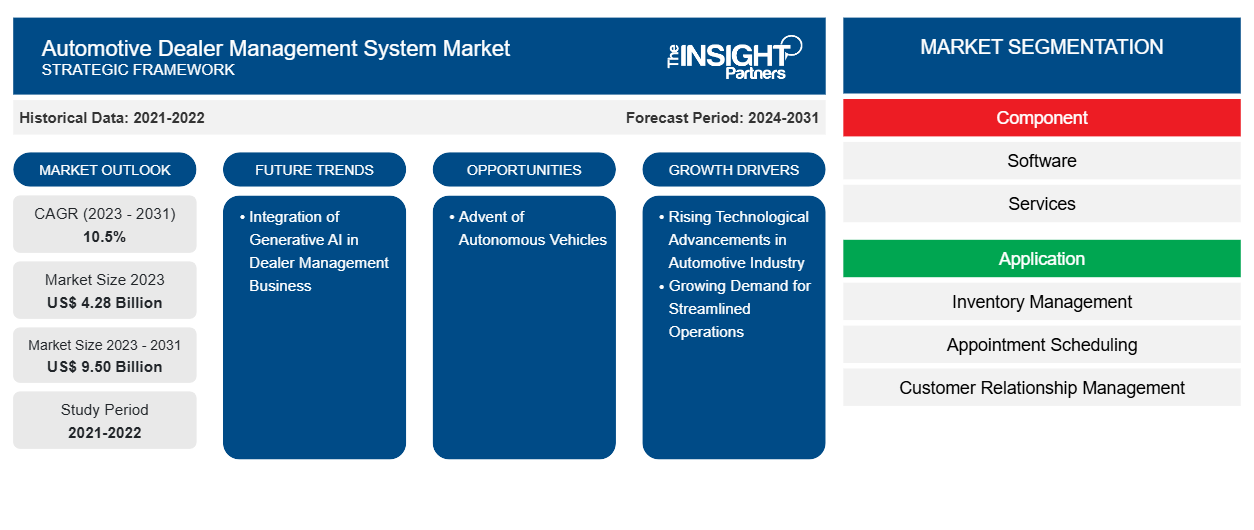

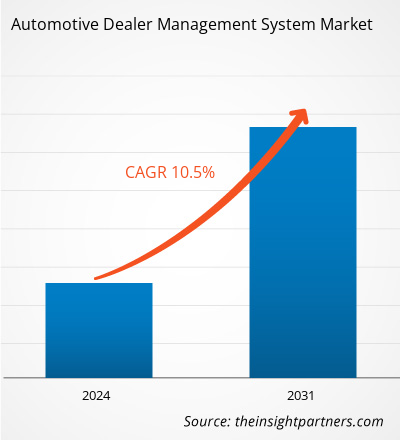

The automotive dealer management system market size is expected to reach US$ 9.50 billion by 2031 from US$ 4.28 billion in 2023. The market is estimated to record a CAGR of 10.5% from 2023 to 2031. The integration of generative Artificial Intelligence (AI) in dealer management businesses is likely to remain a key market trend.

Automotive Dealer Management System Market Analysis

The global automotive dealer management system market is experiencing significant growth owing to the rising technological advancements in the automotive industry. The rising use of digital technologies across the world enabled automakers to apply sophisticated solutions. The dealer management system is an ideal option for automotive firms that handle spare parts inventories and repair orders. The system uses customer relationship management (CRM) and business intelligence technologies to monitor manufacturer and customer connections. Several auto dealers also use this system to handle inventory and sales information. The dealer management system simplifies interactions among consumers, dealers, and original equipment manufacturers (OEMs). The system fulfils the specific requirements of automobile retail business. Many organizations use inorganic and organic techniques to grow the business of their dealer management system company in the automobile market. In June 2023, HBS Systems, Inc. collaborated with Record360 to speed up the inspection process, eliminate damage claims, and manage their assets. Record360 and HBS Systems, Inc. collaborated to optimize equipment inspection procedures utilizing NetView ECO dealer management software.

Automotive Dealer Management System Market Overview

An automotive dealer management system (DMS) is designed specifically for car dealers and large equipment manufacturers in the automotive industry. It is a comprehensive suite of tools that helps dealers in managing various aspects of their business on a single integrated platform. A DMS allows dealers to monitor and manage their entire operation from a single interface, automating tasks and tracking metrics for maximum efficiency. In addition, it consolidates all the tools and functions required by dealerships, including finance, sales, workshops, parts, inventory, and administration components, into a single platform. A DMS facilitates effective communication and collaboration between different departments, ensuring that all areas of the dealership business work together seamlessly. With a strong DMS, dealers can accelerate the sales process and provide an enhanced buying experience for customers.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Dealer Management System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Dealer Management System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Automotive Dealer Management System Market Drivers and Opportunities

Technological Advancements in Automotive Industry

The desire for simplified operations, effective inventory management, and smooth and integrated sales processes at automobile dealerships drive the requirement for dealer management solutions. Automotive dealer management systems are used for lead management and sales analytics. Additionally, the solutions provide dealership staff with real-time information, allowing them to respond swiftly to client questions, handle transactions efficiently, and manage inventory properly. It helps them increase productivity and enhance customer experience. Automotive dealer management systems improve CRM by allowing dealers to track client contacts, manage leads, and offer tailored services. As a result, they can offer better consumer experience and gain consumer loyalty.

Companies are widely integrating their services with a dealer management system. In March 2024, General Motors partnered with auto supplier Magna and consultancy firm Wipro Limited to launch a virtual market place called SDVerse for buyers and sellers of automotive software. The new B2B platform is expected to effectively serve as an automotive app store for automotive software developers to hock their wares to car manufacturers and other potential customers. General Motors claims SDVerse will overcome current inefficiencies in the shopping and implementation of embedded vehicle software while providing a transparent storefront that buyers and sellers can trust.

Advent of Autonomous Vehicles

The global automobile industry is undergoing a massive paradigm change as the number of connected and autonomous cars grows. The adoption rate of dealer management systems in transportation and logistics applications is predicted to grow rapidly due to the rising popularity of autonomous cars since it allows for a quick analysis of vehicle performance and inefficiencies. The growing inclination toward autonomous automobiles is attributed to technological improvements, customer desire for fully automated vehicles, affordability, and safety. Automakers are increasing their spending on developing self-driving passenger cars, commercial buses and trucks, and robot taxis. This, in turn, is expected to offer lucrative opportunities for the automotive dealer management system market growth during the forecast period.

Automotive Dealer Management System Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Automotive Dealer Management System Market analysis are component, industry vertical, deployment, and organization size.

- Based on component, the automotive dealer management system market is bifurcated into software and services. The software segment held a larger market share in 2023.

- Based on application, the market is segmented into inventory management, appointment scheduling, customer relationship management, dealer tracking, and others. The customer relationship management segment held the largest market share in 2023.

- Based on deployment, the automotive dealer management system market is bifurcated into cloud-based and on-premise. The cloud-based segment held a larger share of the market in 2023.

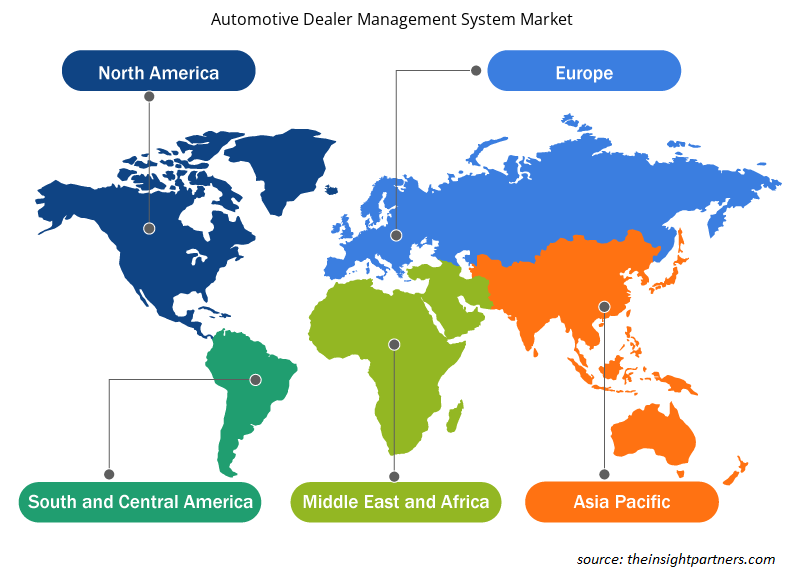

Automotive Dealer Management System Market Share Analysis by Geography

- The automotive dealer management system market is segmented into five major regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. North America dominated the market in 2023, followed by Europe and APAC.

- North America is projected to hold the largest share in the global automotive dealer management system market from 2023 to 2031. The region captures a noteworthy global market share owing to high investments in automation and software and the growing number of dealership management companies in the region. Automakers and auto part dealers largely use automotive DMS to manage and maintain orders. Auto dealers leverage the capability of modern DMS to increase the productivity and efficiency of their dealerships. Many system providers are developing their existing DMS to receive more contact certifications from automotive manufacturers. In July 2023, CDK Global Inc. received an official certification as a DMS provider from BMW Group Canada, including BMW and MINI retailers. CDK Global Inc. serves as a leading CRM provider for the BMW and MINI Canadian network. The partnership with auto manufacturers can strengthen CDK Global Inc.'s position in the US and Canadian markets.

Automotive Dealer Management System Market Regional Insights

The regional trends and factors influencing the Automotive Dealer Management System Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Automotive Dealer Management System Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Automotive Dealer Management System Market

Automotive Dealer Management System Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 4.28 Billion |

| Market Size by 2031 | US$ 9.50 Billion |

| Global CAGR (2023 - 2031) | 10.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Automotive Dealer Management System Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Dealer Management System Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Automotive Dealer Management System Market are:

- CDK Global LLC

- Wipro

- Oracle

- SAP SE

- Automate

- Dominion

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Automotive Dealer Management System Market top key players overview

Automotive Dealer Management System Market News and Recent Developments

The automotive dealer management system market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the automotive dealer management system market are listed below:

- Dominion DMS announced a strategic partnership with Gather, the auto industry's first and only identity and insurance verification and transfer system. The collaboration incorporates Gather's revolutionary technology and Dominion DMS's flagship product, VUE, a cloud-core dealer management system. The integration of Gather’s innovative technology with VUE by Dominion DMS represents a significant milestone in the automotive industry. Together, these solutions empower dealerships to enhance operational efficiency, streamline processes and deliver an exceptional customer experience

(Source: Dominion, Press Release, May 2024)

- CDK announced the extension of its agreement with Group 1 Automotive, a Fortune 300 automotive retailer with 203 dealerships located in the US and the UK, to provide its US franchise locations with the CDK Dealership Xperience, an open and integrated cloud-native platform that modernizes how dealers sell service cars and operate their businesses in a digital world.

(Source: CDK, Press Release, May 2024)

Automotive Dealer Management System Market Report Coverage and Deliverables

The "Automotive Dealer Management System Market Size and Forecast (2021–2031)" provides a detailed analysis of the Market covering the areas mentioned below:

- Automotive dealer management system market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Automotive dealer management system market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Automotive dealer management system market analysis covering key market trends, global and regional framework, major players, regulations, and recent Market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the automotive dealer management system market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Underwater Connector Market

- Dried Blueberry Market

- Oxy-fuel Combustion Technology Market

- Virtual Pipeline Systems Market

- Photo Editing Software Market

- Adaptive Traffic Control System Market

- Real-Time Location Systems Market

- Emergency Department Information System (EDIS) Market

- Procedure Trays Market

- Fertilizer Additives Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Asia Pacific is anticipated to grow with the highest CAGR over the forecast period 2024-2031.

The automotive dealer management system (DMS) market was valued at US$ 4.28 billion in 2023 and is projected to reach US$ 9.50 billion by 2031; it is expected to grow at a CAGR of 10.5% during 2023–2031.

Integration of Generative AI in dealer management business is the future trends of the automotive dealer management system (DMS) market.

Rising technological advancement in automotive industry and growing demand for streamlined operations are the driving factors impacting the automotive dealer management system (DMS) market.

The North America held the largest market share in 2023, followed by Europe and Asia Pacific.

The key players, holding majority shares, in automotive dealer management system (DMS) market includes CDK Global LLC, Wipro, Oracle, SAP SE, Automate, Dominion, Dealerbuilt, Tekion, PBS System Inc., and Autosoft Inc.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Automotive Dealer Management System (DMS) Market

- SAP SE

- Cox Automotive

- Tekion Corp

- DealerBuilt

- Dominion DMS LLC

- CDK Global Inc

- Wipro Ltd

- GaragePlug Inc.

- Oracle Corp

- Autosoft, Inc.

- Jeal Computer Services Pty Ltd

- Aspire Systems

- Nextlane

- AutoManager

- SECL Group Corporation

- PBS Systems

- Gemini Systems

- Excellon Software Pvt. Ltd.

- Auto/Mate, LLC

- Quorum Information Technologies Inc

Get Free Sample For

Get Free Sample For