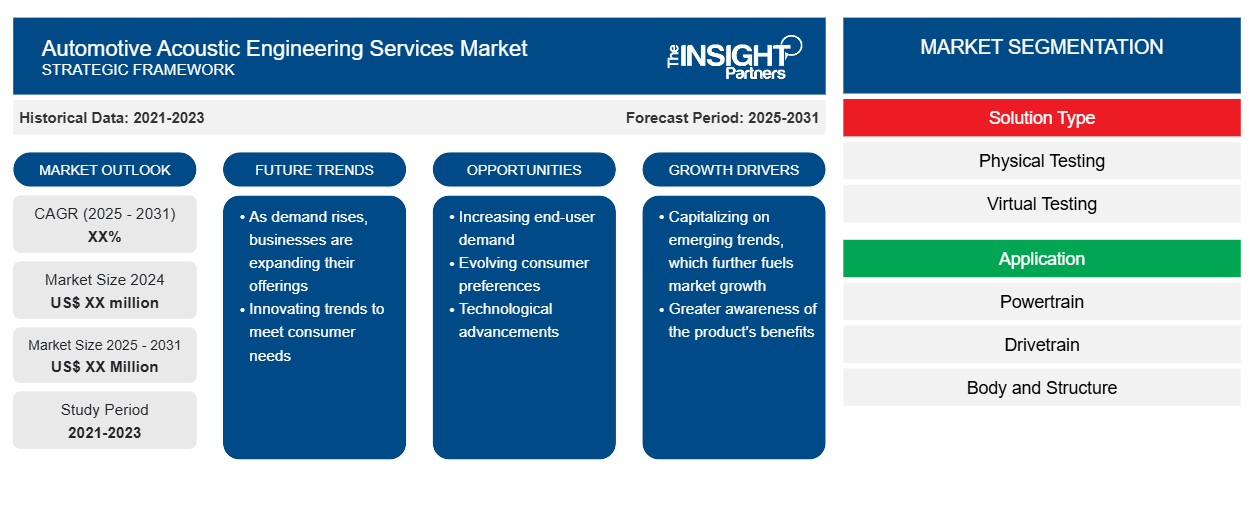

The automotive acoustic engineering services market is expected to register a CAGR of 7.5% during 2023–2031. The evolution of advanced vehicle noice control system is likely to remain a key trend in the market.

Automotive Acoustic Engineering Services Market Analysis

- The automotive acoustic engineering services market has sustained rapid growth owing to the boost in mid-sized and premium vehicles purchase, stringent rules and focus towards enhancing comfort of passengers.

- The automotive acoustic engineering services market has been growing at a greater pace over the past decade due to factors like rising consumption of mid-sized and premium cars, stringent vehicle noise regulations, growing demand for car interiors, enhanced cabin comfort, luxury features and reduced R&D expenses.

Automotive Acoustic Engineering Services Market Overview

- Factors propelling the automotive acoustic engineering services market is the growing demand for car noise cancellation, government mandates on car noise control, and the need to regulate passenger comfort and luxury options.

- In addition, the market is driven by the increasing popularity of automotive acoustic engineering services in premium and luxury vehicles.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Acoustic Engineering Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Acoustic Engineering Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Automotive Acoustic Engineering Services Market Drivers and Opportunities

Environmental Concerns and Strict Emission Regulations to Favor the Market

- Environmental concerns and strict emission regulations have played a significant role in shaping the regulations and standards related to vehicle noise. These measures aim to reduce noise pollution and its impact on human health and the environment which is also acting as a major driver for the market.

- EPA regulates noise pollution from various sources, such as rail and motor carriers, low noise emission products, construction equipment, transport equipment, trucks, motorcycles, and hearing protection device labelling. State and local government, for the most part, cater to the challenges arised from noise pollution issues from vehiles.

- Thus growing government strict regulations and policies to reduce the vehicle noise pollution is acting as a major driver for the market.

Growing Focus on Engine Downsizing

- Replacing a larger engine with a lighter, smaller version, producing the same amount of power is called engine downsizing. It can be done by using a forced aspiration device such as a turbocharger or supercharger either with direct injection technology or engine displacement as well as with a reduced number of cylinders in the combustion engine.

- However, noise, vibration and harshness behaviour, which includes all harshness and roughness in the sound produced by the vehicle might be significantly harmed by all of the mentioned factors.

- Besides, vehicles with lower number of cylinders and displacements have higher vibrations and higher rapid changes of the running speed, and therefore change the sound quality of the vehicle.

- Hence, it is widely expected that the engine downsizing trend will create lucrative opportunities for the global automotive acoustic engineering market to employ the developing technologies in automotive sector in the coming years.

Automotive Acoustic Engineering Services Market Report Segmentation Analysis

Key segments that contributed to the derivation of the automotive acoustic engineering services market analysis are solution type, application, software, vehicle type.

- Based on solution type, the automotive acoustic engineering services market is divided into physical testing, virtual testing.

- On the basis of application, the market is divided into powertrain, drivetrain, body and structure, interior.

- Based on software, the automotive acoustic engineering services market is divided into calibration, signal analysis, simulation, vibration.

- On the basis of vehicle type, the market is divided into light duty vehicle, heavy duty vehicle, electric and hybrid vehicle.

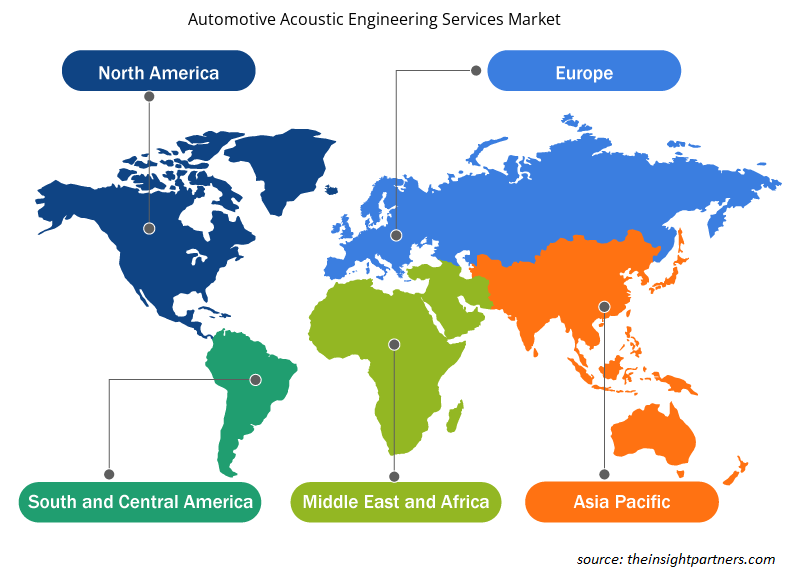

Automotive Acoustic Engineering Services Market Share Analysis by Geography

- The automotive acoustic engineering services market report comprises a detailed analysis of five major geographic regions, which includes current and historical market size and forecasts for 2021 to 2031, covering North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and South & Central America.

- Each region is further sub-segmented into respective countries. This report provides analysis and forecasts of 18+ countries, covering automotive acoustic engineering services market dynamics such as drivers, trends, and opportunities that are impacting the markets at the regional level.

- Also, the report covers PEST analysis, which involves the study of major factors that influence the automotive acoustic engineering services market in these regions.

Automotive Acoustic Engineering Services Market Regional Insights

The regional trends and factors influencing the Automotive Acoustic Engineering Services Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Automotive Acoustic Engineering Services Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Automotive Acoustic Engineering Services Market

Automotive Acoustic Engineering Services Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | XX% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Solution Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Automotive Acoustic Engineering Services Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Acoustic Engineering Services Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Automotive Acoustic Engineering Services Market are:

- AVL GmBH

- STS Group AG

- Siemens PLM Software

- IAV

- Schaeflerr Group

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Automotive Acoustic Engineering Services Market top key players overview

Automotive Acoustic Engineering Services Market News and Recent Developments

The automotive acoustic engineering services market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the automotive acoustic engineering services market are listed below:

- Continental AG has entered a strategic partnership with Munich-based high-tech company DeepDrive to develop core technologies for electric vehicles. As a first milestone, both companies will jointly develop a combined unit comprising drive and brake components for mounting directly on the vehicle wheel. (Source: Continental AG, Company Website, September 2023)

- Hottinger Brüel & Kjær (HBK) launched new data acquisition eco-system. To empower engineers with a highly efficient workflow and strengthen their measurement processes, HBK has released HBK FUSION and HBK ADVANTAGE; a data acquisition (DAQ) system designed to keep up with the demands of development, qualification, and certification.. (Source: Hottinger Brüel & Kjær, Company Website, November 2022)

Automotive Acoustic Engineering Services Market Report Coverage and Deliverables

The “Automotive Acoustic Engineering Services Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Automotive acoustic engineering services market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Automotive acoustic engineering services market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Automotive acoustic engineering services market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the automotive acoustic engineering services market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The increasing sales of commercial and premium vehicles is one of the major factors driving the automotive acoustic engineering services market.

Leveraging lightweight engine is anticipated to play a significant role in the global automotive acoustic engineering services market in the coming years.

The leading players operating in the automotive acoustic engineering services market are AVL GmBH, STS Group AG, Siemens PLM Software, IAV, Schaeflerr Group, Autoneum, EDAG Engineering GmBH, Bertrandt, Continental AG, Bruel & Kjaer.

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request.

Some of the customization options available based on request are additional 3–5 company profiles and country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

The global automotive acoustic engineering services market is expected to grow at a CAGR of 7.5% during the forecast period 2023 - 2031.

Trends and growth analysis reports related to Automotive and Transportation : READ MORE..

The List of Companies

1. AVL GmBH

2. STS Group AG

3. Siemens PLM Software

4. IAV

5. Schaeflerr Group

6. Autoneum

7. EDAG Engineering GmBH

8. Bertrandt

9. Continental AG

10. Bruel and Kjaer

Get Free Sample For

Get Free Sample For