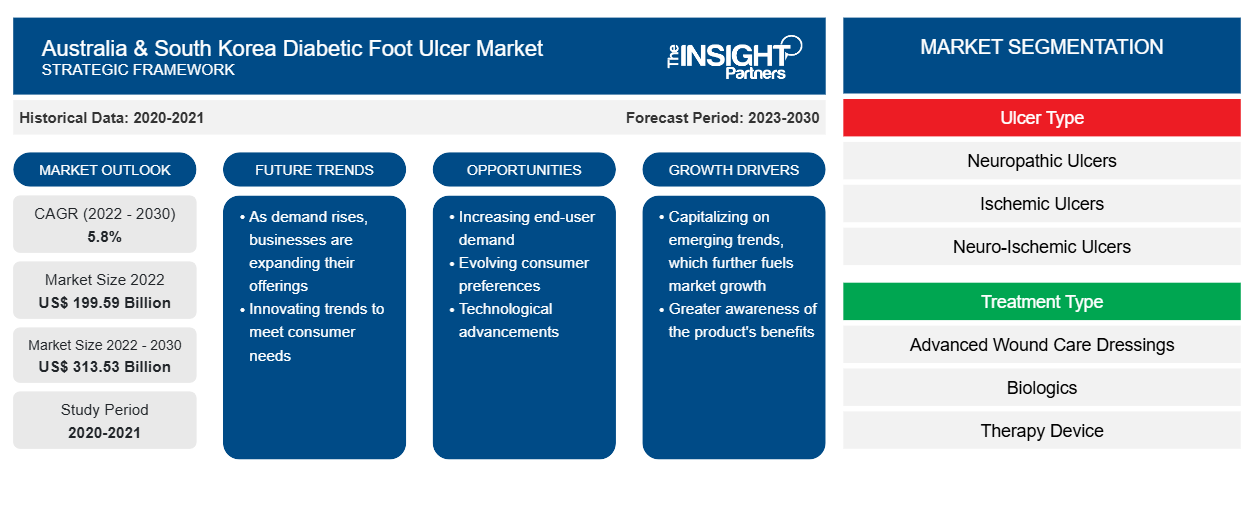

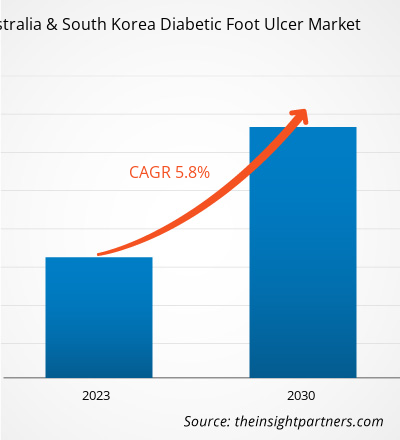

The Australia & South Korea diabetic foot ulcer market size was valued at US$ 199.59 billion in 2022 and is projected to reach US$ 313.53 billion by 2030; it is estimated to register a CAGR of 5.8% from 2022 to 2030.

Market Insights and Analyst View:

Diabetic foot ulcers are the most common complications that occur in patients suffering from diabetes mellitus, wherein the condition is not well controlled. The ulcer develops within a callosity on a pressure site and is often painless, leading to a delay in diagnosis, as well as treatment. The open sore or wound usually occurs in approximately 15% of patients with diabetes. Diabetic foot ulcers can also affect patients who have diabetes-related kidney, skin, or heart disease; patients who are obese; and those who consume alcohol in high risk volumes. High prevalence of diabetes and related chronic wounds, and a surge in the geriatric population are driving the Australia & South Korea diabetic foot ulcer market. However, the high cost of advanced wound care treatments hinders the Australia & South Korea diabetic foot ulcer market growth.

Growth Drivers and Challenges:

Diabetic patients are vulnerable to wounds, and the healing process is usually longer. Depending on the healing timeframe, wounds are classified as acute and chronic. According to the Australian Institute of Health and Welfare, over 1.3 million (1 in 20) Australians had diabetes in 2021. In South Korea, the prevalence of diabetes is growing, presenting significant challenges to the economy, healthcare system, and society. According to the Korean Diabetes Association, in 2020, the estimated prevalence of diabetes mellitus was 16.7% among the Korean population aged 30 years or older. Blood vessels and nerves in the feet of diabetic patients are prone to damages, resulting in numbness. Due to this, diabetic patients have a higher chance of developing diabetic foot ulceration. According to the National Center for Biotechnology Information (NCBI), nearly 15–25% of diabetic patients can develop a diabetic foot ulcer (DFU) during their lifetime. Due to diabetes, over 4,400 amputations are performed yearly in Australia, which is the second-highest rate in the developed world. According to data released by Diabetes Feet Australia and the Australian Diabetes Society in 2020, ~50,000 Australians develop diabetes-related foot disease (DFD) annually, with a further 300,000 having risk factors for developing DFD. Thus, the demand for diabetic foot ulcer treatments is on the rise in Australia and South Korea.

Age-associated diabetes is common in Australia and South Korea. According to the Australian Institute of Health and Welfare data published in 2021, almost 1 in 5 Australians aged 80–84 years are reported to have diabetes; it is nearly 30 times more frequent in this age group than those under 40 years (0.7%). According to the Statistics Korea report, 8.53 million were aged 65 years and older in 2021. The same report also estimated that the number of older people is likely to account for 43.9% of the country's population by 2050. However, wound care treatments are performed when the injured skin loses its ability to heal, making it an expensive procedure. According to the data published in Diabetes Australia, it is estimated that diabetic foot disease costs Australia ~US$ 875 million annually. Furthermore, a diabetes-associated limb amputation procedure costs nearly US$ 23,555, with an additional annual post-surgery expense of US$ 6,065. Over 5 years, diabetes-related amputation amounted to almost US$ 50,000 for the health system, excluding social costs. The area of a wound and the complexity of procedures also determine the cost of the treatment. Thus, the high cost of advanced wound care treatments, despite the availability of reimbursements, is a key factor restraining the Australia & South Korea diabetic foot ulcer market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “Australia & South Korea Diabetic Foot Ulcer Market” is segmented based on ulcer type, treatment type, infection severity, and end user, and country.

Segmental Analysis:

Based on ulcer type, the Australia & South Korea diabetic foot ulcer market is segmented into neuropathic ulcers, ischemic ulcers, and neuro-ischemic ulcers. The neuro-ischemic ulcers segment held the largest share of the Australia & South Korea diabetic foot ulcer market in 2022, and it is anticipated to register the highest CAGR during the forecast period. Diabetic patients are vulnerable to wounds, and the healing process is usually longer. Neuro-ischemia predominately leads to the development of ulcers on the foot, toes, and dorsum margins, especially on pressure sites occurring among people using poorly fitting shoes. The management of such types of wounds is comparatively complex. The wound requires prompt care, appropriate footwear, offloading, dressings, and infection treatment. However, neuro-ischemic ulcers are the most common diabetic foot ulcers. The neuro-ischemic ulcers are caused in patients with peripheral neuropathy and ischemia, resulting in peripheral artery disease. The treatment of neuro-ischemic ulcers includes referral, debridement, footwear modifications, and infection treatment through vascular surgeries and suitable drugs such as antibiotics. In addition, the wound needs to be kept clean regularly, and the blood sugar levels must be within limits to avoid any possible complications.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The Australia & South Korea diabetic foot ulcer market, by treatment type, is segmented into advanced wound care dressings, biologics, and therapy device. The advanced wound care dressings segment held the largest share of Australia & South Korea diabetic foot ulcer market in 2022. The biologics segment is anticipated to register the highest CAGR of 6.4% during 2022–2030.

Only standard-of-care therapy is often not sufficient to heal diabetic foot ulcer wounds and requires the subsequent or simultaneous application of adjuvant wound therapies, including biological skin substitutes. Biologics are developed from natural sources, including humans, animals, and microorganisms. Cell-based biological substitutes are used particularly for the treatment of wounds.

Regional Analysis:

Based on country, the Australia & South Korea diabetic foot ulcer market is divided Australia and South Korea. South Korea held a larger market share owing to the growing cases of diabetes. Diabetes is a significant public health issue nationwide, and its burden is projected to increase in the coming years. According to a study titled Plantar Forefoot Reconstruction in Diabetic Foot Ulcers: A Comparative Study of Perforator Valves and Accidental Valves, published in the Journal of Wound Management and Research in South Korea, in 2021, the number of patients suffering from diabetes mellitus foot problems rose to ~1.4% of the total population, with 0.4% of the total population appearing each year. According to the results of the National Health and Nutrition Survey 2012–2018, 1 in 7 persons over 30 years of age, i.e., 13.8% of South Korea's adult population, has diabetes. The older the age, the higher the prevalence of diabetes. In South Korea, the prevalence of diabetes in men in their 40s and women in their 50s is over 10%. It is estimated that 15–25% of people with diabetes will develop a foot ulcer at some point, with more than half having other complications related to the infection. In extreme cases, ~20% of moderate to severe infections require a foot amputation. Therefore, the number of diabetic patients is also expected to increase with the rising geriatric population, which, in turn, will drive the growth of the diabetic foot ulcer market in South Korea.

Increasing collaborations between public and private players are also driving the growth of the Australia & South Africa foot ulcer treatment market. Lescarden Inc. entered into a license agreement with Daewoong Pharmaceutical Co., Ltd. (Seoul, South Korea), granting Daewoong a 10-year exclusive license to market Catrix(R) diabetic foot ulcer wound dressing in South Korea. Catrix (R) wound dressing, its proprietary product, is a biologic compound derived from specially processed bovine cartilage. The FDA and the EU have approved this compound for managing diabetic foot ulcers. In February 2019, ROKIT Healthcare, a South Korea-based medical startup, came up with a radical regenerative solution for treating diabetic foot ulcers by using a proprietary three-dimensional bioprinting strategy. Further, in September 2021, Rokit Healthcare Inc. received approval from the South Korean Ministry of Food and Drug Safety (MFDS) for Dfurege—an artificial organ platform for treating diabetic foot ulcers.

Therefore, growing geriatric population, increasing diabetes cases, and surging collaborations and product approvals boost the diabetic foot ulcer market in South Korea.

Competitive Landscape and Key Companies:

Developments in the Australia & South Korea diabetic foot ulcer market have been characterized as organic and inorganic growth strategies. Various companies are focusing on organic growth strategies such as launches, expansion, enhancement, and relocation. Inorganic growth strategies witnessed in the Australia & South Korea diabetic foot ulcer market were mergers & acquisitions, partnership, and collaborations. These activities have paved the way for the expansion of business and customer base of Australia & South Korea diabetic foot ulcer market players.

- In January 2023, MiMedx Group, Inc. entered into an exclusive distribution agreement with GUNZE MEDICAL LIMITED (“Gunze Medical”), a subsidiary of Gunze Limited, for sales of EPIFIX in Japan. Gunze Medical is a leading distributor of products used in a wide range of wound and surgical settings, including bioabsorbable devices and materials, such as sutures and sheet products.

- In August 2021, URGO Medical partnered with Diabetes Feet Australia (DFA). As part of their charter, DFA has been working on developing evidence-based guidelines for the Australian healthcare sector for diabetes-related foot disease, which would serve as the new national multi-disciplinary best practice standards of care for providing diabetic foot disease care within Australia.

- In October 2019, 3M acquired Acelity, Inc. and its KCI subsidiaries worldwide. Acelity is a globally leading medical technology company that focuses on offering advanced wound care and specialty surgical solutions under its KCI brand. This acquisition has further accelerated 3M's position as a leader in the advanced wound care market.

- In April 2023, 3M Health Care received Food and Drug Administration (FDA) clearance for its innovative 3M Veraflo Therapy, comprising 3M Veraflo Cleanse Choice Complete Dressing and 3M V.A.C. Veraflo Cleanse Choice Dressing, which facilitates hydromechanical removal of infectious materials, non-viable tissue, and wound debris. The product also reduces the number of surgical debridement’s required, while promoting granulation tissue formation and creating an environment that promotes wound healing.

- In July 2022, Smith+Nephew launched the WOUND COMPASS Clinical Support App. It is a comprehensive digital support tool for healthcare professionals that aids wound assessment and decision-making to help reduce practice variation. The App helps improve nurse confidence when assessing and treating wounds and reassuring specialist nurses that their formulary is followed.

- In March 2022, Convatec entered the attractive wound biologics segment by acquiring Triad Life Sciences Inc. The company develops biologically derived innovative products to address unmet clinical needs associated with surgical wounds, chronic wounds, and burns.

Company Profiles

- MiMedx Group, Inc

- Convatec Group Plc

- URGO MEDICAL Australia Pty Ltd

- 3M

- Organogenesis Inc.

- Smith+Nephew

- Coloplast AS

- B. Braun SE

- Molnlycke Health Care AB

- Medline Industries LP

Australia & South Korea Diabetic Foot Ulcer Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 199.59 Billion |

| Market Size by 2030 | US$ 313.53 Billion |

| Global CAGR (2022 - 2030) | 5.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Ulcer Type

|

| Regions and Countries Covered | Australia & South Korea

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Ulcer Type, Treatment Type, Infection Severity, End User, and Country

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Australia and South Korea Diabetic Foot Ulcer Market

- CONVATEC GROUP PLC

- 3M CO

- COLOPLAST A/S

- SMITH & NEPHEW PLC

- B. BRAUN SE

- MOLNLYCKE HEALTH CARE

- MIMEDX GROUP INC

- URGO MEDICAL AUSTRALIA PTY LTD

- MEDLINE INDUSTRIES LP

- ORGANOGENESIS INC

Get Free Sample For

Get Free Sample For