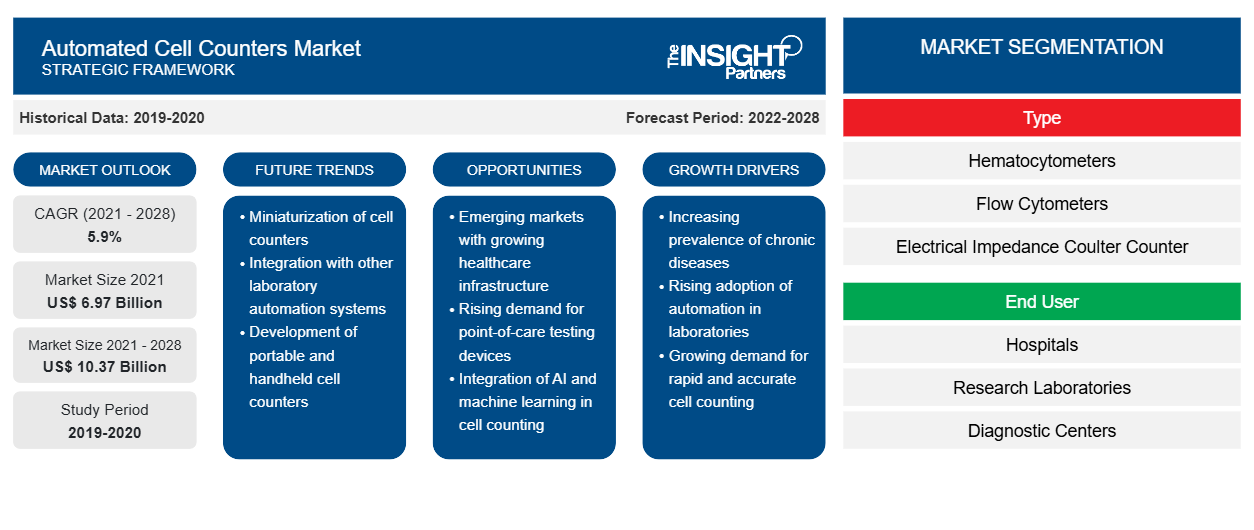

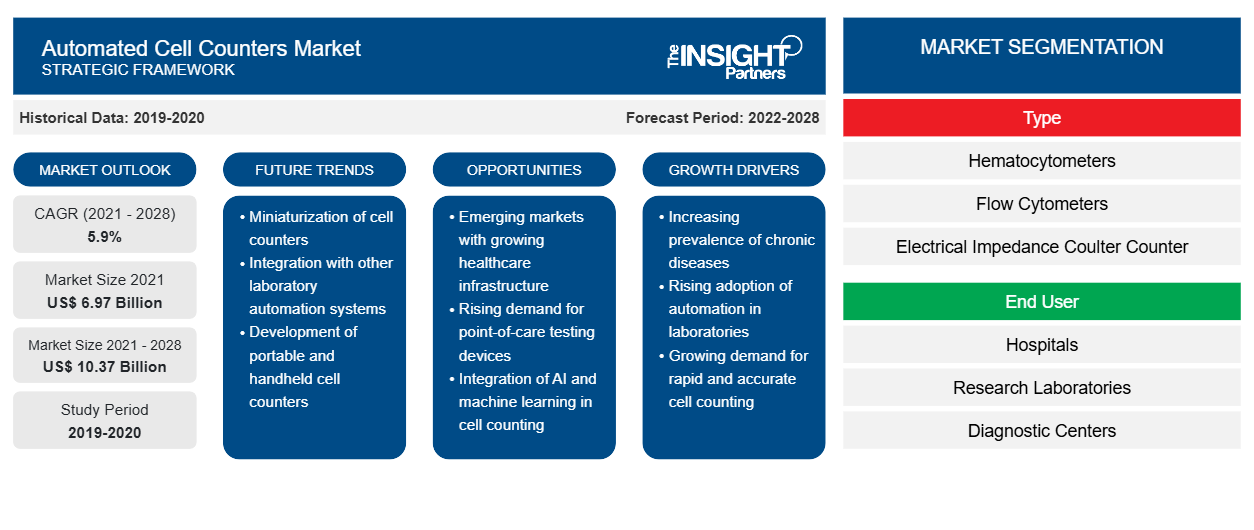

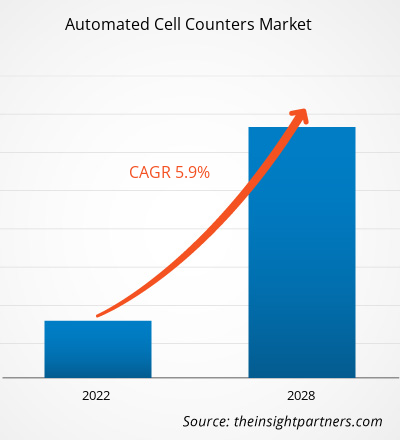

The automated cell counters market is expected to grow from US$ 6,974.29 million in 2021 to US$ 10,365.95 million by 2028; it is estimated to grow at a CAGR of 5.9% from 2022 to 2028.

The market growth is attributed to the high prevalence of infectious and chronic diseases.

The automated cell counters market comprises major competitive players who adopt various strategies, such as product launches, geographic expansion, and technological advancements. A few recent developments in the market are listed below:

- In April 2021, Eppendorf announced the launching of a new product, "Centrifuge 5910 Ri", designed to increase laboratory efficiency. This new centrifuge is a successor to the popular Centrifuge 5910 R, and is a flagship of Eppendorf's multipurpose centrifuge portfolio that offers scientists advanced features to simplify and accelerate the centrifugation steps.

- In August 2019, Agilent Technologies, Inc. announced the acquisition of Biotek Instruments, a pioneer in the design, manufacture, and distribution of innovative life science instrumentation. The acquisition results in the expansion of Agilent's presence and expertise in cell analysis and strengthens the company's position in the large and growing immuno-oncology and immunotherapy areas.

- In May 2021, Bio-Rad Laboratories, Inc. announced a partnership with major diagnostic companies through offering InteliQ products, a range of barcoded, load-and-go quality control tubes. For instance, the partnership with Roche offers customers access to Bio-Rad's complete line of InteliQ products and Unity QC data management solutions and customer training & support services.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automated Cell Counters Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automated Cell Counters Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The active participation of market players in product innovation and development and an increase in approvals of products are fueling the growth of the automated cell counters market. Further, with the advent of advanced technologies, the market will grow exponentially during the forecast period.

According to a World Health Organization (WHO) report, there is a drastic shortage of healthcare professionals or workers trained to use automated cell counter equipment. The ongoing research in pharmaceutical and biotechnology and the development of various drugs to treat diseases such as cancer, cardiovascular disorders, HIV/AIDS, etc. With technological advancements in automated cell counters and a rise in application areas of the instrument, there has been a shift in usage of automated cell counters. The working of the automated cell counter is difficult, and knowledge of this instrument is incredibly important; hence, there is a demand for a skilled workforce. The preparation of a sample for such instruments is tedious work, and the consumables required during the procedure also need to be managed properly. Thus, a lack of a skilled workforce who can easily use these instruments is hampering the growth of the automated cell counters market.

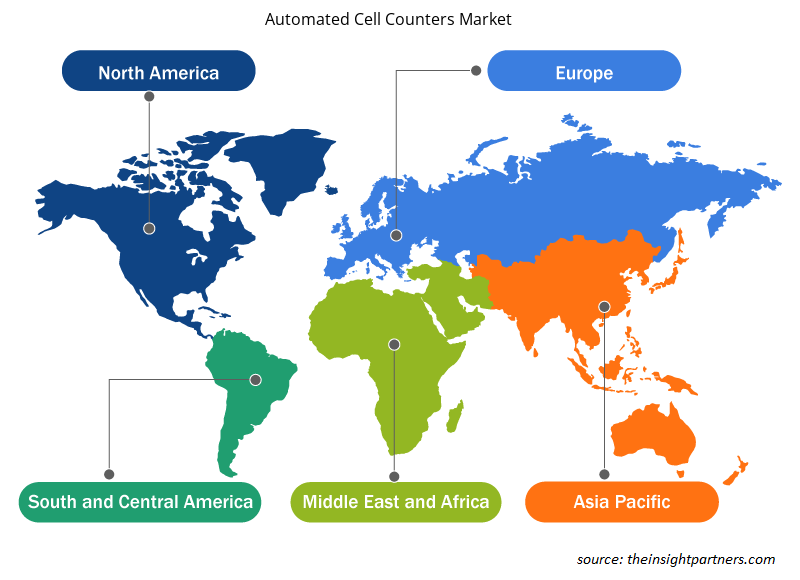

Regional Overview

Asia Pacific registered the highest CAGR in the automated cell counters market in the forecast period. High demand for toxicology testing products and precision medicines, increasing discovery of drugs, and rising investments in R&D by major market players are among the factors bolstering the growth of the Asia Pacific automated cell counters market. The automated cell counters market in China is expanding due to the country's increasing population suffering from chronic and infectious diseases. According to WHO, in 2018, ~1.25 million people were infected with HIV, and the infection was more common among young people. According to China Center for Disease Control, ~400 people were diagnosed with HIV positive. Further, in 2018, there was a 14% increase in HIV and AIDS cases in China. HIV test is conducted through an absolute count of lymphocytes by automated cell counters. Thus, increasing HIV infections is promoting the growth of the automated cell counters market.

The increasing technological development and growing research industry make the Chinese automated cell counters market more attractive. For instance, in 2018, Sysmex Corporation launched the XS-500ix, which is an automated Hematology Analyzer in the China market. With the rapidly growing population and economy in China, the demand for tests is also increasing. Therefore, the Chinese government has promoted policies for allocating medical resources to increase efficiency. Thus, this would increase the demand for sophisticated and high-quality products in China, which is expected to boost the market growth of automated cell counters.

According to the Longitudinal Ageing Study in India (LASI) released by the Union Ministry of Family and Health Welfare, 2020, two in three senior citizens in India are suffering from chronic disease. Furthermore, ~23% of the elderly population have multi-morbidities conditions. CVD is the leading disease among the population above 45 years. The CVD percentage in the age group 45–49 years is 19%, and 37% in the population above 75 years. It is expected that ~45% of the total burden of disease due to noncommunicable will be due to the growing elderly population by 2030. According to WHO, ~5.8 million people die from noncommunicable diseases every year in India. Thus, growing chronic disease cases among the elderly population are driving the growth of the automated cell counters market in India. The government of India is implementing the National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular disease, and Stroke (NPCDS) to create awareness of these diseases. This involves screening for hypertension, diabetes, and oral, breast, and cervical cancers for the early detection of noncommunicable diseases.

Thus, the growing elderly population, chronic disease cases, and measures to control the diseases are expected to boost the automated cell counters market during the forecast period.

Type Insights

Based on type, the global automated cell counters market is segmented into hemocytometers, flow cytometers, electrical impedance coulter counters, and spectrophotometers. In 2021, the spectrophotometers segment held the largest share of the market. In contrast to spot plates, which must be incubated for several days before colonies appear, spectrophotometer readings can be instantly converted into cell densities. The spectrophotometric method is based on light scattering by the cells in the culture. When the light in a spectrophotometer hits a cell, light rays are deflected from a straight path, and these light rays may not reach the detector. The greater the number of cells in a sample, the lighter scattering occurs. The growing demand for early diagnostic procedures for the detection of diseases is boosting the growth of the spectrometers segment. A surge in drug discovery and drug development activities due to increasing diseases and growth in clinical diagnostic procedures drive the segment’s growth. An increase in government initiatives in drug discovery & development and a rise in applications of spectrophotometers in bimolecular analysis is driving the growth of the segment.

The hemocytometers segment is expected to register the highest CAGR during the forecast period. A hemocytometer was initially developed for counting blood cells. It has become popular for counting all types of cells, including single-cell organisms such as yeast, protozoa, and bacteria. Hemocytometer is the most cost-effective method for cell counting. Hemocytometer is reusable and can be easily used with other common tools in a laboratory, such as an optical microscope. An increase in the incidence of blood cell disorders that cause anemia, thalassemia, lymphoma, leukemia, and other disorders is driving the segment's growth. For instance, according to WHO, in 2019, global anemia prevalence was 29.9%, equivalent to over half a million women aged 15-49 years. Furthermore, in 2019, global anemia prevalence was 39.8% in children aged 6-59 months, equivalent to 269 million children with anemia. A hemocytometer is used for rapid and effective cell count in developing countries to detect anemia. Thus, the use of hemocytometers for the detection of various blood disorders is expected to propel the growth of this segment from 2022 to 2028.

Companies operating in the automated cell counters market adopt the product innovation strategy to meet the evolving customer demands worldwide, which also permits them to maintain their brand name in the market.

Global Automated Cell Counters Market – Segmentation

The automated cell counters market is segmented into type, end user, and geography. Based on type, the market is segmented into hemocytometers, flow cytometers, electrical impedance, and spectrophotometers. Based on end user, the market is categorized into hospitals, research laboratories, diagnostic centers, and others. By geography, the automated cell counters market is segmented into North America (US, Canada, and Mexico), Europe (UK, Germany, France, Italy, Spain, and the Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (UAE, Saudi Arabia, Africa, and the Rest of the Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Automated Cell Counters Market Regional Insights

Automated Cell Counters Market Regional Insights

The regional trends and factors influencing the Automated Cell Counters Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Automated Cell Counters Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Automated Cell Counters Market

Automated Cell Counters Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 6.97 Billion |

| Market Size by 2028 | US$ 10.37 Billion |

| Global CAGR (2021 - 2028) | 5.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

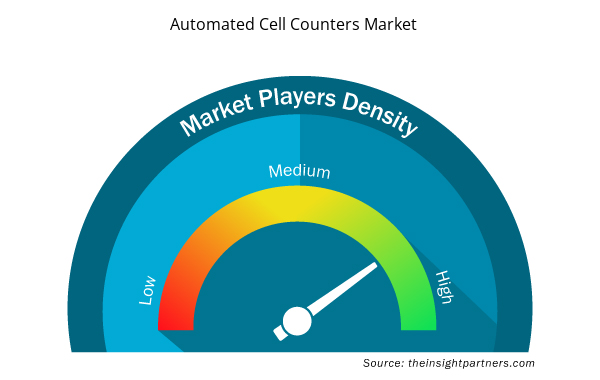

Automated Cell Counters Market Players Density: Understanding Its Impact on Business Dynamics

The Automated Cell Counters Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Automated Cell Counters Market are:

- Eppendorf

- Thermo Fisher Scientific Inc.

- Countstar Inc.

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Automated Cell Counters Market top key players overview

Company Profiles

- Eppendorf

- Thermo Fischer Scientific

- Countstar, Inc.

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche Ltd

- Chemometec A/S

- ALIGNEDGENETICS

- Beckman Coulter, Inc. (Danaher)

- Nanoentek

- Olympus Corporation

- MERCK KGaA

- Sysmex Corporation

- Agilent Technologies, Inc.

- Abbott

- Nexcelom Bioscience LLC

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Sterilization Services Market

- Medical Second Opinion Market

- Enzymatic DNA Synthesis Market

- Artificial Intelligence in Defense Market

- Smart Grid Sensors Market

- Aircraft Wire and Cable Market

- Non-Emergency Medical Transportation Market

- Trade Promotion Management Software Market

- Virtual Production Market

- Online Exam Proctoring Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, RoAPAC, RoE, RoMEA, RoSAM, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Eppendorf, Thermo Fischer Scientific, Countstar, Inc., Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd, Chemometec A/S, ALIGNEDGENETICS, Beckman Coulter, Inc. (Danaher), Nanoentek, Olympus Corporation, MERCK KGaA, Sysmex Corporation, Agilent Technologies, Inc., Abbott, Nexcelom Bioscience LLC. are among the leading companies operating in the global automated cell counters market.

Based on type, the market is segmented into spectrophotometers, flow cytometers, hemocytometers, and electrical impedance. Spectrophotometers segment is anticipated to hold a larger share in 2022 and is expected to continue to do so during the forecast period.

Automated cell counters are machines that automatically count cells. The sample is loaded into an automated cell counter and is forced through a small tube while the automated cell counter uses optical or electrical impedance sensors to count how many cells passed through the tube.

Prevalence of infectious and chronic diseases and increase in drug discovery activities are the most significant factors responsible for the overall market growth.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Automated Cell Counters Market

- Eppendorf

- Thermo Fisher Scientific Inc.

- Countstar Inc.

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche Ltd

- Chemometec A/S

- Aligned Genetics

- Beckman Coulter, Inc. (Danaher)

- Nanoentek

- Olympus Corporation

- Merck KGaA

- Sysmex Corporation

- Agilent Technologies, Inc.

- Abbott Laboratories

- Nexcelom Bioscience LLC.

Get Free Sample For

Get Free Sample For