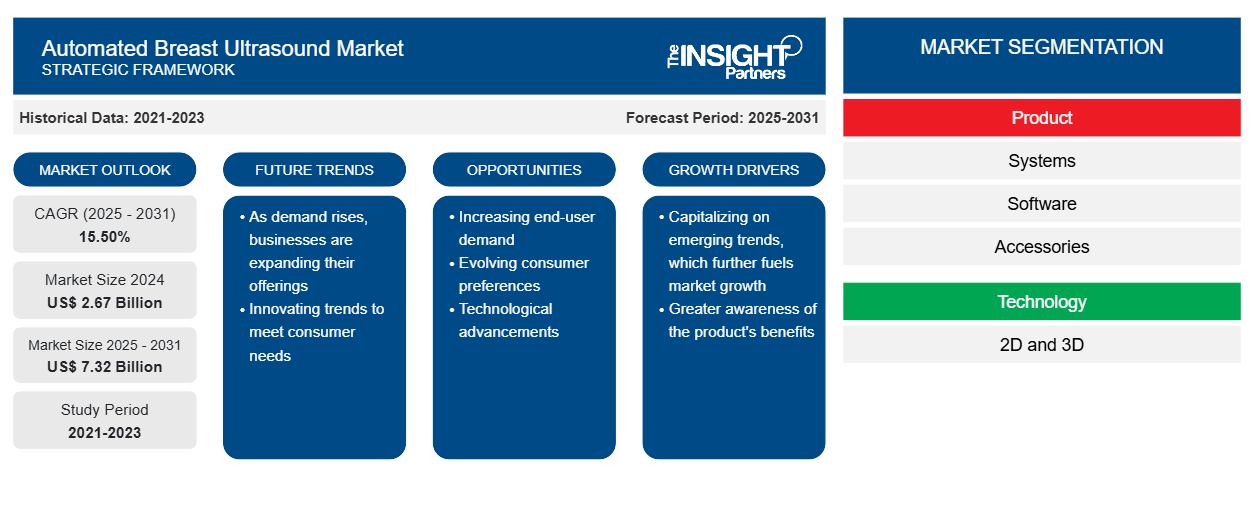

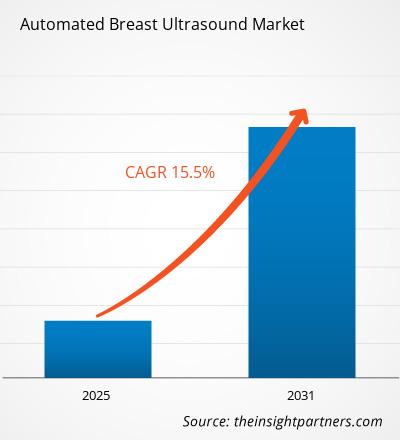

[Research Report] The automated breast ultrasound market is expected to reach US$ 6.5 Bn in 2031 from US$ 2.0 Bn in 2022. The market is estimated to grow with a CAGR of 15.5% during the period 2022-2031.

Market Insights and Analyst View:

Automated breast ultrasound systems (ABUS) are medical imaging devices designed to assist in the detection and diagnosis of breast abnormalities. They use high-frequency sound waves to create detailed images of the breast tissue. ABUS systems are particularly useful for women with dense breast tissue, as they can provide additional information beyond traditional mammography.

ABUS technology typically involves the use of a computer-controlled scanner that moves over the breast, capturing multiple images from different angles. These images are then processed and reconstructed to create a three-dimensional view of the breast. Radiologists can analyze these images to identify potential breast lesions, such as tumors or cysts.

ABUS can be a valuable tool for breast cancer screening, especially for patients with dense breast tissue, which can make it more challenging to detect abnormalities using mammography alone. It is often used in conjunction with mammography to improve breast cancer detection rates.

The automated breast ultrasound (ABUS) market has been growing in recent years as there is an increasing demand for advanced breast cancer screening and diagnostic technologies. Several factors contribute to the growth of this market:

Rising Breast Cancer Incidence: The increasing incidence of breast cancer worldwide has led to a greater emphasis on early detection and improved diagnostic capabilities, driving the demand for advanced breast imaging technologies like ABUS.

Advantages of ABUS for Dense Breast Tissue: ABUS is particularly beneficial for women with dense breast tissue, which can make it challenging to detect abnormalities with traditional mammography. As awareness about breast density and its impact on cancer detection increases, the market for ABUS systems has grown.

Technological Advancements: Ongoing advancements in ABUS technology have led to more efficient and accurate systems, making them more attractive to healthcare providers. These advancements include improved image quality and faster scanning times.

Increasing Healthcare Investment: Governments and healthcare organizations are investing in modern medical equipment, including ABUS, to improve breast cancer screening and diagnosis.

Patient Preferences: Patients are becoming more aware of breast cancer screening options and may request or prefer ABUS as an adjunct to mammography, contributing to the market's growth.

Regulatory Approvals: As ABUS systems gain regulatory approvals in different regions, it becomes easier for healthcare providers to offer these services, further expanding the market.

However, high cost of ABUS systems and maintenance charges can make them inaccessible for small healthcare facilties.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automated Breast Ultrasound Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automated Breast Ultrasound Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Growth Drivers and Challenges:

Increasing Incidence of Breast Cancer

The increasing incidence of breast cancer across the globe is a significant factor for the growth of the automated breast ultrasound system (ABUS) market. Breast cancer is one of the most common cancers affecting women worldwide, and its rising prevalence underscores the need for advanced and more effective screening and diagnostic tools.

Detecting breast cancer at an early stage is crucial for successful treatment and improved patient outcomes. As breast cancer incidence rises, there is a growing emphasis on early detection. ABUS plays a vital role in this by providing additional screening and diagnostic capabilities, especially in women with dense breast tissue where mammography may be less effective. Many women have dense breast tissue, which can make it challenging to detect abnormalities using mammography alone. ABUS is particularly effective in such cases. As the breast density awareness increases, healthcare providers are more inclined to invest in ABUS technology to improve the accuracy of breast cancer screening.

Breast cancer is not limited to older women; it can affect women of all ages. The rising incidence of breast cancer in young women highlights the importance of effective screening methods. ABUS can be used for women of various age groups, making it a valuable tool in addressing this trend.

Early detection of breast cancer through ABUS can lead to less aggressive treatment options, reduced morbidity, and improved overall patient outcomes. This benefits both patients and healthcare systems, creating a strong incentive for the adoption of ABUS. The increasing awareness about the importance of breast cancer screening among the general population and advocacy for dense breast notifications have led more women to seek comprehensive screening options, which include ABUS. Many governments and healthcare organizations have initiated breast cancer awareness and screening programs. These initiatives often include investments in advanced technologies such as ABUS to enhance the quality and reach of breast cancer screening services.

The demand for ABUS systems has led to market growth, resulting in technological advancements and increased competition among manufacturers, which can lead to improved system features and cost-effectiveness. The increasing breast cancer incidence also drives research and clinical studies, which often rely on advanced imaging tools like ABUS for data collection and analysis. This further stimulates the adoption of ABUS systems.

In conclusion, the rising incidence of breast cancer globally is a compelling driver for the ABUS system market. ABUS not only addresses the challenges of breast cancer detection but also contributes to early diagnosis, improved patient outcomes, and enhanced breast health management. As breast cancer awareness and healthcare infrastructure continue to evolve, the demand for ABUS systems is likely to persist and expand, making it an integral part of breast cancer care worldwide.

Report Segmentation and Scope:

The "global automated breast ultrasound market" is segmented based on product, technology, application, end user, and geography. By product the market is segmented into systems, software, accessories, services. On the basis of technology, the market is bifurcated into 2D and 3D. Based on application, the automated breast ultrasound market is classified into screening, diagnosis, research and clinical studies, and others. In terms of end user, the market is categorized into hospitals, diagnostic imaging centers, ambulatory surgical centers and others.

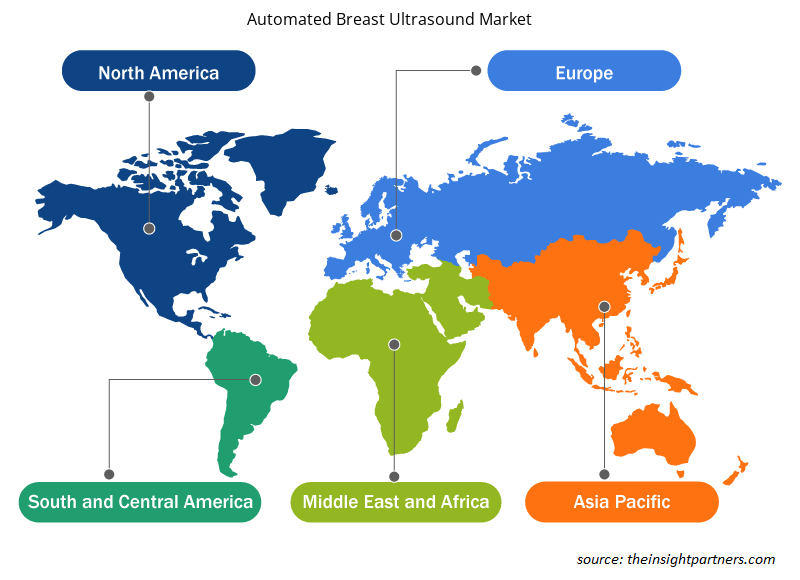

The automated breast ultrasound market based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Spain, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America)

Segmental Analysis:

Based on the end-user, the global automated breast ultrasound market was segmented into hospitals, diagnostic imaging centers, ambulatory surgical centers and others. In 2022, the hospitals segment held the largest market share by end user. In addition, the diagnostic imaging centers segment is expected to grow fastest during the coming years.

Hospitals indeed represent a significant segment among end users in the automated breast ultrasound (ABUS) market. Many hospitals have integrated ABUS systems into their breast cancer screening and diagnostic services. Hospitals often provide comprehensive healthcare services and are well-equipped to offer ABUS as part of their breast imaging services, making them a major end user in the market.

Hospitals benefit from ABUS technology because it enhances their ability to provide thorough breast cancer screening and diagnosis, especially for women with dense breast tissue. This technology allows hospitals to offer a more comprehensive range of breast health services to their patients.

It's important to note that while hospitals are a major end user, ABUS systems can also be found in diagnostic imaging centers, ambulatory surgical centers, and research institutions, depending on the healthcare infrastructure and regional preferences. The distribution of ABUS systems among different end users may vary based on geographic location and healthcare practices.

Regional Analysis:

Based on geography, the automated breast ultrasound market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In terms of revenue, North America dominated the automated breast ultrasound market share. The North American automated breast ultrasound market has been segmented into US, Canada, and Mexico.

The automated breast ultrasound market in North America is dynamic and evolving segment of the broader healthcare industry. The market for automated breast ultrasound in North America included the United States, Canada, and Mexico, with the United States being the region's largest and most influential market. North America, especially the United States, has been a major market for ABUS systems. The FDA has cleared several ABUS systems for use in breast cancer screening, and many healthcare providers have adopted this technology, particularly to address the challenges of dense breast tissue. Similar to the U.S., Canada has seen increasing adoption of ABUS, with healthcare facilities offering it as a complementary screening tool alongside mammography.

Several countries in Western Europe have embraced ABUS as an additional breast imaging modality. This region's adoption has been driven by the emphasis on early cancer detection and advancements in healthcare technology.

The Asia-Pacific region is expected to witness fastest growth rate during the forecast period. The Asia Pacific region is segmented to China, Japan, India, South Korea, Australia and rest of Asia-Pacific.

The Asia-Pacific region, including China, has seen increasing interest in breast cancer screening and diagnosis. ABUS technology is gradually gaining acceptance, driven by the growing healthcare infrastructure and rising awareness of breast health. Japan has a long history of using ultrasound for breast imaging, and ABUS systems have also found acceptance here as an adjunct to mammography. South Korea is another country in the Asia-Pacific region where ABUS technology is being adopted to improve breast cancer screening.

Industry Developments and Future Opportunities:

Multiple companies are involved in the development and marketing of ABUS systems, leading to increased competition and innovation in the market. The ABUS market is expected to continue to grow as technology improves, breast cancer screening guidelines evolve, and healthcare providers recognize the benefits of combining ABUS with traditional mammography for comprehensive breast cancer screening and diagnosis.

Some of the activities undertaken by the company that have promoted its growth are product launches, expansion, and others. Such activities by the major market players will likely boost the global automated breast ultrasound market. Various initiatives taken by key players operating in the global automated breast ultrasound market are listed below:

- In May 2022, iSono Health, Inc. has received clearance from the U.S. Food and Drug Administration (FDA) for its ATUSA System, which is a groundbreaking compact automated whole breast ultrasound system. This innovative technology includes a distinctive wearable accessory and user-friendly software designed for automated image capture and analysis in breast imaging. The patented technology of ATUSA makes 3D breast ultrasound imaging available to both patients and physicians at the point of care.

- In November 2022, Seno Medical, a Texas-based medical imaging company, launched Imagio Breast Imaging System - a revolutionary new modality in breast imaging at the annual RSNA Scientific Assembly and Annual Meeting.

Competitive Landscape and Key Companies:

Some of the prominent players operating in the global automated breast ultrasound market include Siemens Healthcare Private Limited, Canon Medical Systems, Theraclion ENG, Delphinus Medical Technologies Inc., Hitachi Ltd., Koninklijke Philips N.V., SonoCiné, MetriTrack, Inc., CapeRay, NOVA MEDICAL IMAGING TECHNOLOGY CO.LTD., QView Medical, Real Imaging & Research center, Seno Medical Instruments, Inc., GENERAL ELECTRIC COMPANY, OLYMPUS CORPORATION, SIUI, Supersonic Imagine and Volpara Solutions Limited among others. These companies focus on new product launches and geographical expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. They have a widespread global presence, allowing them to serve a large set of customers and subsequently increase their market share.

Report Scope

Automated Breast Ultrasound Market Regional Insights

The regional trends and factors influencing the Automated Breast Ultrasound Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Automated Breast Ultrasound Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Automated Breast Ultrasound Market

Automated Breast Ultrasound Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 2.67 Billion |

| Market Size by 2031 | US$ 7.32 Billion |

| Global CAGR (2025 - 2031) | 15.50% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

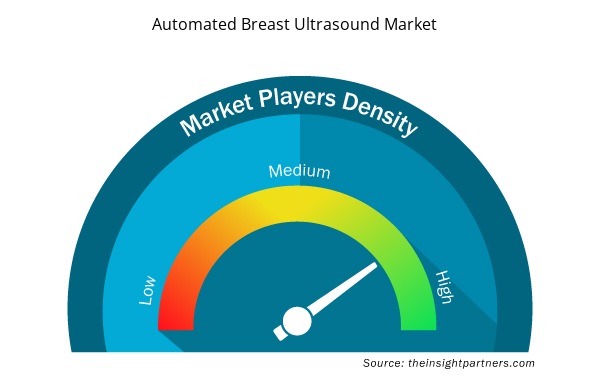

Automated Breast Ultrasound Market Players Density: Understanding Its Impact on Business Dynamics

The Automated Breast Ultrasound Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Automated Breast Ultrasound Market are:

- Siemens Healthcare Private Limited

- Canon Medical Systems

- Theraclion ENG

- Delphinus Medical Technologies Inc.

- Hitachi Ltd.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Automated Breast Ultrasound Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Life Sciences : READ MORE..

- Siemens Healthcare Private Limited

- Canon Medical Systems

- Theraclion ENG

- Delphinus Medical Technologies Inc.

- Hitachi Ltd.

- Koninklijke Philips N.V.

- SonoCiné

- MetriTrack, Inc.

- CapeRay

- NOVA MEDICAL IMAGING TECHNOLOGY CO.LTD.

- QView Medical

- Real Imaging & Research center

- Seno Medical Instruments, Inc.

- GENERAL ELECTRIC COMPANY

- OLYMPUS CORPORATION

- SIUI

- Supersonic Imagine and Volpara Solutions Limited

Get Free Sample For

Get Free Sample For