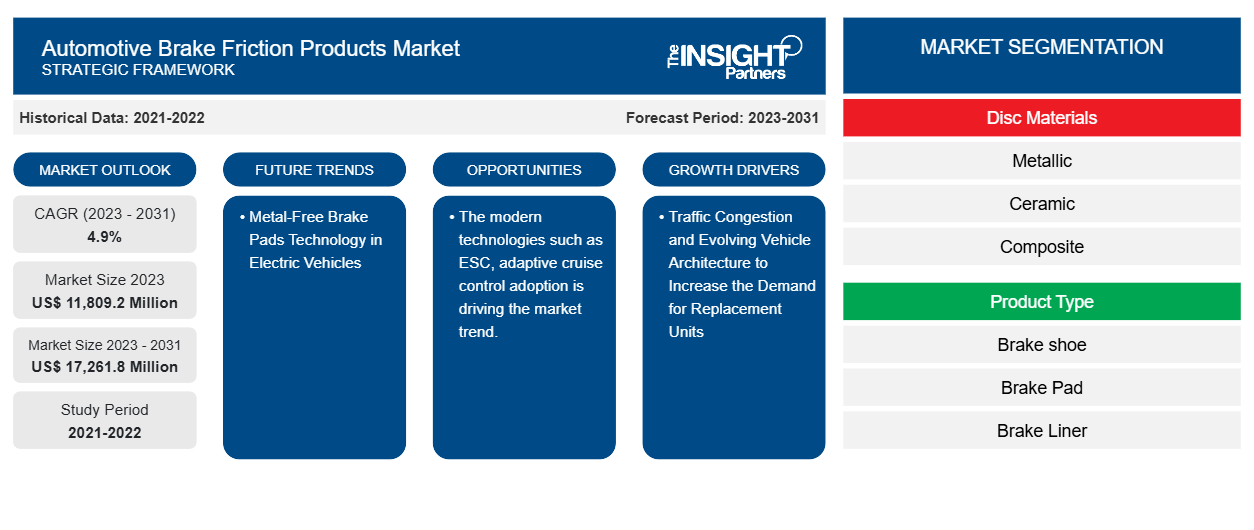

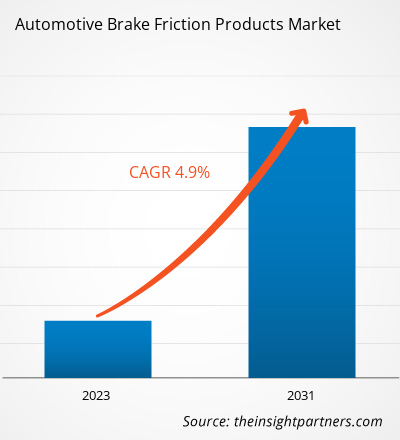

The automotive brake friction products market size is projected to reach US$ 17,261.8 million by 2031 from US$ 11,809.2 million in 2023. The market is expected to register a CAGR of 4.9% during 2023–2031. The increasing adoption of ABS technology in the vehicles drives the market growth. The modern technologies such as electronic stability control (ESC), adaptive cruise control adoption is driving the market trend. It also leads the way in the development of autonomous driving functions. Further, ABS and EBD are required in all new cars sold in India.

Automotive Brake Friction Products Market Analysis

Manufacturers of brake friction products face a significant challenge as vehicle components live longer. OEMs prefer long-lasting brake friction products that fade less quickly due to controlled friction, reduced wear, reduced noise, and reduced roughness. Additionally, OEMs and manufacturers consider durability across a resistance to water washout, wide service temperature range, clean assembly of brake-Caliper components, road contaminants, and oxidation, and when developing brake friction products. Regenerative braking has been used in battery-operated electric vehicles in recent years. The electric vehicle manufacturers are adopting advanced frictional products to smoothly run the vehicles. Metal rotor discs are used in the manufacturing of electric vehicles. With the increased sales of electric vehicles, the demand for the automotive brake friction products market is growing at a rapid pace during the forecast period as these brake frictional products are lighter and highly efficient. Therefore, with the increasing demand for eco-friendly transportation with high demand for electric vehicles, there is expected to be ample opportunity for the automotive brake friction products market growth.

Automotive Brake Friction Products Market Overview

The growth of automotive brake friction products is primarily attributed to increasing automotive production and sales in major countries in Asia Pacific, such as India, China, Indonesia, Japan, and Thailand. The increased electric vehicle production and stringent government safety rules and regulations across Japan, China, and India are boosting the global automotive brake friction products market growth. China is projected to dominate the global market owing to increased automotive production and rapid sales of electric vehicles in this country. China is the largest automotive and automotive components manufacturer. Thus, the automotive brake friction products market is growing at a rapid pace. Several OEMs in China are focused on the development of lightweight materials such as composites, carbon fiber, and many others for brake friction products. Also, the increasing adoption of safety features in the latest launched vehicle models is driving the market growth. For instance, Shanghai Automotive Brake Systems Co., Ltd. made a joint venture between Huayu Automotive Systems Company Limited and Continental AG to supply brake friction products in China.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Brake Friction Products Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Automotive Brake Friction Products Market Drivers and Opportunities

Increasing Traffic Congestion with Surge in Demand for Replacement of the Automotive Components Drives the Market Growth

The use of brakes is increasing at a rapid pace while driving owing to a surge in traffic congestion. In traffic conditions, vehicles are subjected to more braking, which wears down the brake shoes and brake pads, which ultimately reduces braking power. The braking power is being reduced, which strengthens higher demand for the replacement of brake pads and brake shoes. This has increased the use of frictional brakes owing to traffic congestion that results in driving the global automotive brake friction products market growth during the forecast period.

Metal-Free Brake Pads Technology in Electric Vehicles

Phenolic composite brake pad backing plates are 75% lighter, inert, and corrosion-free, thermally insulating, and have superior damping properties required for electric vehicle braking duty cycles. Further, in February 2022, Brakes India launched high-performance 'Elite' friction brake pads. Brakes India launched wide range of high-performance braking pads designed to enhance the braking capabilities at high speeds and in the hilly areas.

Phenolic composite braking pads are 75% lighter, and corrosion-free. These pads are thermally insulated, and have superior damping properties required for electric vehicle braking duty cycles. Further, in February 2022, Brakes India launched high-performance 'Elite' friction brake pads. Brakes India launched wide range of high-performance braking pads designed to enhance the braking capabilities at high speeds and in the hilly areas. Electric vehicles are lighter than their internal combustion engine vehicles. Several vehicle models such as Mercedes-Benz EQV Luxury passenger van uses automotive friction pads for smooth and comfortable driving.

Automotive Brake Friction Products Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Automotive Brake Friction Products market analysis are Disc Materials, Product Type, Vehicle Type, and geography.

- Based on disc materials, the global automotive brake friction market is divided into metallic, ceramic, and composite. Among these, composite disc materials have the largest share in 2023, this is owing to increasing development of the advanced composite materials.

- Depending upon the product type, the global market is divided into brake shoe, brake pad, brake liner, brake disc, and drum brake. Among these, brake liner has the largest share in 2023.

- Based on vehicle type, the market is segmented into passenger vehicle, and commercial vehicle. Among these, passenger vehicles have a larger share in 2023, this is owing to increasing passenger cars sale across the globe.

Automotive Brake Friction Products Market Share Analysis by Geography

The geographic scope of the Automotive Brake Friction Products market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific is expected to have the largest share in 2023. This is primarily owing to increasing production and sale of the automotive across China, India, and Japan. The market growth in the Asia Pacific region is primarily attributed to increasing vehicle sales across India, China, and Japan. The increasing vehicle production with stringent government rules and regulations related to the safety norms in Japan, China and India boost the automotive brake friction products market growth during the forecast period. China dominates the Asia Pacific automotive brake friction products market owing to the presence of several automotive component manufacturers. Also, India is estimated to grow with the highest CAGR during the forecast period.

Automotive Brake Friction Products Market Regional Insights

The regional trends and factors influencing the Automotive Brake Friction Products Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Automotive Brake Friction Products Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Automotive Brake Friction Products Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 11,809.2 Million |

| Market Size by 2031 | US$ 17,261.8 Million |

| Global CAGR (2023 - 2031) | 4.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Disc Materials

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Automotive Brake Friction Products Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Brake Friction Products Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Automotive Brake Friction Products Market top key players overview

Automotive Brake Friction Products Market News and Recent Developments

The automotive brake friction products market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Automotive Brake Friction Products Market are listed below:

- TMD Friction, a leading global supplier of braking solutions, is accelerating its transformation focus towards a safer and more sustainable future of mobility. Building on its heritage of more than 110 years of premium OE experience as well as its 140 years of success as an industry leader, the company is now entering a new chapter in its history. After establishing its leading expertise in supplying braking products and solutions people can trust, the company is now developing a new, modern brand direction which includes focusing on business practices and solutions to minimise its environmental impact. (Source: Company Website, February 2024)

- Tenneco’s Ferodo original equipment (OE) braking business has introduced advanced copper-free hybrid friction material composites that simultaneously serve braking performance and comfort requirements in both internal combustion engine (ICE) and electric vehicles (EVs). (Source: Press Release, July 2023)

Automotive Brake Friction Products Market Report Coverage and Deliverables

The “Automotive Brake Friction Products Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Automotive brake friction products market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Automotive brake friction products market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Automotive Brake Friction Products market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the automotive brake friction products market

- Detailed company profiles

Frequently Asked Questions

Which region dominated the automotive brake friction products market in 2023?

What are the driving factors impacting the automotive brake friction products market?

What are the future trends of the automotive brake friction products market?

Which are the leading players operating in the automotive brake friction products market?

What would be the estimated value of the automotive brake friction products market by 2031?

What is the expected CAGR of the automotive brake friction products market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For