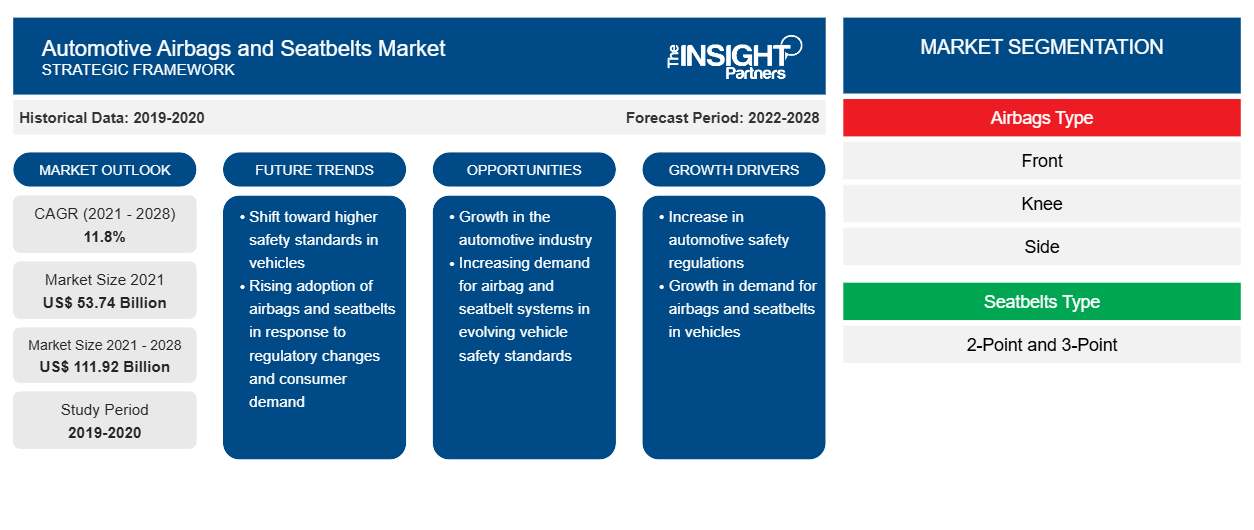

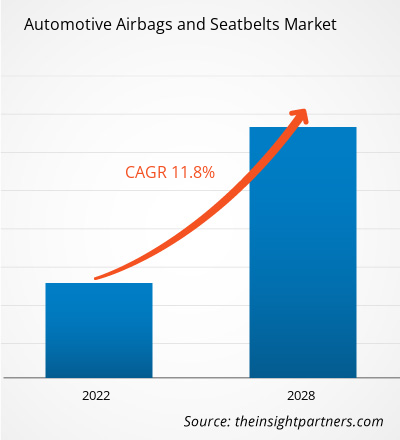

The automotive airbags and seatbelts market was valued at US$ 53,744.00 million in 2021 and is expected to reach US$ 1,11,917.12 million by 2028; it is estimated to register a CAGR of 11.8% from 2022 to 2028.

The key players in the automotive airbags and seatbelts market are expected to have lucrative opportunities in the coming years, owing to the growing initiatives for introducing regulatory standards related to vehicle safety. After the COVID-19 pandemic, a sharp increase in car sales and a significant rise in traffic accidents have become increasingly frequent and severe. At the same time, with the rapid development of science and technology, automotive technology has also been rapidly improved, and automotive safety technology has gradually become involved in all aspects of the car. As per the report published by National Highway Traffic Safety Administration (NHTSA), the traffic fatalities in 2021 had shown an increase of about 10.5% compared to reported fatalities in 2020. The estimated fatalities are the highest since 2005 and the largest annual percentage increase in the US's Fatality Analysis Reporting System’s history. Thus, the government agencies strongly emphasized on improving safety policies and standards, along with significant investment in reducing road accidents. For instance, in May 2022, the NHTSA approved US$ 740 million in funding for the 402 State and Community Grant Program, Section 1906 Racial Profiling Data Collection Grants, and Section 405 National Priority Safety Program. The European Commission is working on framing the regulatory standards for motor vehicles considering the safety of vehicle occupants and vulnerable road users. The European Commission planned to adopt updated UNECE regulations on seatbelts that requires seatbelt reminder systems in all front and rear seats on new cars from September 2019. Thus, such initiatives for introducing regulatory standards related to vehicle safety fuel the automotive airbags and seatbelts market growth.

The growing adoption of electric vehicles is the future trend in the automotive airbags and seatbelts market. As per the Global Electric Vehicle Outlook, sales of electric cars, including fully electric and plug-in hybrid vehicles, increased in 2021 to a new record of 6.6 million units. As per the same report, in China, electric car sales increased significantly in 2021 to 3.3 million, accounting for about half of the total global sales. EV sales also grew strongly in Europe by 65% to 2.3 million units, and sales in the US doubled to 630,000 units in 2021. In addition, supportive government regulations for electric vehicle charging stations further propel electric vehicle sales, thereby driving the demand for automotive airbags and seatbelts market. For instance, in June 2022, the US government proposed new standards for its program to build a national network of 500,000 electric vehicle charging stations by 2030. Furthermore, the government had introduced a plan to allocate US$ 5 billion to states to fund EV chargers by 2028. Thus, such growth prospects in EV industry is anticipated to drive the automotive airbags and seatbelts market over the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Airbags and Seatbelts Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Airbags and Seatbelts Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Automotive Airbags and Seatbelts Market

The COVID-19 outbreak dramatically impacted the global economy during its peak in 2020 in its initial days, and the crisis hampered the business activities in manufacturing industries. Before the COVID-19 outbreak, there were significant investment initiatives in developing electric vehicles to strengthen the demand for automotive airbags and seatbelts. During the initial days of the COVID-19 pandemic, the crisis significantly restricted all business deals, collaborations, and partnerships that disrupted the automotive airbags and seatbelts market. The emergence of the pandemic hampered the sales of vehicles in February 2020; furthermore, the sales dropped by 47% in the US and 80% in Europe by April. As per a report by Statista, global car sales dropped to 63.8 million in 2020 and registered a slow recovery in 2021 with 66 million sales. From 2021, market players witnessed mandatory regulations for deploying a specific number of airbags which incurs costs. This forced the car manufacturers to provide cars with added features of airbags and seatbelts at the same cost during the pandemic recovery period. The COVID-19 pandemic swiftly and severely impacted the globally integrated automotive industry. The pandemic disrupted the Chinese parts exports, large-scale manufacturing interruptions across Europe, and the closure of assembly plants in the US. All these factors are causing the automotive industry to decline in global demand for automotive vehicles. The COVID-19pandemic forced businesses to restructure their business models and strengthen strategies to achieve economies of scale. Therefore, although the global airbags and seatbelts market plummeted initially in 2020 due to the adverse impact of the COVID-19 pandemic and the related regulations, it achieved a strong recovery after the COVID-19 pandemic.

Automotive Airbags and Seatbelts Market Insights

Growing Initiatives for Introducing Regulatory Standards Related to Vehicle Safety

The automotive industry is a pillar of the global economy. It plays a crucial role in a country's economy and helps build macroeconomic growth and stability in developed and developing countries, spanning many adjacent sectors. After the COVID-19 pandemic, a sharp increase in car sales and a significant rise in traffic accidents have become increasingly frequent and severe. At the same time, with the rapid development of science and technology, automotive technology has also been rapidly improved, and automotive safety technology has gradually become involved in all aspects of the car. As per the report published by National Highway Traffic Safety Administration (NHTSA), the traffic fatalities in 2021 had shown an increase of about 10.5% compared to reported fatalities in 2020. The estimated fatalities are the highest number since 2005 and the largest annual percentage increase in the US's Fatality Analysis Reporting System’s history. Thus, the government agencies strongly emphasized improving safety policies and standards and significant investment in reducing road accidents. For instance, in May 2022, the NHTSA approved US$ 740 million in funding for the 402 State and Community Grant Program, Section 1906 Racial Profiling Data Collection Grants, and Section 405 National Priority Safety Program. Thus, such initiatives for introducing regulatory standards related to vehicle safety are fueling the automotive airbags and seatbelts market growth.

Airbags Type-Based Market Insights

Based on airbags type, the automotive airbags and seatbelts market is segmented into front, knee, side, and curtain. Frontal airbag systems are increasingly being used for driver safety, making their use compulsory by regulatory bodies worldwide. Additionally, consumers are spending more on the safety features of their vehicles due to growing awareness about vehicle safety and increasing disposable income. Top manufacturers now equip their vehicles with side airbags (SABs) to lessen significant chest injuries in side-impact incidents. A new front-center airbag from Autoliv Inc. was introduced in 2019; it is positioned in the area between the driver and front-seat passenger, and it lowers the risk of chest, shoulder, and head injuries while also saving lives in side-impact collisions.

Automotive Airbags and Seatbelts Market Regional Insights

Automotive Airbags and Seatbelts Market Regional Insights

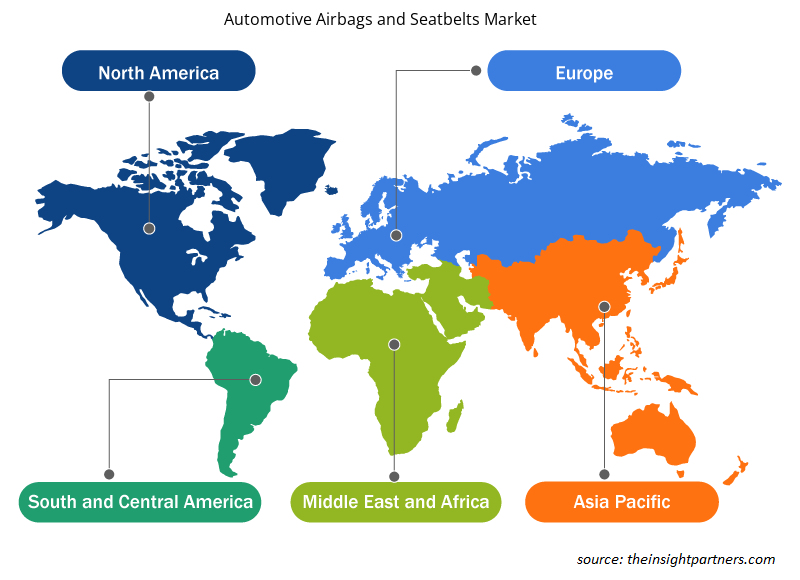

The regional trends and factors influencing the Automotive Airbags and Seatbelts Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Automotive Airbags and Seatbelts Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Automotive Airbags and Seatbelts Market

Automotive Airbags and Seatbelts Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 53.74 Billion |

| Market Size by 2028 | US$ 111.92 Billion |

| Global CAGR (2021 - 2028) | 11.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Airbags Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Automotive Airbags and Seatbelts Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Airbags and Seatbelts Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Automotive Airbags and Seatbelts Market are:

- Autoliv Inc.

- Continental AG

- Denso Corporation

- INFINEON TECHNOLOGIES AG

- Robert Bosch GmbH

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Automotive Airbags and Seatbelts Market top key players overview

Seatbelts Type -Based Market Insights

Based on

seatbelts type

, the automotive airbags and seatbelts market is segmented as 2-point and 3-point. The 3-point segment is expected to hold a larger portion of automotive airbags and seatbelts market share owing to its advantageous features. The Indian government will soon require automakers to install three-point seatbelts in every seat, including the middle one in the back. Lap belts have been determined to be less safe than three-point seatbelts. In the event of an accident, the new regulation is anticipated to increase passenger security generally. A draught notification that requires automakers to provide a minimum of six airbags in cars that can seat up to eight passengers was authorized by the Ministry of Road Transport and Highways.The players operating in the automotive airbags and seatbelts market adopt strategies such as mergers, acquisitions, and market initiatives to maintain their positions in the market. A few developments by key automotive airbags and seatbelts market players are listed below:

- In February 2022, Autoliv, Inc., announced its collaboration with Nuro, an autonomous vehicle company to provide higher safety features with exterior airbag to Nuro's latest third-generation vehicle

- In April 2021, Continental AG developed new features for its airbag control units. The company aimed to make use of signals from control units and develop functions for faster airbags deployment, particularly in a side crash.

The global automotive airbags and seatbelts market is segmented based on airbags type, seatbelts type, and vehicle class. Based on airbags type, the automotive airbags and seatbelts market is segmented into front, knee, side, and curtain. In terms of seatbelts type, the automotive airbags and seatbelts market is segmented into 2-point and 3-point. Further, based on vehicle class, the automotive airbags and seatbelts market is segmented into passenger cars, light commercial vehicles, and heavy commercial vehicles.

Autoliv, ZF Friedrichshafen AG, TOYODA GOSEI Co., Ltd., Joyson Safety Systems, and Continental AG are the key automotive airbags and seatbelts market players considered for the research study. In addition, several other significant automotive airbags and seatbelts market players have been studied and analyzed in this research report to get a holistic view of the global automotive airbags and seatbelts market and its ecosystem.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Airbags Type, Seatbelts Type, Material, and Vehicle Class

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The growing initiatives for introducing regulatory standards related to vehicle safety and increasing advancements in airbag and seatbelt technologies are driving the Automotive airbags and seatbelts market

The Automotive airbags and seatbelts market is estimated to grow at 111917.12 million US dollars in 2028 at a CAGR of 11.8%.

The growing adoption of electric vehicles is the future trends for the Automotive airbags and seatbelts market.

Autoliv, Inc., Continental AG, TOYODA Gosei Co., Takata India Pvt Litd., Daicel Corporation and Joyson Safety Systems are the key players holding the major market share in the automotive airbags and seatbelts market.

APAC is holding major market share of Automotive airbags and seatbelts market.

Passenger cars is the leading vehicle class segment in the Automotive airbags and seatbelts market.

The incremental growth of Automotive airbags and seatbelts market during the forecast period is US $ 58173.12 million.

Trends and growth analysis reports related to Automotive and Transportation : READ MORE..

The List of Companies - Automotive Airbags and Seatbelts Market

- Autoliv Inc.

- Continental AG

- Denso Corporation

- INFINEON TECHNOLOGIES AG

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Hyundai Mobis

- Joyson Safety Systems

- Toyoda Gosei Co., Ltd.

- Ashimori Industry Co., Ltd

Get Free Sample For

Get Free Sample For