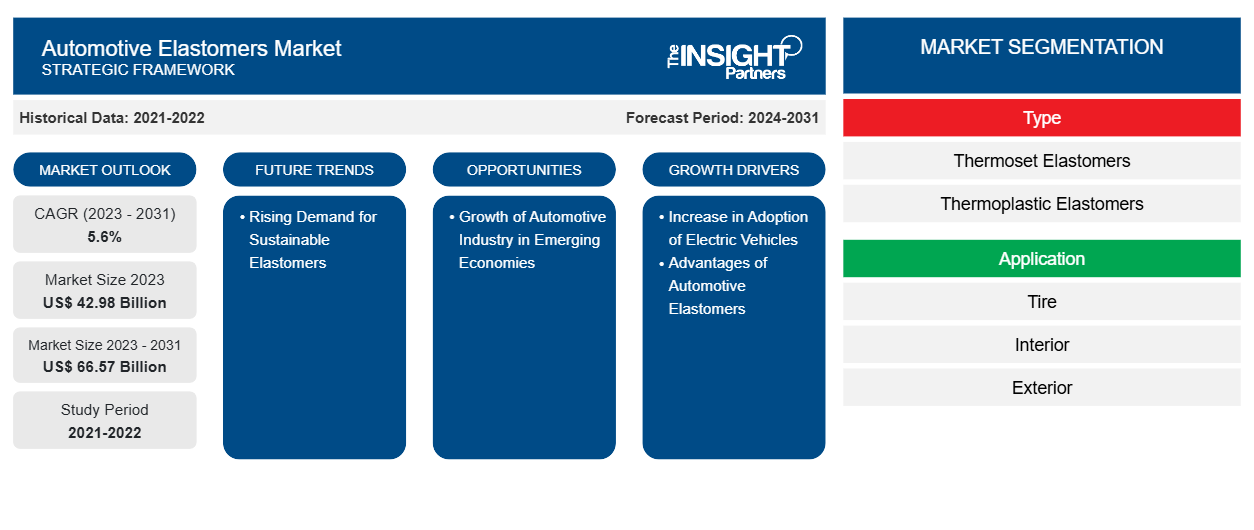

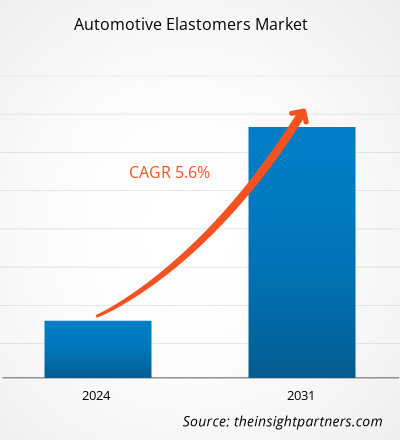

The automotive elastomers market size is projected to reach US$ 66.57 billion by 2031 from US$ 42.98 billion in 2023. The market is expected to register a CAGR of 5.6% during 2023–2031. The rising demand for sustainable elastomers is likely to bring new trends to market.

Automotive Elastomers Market Analysis

The rise in fuel prices and the environmental impact of conventional gasoline vehicles have paved the way for alternative fuel vehicles across the globe. Buyers are gradually getting inclined to use battery-powered or hybrid automobiles, which is anticipated to boost the demand for electric vehicles. According to the International Energy Agency's annual Global Electric Vehicle Outlook, over 10 million electric cars were sold worldwide in 2022, and the number is projected to grow by 35% in 2023 to reach 14 million. As the automotive industry witnesses a transformative shift toward electric vehicles (EVs), the role of elastomers has become more crucial. Elastomers are used for recyclability, reducing the weight of the vehicles, and enhancing tire rolling resistance for improved EV performance and energy efficiency. Thus, the growing adoption of electric vehicles drives the demand for automotive elastomers.

Automotive Elastomers Market Overview

The automotive elastomers market has been experiencing significant growth, driven by the rising demand for lightweight, durable, and high-performance materials in the automotive industry. Elastomers, known for their flexibility, resilience, and ability to return to their original shapes after deformation, are increasingly being used in various automotive applications, including seals, gaskets, hoses, and vibration-damping systems. The shift toward electric vehicles (EVs) and the focus on fuel efficiency have further accelerated the demand for elastomers, as they contribute to weight reduction and improve overall vehicle performance. Automotive manufacturers are increasingly adopting elastomers that are recyclable and have a lower carbon footprint. Additionally, advancements in elastomer technology, such as the development of thermoplastic elastomers (TPEs), are offering enhanced properties such as higher thermal stability, better chemical resistance, and ease of processing, making them highly desirable in the automotive sector.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Elastomers Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Elastomers Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Automotive Elastomers Market Drivers and Opportunities

Advantages of Automotive Elastomers

Elastomer is the best material to utilize when creating lightweight parts for automobiles, which has led to a rise in demand for elastomers in the automotive sector. Elastomers are extensively utilized in automobiles because of their superior strength-to-weight ratio, outstanding viscoelasticity, and sound-absorbing qualities. Because of their superior abrasion resistance, automotive elastomers are easily molded and found in radiator hoses, bumper guards, under the hood, seat coverings, and other applications. They are utilized in automotive seat covers, instrument panels, and caster wheels since they are lightweight and fuel-efficient. Therefore, the growing automobile industry is expected to increase the demand for automotive elastomers.

The rising awareness regarding various benefits of automotive elastomers, such as noise reduction, emissions reduction, safety improvement, and performance improvement, is likely to boost the demand for various types of automotive elastomers. The advantages and beneficial properties of automotive elastomers are boosting their demand for use in passenger vehicles, commercial vehicles, two wheelers.

Growth of Automotive Industry in Emerging Economies

In the last few years, the automotive industry has been significantly growing across emerging economies such as Brazil, China, India, Mexico, and South Africa. With the increasing disposable income, the demand for both passenger and commercial vehicles is growing in developing countries. For instance, according to the Federation of Automobile Dealers Associations (FADA), in India, sales of passenger vehicles increased to 2,854,242 units in November 2023, an increase from 2,409,535 units in November 2022. The automotive industry also paved its way in Brazil and South Africa. According to the International Organization of Motor Vehicle Manufacturers (OICA), South Africa's automobile production increased by 24% to 555,889 units in 2022. Thus, the growth of automotive industries in emerging economies is expected to create lucrative opportunities for the automotive elastomers market growth.

Automotive Elastomers Market Report Segmentation Analysis

Key segments that contributed to the derivation of the automotive elastomers market analysis are type and application.

- The automotive elastomers market, based on type, is segmented into thermoset elastomers and thermoplastic elastomers. The thermoset elastomers segment dominated the market in 2023.

- The automotive elastomers market, based on application, is segmented into tire, interior, exterior, and under the hood. The tire segment dominated the market in 2023.

- By vehicle type, the market is segmented into passenger vehicles, light commercial vehicles (LCV), heavy commercial vehicles, and two wheelers and others. The passenger vehicles segment accounted for the largest share of the automotive elastomers market in 2023.

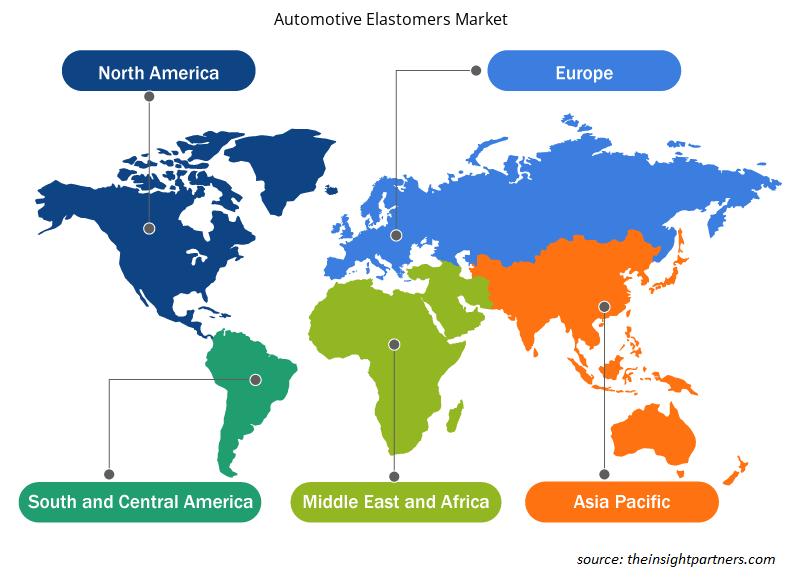

Automotive Elastomers Market Share Analysis by Geography

The geographic scope of the automotive elastomers market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific is home to major automotive companies, including Toyota Motor Corp, Tata Motors Ltd, Hyundai Motor Co, Nissan Motor Co Ltd, and Honda Motor Co Ltd. Further, Asia Pacific is a center for automotive manufacturing, with a significant presence of international and domestic players in the region. The development of automotive parts and components in the region and the rise of electric vehicle production will create lucrative opportunities for elastomer manufacturers. Extensive innovation and prototyping from major automakers are driving the market growth.

Automotive Elastomers Market Regional Insights

The regional trends and factors influencing the Automotive Elastomers Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Automotive Elastomers Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Automotive Elastomers Market

Automotive Elastomers Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 42.98 Billion |

| Market Size by 2031 | US$ 66.57 Billion |

| Global CAGR (2023 - 2031) | 5.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Automotive Elastomers Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Elastomers Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Automotive Elastomers Market are:

- KRAIBURG TPE

- APAR Industries Ltd

- Arkema SA

- Asahi Kasei Corp

- BASF SE

- DuPont de Nemours Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Automotive Elastomers Market top key players overview

Automotive Elastomers Market News and Recent Developments

The automotive elastomers market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the automotive elastomers market are listed below:

- Arkema increased its global manufacturing capacity for Pebax elastomers by 40% at its Serquigny plant in France. Arkema successfully started its new Pebax elastomer unit at the Serquigny plant in France. This new unit, designed with the latest advancements in industrial processes, can produce both the bio-circular Pebax Rnew and classical Pebax elastomer ranges. (Source: Arkema, Press Release, February 2024)

Automotive Elastomers Market Report Coverage and Deliverables

The "Automotive Elastomers Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Automotive elastomers market size and forecast for all the key market segments covered under the scope

- Automotive elastomers market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- Automotive elastomers market analysis covering key market trends, country framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the automotive elastomers market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Intradermal Injection Market

- Print Management Software Market

- Bioremediation Technology and Services Market

- Adaptive Traffic Control System Market

- Aesthetic Medical Devices Market

- Battery Testing Equipment Market

- Architecture Software Market

- Hummus Market

- Rare Neurological Disease Treatment Market

- Animal Genetics Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The rising demand for sustainable elastomers is expected to emerge as a future trend in the market.

The tire segment dominated the global automotive elastomers market in 2023.

The increasing adoption of electric vehicles is the key factor responsible for the automotive elastomers market growth.

KRAIBURG TPE, APAR Industries Ltd, Arkema SA, Asahi Kasei Corp, BASF SE, DuPont de Nemours Inc, Evonik Industries AG, Kraton Corp, Huntsman International LLC, LG Chem Ltd, LyondellBasell Industries NV, Mitsui Chemicals Inc, Saudi Basic Industries Corporation, Sumitomo Chemical Co Ltd, and The Lubrizol Corporation are among the leading market players.

The market is expected to register a CAGR of 5.6% during 2023–2031.

The thermoset elastomers segment held a larger share of the global automotive elastomers market in 2023.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Automotive Elastomers Market

- KRAIBURG TPE

- APAR Industries Ltd

- Arkema SA

- Asahi Kasei Corp

- BASF SE

- DuPont de Nemours Inc

- Evonik Industries AG

- Kraton Corp

- Huntsman International LLC

- LG Chem Ltd

- LyondellBasell Industries NV

- Mitsui Chemicals Inc

- Saudi Basic Industries Corporation

- Sumitomo Chemical Co Ltd

- The Lubrizol Corporation

Get Free Sample For

Get Free Sample For