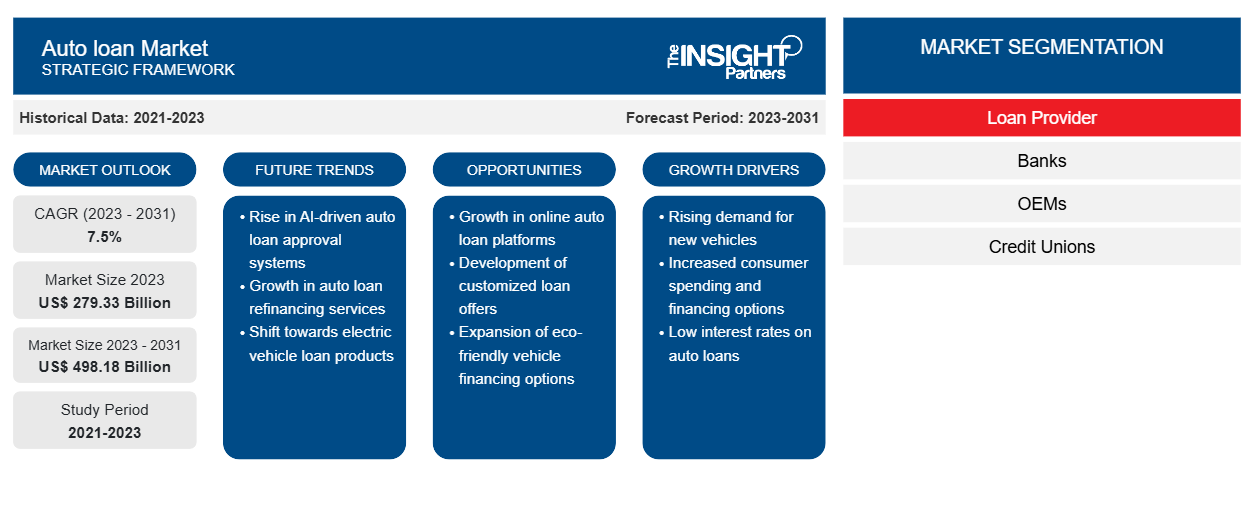

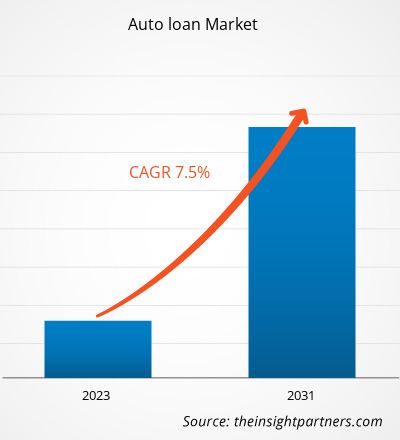

The auto loan market size is expected to grow from US$ 279.33 billion in 2023 to US$ 498.18 billion by 2031; it is anticipated to expand at a CAGR of 7.5% from 2023 to 2031. The automotive industry has observed exponential growth since its beginning. Consumers are looking at used cars more than ever before, and some are even choosing them over two-wheelers. This, in turn, is anticipated to drive the demand for auto load market growth during the forecast period.

Auto Loan Market Analysis

Ownership of cars, which used to be a status symbol long ago, has become a necessity in recent times. Thus, growing consumer preference for owning a vehicle and evading public transportation is also an important factor in the adoption of used cars across the globe. Increasing digitization and startups with novel business models are promoting the used car financing market. Digitization helps to store, retrieve, and retain data. Saving information in digital format reduces the capital resources required and decreases the problem of storing documents. The surge in digitization in auto loans is growing. Further, including digital loan documents and e-signatures gives an opportunity to gain an advantage in the auto loan market during the forecast period.

Auto Loan

Industry Overview

- Auto loans are secured loans where the automobile itself is used as a security. It is offered by lenders for used cars, new cars, and commercial vehicles. Auto loans are obtainable through credit unions, banks, and online lenders and need the vehicle to be used as security for the loan.

- An auto loan is a kind of financing that can make it possible to buy a vehicle, such as a truck or car, and pay it off over time. The auto loan market is expected to grow during the forecast period due to growing digitization in the insurance and finance industry.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Auto loan Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Auto loan Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Auto Loan Market Driver

Increasing Digitization in the Auto Loan to Drive the Market Growth

- With digital touchpoints growing in the customer buying of a vehicle, digitization of vehicle financing is unavoidable. The digital transformation movement is sweeping across numerous industries, and the auto loan sector is no exception. Thus, with a shift to digital services, customers across all auto segments are selecting a hassle-free vehicle purchase journey.

- The appearance of online automotive finance applications and growing vehicle prices are driving the growth of the global auto loan market. In addition, the implementation of digital technologies for automotive financing positively influences the growth of the auto finance market. Automotive lenders all over the globe are digitizing the consumer experience using technologies like biometrics, e-signature, and identification document verification.

- With advanced document scanning technology, all documents can be digitalized, verified, and stored. Cloud-based platforms can also help numerous participants to access and act on the loan application in parallelly. Digital loan processing can also help eliminate several rounds of discussions and tedious paperwork, thereby democratizing the vehicle lending process. Real-time credit risk valuation of the loan request with information from open APIs and credit score analysis can substantially reduce fraud. Thus, the auto loan market is expected to be supported by the digitization in the insurance finance industry.

Auto Loan

Market Report Segmentation Analysis

- Based on financier, the auto loan market is segmented into banks, OEMs, credit unions, and other loan providers.

- The OEM segment held a significant auto loan market share in 2023. OEMs are observing the rise in demand for financing for used vehicles.

- Further, the bank's segment is expected to grow at the fastest rate during the forecast period as it provides better after-sales services.

Auto Loan

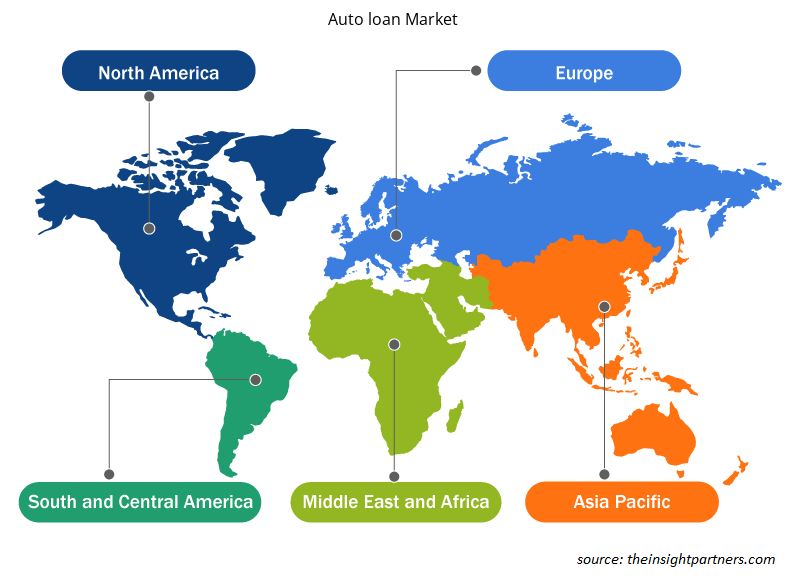

Market Regional Analysis

The scope of the auto loan market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is observing rapid growth and is expected to hold a noteworthy auto loan market share in 2022. The market for used car financing in the Asia Pacific region is on the fragmented side. The presence of numerous unorganized and organized players has shaped such a market scenario. Also, the majority of auto manufacturers, apart from offering their financing, have tie-ups with financial institutions and banks to offer a broader choice for their customers.

Additionally, the surge in auto sales has also influenced vehicle financing volumes. As per data published by the Reserve Bank of India (RBI) data, vehicle advances of commercial banks grew 18% at the end of June 2022. The surge was seen more for passenger vehicles than commercial vehicles. Thus, the market in the Asia Pacific region is expected to grow during the forecast period.

Auto Loan

Auto loan Market Regional Insights

The regional trends and factors influencing the Auto loan Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Auto loan Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Auto loan Market

Auto loan Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 279.33 Billion |

| Market Size by 2031 | US$ 498.18 Billion |

| Global CAGR (2023 - 2031) | 7.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Loan Provider

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

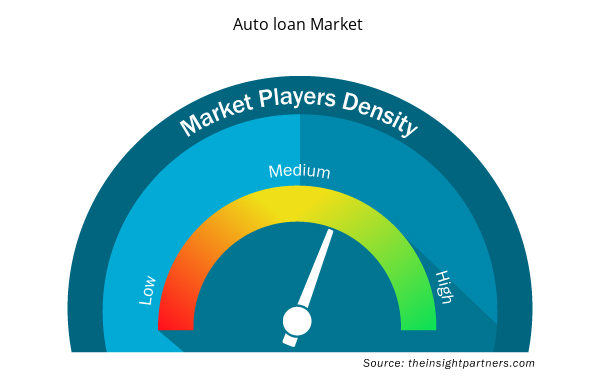

Auto loan Market Players Density: Understanding Its Impact on Business Dynamics

The Auto loan Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Auto loan Market are:

- Ally Financial

- HDFC Bank

- Chase

- Wells Fargo

- Capital One

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Auto loan Market top key players overview

The "Auto loan Market Analysis" was carried out based on vehicle type, ownership, end-user, loan provider, and geography. In terms of vehicle type, the market is segmented into passenger vehicles and commercial vehicles. In terms of ownership, the market is segmented into new vehicles and used vehicles. In terms of end-users, the market is segmented into individuals and enterprises. In terms of vehicle loan providers, the market is segmented into banks, OEMs, credit unions, and other loan providers. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Auto Loan

Market Leaders & Share Analysis

Insurance Auto Loan

Market Leaders & Share Analysis

Ally Financial, HDFC Bank, Chase, Wells Fargo, Capital One, Bank of America, ICICI Bank, Credit Agricole, Mashreq Bank, and Tata Capital. are among the prominent players profiled in the Auto loan market report. In addition, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem. The auto loan market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases.

Auto Loan

Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the auto loan market. A few recent key market developments are listed below:

- In August 2021, Tata Motors partnered with Sundaram Finance to provide exclusive offers to customers electing to purchase its variety of passenger cars. Under this partnership with TATA Motors, Sundaram Finance agreed to offer 6 years of loans on the novel 'Forever' range of cars, and with 100% financing, that would require a minimum down payment.

(Source: Tata Motors, Company Website)

- In November 2021, Mahindra & Mahindra Financial Service Limited launched the subscription and leasing business 'Quiklyz.' This venture is a novel digital platform for vehicle leasing and subscription. This platform allows customers to choose the car and provides flexibility.

(Source: Mahindra & Mahindra, Company Website)

- In July 2021, Maruti Suzuki Limited launched a digital platform that provides customers with end-to-end online car financing solutions.

(Source: Maruti Suzuki, Company Website)

- In May 2023, as part of the Dutton Group, Albert Automotive Holdings Pty Ltd is a wholesale and retail used car business. Sojitz Corporation, a pre-owned car dealer, acquired this business to expand its reach into both foreign and domestic markets.

(Source: Sojitz Corporation, Company Website)

Auto Loan

Market Report Coverage & Deliverables

The market report "Auto Loan Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Vehicle Type, Ownership, End-User, Loan Provider, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players holding majority shares in the global auto loan market are General Electrics, TomTec, Imaging Systems GMBH, Olympus Corporation, PLANMECA OY, and Ajile Light Industry.

The global auto loan market is expected to reach US$ 498.18 billion by 2031.

The global auto loan market was estimated to be US$ 279.33 billion in 2023 and is expected to grow at a CAGR of 7.5 % during the forecast period 2023 - 2031.

Digital advancements in the auto loan market to play a significant role in the global auto loan market in the coming years.

Increasing investments in the auto loan market and high adoption in the commercial sector are the major factors that propel the global auto loan market.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Ally Financial

- HDFC Bank

- Chase

- Wells Fargo

- Capital One

- Bank of America

- ICICI Bank

- Credit Agricole

- Mashreq Bank

- Tata Capital

Get Free Sample For

Get Free Sample For