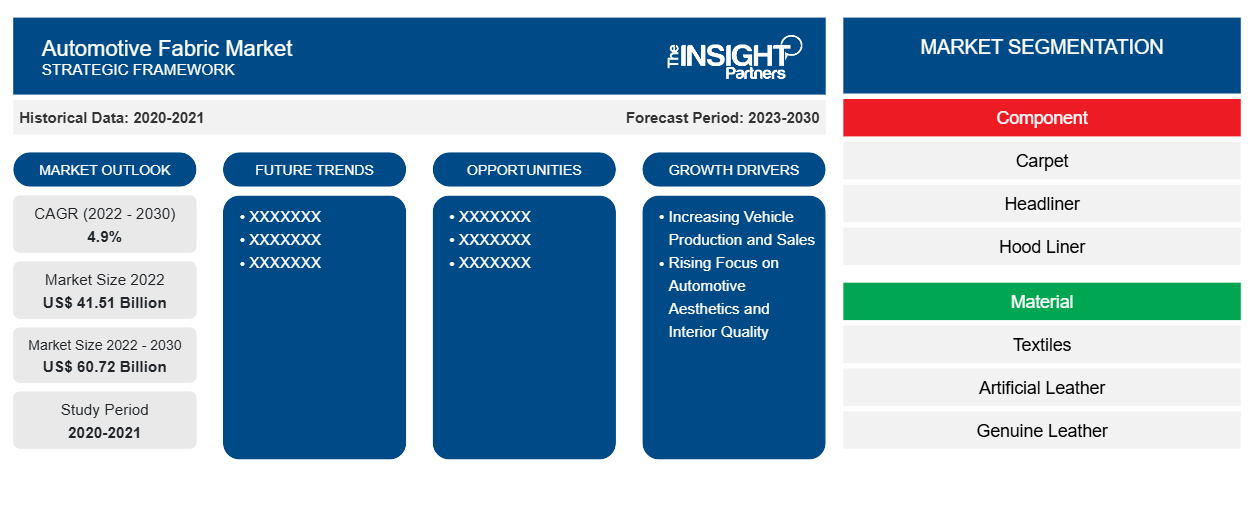

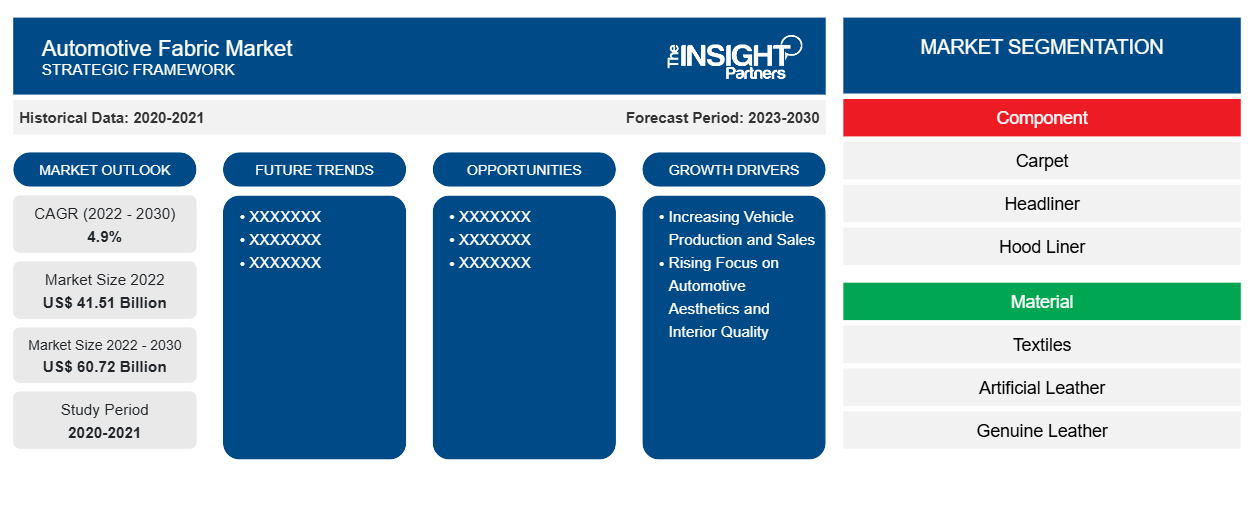

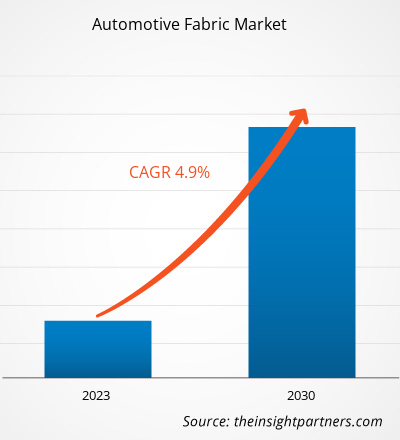

[Research Report] The automotive fabric market size was valued at US$ 41,513.83 million in 2022 and is projected to reach US$ 60,722.34 million by 2030; it is anticipated to record a CAGR of 4.9% from 2022 to 2030.

MARKET ANALYSIS

Automotive fabrics are the types of fabrics available in the form of woven, nonwoven, and coated. These type of fabric materials is quite flexible and possesses features such as resistance to UV rays and cold cracking along with durability and lightweight in design. Automotive fabrics provide seating comfort as well as promote the overall aesthetic experience. The growth of the market is strongly driven by advancements in technology, along with a preference toward superior comfort and high-quality materials. With the increasing production of automobiles, the demand for automobile accessories has also increased, which is expected to contribute to the growth of the automotive fabric market in the coming years.

GROWTH DRIVERS AND CHALLENGES

The advancement in automotive manufacturing capabilities and rising demand for electric vehicles are a few factors boosting the global automotive industry growth. Automotive is one of the leading industries in Europe as it contributes significantly to the GDPs of European countries, including Germany, Italy, and the UK, among others. The focus on developing automotive interior and exterior aesthetics and properties has increased, owing to consumer emphasis on quality and aesthetics, which drives the demand for automotive fabrics. Governments of various countries imposed stringent safety regulations, including the mandatory installation and use of seat belts, airbags, and anti-lock braking systems to promote in-vehicle safety, which is boosting the demand for high-performing and safe automotive fabric materials. Thus, the increasing vehicle production and rising focus on automotive aesthetics fuels the automotive fabric market growth.

Polyvinyl chloride (PVC) and polyurethane (PU) are two of the most used synthetic plastic polymers to make synthetic leather. The process of manufacturing synthetic leather made by using plastic is not an eco-friendly method. The production process of plastics used in most synthetic leathers is often a relatively energy-intensive and chemical-filled process that also produces significant waste. Hence, the harmful effects of PVC and PU, coupled with less durability of synthetic leather compared to leather, restrain the automotive fabric market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Fabric Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Fabric Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

REPORT SEGMENTATION AND SCOPE

The "Global Automotive Fabric Market Analysis and Forecast to 2030" is a specialized and in-depth study with a significant focus on global market trends and growth opportunities. The report aims to provide an overview of the global market with detailed market segmentation on the basis of component, material, and geography. The report provides key statistics on the consumption of automotive fabric across the world, along with their demand in major regions and countries. In addition, the report provides a qualitative assessment of various factors affecting the automotive fabric market performance in major regions and countries. It also includes a comprehensive analysis of the leading players in the automotive fabric market and their key strategic developments. Analysis of the market dynamics is also included to help identify the key driving factors, market trends, and lucrative opportunities, which, in turn, aid in identifying the major revenue pockets.

The ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the global automotive fabric market, which helps understand the entire supply chain and various factors affecting the market growth.

SEGMENTAL ANALYSIS

The global automotive fabric market is divided on the basis of component and material. Based on component, the automotive fabric market is segmented into carpet, headliner, hood liner, insulation, seat covering material, and others. Based on material, the market is segmented into textiles, artificial leather, genuine leather, and artificial suede. Further, the carpet segment accounted for a significant share of the automotive fabric market in 2022. Fabrics for carpets are exclusively designed by a needle-punched, nonwoven, or tufted fabric. Polyester, polyamide, polypropylene, and aramid are preferably used as fiber materials in designing carpets to enhance automotive interiors. Headliners are composed of tricot knit fabric that offers a soft touch and uniform appeal and adds to overall interior styling. A hood liner is composed of a thin layer of insulating material with a proper sound barrier element, which prevents noise arising from the engine due to faulty hood insulation. Acoustic and thermal insulation is considered one of the essential features deployed across various automotive parts such as engine covers, under trays, bonnets, and other such automotive parts. Tri-laminate polyester is used as automotive seat fabric for many types of car seats.

Based on material, the textiles segment accounted for a significant share in 2022. Automotive textiles have several applications in cars, trains, buses, and other vehicles. Automotive textiles comprise different types of textile components, such as yarn fibers, filaments, and other fabrics. Artificial leather, also known as faux leather or synthetic leather, is designed with the help of polyvinyl chloride (PVC) or polyurethane (PU). Genuine leather is perceived to be an expensive form of fabric material used in the automotive industry for upholstery components. The demand for synthetic suede continues to grow, often used for designing high-end automobile components. With the shift in consumer lifestyle and rising preference toward luxury driving and car-sharing services, the market for artificial suede is thriving globally.

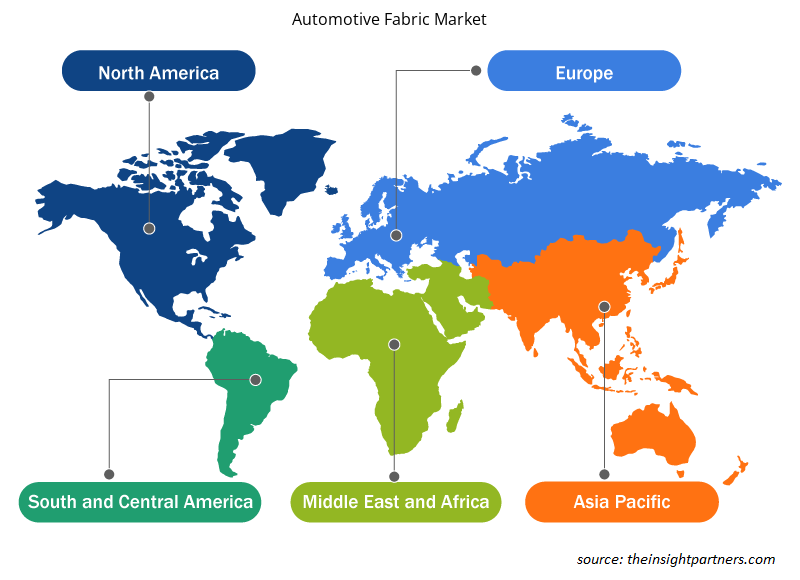

REGIONAL ANALYSIS

The report provides a detailed overview of the global automotive fabric market with respect to five major regions—North America, Europe, Asia-Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. Asia Pacific accounted for a significant share of automotive fabric market and was valued at more than US$ 20 billion in 2022. Asia Pacific is a hub for automotive manufacturing with a large presence of international and domestic players operating in the region. The International Organization of Motor Vehicle Manufacturers report stated that various countries in Asia Pacific produced ~46.73 million units of motor vehicles in 2021. The Europe market is expected to reach more than US$ 10 billion by 2030. The automotive industry is a major industry in Europe as it contributes significantly to the GDP of many European countries, including Germany, the UK, and Italy. Automotive fabric is extensively used in automotive carpeting, trunk areas, interior trims, soundproofing, and insulation. The North America automotive fabric market is expected to record a CAGR of ~4% from 2022 to 2030. North America has well-established automotive manufacturers such as Audi AG, Bayerische Motoren Werke AG, Stellantis NV, Ford Motor Company, Honda Motor Co Ltd, Hyundai Motor Company, Mercedes Benz, and Volkswagen Group. Therefore, the expansion of the automotive industry is projected to fuel the demand for automotive fabrics in North America in the coming years.

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

Various initiatives taken by the key players operating in the automotive fabric market are listed below:

- In September 2023, Apex Mills acquired the HanesBrands Inc. facility in Stuart, the US. The acquisition has helped in the expansion of elastomeric knitting, dyeing, and finishing capabilities.

- In March 2022, Lear Corp completed the acquisition of Thagora Technology SRL, a Roman company. The acquisition helped Lear Corp to add scalable smart manufacturing technology to its competencies.

- In February 2022, Lear Corp announced the complete acquisition of Kongsberg Automotive’s Interior Comfort Systems business unit. The acquisition enhanced Lear’s seat component capabilities and expanded product offerings.

Automotive Fabric Market Regional Insights

The regional trends and factors influencing the Automotive Fabric Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Automotive Fabric Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Automotive Fabric Market

Automotive Fabric Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 41.51 Billion |

| Market Size by 2030 | US$ 60.72 Billion |

| Global CAGR (2022 - 2030) | 4.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Automotive Fabric Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Fabric Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Automotive Fabric Market are:

- Lear Corp

- Bader GmbH & Co KG

- BOXMARK Leather GmbH & Co KG

- AUNDE Group SE

- Grupo Empresarial Copo SA

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Automotive Fabric Market top key players overview

IMPACT OF COVID-19 PANDEMIC/IMPACT OF GEOPOLITICAL SCENARIO/IMPACT OF RECESSION

Before the COVID-19 pandemic, many countries across the globe reported economic growth. The key manufacturers invested in the research and development of automotive fabric. They also focused on the expansion of geographic reach through merger and acquisition strategies to cater to a wide customer base. Before the COVID-19 pandemic, the automotive fabric producers reported steady growth in manufacturing, due to increasing demand from the automotive industry. The automotive fabric manufacturers were more focused on developing eco-friendly, durable, and easy-to-clean fabrics. According to the US International Trade Commission (USITC), owing to the high vulnerability of the automotive industry, vehicle sales in the US decreased by 15% in 2020 compared to 2019. During the pandemic, supply chain disruptions, raw material and labor shortages, and operational difficulties created a demand and supply gap, which adversely affected the automotive fabric market growth. Manufacturers reported challenges in sourcing raw materials and ingredients from suppliers, thereby impacting the production rate of automotive fabric.

Further, production shortfall caused by severe disruptions in supply chains and limited skilled laborers created a demand-supply gap in many regions, particularly Asia Pacific, Europe, and North America. The demand and supply gap was also recorded in the aforementioned regions due to fluctuating demand from the automotive industry. In 2021, rising vaccination rates contributed to improvements in the overall conditions in different countries, which led to conducive environments for the chemicals & materials industry. The sales of automotive fabric increased with the resumption of production & sales operations of companies operating in the automotive industry.

COMPETITIVE LANDSCAPE AND KEY COMPANIES

Lear Corp, Bader GmbH & Co KG, BOXMARK Leather GmbH & Co KG, AUNDE Group SE, Grupo Empresarial Copo SA, Classic Soft Trim Inc, Dual Borgstena Textile Portugal Unipessoal Lda, Shawmut Corp; Apex Mills Corp, Seiren Co Ltd are among the key players operating in the automotive fabric market.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, and Material

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The carpet segment held the largest market share. Automotive carpet is effectively designed to keep the vehicle's floor free from dirt, wear, and corrosion from salt, thereby maintaining cleanliness.

The textiles segment held the largest share of the market in 2022. Automotive textiles have several applications in cars, buses, and other vehicles. Automotive textiles comprise different types of textile components such as yarn fibers, filaments, and other fabrics.

Asia Pacific is estimated to register the fastest CAGR in the global automotive fabric market over the forecast period. The growing automotive industry in Asia Pacific is expected to create lucrative business opportunities for the automotive fabric market players in the region during the forecast period.

The carpet segment is estimated to register the fastest CAGR in the global automotive fabric market over the forecast period. Polyester, polyamide, polypropylene, and aramid are preferably used as fiber materials in designing carpets to enhance automotive interiors.

In 2022, Asia Pacific held the largest revenue share of the global automotive fabric market. The automotive fabric market growth in Australia, China, India, and Indonesia is attributed to growing automotive production in the region.

The major players operating in the global automotive fabric market are Lear Corp, Bader GmbH & Co KG, BOXMARK Leather GmbH & Co KG, AUNDE Group SE, Grupo Empresarial Copo SA, Classic Soft Trim Inc, Dual Borgstena Textile Portugal Unipessoal Lda, Shawmut Corp; Apex Mills Corp, Seiren Co Ltd, DK Schweizer Leather Sdn Bhd, Suminoe Textile Co Ltd, JBS Couros SA, Kyowa Leather Cloth Co Ltd, Moriden America Inc, Scottish Leather Group Ltd, Vulcaflex SpA, TB Kawashima Co Ltd, Martur Fompak International, and Sage Automotive Interiors Inc.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Automotive Fabric Market

- Lear Corp

- Bader GmbH & Co KG

- BOXMARK Leather GmbH & Co KG

- AUNDE Group SE

- Grupo Empresarial Copo SA

- Classic Soft Trim Inc

- Dual Borgstena Textile Portugal Unipessoal Lda

- Shawmut Corp

- Apex Mills Corp

- Seiren Co Ltd

Get Free Sample For

Get Free Sample For