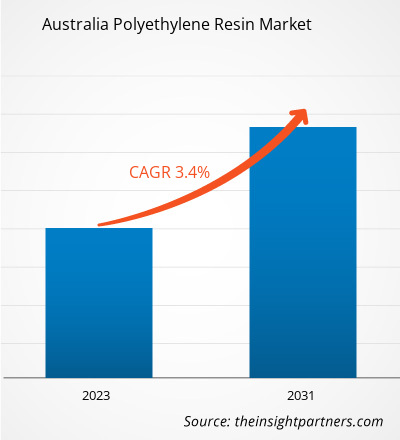

The Australia polyethylene resin market size is projected to reach US$ 1.57 billion by 2031 from US$ 1.20 billion in 2023. The market is expected to register a CAGR of 3.4% during 2023–2031. The growing use of polyethylene resin for packaging purposes across multiple industries as well as urban infrastructure emerges as a significant trend in the Australia polyethylene resin market.

Australia Polyethylene Resin Market Analysis

Polyethylene, particularly in its forms of high-density polyethylene (HDPE) and low-density polyethylene (LDPE), is widely used in packaging due to its versatility, durability, and cost-effectiveness. Polyethylene's robustness and flexibility make it an ideal choice for packaging applications, such as bubble wrap and foam sheets, to rigid containers and flexible films. In addition, rapid urbanization and infrastructure development, including the industrial sector's expansion, particularly in logistics and warehousing, relies heavily on polyethylene for packaging, transportation, and storage solutions. Moreover, with the development of a robust polyethylene resin industry, Australia can meet its internal demand more effectively and position itself as a competitive player in the global market. This can lead to the expansion of export opportunities regarding polyethylene resin in the coming years.

Australia Polyethylene Resin Market Overview

Polyethylene resin is produced from the copolymerization of ethylene. It can be converted into film-like materials that retain tensile strength; thus, it is highly preferred in the packaging industry. Further, the major advantages of polyethylene are high chemical resistance, better mechanical strength both at low and high temperatures, high surface gloss, and high resistance to cracking, making it more suitable for film formation.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Australia Polyethylene Resin Market Drivers and Opportunities

Rapid Urbanization and Infrastructure Development

Rapid urbanization and infrastructure development lead to an increased need for a wide range of construction materials. As per the International Trade Administration (ITA), the building & construction industry in Australia conducts over US$ 162 billion worth of building and construction work each year. The industry accounts for ~10% of GDP, thereby becoming the fifth-largest industry in the economy. Polyethylene, a versatile and durable plastic, is extensively used in the construction industry for piping systems, insulation, and protective sheathing applications. The material's lightweight nature, coupled with its strength and resistance to chemicals, aligns well with the growing infrastructural requirements of modern Australian cities. The growth of residential, commercial, and industrial sectors in urban areas fuels the demand for various polyethylene products.

Growing Focus on Domestic Manufacturing

A strategic shift toward reducing reliance on imports and enhancing local production capabilities is expected to boost the demand for polyethylene resins. As manufacturing activities increase, the need for raw materials such as polyethylene resins also rises. This material is essential for producing a wide range of products, from packaging materials to automotive components. This surge in demand is likely to encourage investments in local production facilities, fostering innovation and efficiency within the industry in the coming years.

Australia Polyethylene Resin Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Australia polyethylene resin market analysis are type, process, and application.

- The Australia polyethylene resin market, based on type, is segmented into linear low density polyethylene, low density polyethylene, and high density polyethylene. The high density polyethylene segment held the largest market share in 2023.

- By process, the market is segmented into injection molding, extrusion, blow molding, and others. The extrusion segment dominated the Australia polyethylene resin market in 2023.

- In terms of application, the Australia polyethylene resin market is segmented into packaging, automotive, construction, consumer goods, electrical and electronics, textiles, agriculture, medical devices, and others. The packaging segment led the market in 2023 with the largest revenue share.

Australia Polyethylene Resin Market Regional Insights

The regional trends and factors influencing the Australia Polyethylene Resin Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Australia Polyethylene Resin Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Australia Polyethylene Resin Market

Australia Polyethylene Resin Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.20 Billion |

| Market Size by 2031 | US$ 1.57 Billion |

| Global CAGR (2023 - 2031) | 3.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Australia

|

| Market leaders and key company profiles |

Australia Polyethylene Resin Market Players Density: Understanding Its Impact on Business Dynamics

The Australia Polyethylene Resin Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Australia Polyethylene Resin Market are:

- Saudi Basic Industries Corp

- Qenos Pty Ltd

- Olympic Polymers Pty Ltd

- Martogg & Company

- Exxon Mobil Corp

- LyondellBasell Industries NV

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Australia Polyethylene Resin Market top key players overview

Australia Polyethylene Resin Market News and Recent Developments

The Australia polyethylene resin market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Australia polyethylene resin market are listed below:

- SEE announced the use of certified-circular resins from ExxonMobil in packaging trays for red meat at grocery stores in Australia, a first-of-its-kind circularity initiative in the country to widen the range of plastics that can be recycled while ensuring the safety and quality of packaged fresh foods. (Source: Exxon Mobil Corporation, News Release, July 2023)

- BASF has broken ground on a polyethylene plant at its Verbund site in Zhanjiang, China. The new plant, with a capacity of 500,000 metric tons of polyethylene annually, will serve the rapidly growing demand in China. The plant is scheduled to start operations by 2025. (Source: BASF SE, Trade News, June 2023)

Australia Polyethylene Resin Market Report Coverage and Deliverables

The “Australia Polyethylene Resin Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Australia polyethylene resin market size and forecast for all the key market segments covered under the scope

- Australia polyethylene resin market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter’s Five Forces and SWOT analysis

- Australia polyethylene resin market analysis covering key market trends, country framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Australia polyethylene resin market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Transdermal Drug Delivery System Market

- Airport Runway FOD Detection Systems Market

- Oxy-fuel Combustion Technology Market

- Microcatheters Market

- Ketogenic Diet Market

- Military Rubber Tracks Market

- Fill Finish Manufacturing Market

- Pharmacovigilance and Drug Safety Software Market

- Gas Engine Market

- Unit Heater Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The continuous demand from diverse industries for packaging and rapid urbanization and infrastructure development in Australia fuel the market growth.

The escalating emphasis on plastic recycling is expected to emerge as a future trend in the market.

Saudi Basic Industries Corp, Qenos Pty Ltd, Olympic Polymers Pty Ltd, Martogg & Company, Exxon Mobil Corp, LyondellBasell Industries NV, DuPont de Nemours Inc, Lanxess AG, Chevron Phillips Chemical Company LLC, and BASF SE are among the leading market players.

The market is expected to register a CAGR of 3.4% during 2023–2031.

On the basis of application, the packaging segment dominated the market in 2023.

In terms of type, the high density polyethylene segment held the largest share of the Australia polyethylene resin market in 2023.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Americas Frozen Dough Market

- DuPont de Nemours Inc

- Redbak International

- Stile Board Pty Ltd

- Bewi ASA

- Foamex Group Pty Ltd

- Kingspan Group Plc

- Koolfoam Pty Ltd

- The Foam Co

- Owens Corning

- BASF SE

Get Free Sample For

Get Free Sample For